The Guide to American Express Travel Insurance

Travel insurance by AmEx can be bought outright or included as a perk for eligible cards.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Nerdy takeaways

- You can get AmEx travel insurance via your card or as a standalone policy.

- AmEx cards typically include coverage for trip delays, interruptions, cancellations, baggage and car rentals.

- Coverage tends to be secondary.

- Policies vary by card.

American Express has two types of travel insurance offerings: standalone travel insurance plans that customers can purchase and travel insurance that is included as a complimentary benefit on certain cards.

So if you’re thinking about getting travel insurance before a trip, get familiar with American Express travel insurance benefits that are included on your cards. Knowing what protections you already have will prevent you from spending money on a separate policy with benefits that overlap.

On this page

American Express travel insurance vs. coverage provided by AmEx cards

A standalone travel insurance policy from American Express may offer more robust coverage, but depending on your needs, the travel insurance perks provided by your AmEx card may be sufficient.

If you primarily want specific coverage for cancellations, delays or rental cars and baggage, it’s likely your card will be enough.

If, however, you’re mainly concerned with emergency health coverage while traveling, you’re better off with a separate medical insurance policy because the benefits provided by cards are limited in those areas. You can purchase this from American Express directly or shop around other travel insurance companies.

» Learn more: How to find the best travel insurance

Complimentary travel insurance provided by AmEx cards

There are six travel insurance benefits offered on many American Express cards:

Here's a closer look at each.

Earn up to 120,000 bonus points with our favorite American Express cards

Check out our nerdy picks for the best American Express credit cards and find the right card for you.

Trip cancellation and interruption insurance

Trip cancellation will protect you if you need to cancel your trip for a covered reason (more on that below), and you will be reimbursed for any nonrefundable amounts paid to a travel supplier with your AmEx card. Bookings made with Membership Reward Points are also eligible for reimbursement. Travel suppliers are generally defined as airlines, tour operators, cruise companies or other common carriers.

Trip interruption coverage applies if you experience a covered loss on your way to the point of departure or after departure. AmEx will reimburse you if you miss your flight or incur additional transportation expenses due to the interruption. American Express considers the following to be covered reasons:

- Accidental injuries.

- Illness (must have proof from doctor).

- Inclement weather.

- Change in military orders.

- Terrorist acts.

- Non-postponable jury duty or subpoena by a court.

- An event occurring that makes the traveler’s home uninhabitable.

- Quarantine imposed by a doctor for medical reasons.

There are many reasons that are specifically called out as not covered (e.g., preexisting conditions, war, self-harm, fraud and more), so we recommend checking the terms of your coverage carefully.

If you want a higher level of coverage for trip cancellation, consider purchasing Cancel For Any Reason (CFAR) travel insurance. CFAR is an optional upgrade available on some standalone travel insurance plans. This supplementary benefit allows you to cancel a trip for any reason and get a partial refund of your nonrefundable deposit.

Alternatively, if you want what essentially amounts to CFAR insurance on your flights specifically, purchase your fares through the AmEx Travel portal and tack on Trip Cancel Guard for an extra fee. Trip Cancel Guard guarantees you an up to 75% refund on nonrefundable airfare costs when you cancel at least two days before departure, regardless of why. This isn't as comprehensive as other CFAR policies, but it can add some peace of mind for people who want the cash back (as opposed to a travel credit) for flights they may not take.

AmEx cards with trip cancellation, interruption coverage

The following American Express cards offer trip cancellation and trip interruption coverage:

Additional AmEx cards that offer trip cancellation and interruption coverage include:

- Centurion® Card from American Express.

- Business Centurion® Card from American Express.

- The Corporate Centurion® Card from American Express.

- The American Express Platinum Card® for Schwab.

- The Platinum Card® from American Express for Goldman Sachs.

- The Platinum Card® from American Express for Morgan Stanley.

- Corporate Platinum Card®.

Terms apply.

SOME CARD INFO MAY BE OUTDATEDAll information about The Centurion® Card from American Express and the Business Centurion® Card from American Express has been collected independently by NerdWallet. The Centurion® Card from American Express and the Business Centurion® Card from American Express are not available through NerdWallet. |

Covered amount

The maximum benefit amount for trip cancellation and interruption insurance is $10,000 per covered trip and $20,000 per eligible card per 12 consecutive month period. Coverage is secondary and applies after your primary policy provides reimbursement. Claims must be filed within 60 days. To start a claim, call 844-933-0648.

