The Nerds can find your next financial product in minutes

Find auto insurance at a price that works for you.Get matched with top providers in minutes.

Enter your ZIP code

Want to view more options? Easily compare top picks side-by-side

What product or service are you looking for?

What product or service are you looking for?

Want to view more options? Easily compare top picks side-by-side

What product or service are you looking for?

What product or service are you looking for?

Stay up to date with the latest financial news from the Nerds

View all news

Super Bowl Betting is Only Getting Easier — And Weirder

Feb 6, 20264 min read

Stay up to date with the latest financial news from the Nerds

Super Bowl Betting is Only Getting Easier — And Weirder

Feb 6, 20264 min read

AD

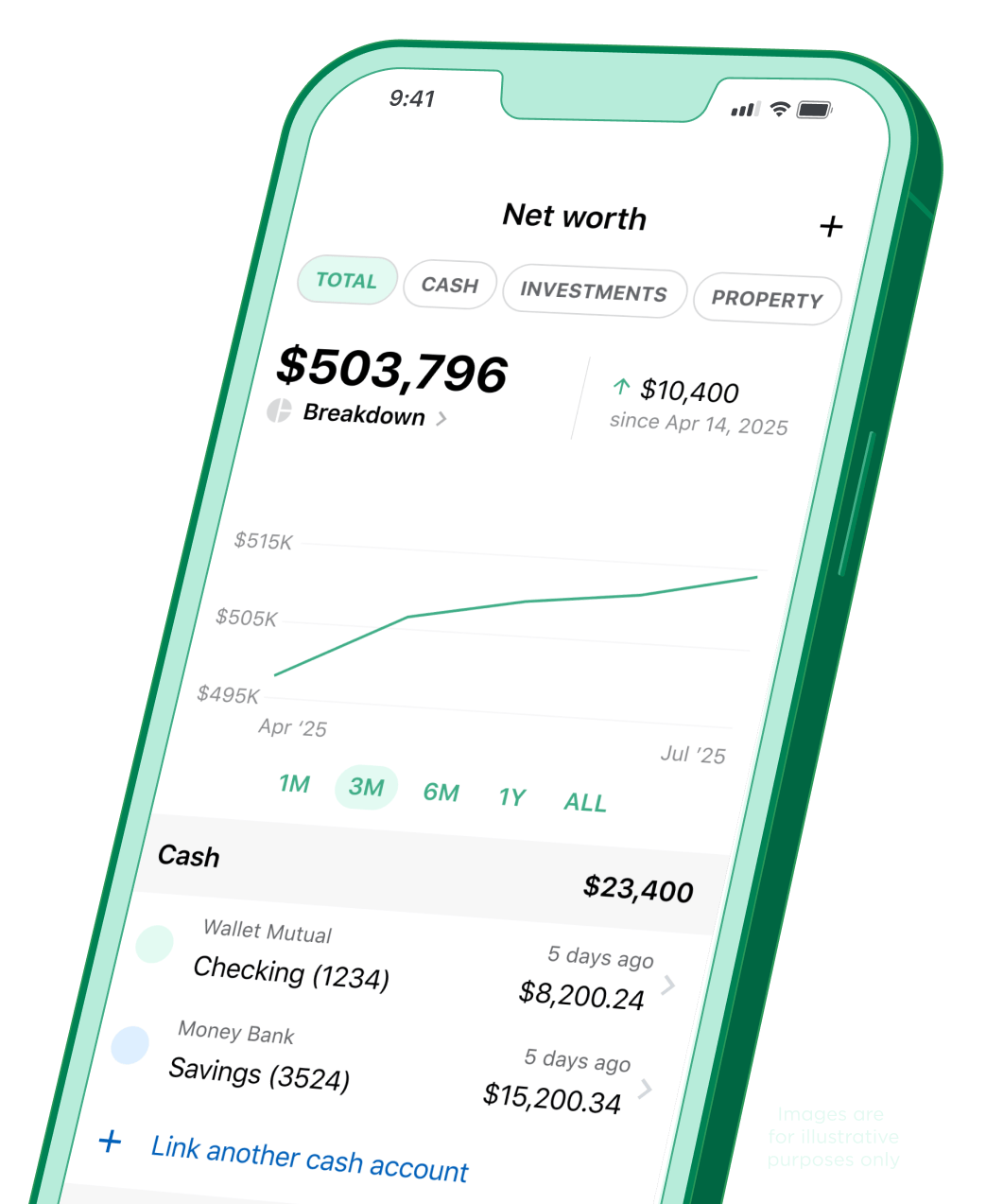

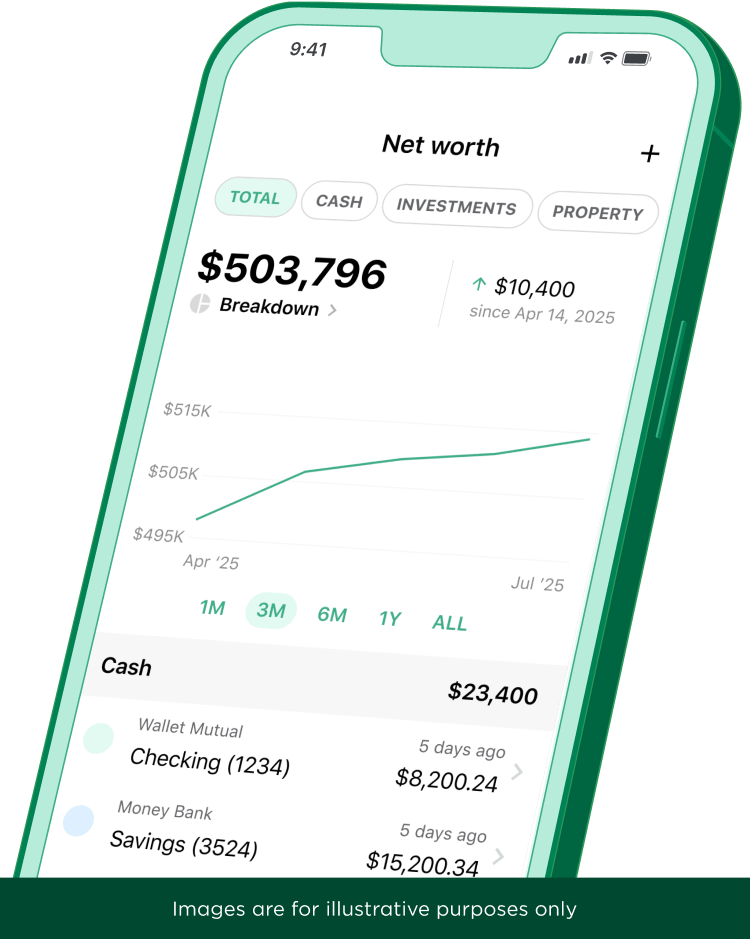

Life is messy  Make a financial planNerdWallet Wealth Partners builds personalized financial plans and investment strategies, helping you control what you can and prepare for what you can’t.on NerdWallet Wealth Partners' website. For informational purposes only. NerdWallet Wealth Partners does not provide tax or legal advice.

Make a financial planNerdWallet Wealth Partners builds personalized financial plans and investment strategies, helping you control what you can and prepare for what you can’t.on NerdWallet Wealth Partners' website. For informational purposes only. NerdWallet Wealth Partners does not provide tax or legal advice.

AD

Life is messy  Make a financial planNerdWallet Wealth Partners builds personalized financial plans and investment strategies, helping you control what you can and prepare for what you can’t.on NerdWallet Wealth Partners' website. For informational purposes only. NerdWallet Wealth Partners does not provide tax or legal advice.

Make a financial planNerdWallet Wealth Partners builds personalized financial plans and investment strategies, helping you control what you can and prepare for what you can’t.on NerdWallet Wealth Partners' website. For informational purposes only. NerdWallet Wealth Partners does not provide tax or legal advice.

*The annualized yield for a Treasury Bill (“T-Bill”) maturing in one month as of 02/06/26 when held to maturity is 3.75%. Rate shown is gross of fees. Annual percentage yield (APY) is the nominal interest rate of the T-Bill maturing in one month with 12 compounding periods per year. Annualized yield and APY are investment characteristics of the T-bill and should not be regarded as performance or a projection of performance of any Treasury account. The effective return on T-Bills will be reduced by fees which has a compounding impact on returns over time.