2016 American Household Credit Card Debt Study

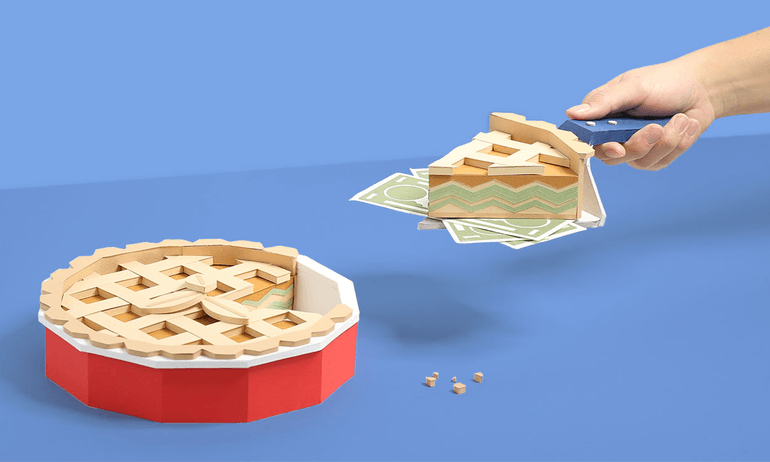

Debt is as American as apple pie: The average household has $127,977 in debt. For households that carry credit card debt, it costs them about $1,300 a year in interest. It's time to take action.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

Debt is a way of life for Americans, with overall U.S. household debt increasing by 11% in the past decade. Today, the average household with credit card debt has balances totaling $15,391, and the average household with any kind of debt owes $127,977, including mortgages.

While “don’t spend above your means” will always be sound advice, NerdWallet’s annual survey of household debt and its costs makes clear that increasing debt loads aren’t just a case of lifestyle creep. The rapid growth in medical and housing costs is dwarfing income growth, making it challenging for many families to make ends meet without leaning on credit cards and loans.

But this doesn’t mean Americans are doomed to be indebted for life. Careful spending and steady debt eradication can go a long way toward getting people to financial freedom.

This is the 2016 edition of NerdWallet's annual household credit card debt study. For the current edition and more, click here.

Before we begin getting rid of our debt, it’s important to know how much we’re working with. Here’s what the typical household is carrying, as well as total consumer debt balances in the U.S.:

Total owed by average U.S. household carrying this type of debt | Total debt owed by U.S. consumers | |

|---|---|---|

Credit cards | $15,391 | $839 billion |

Mortgages | $165,805 | $8.35 trillion |

Auto loans | $26,944 | $1.14 trillion |

Student loans | $46,107 | $1.28 trillion |

Any type of debt | $127,977 | $12.35 trillion |

Debt balances are current as of September 2016.

NerdWallet analyzed data from several sources, including the Federal Reserve Bank of New York and the U.S. Census Bureau, to determine how much debt Americans are carrying, why they have so much debt and how this debt will grow and affect the U.S. economy in the future.

As part of NerdWallet’s mission to deliver clarity for all of life’s financial decisions, we’ve scrutinized the results and provided tips for consumers to understand their debt, make room in their budgets and pay down their balances to avoid or minimize interest charges.

Key findings

Why debt has grown: The rise in the cost of living has outpaced income growth over the past 13 years. Median household income has grown 28% since 2003, but expenses have outpaced it significantly. Medical costs increased by 57% and food and beverage prices by 36% in that same span. [1]

How much debt we have: Total debt is expected to surpass the amounts owed at the beginning of the Great Recession by the end of 2016. [2] Americans will soon owe more than they did in December 2007 — but that doesn’t mean another recession is looming.

The cost of debt: The average household with credit card debt pays a total of $1,292 in credit card interest per year. This could increase to $1,309 after the Federal Reserve voted on a rate hike of a quarter of a percentage point. [3]

Debt soars as it becomes more expensive to be an American

Household income has grown by 28% in the past 13 years, but the cost of living has gone up 30% in that time period. Some of the largest expenses for consumers — like medical care, food and housing — have significantly outpaced income growth.

WHEN COST OF LIVING OUTPACES INCOME GROWTH, DEBT INCREASES

Many people assume that credit card debt is the result of reckless spending and think that to get out of debt, people need to stop buying designer clothes and eating at five-star restaurants. But many people use credit cards to cover necessities when their income just doesn’t cut it.

