Is a 750 Credit Score Good or Bad?

A 750 score is very good and higher than the American average. You'll get among the very best rates on loans and credit cards.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Is 750 a good credit score?

A 750 credit score is considered very good and above the average score in America.

The average FICO 8 credit score was 715 as of September 2025, according to FICO. The average VantageScore 3.0 was 702 as as of March 2025.

Your credit score helps lenders decide if you qualify for products like credit cards and loans, and your interest rate. A score of 750 puts you in a strong position.

A 750 credit score can help get you the best rates on loans and credit cards

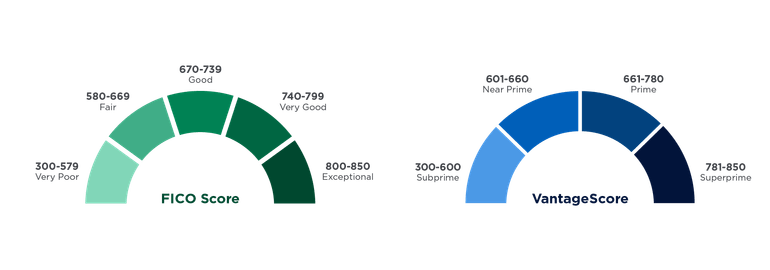

When your score is 750, you’re in a strong position to qualify for most financial products and get among the very best rates on them. A 750 credit score is considered excellent on commonly used FICO and VantageScore scales.

There are some exceptions; a high score by itself isn't always enough. The length of your credit history and how much debt you carry relative to your income also matter.

Stress less. Track more.

See the full picture: savings, debt, investments and more. Smarter money moves start in our app.

Can I buy a car with a 750 credit score?

You’ll find solid financing options with a 750 credit score. The average credit score was 754 for a new-car loan but 691 for a used-car loan in the third quarter of 2025, according to a report from credit bureau Experian . The average auto loan rate for borrowers with a 750 credit score was 6.51% for a new car and 9.65% for a used car.

Can I buy a house with a 750 credit score?

A 750 credit score is well above the minimum credit score needed to buy a house, by most lenders’ standards. You are likely to qualify for the lowest interest rates on a mortgage.

How to safeguard your 750 credit score

You already practice good credit habits, but there are ways to safeguard your score and possibly take it higher:

- Consider setting up automatic payments. A single late payment can knock as much as 100 points off your credit score. If you haven’t set up automatic payments, consider doing so to avoid the risk of missing a payment.

- Keep an eye on your credit utilization. The lower your credit card balances are compared with your credit limits, the better it is for your score.

- Look for errors on your credit reports. There may be mistakes on your report that prevent your score from going higher. Check your reports at all three major credit bureaus and dispute any errors you find.

While you may be determined to move your score up to 800 or higher to qualify for the best terms and rates, remember that 750 is above the good credit score threshold and will help get you great offers.

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

- 1. Experian Information Solutions. State of the Automotive Finance Market Q3 2025. Accessed Dec 5, 2025.

Related articles