How the Capital One Venture X Priority Pass Works

Capital One Venture X card's unlimited Priority Pass lounge access is a major perk for frequent travelers.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

The Capital One Venture X Rewards Credit Card is a premium credit card that offers cardholders a host of benefits, such as a $300 annual travel credit, 10,000 anniversary bonus miles, 10x miles on hotels and rental cars booked through Capital One Travel and Priority Pass membership.

Below we dive into the specifics of the Priority Pass membership benefit so you can take full advantage of it when traveling with your Capital One Venture X Rewards Credit Card.

By signing up, you will receive newsletters and promotional content and agree to our Terms of Use and acknowledge the data practices in our Privacy Policy. You may unsubscribe at any time.

Overview of the Capital One Venture X Rewards Credit Card Priority Pass benefit

For frequent flyers, the Capital One Venture X Rewards Credit Card Priority Pass membership is one of the card’s most useful benefits as it gives cardholders access to participating Priority Pass airport lounges.

Authorized users of the card are also eligible to sign up for a Priority Pass membership, meaning that if you have a Capital One Venture X Rewards Credit Card and add someone as an authorized user (for instance, a spouse or relative), that individual can also access Priority Pass lounges when traveling.

» Learn more: Is the Capital One Venture X Card worth its annual fee?

How to enroll in Priority Pass as a Capital One Venture X Rewards Credit Card holder

To take advantage of the Priority Pass benefit, you’ll need to enroll by following these steps:

- Receive your Capital One Venture X Rewards Credit Card in the mail, which can take up to two weeks after you’ve been approved for the card.

- Activate your Priority Pass membership by or following the link in your Capital One Priority Pass welcome email or going to the Priority Pass tile under "Benefits" in your Capital One app.

- Enter your Capital One card number, country of residence and address to create your Priority Pass account.

- Enter your billing details, which will be used to identify you when you arrive at a Priority Pass lounge.

- Review and accept the membership declaration, then click “Join.”

