First-Time Home Buyer Affordability Data — Q3 2025

There were marginal improvements in home affordability in the third quarter of 2025.

Some or all of the mortgage lenders featured on our site are advertising partners of NerdWallet, but this does not influence our evaluations, lender star ratings or the order in which lenders are listed on the page. Our opinions are our own. Here is a list of our partners.

With interest rates high and prices out of reach in many markets, the median age for first-time home buyers rose to 40 in 2025, an all-time high, according to the National Association of Realtors. But during the third quarter of the year, price growth moderated slightly and inventory rose. These subtle changes marginally improved conditions for would-be buyers.

Note: This analysis is updated quarterly. If you’re a member of the media and would like to discuss these findings and what they mean for potential buyers, please reach out to [email protected] to be put in touch with the author of this report or one of our other subject matter experts.

Key Findings

List prices were relatively stable in the third quarter.

List prices fell 2% in the third quarter to $432,600, on average, nationwide.

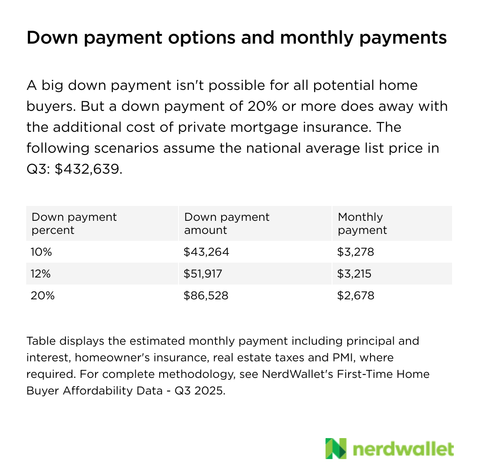

This puts the typical monthly payment for first-time home buyers at around $3,300, assuming a 10% down payment (the average for this group of buyers).

Among the 50 most populous metros, prices fell furthest in a couple of the traditionally most costly markets: Los Angeles (-7%) and Boston (-7%).

Inventory, or the typical number of homes on the market during the month, continued to rise in the third quarter.

National inventory rose 7% quarter over quarter, and is up 21% compared to the same period last year.

Four midwestern metros saw inventory rise 25% or more over the quarter: Columbus (+25%), Detroit (+26%), Cincinnati (+27%) and Indianapolis (+27%).

Third quarter data

The number of active listings plays a big role in whether buyers will find a home that suits their needs.

How much you pay for a home depends significantly on where you buy. Pricing and competition varies across the U.S.

A home’s price is only part of the equation when determining monthly affordability — housing payments also generally include homeowners insurance, real estate taxes and private mortgage insurance if your down payment is less than 20%.

» CALCULATOR: How Much House Can I Afford?