U.S. Bank, Edward Jones Team on New Suite of Credit Cards

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

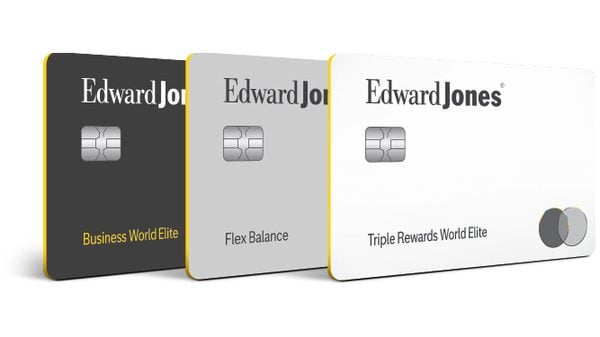

U.S. Bank has launched three new co-branded credit cards for Edward Jones clients that cater to different uses, from saving on interest to earning rewards.

The cards include:

- The Edward Jones Everyday Solutions Triple Rewards World Elite Mastercard.

- The Edward Jones Everyday Solutions Flex Balance Mastercard.

- The Edward Jones Everyday Solutions Business World Elite Mastercard.

With these cards, Edwards Jones clients will now have an option to keep more accounts at one institution.

Here’s what the cards have to offer.

» MORE: NerdWallet's best credit cards

Edward Jones Everyday Solutions Triple Rewards World Elite Mastercard

This card allows you to earn a top rewards rate on travel and everyday spending.

- Annual fee: $0.

- Bonus: 15,000 loyalty points (worth up to $150) when you spend $1,500 within 90 days of opening your account.

- Rewards:

- Earn 5 loyalty points per $1 spent on travel booked through the Rewards Center.

- Earn 3 loyalty points per $1 spent in your top three spending categories from a list of options that include grocery stores, dining, gas and travel, to name a few.

- Earn 1 loyalty point per $1 spent on all other eligible purchases

Edward Jones Everyday Solutions Flex Balance Mastercard

Cardholders will get a promotional interest rate on purchases or an option to pay down debt with this card's offers. Unlike other balance transfer cards, this one offers a $20 annual statement credit if you meet the terms. The card also features an ExtendPay plan, which offers an interest-free and fee-free window for three months each calendar year. This option is useful if you occasionally need breathing room to cover purchases.

- Annual fee: $0.

- A statement credit: Receive $20 annually if you've used the card to make purchases for 11 consecutive calendar months.

- An introductory APR: Get a 0% introductory APR on purchases and balance transfers for 15 billing cycles. After that, a variable APR applies. (For balance transfers, there's a fee of 5% of the amount of each transfer or a $5 minimum, whichever is greater.)

- An ongoing interest-free window: Receive the option of a three-month $0 ExtendPay Plan each calendar year.

- Rewards: 4 loyalty points per $1 spent on travel booked through the Rewards Center.

Edward Jones Everyday Solutions Business World Elite Mastercard

Most spending with this card will earn a high flat rate, so you don't have to track many categories.

- Annual fee: $0.

- Bonus: 20,000 loyalty points after spending $1,500 within 90 days of opening your account.

- An introductory APR: Get a 0% introductory APR on purchases for 12 billing cycles. After that, a variable APR applies.

- Rewards:

- Earn 6 points per $1 spent on travel booked through the Rewards Center.

- Earn 2 loyalty points per $1 spent on eligible purchases.

Loyalty points earned with these cards can be redeemed for investments with Edward Jones Loyalty Invest, or for a statement credit, merchandise, travel or other options. They expire five years from the end of the calendar quarter in which they were earned.

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Find the right credit card for you.

Whether you want to pay less interest or earn more rewards, the right card's out there. Just answer a few questions and we'll narrow the search for you.

Related articles