The Complete Guide to Hilton Honors

Hilton Honors members most commonly earn points through stays and spending on Hilton's credit cards. Redeem those points for free hotel nights.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

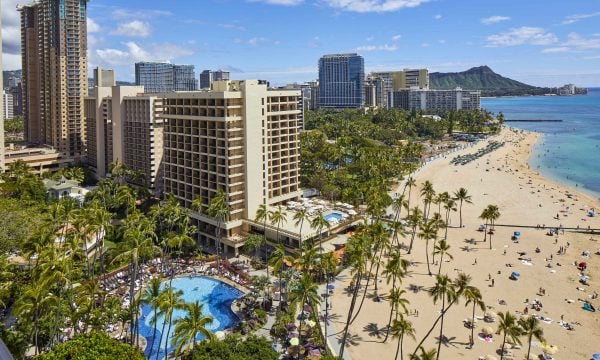

Hilton Honors is the loyalty program covering Hilton's sprawling empire of more than 9,000 properties across 141 countries. The Hilton Honors program is free to join, and you'll earn points that can be redeemed for hotel stays.

The program stands out for a few reasons: It's relatively easy to earn elite status (provided you're willing to open a credit card), members with Gold status and above get genuinely useful perks like free breakfast or dining credits, and there are multiple paths to earn free hotel nights. But let's be honest — Hilton points have become one of the weakest currencies in travel rewards, valued at just 0.4 cent each by our analysis.

On this page

By signing up, you will receive newsletters and promotional content and agree to our Terms of Use and acknowledge the data practices in our Privacy Policy. You may unsubscribe at any time.

What are Hilton points worth?

Relative to other hotel loyalty programs, Hilton points aren't worth much. NerdWallet values Hilton Honors points at 0.4 cent each, making them the least valuable points currency we track. To put that in perspective, a 100,000-point sign-up bonus is worth just $400 in real-world value.

That doesn't mean Hilton points are useless — they're just inflated. You earn them easily (10 points per dollar at most properties), but you need mountains of them to book anything worthwhile. After multiple devaluations in 2024 and 2025, luxury properties that once cost 95,000 points per night now run 200,000 or even 250,000 points. Mid-tier hotels have crept up by 5,000 to 10,000 points per night.

The good news? Hilton points are abundant. You can rack them up quickly through credit card spending, sign-up bonuses and hotel stays. Just don't expect them to stretch as far as they once did.

How to join Hilton Honors

Signing up is straightforward and free. Head to Hilton.com and create an account. Once you're enrolled, you can track points, book stays and manage reservations through the website or mobile app. It’s free to join, and you can register here.

To log in to your Hilton account, visit Hilton.com and select “sign in” from the menu at the top.

» Learn more: How to become a Hilton Honors member

How to earn Hilton Honors points

You'll earn two types of points with Hilton: base points and bonus points. Generally, this is a distinction without a difference. Both types can be redeemed for hotel stays.

Base earning rates:

- 10 points per dollar at most Hilton properties.

- 5 points per dollar at Home2 Suites, Homewood Suites, Spark by Hilton and Tru by Hilton.

- 3 points per dollar at LivSmart Studios.

Elite status bonus rates (on top of base rates):

- Silver: 20% bonus, or 12 points per dollar total.

- Gold: 80% bonus, .

- Diamond: 100% bonus.

- Diamond Reserve: 120% bonus.

Even when you're not booking stays, there are many other ways to earn Hilton Honors points.

Do Hilton points expire?

Yes, but it's easy to keep them alive. Hilton Honors points expire after 24 months of account inactivity. Any earning or redemption activity — even something small like shopping on Amazon with points — resets the clock.

Hilton credit cards

The easiest way to earn Hilton points (and elite status) is through American Express co-branded cards. Here are a few of your options:

Annual fee

$0.

$150.

$195.

Earning rates

• 7 points per $1 on eligible purchases with a hotel or resort within the Hilton portfolio.

• 5 points per $1 at U.S. restaurants, U.S. supermarkets and U.S. gas stations.

• 3 points per $1 on all other eligible purchases.

Terms apply.

• 12 points per $1 on eligible purchases with a hotel or resort within the Hilton portfolio.

• 6 points per $1 at U.S. restaurants, U.S. supermarkets and U.S. gas stations.

