4 Best Roth IRA Accounts for Beginner Retirement Investors

Roth IRA accounts generally offer the same core features, no matter where you open one. But we've narrowed down the options to highlight four Roth IRAs that offer truly unique value.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet, Inc. does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

They say the best time to start saving for retirement is now, but the second-best time is probably the first few months of the year — which, coincidentally, also happens to be now.

The reason: Retirement accounts like Roth IRAs have annual contribution limits, which means you can contribute only up to a certain amount each year. But there’s a loophole of sorts — the limits allow contributions for the previous year up until the tax-filing deadline. That means you can contribute for 2025 until April 15, 2026. If you didn’t quite get to it last year — because you put it off, or the budget didn’t stretch that far — these first few months can offer you a do-over.

The blocker, for many people — at least according to the question I always get in my email inbox — is that they don’t know where to open an account. The options can be a little bit dizzying. It feels like a heavy, hard-to-reverse decision. But the reality is most Roth IRA accounts are pretty similar at their core:

The contribution limits and eligibility requirements are set by the IRS, not the individual account providers. The limit is $7,500 in 2026 ($8,600 if you’re 50 or older). If you’re contributing for last year, it was $7,000 ($8,000 for 50 or older). Roth IRAs also have income rules, which you can review here. These, too, are set by the IRS and won’t vary by account.

Commissions for things like buying and selling investments are rare these days. You shouldn’t encounter them, but if you do, it probably isn’t the Roth IRA provider for you.

Most Roth IRA accounts will offer a large-enough selection of investments to meet the needs of most retirement investors.

In that case, you may be looking for a Roth account that adds a unique value; something that stands out from the pretty bland crowd. That’s a large part of what we considered when making this list:

Best overall Roth IRA account → Charles Schwab

Best for holistic retirement planning → Fidelity

Best Roth IRA match → Robinhood

Best for access to financial advisors → SoFi

This is a short list of our top options — the ones that truly impressed our team the most. To see the full list, any current promotions and each broker's overall star rating checkout our full Roth IRA comparison page here.

Charles Schwab: The best overall Roth IRA account

Schwab won our team’s award this year for the best broker for IRA investors, and its robo-advisor service, Schwab Intelligent Portfolios, won the sister award for the best robo-advisor for IRA investors. Candidly, this surprised us a bit; Fidelity, who I’ll talk about next, has swept this category for a few years.

What made us pick Schwab this year

Mutual fund selection: The race was tight, but the differentiator was that Schwab offers about double the number of no-transaction fee mutual funds as Fidelity. These funds are popular among Roth IRA investors, who tend to want to be hands-off with their portfolios. Knowing you can find the funds you want without paying a fee to buy — or sell — them is nice peace of mind; the wider the selection, the more likely the broker is to have a specific fund you’re after.

Educational support: Schwab also stood out to our team because it puts a lot of effort into creating investor education materials — articles, sure, but also video explainers and full courses — and tools, like a free, self-guided way to create a financial plan and track your progress. These are all really useful ways to get off on the right foot if you’re just starting to invest in a Roth IRA, and they feel authentically helpful rather than performative. (You can read our full review of Charles Schwab here.)

What Schwab doesn’t do as well

The app isn’t as slick as competitor apps, especially for people who aren’t advanced stock traders. (Among that group, Schwab has a bit of a cult following for its thinkorswim trading platform, which came over during its acquisition of TD Ameritrade.) It feels a little bit clunky and outdated. But on the other hand, I make a point of not checking my Roth IRA and other retirement accounts frequently — I’m in it for the long haul, and I don’t want to spook myself when the markets are rocky. So I don’t necessarily need or want a super slick app here.

Finally, some of us (myself included) would argue that there’s a bit of a tipping point when it comes to the number of mutual funds on offer — too many to wade through can make a relatively straightforward decision overly complex. If that’s you, you might prefer Schwab Intelligent Portfolios.

Schwab Intelligent Portfolios

A word about robo-advisors like Intelligent Portfolios: These services select investments for you based on information you provide, like how old you are, when you want to retire and how much risk you’re willing to tolerate. They’re not financial advisors; the advice is not personalized and the portfolios are built and managed using algorithms. Every time you contribute to the account, the robo-advisor will spread that contribution across investments to stay in line with the investment strategy it chose for you. In exchange, you typically pay a low management fee — most of the robo-advisors we’ve reviewed charge around 0.25% or less.

Schwab Intelligent Portfolios is different — it charges no management fee at all. But that’s just one of the reasons it made this list. The service is a five-star offering in every sense of the word. It can create over 80 different portfolios, which means it will meet the needs of basically every Roth IRA investor. You get access to all the educational and retirement planning tools I mentioned above, including that self-guided financial plan.

