Currency Conversion: Is Your Credit Card Giving You a Fair Rate?

The currency conversion rates applied by Visa and MasterCard when you use your card overseas are generally on par with market rates.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

Nerdy takeaways

- After comparing exchange rates between U.S. dollars and more than 40 foreign currencies, NerdWallet found generally small differences in the rates used by MasterCard and Visa.

- MasterCard was better on more currencies, but there was no overall “winner” between the two.

- Both networks’ rates were generally comparable to market rates as well.

- When abroad, you’re better off charging purchases in the local currency than having them converted to dollars by the merchant, usually for a fee, or exchanging cash at a kiosk.

Elektra Printz Gorski didn’t pay much attention to currency exchange rates until recently.

A fashion designer and entrepreneur in New York City, Gorski paid more than $5,000 a month to an Australian law firm to sue a fast fashion company that allegedly co-opted her trademarked slogan. Paying her legal fees with a Visa card with a high rewards rate and no foreign transaction fees seemed to be the obvious choice.

But with a weakening U.S. dollar pushing her bills higher each month, she noticed that the market rates for currency conversions from Australian dollars to U.S. dollars were about 1% stronger than the exchange rate her card charged. Further research showed that Mastercard’s rates were better than those on her Visa card.

“All I know is, it seems to add up,” Gorski says. “I don’t like the lack of transparency.”

For people like Gorski, who spend tens of thousands of dollars abroad every year, these differences are worth considering. But when NerdWallet compared credit card exchange rates between U.S. dollars and more than 40 currencies, the variations among networks were generally small. The best deal would likely save you no more than about $8 on an international trip, based on federal travel data, and often much less.

In general, Mastercard tends to offer better exchange rates than Visa in most of the currencies surveyed. But there is no clear overall "winner," and on several currencies, the competition was too close to call. And despite any differences, credit cards still give you a much better conversion rate than if you exchange money at an airport kiosk or at checkout.

IN THIS REPORT

Which network offers the best exchange rates?

Credit card issuers use currency exchange rates to bill you in U.S. dollars for transactions made in foreign currencies. These rates are set and updated daily by your card’s payment network — Visa, Mastercard, Discover or American Express — and typically listed on your statement when you make purchases overseas. Visa and Mastercard make their rates publicly available online in currency conversion tools; American Express and Discover don’t.

Depending on your network’s exchange rates, you may need to pay more U.S. dollars to cover your purchases abroad. Say you charged something overseas for 100 euros. Now say that 1 euro is equal to 1.1 U.S. dollars under the exchange rate used by Network A, while 1 euro equals 1.2 U.S. dollars with Network B. Assuming you used a card with no foreign transaction fees, your 100-euro purchase would cost you $110 on Network A, and $120 on Network B.

NerdWallet compared the rates for exchanging 44 different currencies into U.S. dollars through Visa, Mastercard and Oanda, a foreign exchange platform whose market rates are used by tax authorities and big accounting firms, among others. This study is based on 15,576 rate queries NerdWallet made on the currency exchange rate tools from Visa, Mastercard and Oanda during August and September 2016. We compared rates on a weekly basis for a year and a daily basis for three months. (See Methodology for more details.)

Here’s what our analysis found:

Mastercard has an edge on Visa, but it’s not the best option in every case. For 23 out of the 44 currencies, Mastercard offered a better rate than Visa more than 70% of the time in the weekly comparison. Visa had a better rate more than 70% of the time for only three currencies. The other currencies were either tied or could be considered a toss-up.

Average differences between exchange rates are small. In the weekly comparison, Mastercard's average rates were generally more favorable for U.S. consumers than Visa rates, but usually by less than 1%. But even in a worst-case scenario, with rates that were consistently 1% worse than those offered by a competing network, the average international traveler would only be out about $8 on each trip, based on the most recent data available from the National Travel and Tourism Office. That’s cheaper than buying a sandwich at an airport.

Rates from Mastercard and Visa appear to be on par with market rates. Oanda’s interbank rates — that is, its wholesale rates applied to exchanges of $1 million or more — didn’t appear to be significantly better than the network rates. That means you can get rock-bottom rates even when you’re just buying a cup of coffee, making no-foreign-transaction-fee credit cards an excellent deal.

When you include Oanda in the weekly comparison, Mastercard offered the best rate more than 70% of the time for 11 of 44 currencies; Oanda offered the best rate more than 70% of the time for four currencies; Visa didn’t offer the best rate more than 70% of the time for any currencies. The remaining 29 currencies were either tied or could be considered a toss-up.