Trip delay insurance

This benefit will reimburse you for reasonable additional expenses incurred if a trip is delayed by a certain number of hours. Examples of eligible expenses include meals, lodging, toiletries, medication and other charges that are deemed appropriate by American Express. It makes sense to use your judgment in terms of what will get approved based on your policy’s fine print.

Acceptable delays include those that are caused by weather, terrorist actions, carrier equipment failure, or lost/stolen passports or travel documents. There are also plenty of exclusions, such as intentional acts by the traveler.

AmEx cards with trip delay insurance

The reimbursable amount depends on which card you hold.

- Up to $500 per covered trip that is delayed for more than six hours; and two claims per eligible card per 12 consecutive month period.

- Up to $300 per covered trip that is delayed for more than 12 hours; and two claims per eligible card per 12 consecutive month period.

As expected, the more premium travel cards offer higher compensation for shorter delays. Trip delay insurance is offered on the following American Express cards:

| Card | Length of delay | Reimbursement amount |

|---|---|---|

| American Express Platinum Card® | 6 hours. | $500. |

| The Business Platinum Card® from American Express | 6 hours. | $500. |

| American Express® Gold Card | 12 hours. | $300. |

| American Express® Business Gold Card | 12 hours. | $300. |

| American Express® Green Card | 12 hours. | $300. |

| Centurion® Card from American Express | 6 hours. | $500. |

| Business Centurion® Card from American Express | 6 hours. | $500. |

| The Corporate Centurion® Card from American Express | 6 hours. | $500. |

| The American Express Platinum Card® for Schwab | 6 hours. | $500. |

| The Platinum Card® from American Express for Goldman Sachs | 6 hours. | $500. |

| The Platinum Card® from American Express for Morgan Stanley | 6 hours. | $500. |

| Corporate Platinum Card® | 6 hours. | $500. |

| Delta SkyMiles® Reserve American Express Card | 6 hours. | $500. |

| Delta SkyMiles® Reserve Business American Express Card | 6 hours. | $500. |

| Hilton Honors American Express Aspire Card | 6 hours. | $500. |

| Marriott Bonvoy Brilliant™ American Express® Card | 6 hours. | $500. |

| Delta SkyMiles® Platinum American Express Card | 12 hours. | $300. |

| Delta SkyMiles® Platinum Business American Express Card | 12 hours. | $300. |

Terms apply.

» Learn more: The best travel cards right now

Car rental loss and damage insurance

When you decline the collision damage waiver offered by the car rental agency, you will be covered if the car is damaged or stolen through your AmEx travel insurance. Depending on the card you have, the coverage is $50,000 or $75,000.

In addition, the cards offering car rental damage and theft insurance up to $75,000 also provide secondary benefits:

- Accidental death or dismemberment coverage.

- Accidental injury coverage.

- Car rental personal property coverage.

To qualify, you must decline the personal accident coverage and personal effects insurance provided by your car rental company.

The entire rental must be charged on the American Express card to receive coverage for car rental loss and damage. And keep in mind that you do still need liability insurance when making your rental car reservation (you may have this through your personal auto insurance policy), as these card-provided coverage options don't include personal liability.

» Learn more: How AmEx car rental insurance works

AmEx cards with car rental coverage

American Express lists over 50 cards on its site that come with one of the two forms of car rental insurance. Cards that link to the Tier 1 policies are the $50,000-coverage cards, and Tier 2 policies are the $75,000 cards.

- Car rental loss and damage insurance can provide coverage up to $75,000 for theft of or damage to most rental vehicles when you use your eligible card to reserve and pay for the entire eligible vehicle rental and decline the collision damage waiver or similar option offered by the commercial car rental company. This product provides secondary coverage and does not include liability coverage. Not all vehicle types or rentals are covered. Geographic restrictions apply.

