5 Low-Cost Target-Date Funds for 2026

Target-date funds are designed to age with the investor by automatically rebalancing the asset allocation over time.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet, Inc. does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

Target-date funds are a "set it and forget it" retirement savings option that can remove two headaches for investors: deciding on a mix of assets and rebalancing those investments over time.

What is a target-date fund?

Target-date funds, also called life-cycle funds or target-retirement funds, are diversified mutual funds that automatically rebalance their asset allocation as the investor approaches retirement (the "target date"). The idea is to continually balance risk and returns in order to build wealth and protect a growing nest egg.

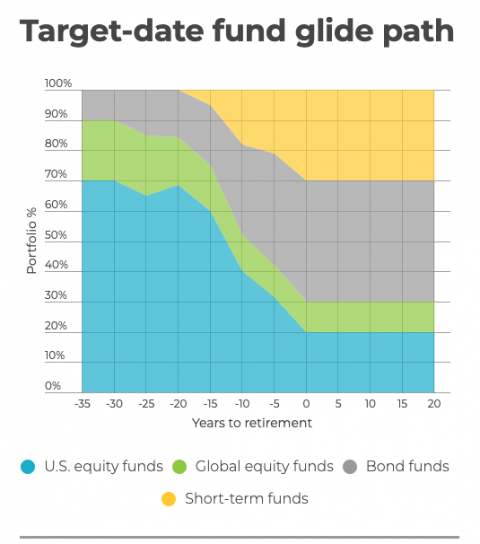

When the target date is far away, target-date funds generally tend to invest a much larger portion of the portfolio in stocks rather than fixed-income investments such as bonds, which can be safer but provide smaller returns.

As the target date approaches, the fund gradually shifts toward more bonds, money market accounts and other lower-risk investments.

Most target-date funds have names that include target dates in five-year increments. This makes it easier to identify funds with target dates near your planned retirement date (e.g., the "XYZ 2040 Fund").

Brokerage firms | |

|---|---|

Top target-date funds with low costs for 2026

This year, around 1 in 6 Americans (16%) set a goal to invest in a retirement account, according to a recent NerdWallet study. If you're among those, target-date funds could be a good place to start.

Here are some popular target-date funds designed for investors planning to retire in 2045. We selected funds open to new investors with low costs (no sales commissions, and expense ratios of 1% or less) and minimum investments of $2,500 or less.

Fund | Symbol | Expense Ratio |

|---|---|---|

Vanguard Target Retirement 2045 Fund Investor Shares | VTIVX | 0.08% |

Fidelity Freedom Index 2045 Fund Investor Class | FIOFX | 0.12% |

Nuveen Lifecycle Index 2045 Fund Premier Class | TLMPX | 0.25% |

American Funds 2045 Target Date Retirement Fund Class R-5 | REHTX | 0.42% |

T. Rowe Price Retirement 2045 Fund | TRRKX | 0.60% |

Source: Fund issuers. Data is current as of Jan 7, 2026, and is intended for informational purposes only, not for trading purposes. | ||

Pros and cons of target-date funds

Convenience.

Automation.

Strategy reinforcement.

Requires patience.

May miss short-term run-ups in specific securities.

Glide path may not align with actual retirement needs.

Why invest in target-date funds

Convenience is a big reason many Americans own target-date funds, although many may not know it. Target-date funds are the default plan of choice for many providers of employer-backed retirement plans such as 401(k) accounts.

Another advantage of target-date funds is that they keep investors from being their own worst enemy by being too reactive to the market's twists and turns, which often results in buying high and selling low.

How target-date funds work

A key feature of target-date funds is their “glide path,” or how the funds descend from a high ratio of riskier equity funds toward safer investments like bonds, and then land, freezing your asset allocation at its most conservative mix to protect your nest egg.

For example, a target fund may begin with a heavy mix of domestic and global equity funds making up 90% of the total investment. But by the target date (retirement), equity funds may make up only 30% of the total investment, and fixed-income investments (such as bonds and short-term funds) may make up the rest. Providers may offer a more sophisticated range of strategies and mixes in gliding toward your final asset allocation.

An important question to ask when choosing among target-date funds: Is this a “to” fund, in which the glide path freezes your asset allocation the year you plan to retire, or a “through” fund that continues the glide path for 10 years or more past retirement before freezing your asset allocation?

The philosophy of “through” funds is that life (hopefully) doesn’t stop at retirement. You still may have 20 years or more of living expenses, and the glide path toward safer investments should reflect that.

Different “through” target-date funds may extend the glide path 10, 15 or 20 years past retirement, so choose one that’s right for your retirement goals.

How to invest in target-date funds

There are three ways to invest in a target-date fund.

Through your 401(k). As mentioned, target-date funds are a common preset choice for a 401(k). If you have a 401(k) and never changed what's in it, there’s a good chance you already have a target-date fund.

Through a financial advisor or brokerage account. Work with a qualified financial advisor to select a fund that’s best for you. You can open a brokerage account and shop for target-date funds on your own.

Directly from the provider. You can purchase a target date fund directly from Vanguard, Fidelity, T. Rowe Price or other provider, but your choices may be limited. The fund may require a minimum investment of $500 to $3,000 or more, for example. However, some funds waive the minimum if you make monthly deposits to your account.

Tips to evaluate a target-date fund

1. Check the fees.

A mutual fund’s expense ratio, is an annual fee expressed as a percentage of your investment. The higher the fees, the more costs can erode total returns. Fees often revolve around whether the fund leans on cheaper passive investing strategies or more costly actively managed accounts.

2. Learn about what the fund invests in.

Two identically named 2050 target-date funds can have very different strategies for transitioning from equities to bonds over time. One fund’sasset-allocation strategy may be too conservative — or not conservative enough — depending on your appetite for risk.

This is also a good reason to crack open your 401(k) and see if there are other target-date funds on offer that are a better fit than the default choice.

3. Don't just forget about it.

Look at your fund's performance once a year, and look at other investments you hold. How do those assets and your target-date fund fit together? Are you double-dipping on asset classes, or even buying the same fund twice? Talking with a qualified financial advisor who can do an annual checkup of your total portfolio could help avoid these problems.

» MORE: How to invest $100,000

See where you stand compared to households like yours, and get steps you could take to grow from here.

NWWP is an SEC-registered investment adviser. Registration does not imply skill or training. Calculator by NerdWallet, Inc., an affiliate, for informational purposes only.

ON THIS PAGE

ON THIS PAGE