Out of eight major spending categories, four have grown faster than income. Unfortunately, some of the fastest-growing expenses are also the most material in many Americans’ budget. Medical expenses have gone up the most: 57% since 2003. Food and housing have also increased significantly, 36% [1] and 32%, respectively. [4]

On its face, the gap between 28% income growth and 30% cost of living growth might not seem very significant. But for Americans who have chronic health problems or live in cities with a high cost of living, the difference can be huge. It’s not surprising that debt continues to increase when it’s becoming harder to make ends meet.

After adjusting for inflation, household debt has grown 10 percentage points faster than household income since 2002. However, this gap has gotten significantly smaller since 2008, when the difference between debt and income was 38 points. [5]

EDUCATION COSTS ARE STILL INCREASING, BUT THEY’VE SLOWED SIGNIFICANTLY

After years of rapid growth, education costs have stopped outpacing income — growing 26% since 2003 [6], compared with 28% income growth.

And while student loan debt has grown 186% in the past decade [7], this growth has also slowed in recent years. Between September 2015 and September 2016, student loan balances increased by just 6.32%, the lowest annual growth since we started tracking the numbers in 2003. [8]

In addition to the apparent plateauing of education costs, it’s possible that student loan growth has slowed because of lower college attendance, specifically in the for-profit sector. There’s been a steep decline in enrollment at four-year for-profit institutions: 13.7% between fall 2014 and fall 2015. [9]

This isn’t totally surprising. Several for-profit colleges have closed due to pressure by the Department of Education and stronger regulatory scrutiny, and others are losing students as the economy rebounds and their potential students now have more job opportunities. In addition, the number of for-profit colleges that can award financial aid has declined.

For-profit schools are, on average, more expensive than public universities, and students who attend are more likely to take out loans. Students are opting instead to either attend nonprofit colleges or universities or be in the workforce, both of which likely contribute to lower overall student loan balances.

WHAT YOU CAN DO

Try to increase income and cut expenses. Seeing education costs leveling off is great, but the challenge of rising housing, food and medical costs can make it tempting to use a credit card to cover what you can’t. Consumer debt is typically more expensive than student loan debt. Ideally, you should work within your budget to avoid pricey lifestyle financing.

“Taking on debt to cover the gap between income and expenses is a short-term fix with costly long-term results,” says Sean McQuay, NerdWallet’s credit and banking expert. “Instead of taking on debt, try to increase your income by finding freelance work or a part-time job you can do on the side, or cut back on expenses where you reasonably can, before adding to your credit card’s balance.”

Don’t beat yourself up if you’re finding it increasingly harder to stay above water; the gap in income and expense growth is no joke.

Check out NerdWallet’s salary negotiation guide if you think you’re being underpaid for your work. Then, learn how to make more and spend less to free up money to put toward your debt or put less stress on your budget.

Debt alone isn’t an omen pointing to the next recession

The Great Recession was a period of economic decline — starting in December 2007 and ending in June 2009 — related to the financial crisis of 2007-2008 and the mortgage crisis of 2007-2009.

It resulted in huge losses in the stock market — which has since recovered, and then some — massive layoffs, plummeting home values and a large increase in the U.S. national debt.

In December 2007, Americans had $12.37 trillion in total debt and $839 billion in credit card debt. [2] Total debt is expected to surpass the 2007 number by the end of 2016 due largely to mortgages and student loans. That’s not a surprise, considering the increase in costs for housing and education described earlier. Credit card debt levels, on the other hand, are far from reaching recession levels. In fact, NerdWallet projects that we won’t hit December 2007 credit card debt levels again until the end of 2019. [10]

The fearmongering has already started. Several news sources and financial sites are suggesting another major recession is ahead based on increasing debt numbers. However, debt levels alone don’t point to a recession. Inflation rates are down [11], delinquencies are flat [12], and the housing market is trending up [13] — all positive signs for the economy.

“When the next recession strikes, it’s unlikely to be the result of poorly managed credit card debt,” McQuay says. “By all measures, consumers are handling their debt far more responsibly than they have in years past, likely due to a combination of issuers tightening their lending rules and consumers paying their minimums more responsibly.”

Revolving credit card debt is costly

There are two main types of credit card users:

Transactors pay off their credit card balances every month, so they don’t owe interest.

Revolvers carry all or part of their credit card balances from one month to the next, so they pay interest on their average daily balance.

Because credit card debt is one of the most expensive types of debt, it’s not cheap to be a revolver. The average household with revolving credit card debt carried a balance of $6,885 as of June 2016 and pays $1,292 a year in interest, assuming an annual percentage rate of 18.76%. [3] This average changes when you break it down by household income and employment status.