- Car rental loss and damage insurance can provide coverage up to $50,000 for theft of or damage to most rental vehicles when you use your eligible card to reserve and pay for the entire eligible vehicle rental and decline the collision damage waiver or similar option offered by the commercial car rental company. This product provides secondary coverage and does not include liability coverage. Not all vehicle types or rentals are covered. Geographic restrictions apply.

The amount reimbursed is calculated as whichever is lowest:

- The cost to repair the rental car.

- The wholesale book value (minus salvage and depreciation).

- The invoice purchase price (minus salvage and depreciation).

Here are some key exclusions to be aware of with this coverage:

- These policies don't cover theft or damage that was caused by a driver’s illegal operation of the car, operation under the influence of drugs/alcohol or damage caused by any acts of war.

- Policies don't cover drivers not named as "authorized drivers" on your rental agreement.

- The benefit only covers car rentals up to 30 consecutive days.

- Not all cars are included in the policy. Certain trucks, vans, limousines, motorcycles and campers are excluded from coverage.

- Insurance protection doesn't apply in Australia, Italy, New Zealand and any country subject to U.S. sanctions.

You can file a claim online or call toll-free in the U.S. at 800-338-1670. From overseas, call collect to 303-273-6497. Your claim must be filed within 30 days of the loss. Additionally, some benefits vary by state, so check the policy for your specific card.

» Learn more: The guide to AmEx Platinum’s rental car insurance

Baggage insurance

As an American Express cardholder, you are eligible to receive compensation if your luggage is lost or stolen. This benefit is in addition to what you may receive from the carrier. However, the AmEx policy is secondary, which means that it kicks in after the carrier provides any compensation for losses.

AmEx provides this insurance to "covered persons," who are defined as:

- The cardmember.

- Their spouse or domestic partner.

- Their dependent children who are under 23 years old (there are age exceptions for children with a disability).

- Some business travelers (Tier 2 coverage only).

AmEx cards with baggage insurance

Naturally, the higher-end cards offer more protection, but even the basic cards have decent coverage. The compensation limits per person are as follows (note that the maximum payout per covered person for lost luggage is $3,000 on all of these cards).

Below are the limits for cardholders of American Express Platinum Card®, The Business Platinum Card® from American Express, The American Express Platinum Card® for Schwab, The Platinum Card® from American Express for Goldman Sachs, The Platinum Card® from American Express for Morgan Stanley, Hilton Honors American Express Aspire Card, Marriott Bonvoy Brilliant™ American Express® Card, Centurion® Card from American Express and Business Centurion® Card from American Express:

- Baggage in-transit to/from common carrier: $3,000.

- Carry-on baggage: $3,000.

- Checked luggage: $2,000.

- Combined maximum: $3,000.

- High-end items: $1,000.

And here are the coverage limits for cardholders of the American Express® Gold Card, American Express® Business Gold Card, American Express® Green Card, Business Green Rewards Card from American Express, Hilton Honors American Express Surpass® Card, Marriott Bonvoy™ American Express® Card, Marriott Bonvoy Business® American Express® Card, Delta SkyMiles® Reserve American Express Card, Delta SkyMiles® Reserve Business American Express Card, Delta SkyMiles® Platinum American Express Card, Delta SkyMiles® Platinum Business American Express Card, Delta SkyMiles® Gold American Express Card, Delta SkyMiles® Gold Business American Express Card and The Hilton Honors American Express Business Card:

- Baggage in-transit to/from common carrier: $1,250.

- Carry-on baggage: $1,250.

- Checked luggage: $500.

- High-end items: $250.

AmEx also offers limited reimbursement for high-end items (coverage varies by card), such as:

- Jewelry.

- Sports equipment.

- Photography or electronic equipment.

- Computers and audiovisual equipment.

- Wearable technology.

- Furs (including items made mostly of fur and those trimmed/lined with fur).

- Items made fully or partially of gold, silver or platinum.

Terms apply.

Claims must be filed within 30 days of your baggage loss. To file a claim, call 800-228-6855 from the U.S. or collect to 303-273-6497 if overseas. You can also file a claim online.

This benefit helps with lost passport replacement assistance, missing luggage assistance, emergency legal and medical referrals and, in some instances, emergency medical transportation assistance.

