Schedule C: What It Is, Who Has to File It

Schedule C is an IRS tax form that reports profit or loss from a business. Sole proprietors or single-member LLCs typically use the form.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

If you freelance, have a side gig, run a small business or otherwise work for yourself, you may need to fill out IRS Schedule C at tax time. Here’s a simple explainer of what IRS Schedule C is for, who has to file one and some tips and tricks that could save money and time.

What is Schedule C?

IRS Schedule C is a tax form for reporting profit or loss from a business. You fill out Schedule C at tax time and attach it to or file it electronically with Form 1040. Schedule C is typically for people who operate sole proprietorships or single-member LLCs.

A Schedule C is not the same as a 1099 form. Although, you may need IRS Form 1099 (a 1099-NEC or 1099-K in particular) to fill out a Schedule C.

NerdWallet Wealth Partners can create a personalized plan that evolves with you, from this tax season to the next chapter. Start by answering a few questions.

on NerdWallet Wealth Partners' site. For informational purposes only. NerdWallet Wealth Partners does not provide tax or legal advice.

Who files a Schedule C form?

Schedule C is for two types of businesses: sole proprietors or single-member limited liability corporations (LLCs). Schedule C is not for C corporations or S corporations.

For tax purposes, the IRS says you’re in business if you pursue your gig continually and regularly to make money.

If your side gig involves rental income or royalties, you may need to fill out Schedule E.

If your side gig is farming, you may need to fill out Schedule F.

Sole proprietorships are unincorporated businesses that are owned and run by one person who is entitled to all of the profits and is responsible for all of the losses and liabilities. People who freelance, have a side gig, are independent contractors or operate a business by themselves often choose them.

Single-member LLCs are business entities owned by just one person. In most cases, there’s no distinction between the owner and the LLC for income tax purposes; the business’s income and profits go right onto the owner’s personal tax return.

You may have to file a Schedule C even if you have a regular day job where you’re someone’s employee. So if you’re freelancing on the side, your self-employment means you’ll probably need to add the Schedule C to your to-do list.

» Thinking about hiring a financial advisor? Here are 10 questions to ask

What is on a Schedule C form?

Schedule C is a place to report the revenue from your business and the types of expenses you incurred to run your business. Your business income minus your business expenses is your net profit (or loss). You report your net profit as income on Form 1040.

How to fill out Schedule C

Here's some information you’ll need:

Your business income statement and balance sheet for the tax year.

Receipts for your business expenses.

Inventory records, if you have inventory.

Mileage and other vehicle records if you used one for business.

Here's the basic structure of Schedule C:

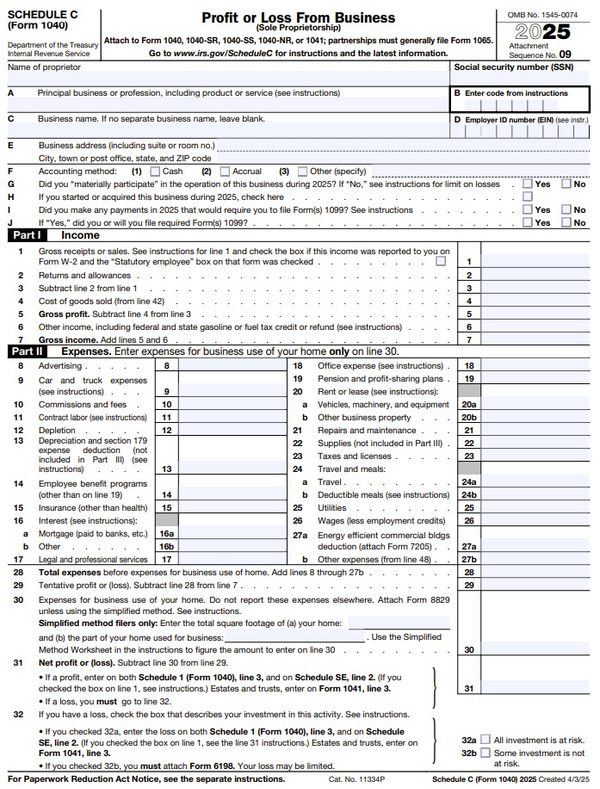

Part I is where you tally your sales and report your cost of goods sold so you can see your gross profit.

Part II is where you report your business expenses. There are over two dozen categories to help you stay organized, such as advertising, car and truck expenses, legal and professional services, rent, travel and meal expenses and other costs. The IRS' Schedule C instructions page explains the rules for each type of expense. You’ll add up all the expenses and subtract them from your gross profit to arrive at your net profit, which is taxable income for your personal tax return. If you have a net loss, it may be deductible on your personal tax return.

Part III helps you calculate your cost of goods sold.

Part IV is a place to report certain information on a vehicle if you have car- or truck-related business expenses.

Part V is a place to list other business expenses that didn’t fit into the categories in Part II.

2025 Schedule C

The more you earn, the more complex your taxes become. Learn the 10 traps to dodge.

on NerdWallet Wealth Partners' site. For informational purposes only. NerdWallet Wealth Partners does not provide tax or legal advice.

Schedule C: Tips and tricks

You may need to fill out more than one Schedule C. It’s one Schedule C per side gig. So if you have two side gigs, you’ll need to fill out two Schedule Cs.

Be sure to take advantage of other tax deductions. Self-employment can score you a lot of tax deductions, and one of the newest is the qualified business income deduction. If you qualify, you can deduct a portion of your business’s net income on your tax return.

Measure your home office’s square footage. If you have a home office, you can probably deduct some expenses associated with keeping it up and running if you’re self-employed. The IRS offers a flat-rate deduction of $5 per square foot for up to 300 square feet of home office space. But if a big percentage of your home’s square footage is dedicated to your home office, your home expenses (utilities, etc.) are high enough, and you're able to keep and compare detailed records, you might get a bigger deduction with the “regular” method.

Think about hiring someone to help. Most name-brand tax software providers sell versions that can prepare Schedule C. However, you’ll likely need to purchase the highest-end version to get Schedule C functionality. That might end up costing less than paying someone else to do your taxes (though it could cost you time). Don’t underestimate the value of a good financial advisor or accountant.

Make estimated quarterly tax payments to avoid penalties. Taxes are a pay-as-you-go arrangement in the United States; when you earn money, the IRS wants its cut as soon as possible. That’s why employers withhold taxes from employees' paychecks. But when you’re paying yourself, that’s probably not happening. To avoid late-payment penalties, you can make estimated quarterly payments to the IRS.