Mastercard has an edge, but it’s complicated

Our data show that Mastercard has a small advantage over Visa in the aggregate, but there are at least two caveats:

- Mastercard offers better exchange rates for specific currencies, not all currencies. And even for a currency on which Mastercard has an edge, Visa might do better on certain days.

- Currency exchange rates make up only a small part of a card’s overall value.

To that first point, currency exchange rates aren’t uniform. If you regularly travel to a country such as Hungary or Thailand, Mastercard’s overall edge on the euro or Canadian dollar won’t do you much good. And for many currencies, there just wasn’t an unequivocal winner, as you can see in the chart below.

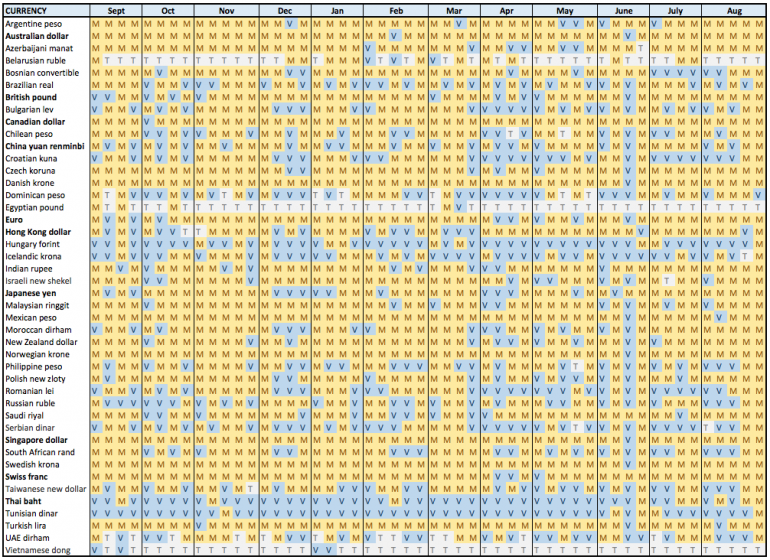

The yellow squares show when Mastercard’s rates were better than Visa’s during the survey period; the blue squares show when Visa’s rates were better; gray squares denote ties. The bolded currencies represent the 10 most-converted currencies (aside from the U.S. dollar) on the SWIFT network, which banks use to send financial transaction information internationally.

Click to hide / show chart

Mastercard vs. Visa: Weekly results

As you can see, Visa consistently offers a better rate than Mastercard for the Tunisian dinar, Hungarian forint and Thai baht. For many currencies, there’s no clear winner.

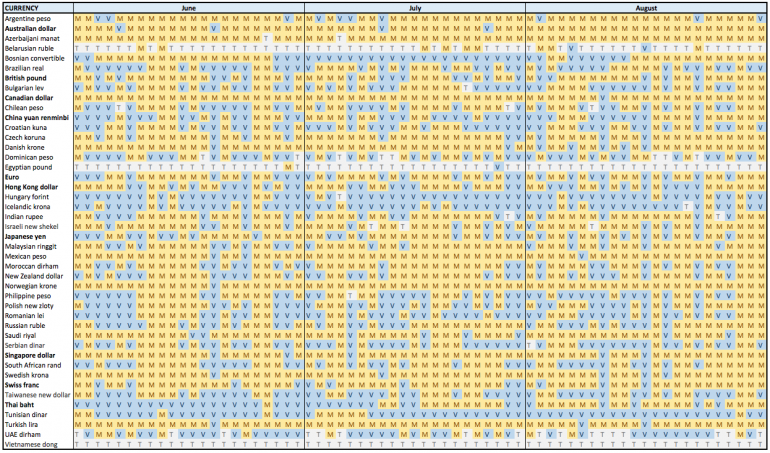

These trends are echoed in the daily comparison, below, where you can also see Visa and Mastercard going back and forth in offering the best rates.

Take the Chinese yuan. In June, July and August, Visa had a better rate than Mastercard for 36 out of 66 weekdays. Mastercard offered a better rate in the other 30 days. Depending on which week or month you were traveling, either network could have been a better choice.

Click to hide / show chart

Mastercard vs. Visa: Daily results

Why Visa and Mastercard rates are different

Visa and Mastercard rates aren’t the same. But that’s most likely a result of how they gather information to set their rates, rather than a deliberate markup to squeeze profit out of conversions.

Beginning in the early 2000s, credit cards used to “embed” fees into their exchange rates, making foreign purchases more expensive for consumers. In addition, most cards also charged foreign transaction fees of 1% to 3% on all international purchases. But a 2006 court decision put the kibosh on embedding fees within rates. It also required card issuers to add disclosures if rates were “outside a range of wholesale or government-mandated/managed rates,” according to the settlement agreement. Today, these requirements and competitive pressures make it difficult for networks to use inflated exchange rates.