The service can also help you figure out important travel-related details like customs information, currency information, travel warnings, tourist office locations, foreign exchange rates, vaccine recommendations for the country you’re visiting, passport/visa requirements and weather forecasts.

AmEx cards with Premium Global Assist

Premium Global Assist is offered on the following American Express cards:

- American Express Platinum Card®.

- The Business Platinum Card® from American Express.

- Centurion® Card from American Express.

- Business Centurion® Card from American Express.

- The Corporate Centurion® Card from American Express.

- The American Express Platinum Card® for Schwab.

- The Platinum Card® from American Express for Goldman Sachs.

- The Platinum Card® from American Express for Morgan Stanley.

- Corporate Platinum Card®.

- Delta SkyMiles® Reserve American Express Card.

- Delta SkyMiles® Reserve Business American Express Card.

- Hilton Honors American Express Aspire Card.

- Marriott Bonvoy Brilliant™ American Express® Card.

Terms apply.

Services provided by Premium Global Assist Hotline

You can rely on Global Assist Hotline 24/7 for medical, legal, financial or other select emergency coordination and assistance services while traveling more than 100 miles away from your home. Plus, the Premium Global Assist Hotline may provide emergency medical transportation assistance and related services. Third-party service costs may be your responsibility.

The hotline isn’t so much a concierge as a service that provides logistical assistance, which can include the following:

General travel advice

- Emergency translation if you need an interpreter to help with legal or medical documents (cost isn't covered).

- Lost item search if your belongings are lost while traveling.

- Missing luggage assistance if an airline loses your luggage. The hotline will contact your airline on a daily basis on your behalf to help locate your bags.

- Passport/card assistance if your card or passport is lost or stolen.

- Urgent message relay if you need to contact a family member and/or friend in the event of an emergency.

Medical assistance

- Emergency medical transportation assistance if the cardmember or another covered family member traveling on the same itinerary gets sick or injured and needs medical treatment (there are many conditions for this coverage; review your policy’s fine print).

- Physician referral if you need a doctor or dentist (cardmember is responsible for costs).

- Repatriation of remains in the event of death.

Financial assistance

- Emergency wire service to get help obtaining cash (fees will be reimbursed).

- Emergency hotel check-in/out if your card has been lost or stolen.

Legal assistance

- Bail bond assistance if you need access to an agency that accepts AmEx (cardmember is responsible for paying bail bond fees).

- Embassy and consulate referral if you need help finding or accessing local embassies.

- English-speaking lawyer referral if you’re traveling and need a list of available attorneys (cardmember is responsible for any legal fees).

To use this benefit, call the Premium Global Assist Hotline toll-free at 800-345-AMEX (2639). You can also call collect at 715-343-7979.

» Learn more: How to find the best travel insurance

Global Assist Hotline

The main difference between the Global Assist Hotline and the Premium version is that some of the services that are fully covered by Premium Global Assist aren't covered in the more basic version (cited examples include emergency medical transportation assistance and repatriation of mortal remains).

You can rely on Global Assist Hotline 24/7 for medical, legal, financial or other select emergency coordination and assistance services while traveling more than 100 miles away from your home. Third-party service costs may be your responsibility.

AmEx cards with Global Assist Hotline access

The Global Assist Hotline is available to holders of several cards, including:

- American Express® Gold Card.

- American Express® Business Gold Card.

- American Express® Green Card.

- Business Green Rewards Card from American Express.

- Delta SkyMiles® Platinum American Express Card.

- Delta SkyMiles® Platinum Business American Express Card.

- Delta SkyMiles® Gold American Express Card.

- Delta SkyMiles® Gold Business American Express Card.

- Delta SkyMiles® Blue American Express Card.

- Hilton Honors American Express Surpass® Card.

- Hilton Honors American Express Card.

- The Hilton Honors American Express Business Card.

- Marriott Bonvoy™ American Express® Card.

- Marriott Bonvoy Business® American Express® Card.

- Blue Cash Preferred® Card from American Express.

- The American Express Blue Business Cash™ Card.

- The Blue Business® Plus Credit Card from American Express.

- Blue Cash Everyday® Card from American Express.

Terms apply.