• 4 points per $1 on U.S. online retail purchases.

• 3 points per $1 on all other eligible purchases.

Terms apply.

• 12 points per $1 on eligible purchases with a hotel or resort within the Hilton portfolio.

• 5 points per $1 on other purchases made using the Hilton Honors Business Card on the first $100,000 in purchases each calendar year, 3 points per $1 thereafter.

Terms apply.

Other noteworthy benefits (see reviews for full rundown)

• Hilton Honors™ Silver status, which gives you a 20% bonus on Hilton Honors base points as well as a fifth night free whenever you use points to book five or more nights at a Hilton property.

• Path to Gold status. Get an upgrade to Gold if you spend $20,000 or more on the card in a calendar year.

Terms apply.

Learn more about elite status levels with our guide to the Hilton Honors program.

• Hilton Honors™ Gold Status, which gives you an 80% points bonus, as well as complimentary breakfasts at select hotels and room upgrades at select properties where available.

• Path to Diamond status. Get an upgrade to Diamond if you spend $40,000 or more on the card in a calendar year.

• $200 annual statement credit for eligible Hilton purchases on your card (doled out in $50 statement credits per quarter).

• Potential free night. Earn a free night award after you spend $15,000 on purchases on your card in a calendar year.

Terms apply.

• Hilton Honors™ Gold Status, which gives you an 80% points bonus, as well as complimentary breakfasts at select hotels and room upgrades at select properties where available.

• Path to Diamond status. Get an upgrade to Diamond if you spend $40,000 or more on the card in a calendar year.

Terms apply.

Welcome offer

Earn 70,000 Bonus Points plus a Free Night Reward after you spend $2,000 in purchases on the Card in the first 6 months of Card Membership. Offer Ends 4/15/2026. Terms Apply.

Earn 130,000 Bonus Points plus a Free Night Reward after you spend $3,000 in purchases on the Card in the first 6 months of Card Membership. Offer Ends 4/15/2026. Terms Apply.

Earn 175,000 Hilton Honors Bonus Points plus a Free Night Reward after you spend $8,000 in purchases on the Hilton Honors Business Card in the first six months of Card Membership. Offer ends 4/15/2026. Terms Apply.

Learn more

» Learn more: Hilton credit cards — which one should you get?

There's also the Hilton Honors American Express Aspire Card.

- Annual fee: $550.

- Welcome bonus: Earn 150,000 Hilton Honors Bonus Points after you spend $6,000 on eligible purchases on the Hilton Honors American Express Aspire Card within your first 6 months of Card Membership. Terms Apply.

- Earning rates: 14x points at Hilton properties, 7x on select travel, 7x at U.S. restaurants and 3x everywhere else.

- Status: Automatic Diamond status.

- Perks: $200 airline fee credit (doled out as $50 per quarter), $400 Hilton resort credit (doled out as $200 semi-annually) and a free night reward annually.

Hilton Honors Adventures and Explora Journeys partnership

Starting summer 2026, Hilton Honors members will be able to earn and redeem points on Explora Journeys cruises. Explora Journeys is the luxury ocean travel brand owned by the MSC Group, currently operating two ships with plans to expand to six by 2028.

This partnership introduces "Hilton Honors Adventures," which Hilton is positioning as an expansion of its loyalty program into experiential travel beyond hotels. The program also includes Hilton's existing partnership with AutoCamp, an outdoor hospitality provider.

How it works: By summer 2026, you'll be able to book Explora Journeys voyages using Hilton Honors points, earn points on cruise bookings and receive on-board benefits. Itineraries include the Mediterranean, Northern Europe, the Caribbean, Alaska and Asia (starting 2027).

Current preview offer (through June 7, 2026): Since you can't yet earn or redeem points on these cruises, Hilton is offering a limited-time booking incentive:

- 100,000 bonus Hilton Honors points per suite booked.

- Up to $400 in onboard credits for 16 selected itineraries ($200 on all other voyages).

- In-suite welcome gift.

These credits can be used for dining, excursions, spa treatments, and suite upgrades.

Is it worth it? At 0.4 cent per point, those 100,000 bonus points are worth about $400 in real value. Whether this represents good value depends entirely on the cruise fare you're paying and how those bonus points compare to discounts you could find elsewhere. The onboard credits add some value, but remember you're still paying full price upfront for a luxury cruise.