Even so, networks still have some regulatory leeway when it comes to sourcing currency exchange rates. Neither Visa nor Mastercard discloses exactly how it sets rates. Visa cites “wholesale currency markets or a government-mandated rate,” while Mastercard says it reviews “multiple market sources.”

Neither network responded to questions about when their rates were “fixed,” or set for the day. That could also account for some of the differences between the rates.

For example, the financial information provider Reuters fixes its closing spot rates — that is, the daily rates it calculates — at 4 p.m. GMT each day, according to the company’s methodology. If it fixed them an hour earlier or later, they might be a little different.

“On a typical day, there’s a tenth of a percent to a 2% rate change” in most currency pairs, says Jason Kumpf, director at USForex, a foreign exchange platform. That’s why timing matters — especially, he adds, when those changes are greater because of major economic events. An example might be Britain’s vote to leave the European Union.

If a network posts a slightly weaker rate, it may work to card issuers’ advantage. But exchange rates alone represent only a sliver of the revenue Visa and Mastercard make off international transactions. A large portion of that revenue comes from cross-border fees, charges of about 1% that foreign merchants have to pay on each U.S. credit card transaction. They might also receive a portion of foreign transaction fees you pay on your card, depending on their contract with the issuer.

Both Visa and Mastercard declined to comment on the results of this study.

Card rates are on par with market rates

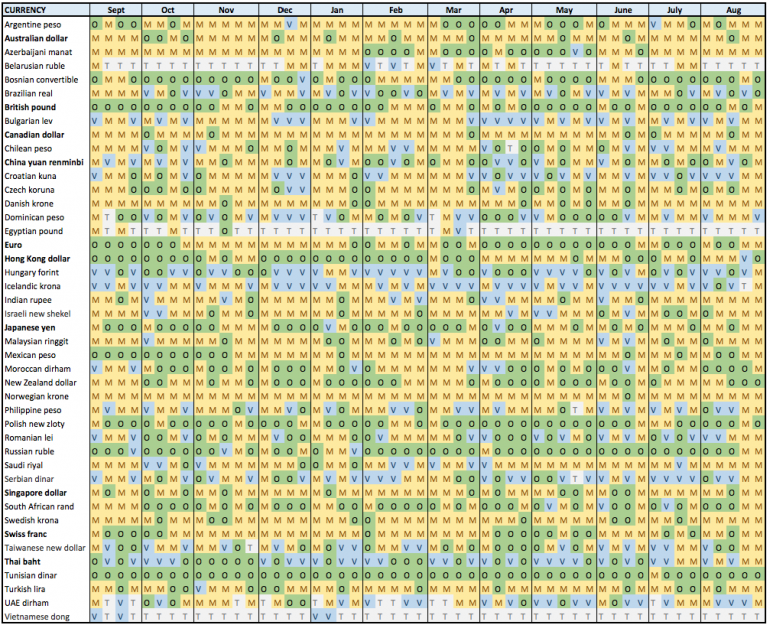

Because the networks look at wholesale rates, it’s unsurprising that their rates are so similar to the interbank rates from Oanda, the foreign exchange platform. The majority of currencies were a toss-up among Oanda, Visa and Mastercard. In the chart below, the green squares denote Oanda offering the best rates.

Clock to hide / show chart

Mastercard vs. Visa vs. Oanda: Weekly results

Mastercard was still was the best option in 11 currencies — meaning it offered the strongest exchange rates more than 70% of the time. Oanda was the best option in 4; Visa wasn’t the best option in any currencies. Among the remaining currencies, two tied most of the time, and 27 were a toss-up, showing how closely these rates compete.

Oanda takes into account data from approximately 15 different sources, according to Natasha Lala, Oanda’s chief of staff. Oanda’s interbank rates are meant to apply to exchanges over $1 million, according to its website. The rates used for this comparison were the “bid” prices, or what you’d pay if you were selling U.S. dollars to buy foreign currency.

The similarities among Mastercard, Visa and Oanda rates underscore just how good a deal you’re getting when you use a credit card with no foreign transaction fees abroad. The exchange rate on your credit card will likely be on par with rates used when exchanging over $1 million, even if you’re only buying a pack of gum. If you have a Mastercard, there’s a decent chance it might even be better.

Exchange rates as a credit card feature

Currency exchange rates are important to consider when you’re shopping for a credit card, but they account for only a small part of a card’s overall value.