That said, I’ve dug through enough fine print on these products to know nothing is ever truly free. Schwab’s portfolios tend to have a higher than typical allocation to cash, and Schwab earns interest on the cash that doesn’t get invested. The company told us anywhere from 6% to about 20% of the money you deposit might remain in cash; where in that range you land depends on the information you tell Schwab about how long you plan to stay invested and how much risk you’re willing to take.

For some people, especially those opening a Roth IRA who are closer to retirement and want to maintain some cash allocation anyway, this isn’t a big deal. But if you want every dollar invested, Intelligent Portfolios probably isn’t for you. I’m a little over halfway to retirement and have a pretty high risk tolerance; that makes this a deal breaker for me.

Fidelity: The best for a holistic retirement planning experience

Our editorial team loves Fidelity. One reason may be that NerdWallet’s 401(k) is administered by Fidelity, which means we all pretty much automatically have a Fidelity account. That may be true of you, too — about 25 million people have a 401(k) plan that is hosted by Fidelity; it’s the largest 401(k) plan administrator in the country.

Why does that matter to your Roth IRA? Because both of these accounts are used to invest for retirement, and seeing their balances and investment allocations side-by-side makes it a lot easier to measure your progress. When I started working at NerdWallet, I moved my IRAs to Fidelity for this reason. I like a one-stop-shop and the simplicity of keeping everything in one place.

But even if you don’t have a 401(k) at Fidelity, you’ll find a nice home for your Roth IRA here for other reasons. Two big ones:

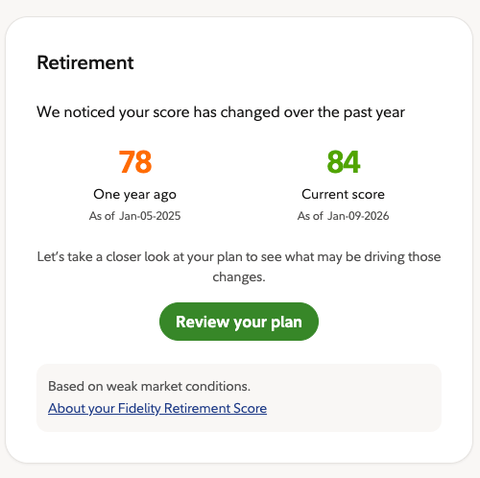

Retirement planning tools: Fidelity’s are among the best — our team gave it a perfect five stars in this category. The tools give you everything you need and nothing you don’t. One example: The Fidelity Retirement Score, which is represented as a tracker right near your accounts. It quickly and easily tells you where you stand on a scale of 1 to 100, and compares your progress to the same time last year:

You can adjust and review your plan at any time, simulating how prepared you’ll be for retirement based on various market conditions. You can also link external accounts to include them in the simulation. And if you also have non-retirement accounts at Fidelity that you plan to use for retirement — like a taxable brokerage account — you can assign them as part of your retirement savings so the tool factors those amounts in.

No-fee index funds: Fidelity is the rare broker that has earmarked a selection of its mutual funds and index funds as no-fee, which means they don’t charge the expense ratios that are typical of mutual funds, index funds and ETFs. Fees drag down your portfolio’s value over time; avoiding them as much as possible is always a good idea.

Like Schwab, Fidelity also has a robo-advisor, Fidelity Go. It’s a good choice for investors who want to be hands off, and it doesn’t charge any advisor fees on balances under $25,000 — so if you’re opening a Roth IRA for the first time, you could get free management for several years due to the annual contribution limits.

What we don’t like about Fidelity

Frankly, not much. The areas where Fidelity can fall short are more applicable to active, advanced traders — for example, you can trade options contracts for less elsewhere, and some very advanced assets aren’t offered, such as futures trading. But these are areas most Roth IRA investors won’t even notice, as they’re typically short-term strategies rather than retirement investments.

Robinhood: Best Roth IRA matching program

I’m happy with my Roth IRA at Fidelity, and I don’t plan on changing accounts, in large part because of the convenience I noted above that comes from having all my retirement accounts in one place. But recently a few IRA account providers have been offering something that is definitely turning my head: Matching programs, similar to the type that have long been offered by employer retirement plans.

Robinhood pioneered this feature, and they still offer the best program out there. Here’s how it works:

1% match on all contributions and rollovers: Anyone with a Roth IRA (or traditional IRA) at Robinhood can get a 1% match on direct contributions, transfers and rollovers. There’s no cap outside of the IRA contribution limits. For contributions, this match is worth $75 in 2026 if you’re under age 50, or $86 if you’re 50 or older. That assumes you make the full contribution.