Once points redemptions go live in 2026, the value proposition will depend on Hilton's award pricing structure for cruises — something we'll need to see before making any recommendations.

How to redeem Hilton points

Good Hilton points redemptions

- Hotel stays: This is the only redemption worth pursuing. Award prices fluctuate based on demand, season, and property, so comparison shopping is essential. Look for stays that deliver at least 0.4 cent per point in value — ideally more.

- Points & Money bookings: If you're short on points, Hilton lets you combine points and cash in flexible increments starting at 5,000 points. This can occasionally be more cost-effective than buying points outright, though you're still not getting great value.

- The Fifth Night Free perk: If you have any elite status (Silver or higher), every fifth night is free when booking a standard room entirely with points. This is one of the program's best features and can effectively boost your redemption value by 20% on longer stays.

» Learn more: Hilton Honors points — sweet spots for redemptions

Terrible Hilton points redemptions

- Amazon shopping: Points are worth just 0.14 cents each when used on Amazon — less than half their hotel redemption value. Unless you're sitting on a pile of points you'll never use, skip this option.

- Transfers to airline partners: Hilton transfers to airline partners at a dismal 10:1 ratio (10 Hilton points = 1 airline mile). Given that Hilton points are already worth just 0.4 cent each, this tanks their value even further. Only consider this if you're a few miles short of a valuable award flight and have no other way to top up your account.

Hilton airline partners

- Aeromexico.

- Air Canada.

- Air Asia BIG.

- ANA All Nippon.

- British Airways.

- Cathay Pacific.

- China Eastern.

- Delta Air Lines.

- Emirates.

- Ethiopian Airlines.

- Etihad Airways.

- EVA Air.

- Flying Blue.

- Genting Rewards.

- Hainan Airlines.

- JAL Japan Airlines.

- Jet Airways.

- Malaysia Airlines.

- Qantas Airways.

- Qatar Airways.

- Saudi Arabian Airlines.

- Singapore Airlines.

- Turkish Airlines.

- United Airlines.

- Virgin Atlantic.

- Virgin Australia.

Hilton elite status

Hilton Honors offers four elite status levels (plus a fifth lifetime tier). In 2026, Hilton significantly overhauled its elite status program by reducing qualification requirements and introducing its ultra-premium Diamond Reserve tier.

You earn elite status through one of three metrics based on your activity at Hilton properties: the number of nights you stay, the number of times you stay or the amount of money you spend. The Diamond Reserve tier requires you to stay a certain number of nights or times, in addition to spending a minimum amount each year.

2026 elite status requirements

Member (free): You get this just by signing up.

- No resort fees on reward stays.

- Late check-out when available.

Silver (10 nights, 4 stays, or $2,500 spend):

All of the above, plus:

- 20% points bonus.

- Free bottled water.

- Fifth night free on award stays.

Gold (25 nights, 15 stays, or $6,000 spend):

All of the above, plus:

- 80% points bonus.

- Space-available room upgrades, up to executive floor rooms.

- Daily food & beverage credit or continental breakfast (varies by brand and region).

Diamond (50 nights, 25 stays, or $11,500 spend):

All of the above, plus:

- 100% points bonus.

- Executive lounge access.

- Space-available room upgrades, up to one-bedroom suites.

- Guaranteed room when booked at least 48 hours in advance.

Diamond Reserve (80 nights or 40 stays AND $18,000 spend):

All of the above, plus:

- Lock in premium room upgrades (up to one-bedroom suites) with a Confirmable Upgrade Reward at the time of booking for stays up to 7 nights. You get one reward when achieving status, plus the option at 120 nights to choose between a second reward or 30,000 points.

- Guaranteed 4 p.m. late checkout on every stay (no exceptions for resort properties).

- Premium Club access (exclusive lounges at select luxury properties, beyond standard executive lounges).

- Highest priority for space-available upgrades.

- 24/7 dedicated customer service line.

Lifetime Diamond: Requires 10 years of Diamond status plus either 1,000 nights or $200,000 in spending (changed from 2 million base points). This status is permanent and cannot be revoked.

