The Guide to the Avis Preferred Loyalty Program

You can use points for a future rental car booking or earn points with another airline or hotel loyalty program.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

If you book a rental car with Avis, then take the extra step to enroll in the rental company’s Avis Preferred membership program. Avis Preferred is free to join, and as a member, you’ll earn Avis Preferred Points that can be used toward future rentals. Uniquely, you also have the option to earn miles and points with Avis’ travel partners in lieu of Avis Preferred Points. This means that you can earn currencies like Southwest Rapid Rewards points or World of Hyatt points instead if you'd like.

Plus, if you book enough rental cars with Avis to reach Avis Preferred Plus status, you’ll unlock even better benefits. These include complimentary upgrades (whenever available), a faster rate of rewards earning, and access to an exclusive phone number for reservations and customer service support.

This guide to Avis Preferred will tell you what you need to know about the program and how it could benefit your travels.

» Learn more: The best travel credit cards right now

By signing up, you will receive newsletters and promotional content and agree to our Terms of Use and acknowledge the data practices in our Privacy Policy. You may unsubscribe at any time.

Elite status tiers

The Avis Preferred loyalty program consists of three levels you can earn: Avis Preferred, Avis Preferred Plus and Avis President's Club. It’s free to become an Avis Preferred member, but it’ll take some effort to earn higher tiers.

Avis Preferred

If you’re new to renting with Avis, you’ll likely begin as an Avis Preferred member, the lowest of the three status tiers. To join, simply register online — it’s a quick process that requires you hand over personal information like your name, address, driver’s license and credit card information, which is saved and auto-populates at checkout when you’re ready to rent.

Its perks include:

- The ability to bypass the rental car counter.

- The ability to earn Avis Preferred Points on qualifying Avis spend.

It’s not the most exciting of membership programs but considering it’s free to join, it’s hard to knock it. And don’t dismiss the timesaver that skipping the rental counter can be.

Avis Preferred Plus

Avis Preferred Plus is the middle tier of Avis’ rental car loyalty program. Its perks include:

- A free, single car class upgrade upon availability.

- The ability to earn additional bonus points on each rental.

- Access to exclusive offers and promotional discounts.

How to become a Preferred Plus member

Avis Preferred members who complete 10 rentals or spend $4,000 on qualifying Avis purchases within a calendar year automatically earn Avis Preferred Plus status.

Avis President's Club

Avis President's Club is the highest tier of status that you can earn with Avis. Benefits of President's Club status include:

- Double upgrades, when available.

- Guaranteed vehicle availability.

- 50% more Avis Preferred points for every dollar you spend on rentals.

How to become a President's Club member

To earnAvis President’s Club status, you must complete 20 rentals or spend $6,000 on qualifying Avis purchases in a calendar year.

Chairman's Club (invite only)

Avis' Chairman's Club membership is a perk of participating in a vacation club called Exclusive Resorts. But good luck joining Exclusive Resorts, as the "exclusive" descriptor is no joke. There’s an initiation fee reportedly as high as $150,000, and that’s on top of the $1,395 you’ll pay every night you stay at one of its properties.

Benefits of Chairman’s Club status include:

- Meet-and-greet service: Upon landing at any major U.S. or Canadian airport location, an Avis representative will escort you directly to your vehicle.

- Guaranteed vehicle availability.

- Complimentary upgrades.

- Complimentary car delivery if within 25 miles of a participating Avis location.

» Learn more: Credit cards that give you elite car rental perks

Cards with auto rental benefits

Annual fee

$95.

$0 intro for the first year, then $150.

$895.

$795.

Rental car benefits

• Primary rental car coverage with reimbursement up to the cash value of most rental vehicles.

• Booking a car rental through Chase Ultimate Rewards® earns 5 points per dollar spent.

• Redeeming points to book travel through Chase — including renting cars — can give you more value per point.

• Primary rental car coverage that reimburses up to the cash value of most rental cars.

• Other day-of-travel benefits for United flyers include a free checked bag, priority boarding and lounge passes.

• Complimentary elite status with Avis, Hertz and National, which entitles the member to upgrades and discounts.

• Secondary rental car coverage.

• Other benefits include expansive airport lounge access and hundreds of dollars' worth of travel credits.

• Terms apply.

• Primary rental car coverage with reimbursement up to $75,000.

• Booking a car rental through Chase Ultimate Rewards® earns 8 points per dollar spent.

• Redeeming points to book travel through Chase — including renting cars — can give you more value per point.