If you transfer a balance in, either from another Roth IRA account or as a 401(k) rollover, Robinhood will base the match on the value of any transferred cash and securities. Let’s say you’re transferring in an account worth $50,000 — Robinhood would kick in $500.

3% match if you’re a Robinhood Gold member: Here’s where the match starts to get really good, and where Robinhood differentiates itself from other providers that are also offering a match. If you enroll in Robinhood Gold, a subscription service that costs $5 a month or $50 annually, you get access to a number of premium features. One of them is an increased IRA match of 3% on contributions. That means making the full allowed contribution in 2026 would get you $225 if you’re under age 50 or $258 if you’re 50 or older. Quick math shows this easily makes up for that $50 subscription fee and then some.

You might have the same question I did: Does this match put you over the contribution limit, which could result in a tax penalty? The answer is no. The matching dollars that come from Robinhood or any other broker’s matching program are considered part of your investment return, not a contribution.

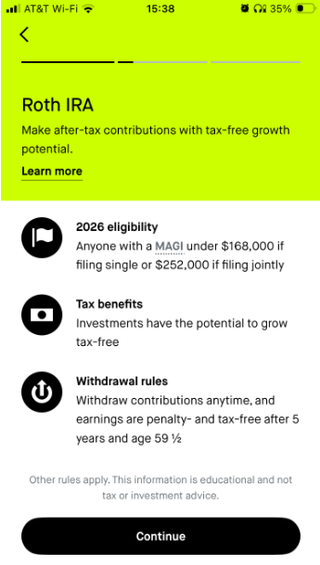

Also, props to Robinhood where props are due — the company has made some waves for targeting beginner investors, but not providing much in the way of educational support or highlighting the risks and considerations that come with investing. But Chris Davis, NerdWallet Investing's Managing Editor, called out that Robinhood is one of the few brokers we tested that shows you the Roth IRA eligibility rules and withdrawal penalties in the app before you open an account.

What we don’t like about Robinhood

Robinhood’s match is really generous, especially with Robinhood Gold, so please know I feel greedy as I say this, but it’s worth noting that the elevated 3% match you get with Robinhood Gold is only available on contributions, not rollovers or transfers. On those, you’ll still get 1% even if you have Robinhood Gold. But again, I wouldn’t turn my back on 1% — if you’ve accumulated a large Roth IRA balance elsewhere and you’re looking for a new home for it, that 1% can add up quickly.

The other thing I’ll say about Robinhood is that while it, too, has a robo-advisor – Robinhood Strategies — the matching program is not available on those accounts.

Finally, there is some fine print here to understand, as always. Most notable is that you must keep the amount of funds that earned the match in your Robinhood IRA account for at least five years; otherwise, Robinhood may claw back the match as a fee.

SoFi: Best Roth IRA if you want access to financial advisors

Like the others on this list, SoFi has a DIY trading product called SoFi Active Investing and a robo-advisor, SoFi Robo Investing. Both products offer access to financial advisors. There are some hoops to jump through which I’ll outline below, but it’s rare enough for a broker to offer access to financial advisors that the jumping could be worth it. Here’s how it works:

One free appointment: All SoFi members can set up one complimentary appointment with a financial planner. The appointment is 30 minutes long, and the planner can advise you about how to prioritize your goals or invest your Roth IRA once you’ve opened it. This is super helpful — a lot of people take the step to open a Roth IRA but then don’t know how to invest what they’ve contributed. Some people fail to invest the money at all. If you don’t want to pay the ongoing cost of a robo-advisor and your situation isn’t complex enough to work with a financial advisor, this 30 minutes may be all you need.

SoFi Plus gets you more: SoFi Plus is a premium program that’s similar to Robinhood Gold. It offers a range of premium features for $10 a month. One such feature is unlimited one-on-one appointments with one of SoFi’s financial planners. If you consider the ongoing cost of a financial advisor, getting access to advisors for $120 a year is a pretty sweet deal. This is especially true if you don’t need an ongoing relationship with an advisor or investment management — SoFi Plus is more of an on-demand option, available to answer your questions or give you guidance when needs arise.

A bonus: Like Robinhood, SoFi offers a 1% IRA match. Unlike Robinhood, that match is also available on SoFi’s robo-advisor product, SoFi Robo Investing. As you can see in the screenshot, it's easy to view all of SoFi's account offerings in one place so you can choose the best option for you.

What we don’t like about SoFi

It used to be easier to access a SoFi Plus membership; eligible direct deposits got you there and waived the $10 monthly fee. That made this financial advisor access all the more attractive. SoFi is eliminating that feature in March, which is a bummer. The company also charges an IRA closing fee of $100. You’re here to open a Roth IRA, but it’s worth looking ahead and anticipating fees like this.