You can call the Global Assist Hotline toll-free at 800-333-AMEX (2639), or collect at 715-343-7977.

Standalone American Express travel insurance plans

If you don’t have any of the cards above and are thinking about purchasing a policy from American Express or just simply want to price compare to see if you get better perks by purchasing a policy, you can go to the AmEx travel insurance website and input your trip plans to build a quote. You’ll need to provide your departure and return date, state of residence, age of traveler, number of travelers covered by the policy and the trip cost per traveler. Then, you can select the option of choosing a package or building your own.

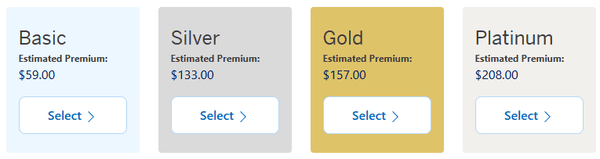

To see which plans are available, we input a sample $3,000, one-week trip by a 35-year-old from South Dakota. Our search result yielded four plans ranging from $59 for a Basic plan to $208 for a Platinum plan.

Global medical protection (not included on AmEx cards)

Medical protection includes coverage for emergency health care and dental costs as well as medical evacuation and repatriation of remains. The limits increase as the plans become more expensive. Although AmEx cards offer an array of travel insurance benefits, medical coverage isn't included. So if medical protection benefits are important to you, you’ll want to look for a standalone travel insurance policy.

Travel accident protection (not included on AmEx cards)

Another benefit not included with AmEx cards is travel accident protection. This benefit provides coverage in case of death or dismemberment while traveling. Although this is a topic no one wants to think about, it's good to be familiar with this coverage. While travel accident protection isn’t offered on the Basic plan, all of the higher plans offer it.

Standalone policy benefits that are also included on AmEx cards

These elements of coverage are offered on the AmEx cards mentioned, although in some, the limits may be higher or lower.

Trip cancellation

The Basic plan only covers a trip up to $1,000; however, all the other plans cover 100% of the trip cost. In contrast, all AmEx cards that include trip cancellation coverage provide up to $10,000 per covered trip.

Trip interruption

Trip interruption coverage ranges from $1,000 on a Basic plan to 150% of trip cost on the Gold and Platinum plans. The trip interruption benefit offered by the AmEx cards is included on all the same cards that offer trip cancellation insurance, with the trip interruption limit capped at $10,000 per covered trip.

Global baggage protection

If your luggage is lost or stolen, this benefit will provide monetary compensation to reimburse you for your lost items. AmEx cards offer baggage coverage as a complimentary benefit, with the higher-end cards naturally providing higher limits.

Global trip delay

If your trip is delayed, you’re eligible for reimbursement of any necessary expenses incurred up to a specific limit. The Basic plan doesn’t offer this benefit, but all the other plans do, with the Platinum plan providing up to $300 per day (maximum of $1,000 per trip). This coverage is also included on the higher-end AmEx cards.

Should you use the complimentary benefits or purchase a policy?

AmEx cards offer key travel insurance benefits: trip cancellation and interruption insurance, trip delay insurance, car rental loss and damage insurance, baggage insurance, Premium Global Assist Hotline (or Global Assist Hotline). However, they don't offer any sort of emergency medical coverage. This is pretty typical of travel cards, as the travel insurance perks they offer don't provide coverage for emergency health care costs.

If you’re looking for emergency medical coverage, you’ll need to purchase a separate policy, such as the standalone one offered by American Express. The other limits provided in the American Express travel insurance policy are comparable to what you get on the AmEx cards, so it makes sense to shop around to make sure that the benefits you’re paying for are sufficient for your needs.

All information about the Hilton Honors American Express Aspire Card has been collected independently by NerdWallet. The Hilton Honors American Express Aspire Card is no longer available through NerdWallet.

To view rates and fees of the American Express Platinum Card®, see this page.

To view rates and fees of the Delta SkyMiles® Reserve American Express Card, see this page.

To view rates and fees of the Marriott Bonvoy Brilliant® American Express® Card, see this page.

Insurance Benefit: Trip Delay Insurance

- Up to $500 per Covered Trip that is delayed for more than 6 hours; and 2 claims per Eligible Card per 12 consecutive month period.

- Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply.

- Please visit americanexpress.com/benefitsguide for more details.

- Underwritten by New Hampshire Insurance Company, an AIG Company.

Insurance Benefit: Trip Delay Insurance

- Up to $300 per Covered Trip that is delayed for more than 12 hours; and 2 claims per Eligible Card per 12 consecutive month period.

- Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply.

- Please visit americanexpress.com/benefitsguide for more details.

- Underwritten by New Hampshire Insurance Company, an AIG Company.

Insurance Benefit: Trip Cancellation and Interruption Insurance

- The maximum benefit amount for Trip Cancellation and Interruption Insurance is $10,000 per Covered Trip and $20,000 per Eligible Card per 12 consecutive month period.

- Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply.

- Please visit americanexpress.com/benefitsguide for more details.

- Underwritten by New Hampshire Insurance Company, an AIG Company.

Insurance Benefit: Premium Global Assist Hotline

- You can rely on Global Assist Hotline 24 hours a day / 7 days a week for medical, legal, financial or other select emergency coordination and assistance services while traveling more than 100 miles away from your home. Plus, the Premium Global Assist Hotline may provide emergency medical transportation assistance and related services. Third-party service costs may be your responsibility.

- Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply.

- Please visit americanexpress.com/benefitsguide for more details.

- If approved and coordinated by Premium Global Assist Hotline, emergency medical transportation assistance may be provided at no cost. In any other circumstance, Card Members may be responsible for the costs charged by third-party service providers.

Insurance Benefit: Baggage Insurance Plan

- Baggage Insurance Plan coverage can be in effect for Covered Persons for eligible lost, damaged, or stolen Baggage during their travel on a Common Carrier Vehicle (e.g., plane, train, ship, or bus) when the Entire Fare for a ticket for the trip (one-way or round-trip) is charged to an Eligible Card. Coverage can be provided for up to $2,000 for checked Baggage and up to a combined maximum of $3,000 for checked and carry-on Baggage, in excess of coverage provided by the Common Carrier. The coverage is also subject to a $3,000 aggregate limit per Covered Trip. For New York State residents, there is a $2,000 per bag/suitcase limit for each Covered Person with a $10,000 aggregate maximum for all Covered Persons per Covered Trip.

- Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply.

- Please visit americanexpress.com/benefitsguide for more details.

- Underwritten by AMEX Assurance Company.

Insurance Benefit: Baggage Insurance Plan

- Baggage Insurance Plan coverage can be in effect for Eligible Persons for eligible lost, damaged, or stolen Baggage during their travel on a Common Carrier (e.g. plane, train, ship, or bus) when the entire fare for a Common Carrier Vehicle ticket for the trip (one-way or round-trip) is charged to an eligible Account. Coverage can be provided for up to $1,250 for carry-on Baggage and up to $500 for checked Baggage, in excess of coverage provided by the Common Carrier (e.g. plane, train, ship, or bus). For New York State residents, there is a $10,000 aggregate maximum limit for all Covered Persons per Covered Trip.

- Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply.

- Please visit americanexpress.com/benefitsguide for more details.

- Underwritten by AMEX Assurance Company.

Insurance Benefit: Global Assist Hotline

- You can rely on Global Assist Hotline 24 hours a day / 7 days a week for medical, legal, financial or other select emergency coordination and assistance services while traveling more than 100 miles away from your home. Third-party service costs may be your responsibility.

- Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply.

- Please visit americanexpress.com/benefitsguide for more details.

- If approved and coordinated by Premium Global Assist Hotline, emergency medical transportation assistance may be provided at no cost. In any other circumstance, Card Members may be responsible for the costs charged by third-party service providers.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2026:

- Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

- No annual fee: Wells Fargo Autograph® Card

- Flat-rate travel rewards: Capital One Venture Rewards Credit Card

- Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

- Luxury perks: American Express Platinum Card®

- Business travelers: Ink Business Preferred® Credit Card

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Limited Time Only: Earn $1,000 Toward Travel!

Capital One Venture Rewards Credit Card

Travel

For a limited time, the

Capital One Venture Rewards Credit Card is offering new cardholders an especially rich bonus: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel!

More like this

Related articles