• Cardholders eligible for special benefits from Avis, National and Silvercar.

Learn more

» See more options: Best credit cards for rental cars

How to earn Avis Preferred Points

The more you spend with Avis, the higher your Preferred Points earnings rate. Here’s how it breaks down:

| Avis Preferred | Avis Preferred Plus (Tier 1) | Avis Preferred Plus (Tier 2) | |

|---|---|---|---|

| How to reach status tier | Available to any member who registers online and opts in to earn Preferred Points. | Complete at least 10 rentals or $4,000 in qualifying spend within a calendar year. | Complete at least 20 rentals or $6,000 in qualifying spend within a calendar year. |

| Earnings rate per dollar spent on car rentals | 1 point. | 1.25 points. | 1.5 points. |

| Earnings rate per dollar spent on other products (e.g., GPS, satellite radio) | 2 points. | 2.5 points. | 3 points. |

| How many points you’d earn from $500 spent on car rentals | 500. | 625. | 750. |

Here’s another bit of good news for customers: Every rental earns a minimum of 100 points. That means even a $50, one-day rental still nets 100 points (rather than just 50 had there not been that minimum).

How to redeem Avis Preferred Points

Avis Preferred Points can be redeemed for car rentals, upgrades or accessories like ski racks and booster seats. Their value roughly corresponds to the price to rent at the counter in cash.

With car rentals, Avis groups award bookings into levels based on ranges correlated to the standard daily cash rates. Depending on where in that range the cash price falls determines the points cost.

| Reward level | Points per day | Standard cash daily rate | Estimated value per point |

| 1 | 700 | Up to $50 | 7.14 cents |

| 2 | 1,400 | $50.01-$85 | 4.82 cents |

| 3 | 2,100 | $85.01-$125 | 5 cents |

| 4 | 3,500 | $125.01-$225 | 5 cents |

Nerdwallet’s estimated value per point is based on the midpoint of the cash price range, except for Reward Level 1, where point value is based on a $50 cash rate.

The sweet spot here is to use your points for a vehicle that costs as close to $50 per day, without actually exceeding $50.

How to earn other travel rewards through your Avis car rental

Avis also gives you the option to earn miles and points with dozens of airline and hotel loyalty programs (you can choose one from the list) in lieu of earning Avis Preferred Points.

Maybe you’re trying to rack up Japan Airlines miles to fund airfare to the Tokyo Olympics. Perhaps you just don’t like the idea of tons of loyalty programs accounts with tiny balances, and would prefer accruing points into one account with a heftier balance.

If that’s you, it’s generally a better deal to opt out of earning Avis Preferred Points and instead opt in to earning travel partner miles or points. Though there’s no double-dipping; you can enroll in only one program at a time.

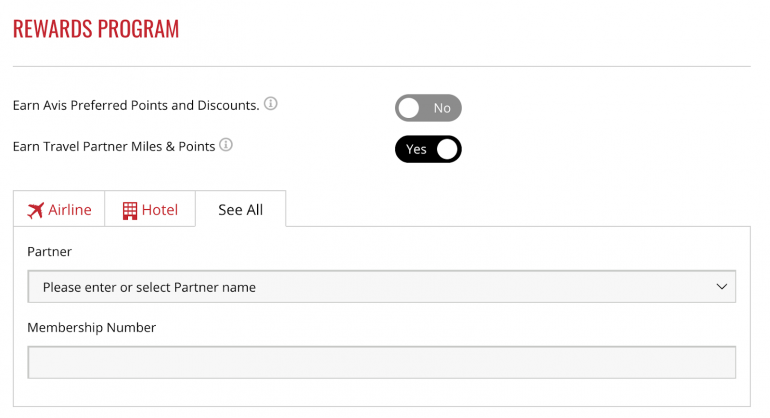

To do that, log in to your Avis Preferred account, click on the rewards tab and toggle between how you want to earn rewards. If you choose the travel partners option, select your airline or hotel from a dropdown and then input your membership number from that program to sync the two accounts.

However, you don’t necessarily earn airline miles at the same rate you earn Preferred points. Often, the value is much lower than had you chosen Avis Preferred Points. Further, the number of points earned is unique to each loyalty program.

Here are some of Avis' major travel partners to consider (visit its site for a complete list of airline partners and hotel partners):

Major Travel Partners

Miles or points earned on all qualifying rentals:

Alaska Airlines: 50 Atmos Rewards points per day or 500 points on rentals of five or more days.

American Airlines: 500 AAdvantage miles per rental.

