How to Set Financial Goals: A Step-By-Step Guide

Think about what you want and why. Then, assess where you are right now to determine what you need to do to get there.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet, Inc. does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

Learning how to set and and balance financial goals can help you build the future you want.

Whether your vision of success is a luxurious lifestyle or simply having enough financial security to stop stressing about money, you need a plan to get you there.

Set aspirations that align with your values, and make sure to leave room for immediate goals as you form a long-term plan.

Here’s how to set financial goals — and reach them

1. Start by finding your 'why'

Think not just about what you want to do, but why you want to do it. Attaching reasons to your goals can put them in perspective and fuel motivation. For example:

- Build up an emergency fund so you can afford to pay rent if you lose your job.

- Get rid of credit card debt so you can put your income toward something other than interest payments.

Starting with your inspiration can also help you identify whether your goals are short-term, long-term or in between. Then, you can prioritize which goals to tackle first.

Here’s the difference between short- and long-term financial goals:

Short-term financial goals

Short-term goals can usually be reached within a couple of weeks, months or years. Think building an emergency fund or making a budget.

Mid-term financial goals

Mid-term goals are those that can take a few years to achieve.

If you want to buy a car, for example, this could take longer to achieve than other short-term goals, but less time than saving for retirement.

Long-term financial goals

Long-term goals take you far into your future — think saving for college or retirement, or paying off a mortgage. These goals often take five years or more to achieve.

2. Focus on the basics

Maybe you have multiple goals in mind and don’t know what to do next. Or maybe you don’t have specific goals. That’s OK.

Looking at where you stand right now can help set you on the right trajectory.

Start by assessing your income, income tax situation, budget and net worth.

“Having an understanding of these four things will help determine goals and prioritization of those goals,” says Steve Martin, wealth planning advisor at Oasis Wealth Planning Advisors in Nashville, Tennessee.

You can use these common financial goals as a guide (we recommend attacking them in this order):

Create a budget

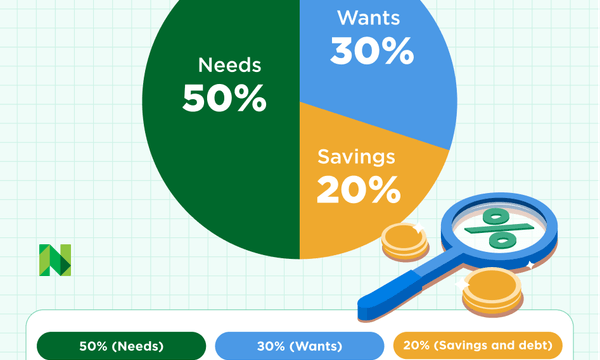

If you don’t have a budget, make one. This can keep all your other goals on track by preventing overspending and under-saving. One option is the 50/30/20 budget, where you allocate 50% of your income toward needs, 30% toward wants and 20% toward savings and debt repayment.

Build an emergency fund

A healthy emergency reserve acts as a safety net during financial shocks like an unexpected bill or job loss.

A good starting goal is $500, which can cover many unexpected expenses.

Over the long haul, it's ideal to save up enough to cover three to six months of your essential expenses. Consider putting the money in a high-yield savings account, which typically earn more interest than traditional savings accounts.

Save for retirement

Retirement may be decades away, but it’s important to start saving as early as possible so that you have enough money to survive on when the time comes. Most experts recommend saving 10% to 15% of your gross income each year.

If your employer offers a 401(k) and matches your contributions, consider taking full advantage of that free money. Factor in whether you're managing money as a single person, or working with a partner.

If your employer offers a 401(k) and matches your contributions, consider taking full advantage of that free money. Factor in whether you're managing money as a single person, or working with a partner.

Pay off debt

Focus on paying down high-interest toxic debt first, like credit card debt or payday loans. Then, pay down lower-rate debt like student loans or a mortgage.

3. Use the 'SMART' goals framework

Consider all the necessary pieces of a plan — not just the goal, but the steps you’ll take to reach it. Quentara Costa, a certified financial planner in North Andover, Massachusetts, says a strong basis for setting any goal is to make sure it’s “SMART”:

- Specific

- Measurable

- Achievable

- Realistic

- Time-bound

Say you want to save for a vacation. Lay out the details before you move forward: Pick a destination, decide when you want to go and estimate the cost.

Determine whether this goal is doable and practical given your income, savings and expenses. If the goal seems out of reach, try to make adjustments before scrapping the idea entirely.

Maybe you’re not on track to save enough for a trip in six months. Push your deadline back to a year, automate your savings, or open a new savings account with a higher interest rate and a sign-up bonus to speed up your progress.

» MORE: Crunch the numbers with our savings goal calculator

4. Write your goals down

After you’ve identified and vetted your goals, mark them down. This can keep objectives clear, organized and tangible.

Fill out a worksheet or spreadsheet, or use a notepad. Check in periodically and track your progress. Once you’ve crossed off one goal, move on to the next.

5. Make treating yourself a part of the plan

Setting goals doesn’t have to feel like a chore. Reward yourself for making progress and accomplishing goals. Once you’ve tackled high-priority goals like building an emergency fund, saving for retirement and shrinking debt, you can focus on more exciting goals.

These might include making more money, investing, working from home, starting a business or saving for a major purchase like a car or house.

»Want to call in a pro? How to choose a financial advisor

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Related articles