AS YOUR INCOME GROWS, SO DOES THE COST OF YOUR DEBT

Just making more money doesn’t solve debt problems. In fact, according to our findings, debt loads increase as income does; therefore, annual interest payments are larger. Higher-income people can get higher credit limits more easily, giving them more room to rack up big balances. Low-income earners, on the other hand, don’t have access to a lot of credit.

Still, the difference is striking: Households that bring in more than $157,479 per year pay almost four times more in credit card interest than households that make less than $21,432.

It’s important to look at debt in relation to income to see the whole picture. Let’s take the average debt owed by someone who makes $20,000 a year versus someone who makes $150,000. The low-income household owes $3,611 in credit card debt, or 18% of its annual income. The high-income household has a card balance of $10,036, or less than 7% of its income. [14]

Despite much higher debt numbers, the higher-income household owes a significantly smaller percentage of its annual income. So while high-income households spend more, it affects their bottom lines much less.

THE (INTEREST) COST OF SELF-EMPLOYMENT

Self-employment can be rewarding, but it can also mean incurring more debt than while working for someone else. Households led by self-employed individuals spend $1,631 in credit card interest annually, whereas heads of household working for someone else pay only $1,211 to finance their credit card debt each year. [15]

FED RATE HIKE WILL INCREASE INTEREST PAYMENTS, BUT ONLY SLIGHTLY (FOR NOW)

The U.S. Federal Reserve voted at its December meeting to increase interest rates by 0.25 percentage point [16], which will affect anyone who has a credit product with a variable interest rate. Because most credit cards have variable rates, that increase is expected to raise the average credit card interest from $1,292 to $1,309 per year. [17]

While a $17 increase doesn’t seem like an emergency situation, it’s unlikely that this would be the last Fed rate hike in the near future. If rates eventually go up by 0.5 point, that’s $34 extra in interest. If they go up by 0.75 point, that’s $52 extra in interest, and so on. If your balance or APR is higher, your interest payments will grow even more.

“It’s easy to write off a 0.25-point interest rate increase … but that would be shortsighted,” McQuay says. “These rates are expected to continue to rise, and each change adds up and increases your debt burden.

“When it comes to credit card debt, the best way to combat rising interest rates is to pay off your balances entirely. Even if it takes time, every cent of debt you can pay off reduces your interest fees. In the least, I suggest doubling the minimum monthly payment, or rounding it up to the nearest hundred dollars. Don’t wait for the Fed to continue increasing rates: Pay off your debt so you can put money in savings and start benefiting from interest increases.”

To help you get a sense of how this rate hike could affect you, we’ve created this calculator where you can enter your debt balances and current interest rates.

WHAT YOU CAN DO

Reduce your consumer debt to reduce your interest costs. Despite the statistics, you needn’t give up your dreams of becoming an entrepreneur or hitting a six-figure salary to save money on interest. Know how much consumer debt you’re carrying and the costs that come with it. Then work on paying down your highest-interest debt, especially credit card balances — the sooner the better, as Fed rate hikes are inevitable.

To help you get started, visit NerdWallet’s hub for getting out of credit card debt. Also check out alternative credit products to minimize interest costs. You can:

Look into personal loans or debt consolidation loans to consolidate your credit card debt.

Consider student loan refinancing.

Compare mortgage rates to make sure you’re getting the best possible deal on your home.

Methodology

NerdWallet reviewed internal and external data sources. Internal data has been identified as such throughout this study. The external data sources are publicly available online:

Board of Governors of the Federal Reserve System. “2013 Survey of Consumer Finances.”

Board of Governors of the Federal Reserve System. “Charge-Off and Delinquency Rates on Loans and Leases at Commercial Banks.”

Bureau of Labor Statistics. “Consumer Price Index.”

Federal Reserve Bank of New York. “The Center for Microeconomic Data.”

Inside Higher Ed. “Borrowing Falls as Prices Keep Climbing.” Oct. 26, 2016.

Inside Higher Ed. “For-Profit College Sector Continues to Shrink.” July 15, 2016.

National Student Clearinghouse Research Center. “Current Term Enrollment Estimates Fall 2015.”

The New York Times. “Fed Signals It’s on Track to Raise Interest Rates in December.” Nov. 2, 2016.

U.S. Census Bureau. “Families and Living Arrangements.”

U.S. Inflation Calculator. “Current U.S. Inflation Rates: 2006-2016.”

The Wall Street Journal. “The U.S. Housing Market in 9 Charts.” June 23, 2016.

Find the right credit card for you.

Whether you want to pay less interest or earn more rewards, the right card's out there. Just answer a few questions and we'll narrow the search for you.