Mastercard's average rates were more than 1% cheaper than Visa rates for only four out of 44 currencies in the weekly comparison, and only two out of 44 currencies in the daily comparison. The rest of the time, the difference between the two were only fractions of a penny on the dollar.

There are plenty of credit card characteristics that hold more sway over your total earning power, such as:

- Foreign transaction fees: These fees, which many issuers add to every international purchase, are usually 1% to 3% of the total amount charged. Nowadays, more credit cards than ever are nixing these fees.

- Dynamic currency conversion fees: Many merchants outside of the U.S. will offer you the option of processing your transaction in U.S. dollars rather than local currency. When you agree to this “dynamic currency conversion,” the merchant’s bank marks up the exchange rate by 1% to 3%. This markup isn’t listed separately on your receipt, and you’ll still have to pay foreign transaction fees. Opt to pay in the local currency to get your network’s exchange rate and save money.

- Rewards: Some credit cards offer high flat-rate rewards — say, 2% back on everything — which can easily offset currency conversion rate differences.

- Annual fee: These fees can eat away at your rewards, too, especially if you’re not a big spender.

- APR, if you carry a balance: You can avoid paying interest entirely by using your card only for purchases and paying it in full each month. But if you carry debt, interest charges can easily outweigh any rewards you earn.

However, if you spend a lot internationally, like Gorski, the fashion designer and entrepreneur, finding a good currency conversion rate could pay off. If Gorski had used a Mastercard instead of a Visa for her Australian legal bills, it might have saved her roughly $50 a month, according to our data. Mastercard’s average exchange rate converting Australian dollars to U.S. dollars was 1.11% more favorable than Visa’s in the weekly comparison.

“It’s not a concern for most people,” Gorski says of currency exchange rates. “But for anyone who cares about money and is spending more than $50,000 a year on international transactions, they should really consider how they’re paying.”

The best way to pay

If you want to make sure you've always got the best exchange rate, you could cover your bases and get both a Visa and a Mastercard with no foreign transaction fees. Before you go shopping, you could check the online currency conversion tools at Visa and Mastercard, and use the card that offers the more favorable rates. Assuming your transaction is processed the same day you make it — there’s sometimes a lag — you’d likely lock in the best rate.

But remember, a good rate is only a winning deal when it’s paired with no foreign transaction fees and a decent rewards rate. If you ditch your no-foreign-transaction-fee rewards card for just any card from the other network, you might end up with a better exchange rate, but a worse overall deal.

Keep an eye on exchange rates, but don’t sweat the small stuff. You might miss out on some good offers while waiting for the perfect deal.

Methodology

Click to expand

NerdWallet compared the currency exchange rates used by Visa, MasterCard and Oanda. This analysis is based on two samples of 44 currencies collected between August and September 2016:

- A weekly sample, including rates from the first Monday of each month for 12 months, from September 2015 to August 2016, or 52 days.

- A daily sample, including rates from Monday through Friday from June 2016 to August 2016, or 66 days. We excluded weekends, because MasterCard didn’t post rates for weekends at the time these figures were collected.

We chose to only compare currencies for which MasterCard, Visa and Oanda all posted rates when the data was collected in August and September 2016. We excluded currencies if there was one or more days of missing data from the network or foreign exchange platform.

Visa rates were collected from Visa’s currency conversion tool. We set “My card is in” to “USD,” “My transaction was in” to the currency, and “Bank fee” to “0.”

MasterCard rates were collected from MasterCard’s currency conversion tool. We set “Base currency” to USD. Because the rates were in a different format from Visa’s rates — for example, MasterCard would list 1 USD = 0.900000 EUR, instead of 1 EUR = 1.111111 USD — we took the inverse of each rate by dividing 1 by the online rate.

MasterCard has since redesigned its currency conversion tool so that it shows how much 1 unit of foreign currency was worth in U.S. dollars (1 EUR = 1.111111 USD, for example). Because the data was taken from the site’s previous format, there are some rounding differences in the fifth and sixth decimal places. This does not impact the results.

Oanda rates were collected from Oanda’s currency conversion tool. We set “currency you have” to USD, based on guidance from Lala, the Oanda chief of staff, and collected the exchange rate from each currency.

The rates gathered from Visa and MasterCard had 6 decimal places, while the Oanda rates had 8.

The average international traveler put $816.20 on their credit card abroad for each trip in 2014, according to the most recent data available from the National Travel and Tourism Office. Even if the average international traveler got a rate that was an average 1% worse than the competing network’s rate over the course of their travels, it would only cost about $8.

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Find the right credit card for you.

Whether you want to pay less interest or earn more rewards, the right card's out there. Just answer a few questions and we'll narrow the search for you.

Related articles