Major changes coming in 2026

Easier qualification: Gold status drops from 40 to 25 nights, while Diamond drops from 60 to 50 nights. This makes mid-tier status significantly more accessible for frequent travelers.

New top tier: Diamond Reserve requires both 80 nights or 40 stays AND $18,000 in annual spending — you can't hit it through credit card spending alone. Hilton estimates only "thousands, not millions" will qualify.

Rollover nights eliminated: Excess nights no longer roll over to help you qualify the following year.

Points devaluation at budget brands: As of January 8, 2026, Homewood Suites and Spark by Hilton earn 5 base points per dollar (down from 10), matching the earning rate at Home2 Suites and Tru by Hilton.

The credit card shortcut

You can bypass nights-based qualification entirely with the right Hilton credit card:

- Silver status: Hilton Honors American Express Card, which has an annual fee of $0 (see rates and fees).

- Gold status: Hilton Honors American Express Surpass® Card ( $150 annual fee) The Hilton Honors American Express Business Card ($195 annual fee), or American Express Platinum Card® ($895 annual fee) (see rates and fees).

- Diamond status: Hilton Honors American Express Aspire Card ($550 annual fee) (see rates and fees).

For most travelers, the credit card route is cheaper and easier than earning status through hotel stays. Even with the 2026 changes making organic qualification easier, you'd need to spend at least 25 nights at Hilton properties to earn Gold — far more expensive than a $150 annual fee.

What makes Hilton Honors competitive (and what doesn't)

The good:

- No blackout dates for award stays.

- No resort fees when booking with all points.

- Fifth night free on point redemptions (with any elite status).

- Easy to earn elite status through credit cards.

- Genuine elite status value from Gold and Diamond status perks (free breakfast/credits, lounge access).

- Massive hotel footprint with 9,000+ properties.

The bad:

- Points are worth just 0.4 cent each — one of the weakest currencies in travel rewards.

- Award prices have increased significantly over the past two years.

- "Space-available" upgrades often don't materialize, especially at popular properties.

- Lowest-tier Silver status benefits are nearly worthless.

- Points earning devaluations at budget brands.

The ugly:

- Recent devaluations have pushed luxury properties to 200,000-250,000 points per night.

- Rollover nights being eliminated in 2026 removes a valuable benefit for frequent travelers.

- More people qualifying for Gold and Diamond could mean increased competition for upgrades and lounge access.

Bottom line

Hilton Honors is worth your attention if you're a frequent Hilton guest or willing to get a co-branded credit card for elite status perks. The program's strength lies in accessible elite status and useful benefits like free breakfast and lounge access, not in point value.

The 2026 changes are a mixed bag: Easier qualification for Gold and Diamond status is genuinely positive, but the new Diamond Reserve tier effectively creates a "haves and have-nots" divide in the elite ranks. Meanwhile, the elimination of rollover nights and points devaluations at popular budget brands chip away at the program's value.

If you're chasing elite status for perks, consider applying for a credit card and save yourself the hotel spending. If you're collecting points for redemptions, set realistic expectations. Hilton points are plentiful but weak, and you'll need a lot of them for meaningful rewards.

What is the Hilton Honors phone number?

Hilton offers a variety of different contact methods, which can vary depending on what country you're in. To call Hilton, dial 800-446-6677 if you’re in the U.S. and Canada.

To view rates and fees of the American Express Platinum Card®, see this page.

To view rates and fees of the Hilton Honors American Express Card, see this page.

To view rates and fees of the Hilton Honors American Express Surpass® Card, see this page.

To view rates and fees of The Hilton Honors American Express Business Card, see this page.

All information about the Hilton Honors American Express Aspire Card has been collected independently by NerdWallet. The Hilton Honors American Express Aspire Card is no longer available through NerdWallet.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2026:

- Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

- No annual fee: Wells Fargo Autograph® Card

- Flat-rate travel rewards: Capital One Venture Rewards Credit Card

- Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

- Luxury perks: American Express Platinum Card®

- Business travelers: Ink Business Preferred® Credit Card

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

On this page

Limited Time Only: Earn $1,000 Toward Travel!

Capital One Venture Rewards Credit Card

Travel

For a limited time, the

Capital One Venture Rewards Credit Card is offering new cardholders an especially rich bonus: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel!

More like this

Related articles