The Complete Guide to IHG Points Transfer Partners

You can earn and redeem IHG points for more than just hotel rooms.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

As a IHG One Rewards member, you can do more than just redeem points for hotel stays. You can also:

- Move points into IHG from outside the program.

- Transfer IHG points to airline partners and even friends or family.

To be sure, these aren't the most valuable way you can use points — but in some cases, they can be useful options to have. Here's what to know.

Airline partners

IHG One Rewards works with a long list of airline partners that allow you to earn miles during an IHG stay or move your IHG points to their frequent flyer program. But, a word of caution: this is usually not a good idea because you can often get a better deal using IHG points for hotel stays. Still, it might make sense to transfer IHG points to an airline partner if:

- You have no upcoming IHG hotel stay opportunities.

- Since IHG points expire after 12 months of inactivity for general members, transferring points will reset the expiration clock and extend their validity for another year. But remember, if you have IHG elite status, your points never expire.

- You need to top up your frequent flyer miles for a pending flight redemption.

If you’re ready to move ahead, these are the 40 airline relationships that IHG has for earning miles during a stay or transferring points into miles from their program. Almost all of them will convert IHG points at a 5:1 ratio, which is not ideal. But, if any of the above requirements apply to you, then go for it.

The transfer process is simple, although not necessarily convenient, since it requires a phone call to the IHG One Rewards Service Center. Those phone numbers are:

- In the U.S. and Canada: 888-211-9874.

- In Mexico: 001 800-272-9273.

- For other locations, contact Customer Care for other phone numbers.

Make sure that the name on your frequent flyer and IHG accounts match exactly to assure there are no issues. Sadly, it can take from four to six weeks for the transfer. This can make it tough to grab a prized frequent flyer deal that may pop up.

By signing up, you will receive newsletters and promotional content and agree to our Terms of Use and acknowledge the data practices in our Privacy Policy. You may unsubscribe at any time.

Credit card partners

In addition to airline partners, you can also boost your IHG One Rewards balance through a variety of credit cards.

IHG co-branded credit cards

IHG has three credit cards (two consumer cards and one business card) that allow members to earn bonus points for being approved as well as when using it to pay for eligible IHG hotel stays. Some even come with instant elite status — which can deliver perks such as late checkout and bonus points. Our favorite is the IHG One Rewards Premier Credit Card.

The IHG One Rewards Premier Credit Card delivers a fast stash of points when staying with IHG hotels. It earns 10x per eligible dollar spent at IHG hotels, and since it comes with Platinum elite status, you will get an additional 16x points per dollar.

It also comes with 5x points for travel purchases, at gas stations, restaurants, eligible delivery services and takeaway spots. Everything else earns 3x points per $1 spent.

Its $99 annual fee packs in a lot, like an anniversary night redemption (up to 40,000 points), fourth-night-free benefit when redeeming points for three nights, a $50 TravelBank credit with United Airlines and credit for application fees toward trusted traveler programs like Global Entry and TSA PreCheck. Other IHG card options include the IHG One Rewards Traveler Credit Card and the IHG One Rewards Premier Business Credit Card.

Chase Ultimate Rewards®

You can transfer Chase Ultimate Rewards® points to IHG points at a 1:1 ratio (so you can send 5,000 Chase points over to IHG to become 5,000 IHG points) on eligible cards. That unlocks a path for several credit cards — not just the IHG One Rewards Premier Credit Card — to help you build up an IHG points balance.

But keep in mind, this is one of the lowest-value ways to use Ultimate Rewards® points. NerdWallet values IHG points at just 0.6 cent. A better alternative is moving Chase points at a 1:1 ratio to World of Hyatt, a points currency that NerdWallet values at 1.8 cents.

Non-IHG credit cards that could help you include:

Annual fee

$795.

$95.

$95.

Welcome offer

Earn 125,000 bonus points after you spend $6,000 on purchases in the first 3 months from account opening.

Earn 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening.

Earn 100,000 bonus points after you spend $8,000 on purchases in the first 3 months from account opening.

Learn more

If you decide to transfer Ultimate Rewards® points to IHG, though, it’s a simple, online process. Start by logging into your Chase account and click on your Ultimate Rewards® balance. From there, click on “Manage Rewards” and “Ways to use your points.”

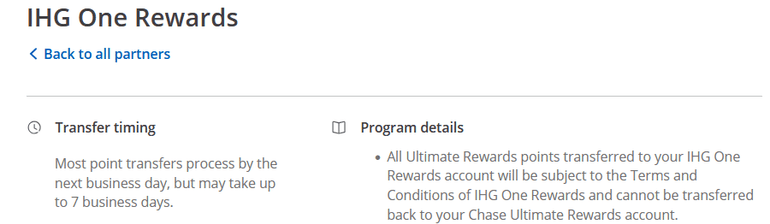

The “Transfer points” button then takes you to the long list of transfer partners, including IHG One Rewards. Here, you can read about how long it takes to move Chase points to IHG (it’s fast, typically by the next day), and also a reminder that this process is irreversible.

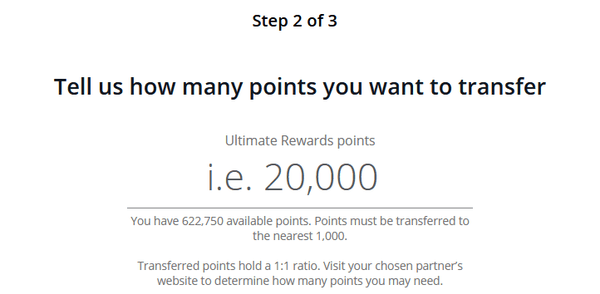

You will be asked to enter your IHG One Rewards number, and then taken to a screen that shows you must transfer points in increments of 1,000. For each Chase point you transfer, you receive one IHG point.

Transferring to family and friends

If you know someone who needs some extra IHG points, and you’re feeling generous, you can gift them for a fee of $5 per 1,000 points. This can either be done via phone (using the same numbers as the airline transfer partner process) or online via IHG’s point transfer page. This can be a good idea if you know someone with more points than you and is close to making an ideal redemption.

NerdWallet values 1,000 IHG points at $5, the same as the transfer fee — so you’d essentially be giving away their value. It only makes sense if someone else can use them more effectively.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2026:

- Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

- No annual fee: Wells Fargo Autograph® Card

- Flat-rate travel rewards: Capital One Venture Rewards Credit Card

- Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

- Luxury perks: American Express Platinum Card®

- Business travelers: Ink Business Preferred® Credit Card

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Limited Time Only: Earn $1,000 Toward Travel!

Capital One Venture Rewards Credit Card

Travel

For a limited time, the

Capital One Venture Rewards Credit Card is offering new cardholders an especially rich bonus: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel!

More like this

Related articles