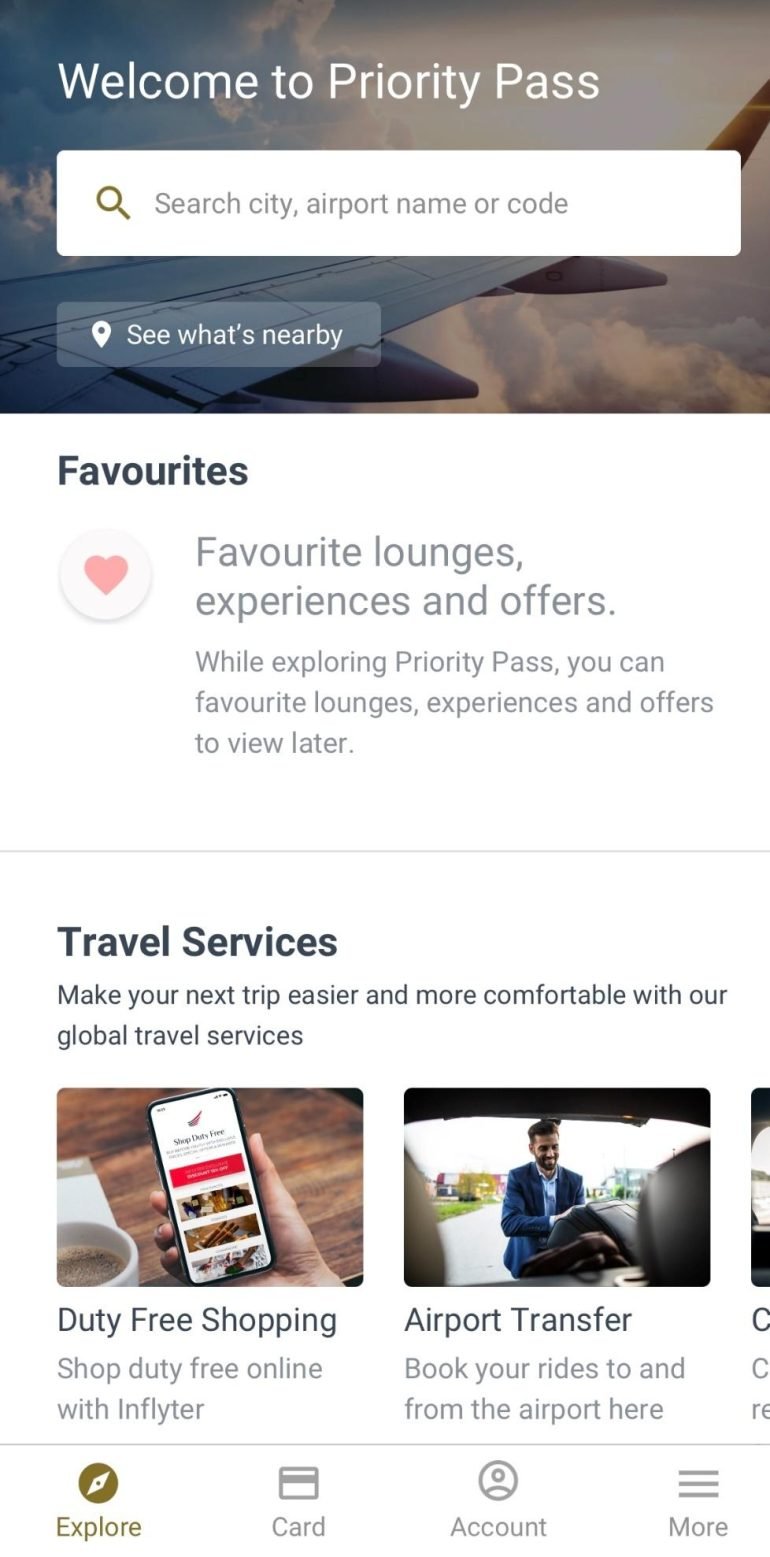

Once you’re enrolled, you can access your account through the Priority Pass website or the mobile app.

🤓 Nerdy Tip

We recommend downloading the Priority Pass mobile app, which makes it easy to find Priority Pass lounges while you’re traveling. You can also take advantage of the digital card on the app to enter eligible lounges. » Learn more: What credit cards can get me into Priority Pass lounges?

How to enter Priority Pass lounges with your membership

To enter a Priority Pass lounge using your membership, you’ll first need to locate a lounge to visit.

Priority Pass has plenty of lounges — over 1,500 internationally. As of this time, the lounges are available in 44 U.S. cities.

U.S. Priority Pass Locations

- Atlanta.

- Baltimore.

- Boston.

- Buffalo, N.Y.

- Charleston, S.C.

- Charlotte, N.C.

- Chicago.

- Cleveland.

- Colorado Springs, Colo.

- Dallas/Ft. Worth.

- Detroit.

- Fort Lauderdale, Fla.

- Greenville-Spartanburg, S.C.

- Honolulu.

- Houston.

- Indianapolis.

- Jacksonville, Fla.

- Kahului, Hawaii.

- Las Vegas.

- Little Rock, Ark.

- Los Angeles.

- Miami.

- Minneapolis/St. Paul.

- New Orleans.

- Newark, N.J.

- New York JFK.

- New York LaGuardia.

- NW Arkansas.

- Orlando, Fla.

- Philadelphia.

- Pittsburgh.

- Portland, Ore.

- Providence, R.I.

- Sacramento.

- Salt Lake City.

- San Francisco.

- San Jose, Calif.

- Seattle/Tacoma.

- St. Louis.

- Syracuse, N.Y.

- Tampa, Fla.

- Tucson, Ariz.

- Tulsa.

- Washington Dulles, D.C.

Some airports may have several Priority Pass lounges, and some have none at all.

Once you find a Priority Pass lounge to visit, you’ll need the following to get in:

- A same-day boarding pass.

- An ID, such as a driver’s license or passport.

- One of the following:

- YourCapital One Venture X Rewards Credit Card.

- Your physical Priority Pass membership card.

- Your digital Priority Pass membership card.

Keep in mind that Priority Pass lounges have capacity limits and can fill up, so we recommend having a back-up lounge or plan in mind if the Priority Pass lounge you want to visit is full.

» Learn more: Are Priority Pass lounges usually crowded?

Can you bring guests to Priority Pass lounges for free with the Capital One Venture X Rewards Credit Card?

No. The Capital One Venture X Rewards Credit Card used to have a generous complimentary guest policy for Priority Pass lounges, but that's changed.

Now, primary cardholders and eligible additional cardholders can bring guests to participating Priority Pass lounges for $35 per visit, per guest.

» Learn more: Capital One Venture X vs. Chase Sapphire Reserve

Is it worth getting a Capital One Venture X Rewards Credit Card for the Priority Pass benefit?

The annual fee on the Capital One Venture X Rewards Credit Card is $395, while a Priority Pass membership that offers unlimited visits costs $469 per year, making the Capital One Venture X Rewards Credit Card Priority Pass membership a great value.

That said, it’s probably not worth signing up for the Capital One Venture X Rewards Credit Card only for its Priority Pass benefit, since you can get access to Priority Pass with other, less expensive cards.

But if you’re able to take advantage of the other benefits offered by the Capital One Venture X Rewards Credit Card, like the card’s $300 annual travel credit, 10x miles on hotels and rental cars booked through Capital One Travel and the 10,000 miles anniversary bonus, then it makes sense to sign up for Priority Pass and the card’s other benefits.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2026:

- Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

- No annual fee: Wells Fargo Autograph® Card

- Flat-rate travel rewards: Capital One Venture Rewards Credit Card

- Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

- Luxury perks: American Express Platinum Card®

- Business travelers: Ink Business Preferred® Credit Card

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Limited Time Only: Earn $1,000 Toward Travel!

Capital One Venture Rewards Credit Card

Travel

For a limited time, the

Capital One Venture Rewards Credit Card is offering new cardholders an especially rich bonus: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel!

More like this

Related articles