Americans’ financial confidence is strong coming into the new year, but some are feeling more equipped to deal with 2026 obstacles than others.

A recent NerdWallet survey, conducted online by The Harris Poll, found that Americans are more often confident than not about their ability to withstand money misfortune should it occur this year. Over 3 in 5 Americans (62%) say they could financially withstand a 2026 recession, and more than half (55%) think they could withstand income loss in 2026. But digging into the demographics reveals differences across genders.

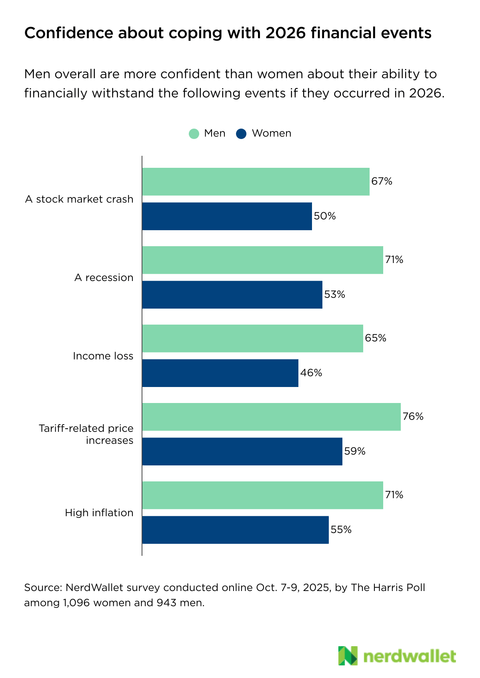

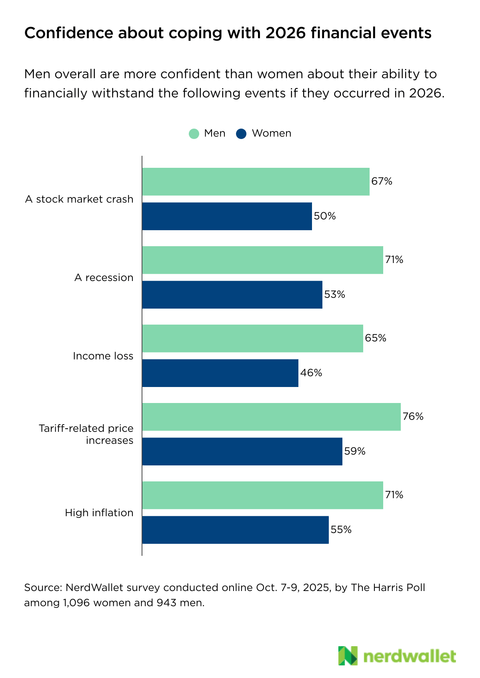

Men are consistently more likely than women to say they’re confident about their ability to financially withstand these events. For example, 65% of men say if they experienced income loss in 2026, they’d be able to financially cope, compared to just 46% of women.

Why are men more likely to feel confident about their ability to deal with these potential financial black swans? It’s likely due to a combination of factors, including financial literacy and wage gaps, as well as a gender gap in general confidence. A 2025 study by the FINRA foundation found that men score higher on a financial literacy quiz than women, though that gap is narrowing for younger generations. This slight leg up on financial knowledge may lead men to have extra confidence about dealing with money events, even potentially stressful ones.

As for the wage gap, women earned an average of 85% of what men earned in 2024, according to the Pew Research Center. And it’s arguably easier to withstand a financial hiccup or two for those who have more resources to do so.

A 2022 report on the gender gap in confidence points to another possible reason why men are more self-assured in navigating negative financial events: They appear to have more self confidence in general than women. This doesn’t necessarily mean men will be more likely to successfully cope with these potential events than women. It just means they view themselves — and therefore, perhaps, their ability to financially withstand negative economic and personal financial events — more positively than women view themselves and their abilities.

Regardless of your gender (or confidence level), being able to financially navigate negative money events gets easier when your financial house is in order. For most, this probably means saving for emergencies, paying off debt and investing for the future.

Saving for emergencies: Experts recommend an emergency fund of three to six months worth of expenses, but we all begin somewhere. If you’re starting from scratch, aim for an initial goal of $500 to $1,000, which could cover some basic home or auto repairs, or even a surprise medical bill. Then set the next goal — maybe one month of expenses — and so on.

A fully funded emergency fund will likely take years to amass, but the ability to use it to handle setbacks can be a financial confidence booster.

Paying off debt: High-interest debt is not just costly, it also eats up your budget with monthly payments. Making a debt payoff plan and sticking to it can free up cash and save money in interest costs.

Investing for the future: Once immediate financial priorities are covered, it’s smart to look to the future and start putting away money for your older self. Investing early and regularly can give you confidence that whatever the future holds, whether in 2026 or 2056, you’re doing what you can to financially prepare.

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.