Hyatt: 500 World of Hyatt Bonus Points per rental.

JetBlue: 100 TrueBlue points per rental day (up to five days).

Southwest Airlines: 600 Rapid Rewards Points at participating locations.

Wyndham: 100 Wyndham Rewards points per rental

Some travel partners also offer additional discounts or promotions. Check with your loyalty program for the most up-to-date information.

Should you choose hotel and airline rewards over Avis Preferred Points?

In many cases, the decision to claim Avis Preferred Points versus other loyalty program rewards depends on the length of your rental and how much it costs per day.

Choosing points through, say, Southwest (which earns about $10 worth of points per rental) is usually better for a short rental of a compact car. On the flip side, choosing Avis points is typically more valuable for more expensive or longer rentals.

Say you’re renting a fancy sports car for a week that’s otherwise going to cost $1,000. You’d earn 1,000 Avis Preferred Points as a base-level member, or 1,500 points if you’re in Tier 2 of the Avis Preferred Plus program. Using a rough estimation of Avis Preferred Points at 5 cents each, you’d earn between $50 to $75 in value (depending on your status). That’s far more than the roughly $10 value you’d get in Southwest Rapid Rewards Points.

Everyone’s situation is different, but a quick calculation of the points you’d earn using our point valuations can give you a straightforward, quantitative answer. But travel rewards are about more than just numbers. Ask yourself how often you’ll really use Avis points. Even if $10 worth of Rapid Rewards points feels pitiful, that’s at least more useful if you’re already committed to building your Southwest account balance. Otherwise, you might earn $50 worth of Avis points that may collect (virtual) dust if you're not committed to renting from it again.

The bottom line

Is it worth joining the Avis Preferred loyalty program? Since the program is free to join and requires minimal effort, it’s almost always worth becoming a member if you place some value on earning travel rewards. Even if you don’t necessarily want to earn Avis Preferred points, you’ll still need to join in order to earn points toward other travel programs, like Alaska Airlines or Wyndham.

Don’t forget to stack your Avis Preferred rewards with credit card rewards, too. Many travel credit cards earn rewards at an elevated rate for rental car spending. Plus, some of the best credit cards for rental cars offer other benefits that can save big money on your next car rental, like trip cancellation insurance and car rental insurance.

Frequently Asked Questions

How long does Preferred status last?

You must continue hitting the tier requirements (either 12 rentals or $5,000 in qualifying Avis spend) every year to retain your status. Tier membership resets every January, so your progress for the following calendar year is based on your Avis loyalty in the current year.

What happens to my Avis Points if I die?

Avis Preferred Points typically cannot be sold or transferred. However, in the event of an Avis Preferred member’s death, Avis will typically be able to transfer unredeeemed Avis points to a family member or friend who is also an Avis Preferred Member.

Do Avis Preferred Points expire?

Avis Preferred Points are valid for 60 months (that’s five years) from when they were earned. After that, points are forfeited and surrendered back to Avis. That’s actually a very generous amount of time, but now for the bad news: You lose your points if you go inactive, and it’s relatively easy to accidentally go inactive. You’re considered inactive if you go 12 months without either completing an eligible rental or earning/redeeming Avis Preferred Points. Once you go inactive, your points are forfeited without notice.

To view rates and fees of the American Express Platinum Card®, see this page.

Insurance Benefit: Car Rental Loss & Damage Insurance

- Car Rental Loss and Damage Insurance can provide coverage up to $75,000 for theft of or damage to most rental vehicles when you use your eligible Card to reserve and pay for the entire eligible vehicle rental and decline the collision damage waiver or similar option offered by the Commercial Car Rental Company. This product provides secondary coverage and does not include liability coverage. Not all vehicle types or rentals are covered. Geographic restrictions apply.

- Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply.

- Please visit americanexpress.com/benefitsguide for more details.

- Underwritten by AMEX Assurance Company. Car Rental Loss or Damage Coverage is offered through American Express Travel Related Services Company, Inc.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2026:

- Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

- No annual fee: Wells Fargo Autograph® Card

- Flat-rate travel rewards: Capital One Venture Rewards Credit Card

- Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

- Luxury perks: American Express Platinum Card®

- Business travelers: Ink Business Preferred® Credit Card

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Limited Time Only: Earn $1,000 Toward Travel!

Capital One Venture Rewards Credit Card

Travel

For a limited time, the

Capital One Venture Rewards Credit Card is offering new cardholders an especially rich bonus: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel!

More like this

Related articles