New Disney Inspire Credit Card: Valuable Credits Offset $149 Fee

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

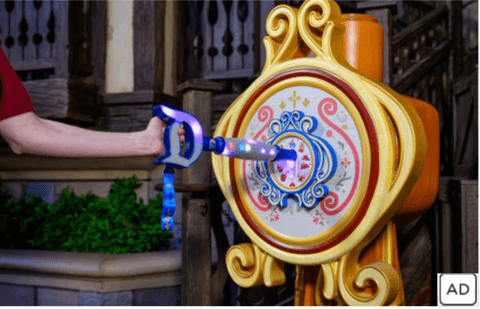

Chase Bank and Disney have partnered again to launch a third co-branded credit card, called the Disney Inspire Visa.

Compared to its two siblings — the Disney® Visa® Card and Disney® Premier Visa® Card — the Disney Inspire offers the most value for Disney fans who make regular pilgrimages to the theme parks.

With a $149 annual fee, it's also much more expensive than those other two Disney cards. But its generous reward rates, multiple statement credits and various discounts can easily offset that cost.

Rewards

The Disney Inspire card's ongoing rewards make it a great card for Disney purchases and a decent choice even for everyday use. It earns the following rates, in the form of Disney Reward Dollars:

- 10% back at DisneyPlus.com, Hulu.com and Plus.ESPN.com.

- 3% back at most other U.S. Disney locations and gas stations.

- 2% at grocery stores and restaurants.

- 1% on all other card purchases.

Disney Reward Dollars earned with the card may be redeemed for Disney theme park tickets, resort stays, Disney Cruise Line packages, purchases at DisneyStore.com and statement credits toward airline purchases, among other things. One Disney Dollar is worth $1 for all redemptions.

Rewards never expire.

Statement credits

The Disney Inspire card offers $420 in annual statement credits and Disney Dollars, more than double the card’s annual fee.

- $100 statement credit after spending $200 per anniversary year on U.S. Disney theme park tickets.

- Up to $120 annual credit on Disney+, Hulu and Plus.ESPN.com purchases.

- 200 Disney Rewards Dollars after spending $2,000 per anniversary year on U.S. Disney Resort stays and Disney Cruise Line bookings.

As of this writing, new cardholders also get a one-time welcome bonus in the form of a $300 Disney Gift Card eGift upon approval, plus a $300 statement credit after spending $1,000 on purchases in the first three months from account opening.

Yes, many of these perks are contingent on spending with your Disney Inspire card, but the spending requirements are easily attainable if you’re using the card to pay for a Disney vacation.

💸 Save 5-10% or More on Real Disney Tickets

Same tickets, less money, no catch – guaranteed! Trusted NerdWallet partner.

Other benefits

The Disney Inspire card comes with a number of ancillary perks that can save you money on your next Disney vacation.

- 0% promotional APR for six months on select Disney vacation packages.

- 10% off select purchases at DisneyStore.com.

- 10% off eligible merchandise purchases at select locations at Walt Disney World Resort and the Disneyland Resort.

- 10% off select dining locations most days at Walt Disney World Resort and the Disneyland Resort.

- 10% off the non-discounted price of select recreation experiences at Walt Disney World Resort.

- 15% off the non-discounted price of select guided tours at Walt Disney World Resort and the Disneyland Resort.

Some of these perks are also features of the other Disney credit cards. Here's how the three cards compare:

| Disney Inspire Visa | Disney® Premier Visa® Card | Disney® Visa® Card | |

|---|---|---|---|

| Annual fee | $149. | $49. | $0. |

| Rewards |

|

| • 1% in rewards on all purchases. |

| Welcome bonus | Earn a $300 Disney Gift Card eGift upon approval, plus a $300 Statement Credit after spending $1,000 on purchases in the first three months from account opening. | Earn a $400 Statement Credit after you spend $1,000 on purchases in the first 3 months from account opening. | Earn a $200 Statement Credit after you spend $500 on purchases in the first 3 months from account opening. |

| Extra perks |

|

|

|

| Foreign transaction fee | 0. | 3%. | 3%. |

Information related to the Disney® Visa® Card, the Disney® Premier Visa® Card and the Disney Inspire Visa has been collected by NerdWallet and has not been reviewed or provided by the issuer of these cards.

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Find the right credit card for you.

Whether you want to pay less interest or earn more rewards, the right card's out there. Just answer a few questions and we'll narrow the search for you.

Related articles