The Guide to Atmos Rewards

Atmos Rewards is the loyalty program for Alaska and Hawaiian Airlines. Here’s what it offers.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

Atmos Rewards, the joint loyalty program of Alaska Airlines and Hawaiian Airlines, lets you earn and redeem Atmos points when you fly with those airlines and over 30 partners.

While the route network for Alaska and Hawaiian is primarily concentrated on the West Coast, even East Coast residents can find value in Atmos’ award sweet spots due to the program’s broad network of partners, including American Airlines.

On this page

Get the 'Cheat Codes' to Cheaper Travel

Unlocking the secret to saving a ton on travel is easier than you think. 📤 Our free newsletter shows you how in 5 min. or less.

How to earn Atmos points

To earn Atmos points, you’ll first have to sign up for the program (it’s free). Then you can earn Atmos points in a number of ways, including:

- Flying with Alaska, Hawaiian or any partner airline.

- Spending on an Alaska or Hawaiian credit card.

- Transferring points from Bilt Rewards.

- Transferring points from Marriott Bonvoy.

- Using the Atmos Rewards Shopping portal and Atmos Dining programs.

- Buying Atmos points.

Atmos points don’t expire, but if you go two years without any activity in your Atmos account, your account may be locked. In this case, you’ll need to call Alaska to verify your identity and reactivate the account, but your miles will still be there.

In addition to points, qualifying activities will earn status points towards elite status with Atmos Rewards. Status points are not redeemable, but are used to track your annual progress toward milestone rewards and Silver, Gold, Platinum and Titanium status.

» Learn more: Do Alaska miles expire?

Nerdy Perspective

What's your experience like flying Alaska Airlines?

Earning Atmos points when you fly

Eligible flights on Alaska, Hawaiian or other qualifying partner airlines earn one base Atmos point per actual mile flown (unless it’s a basic economy fare, which earns 30% of the miles flown). For example, flying 1,000 miles earns 1,000 base points. Alaska or Hawaiian flights shorter than 500 miles will earn 500 points.

This distance-based earning system is rare among U.S. airlines today, most of which award frequent flyer miles based on dollars spent. Generally, the Atmos program rules make it easier to rack up miles and reach elite status faster than other programs, especially if you frequently take long-haul flights.

🤓 Nerdy Tip

Starting in 2026, Atmos Rewards will offer members the choice of how to earn miles, including through distance traveled, segments flown or money spent. You can also earn bonus points depending on the fare class you book. Using the example above, for a flight of 1,000 miles, you would earn an extra 250 miles if you’re Atmos Silver, 500 extra miles with Atmos Gold, etc.

| Elite status level | Bonus earnings |

|---|---|

| Silver (formerly Alaska MVP) | 25% bonus. |

| Gold (formerly Alaska MVP Gold) | 50% bonus. |

| Platinum (formerly Alaska MVP Gold 75K) | 100% bonus. |

| Titanium (formerly Alaska MVP Gold 100K) | 150% bonus. |

Earning Atmos points with a credit card

Besides flying, the easiest way to earn Atmos points is with an Atmos Rewards credit card. The Hawaiian Airlines® World Elite Mastercard® from Barclays still technically earns HawaiianMiles through Oct. 2025, but those miles can be easily converted to Atmos points through your Atmos Rewards account.

Which card you should get depends on the benefits you’ll use. Here’s how they stack up:

Annual Fee

- $395

- $95

- $70 for the company and $25 per card

Welcome offer

Earn 80,000 bonus points and a 25,000-point Global Companion Award with this offer. To qualify, spend $4,000 or more on purchases within the first 90 days of opening your account.

Get 70,000 bonus points and a $99 Companion Fare (plus taxes and fees from $23) with this offer. To qualify, spend $3,000 or more on purchases within the first 90 days of opening your account.

Get 70,000 bonus points and a $99 Companion Fare (plus taxes and fees from $23) after you make $4,000 or more in purchases within the first 90 days of opening your account.

Rewards

- 3 points per $1 spent on Alaska Airlines and Hawaiian Airlines purchases.

- 3 points per $1 spent on foreign purchases, including purchases made in a foreign currency.

- 3 points per $1 spent on dining, which includes restaurants, bars, fast food and catering.

- 1 point per $1 spent on all other purchases.

- 3 points per $1 spent on eligible Alaska Airlines and Hawaiian Airlines purchases.

- 2 points per $1 spent on eligible gas, EV charging, cable, streaming services and local transit, which includes ridesharing, trains, tolls and ferries.

- 1 point per $1 spent on all other purchases.

- 3 points per $1 spent on eligible Alaska Airlines and Hawaiian Airlines purchases.

- 2 points per $1 spent on eligible gas, EV charging, cable, streaming services and local transit, which includes ridesharing, trains, tolls and ferries.

- 1 point per $1 spent on all other purchases.

Benefits

Global Companion Award: Each year, cardholders receive one Global Companion Award of 25,000 points or less. Cardholders can get another Global Companion Award of 100,000 points or less by spending $60,000 in an anniversary year. This award is applied as a discount on the points price of a flight and may be redeemed for any service class on any flight in Alaska's full network, including eligible international partners. Terms apply.

Companion Fare: Get a Companion Fare (good for flights in North America) from $122 ($99 fare plus taxes and fees from $23) each account anniversary after you spend $6,000 or more on purchases within the prior anniversary year. Terms apply.

Companion Fare: Get a Companion Fare (good for flights in North America) from $122 ($99 fare plus taxes and fees from $23) each account anniversary after you spend $6,000 or more on purchases within the prior anniversary year. Terms apply.

Transferring points to Atmos Rewards

Two major partner programs allow you to convert their points to Atmos Rewards: Bilt Rewards and Marriott Bonvoy.

Bilt Rewards is the only credit card rewards program that allows transfer to Atmos Rewards, and at a 1:1 ratio. Transfers from Bilt to Atmos can be initiated in the Bilt app and are usually instant.

Marriott Bonvoy points transfer to Atmos Rewards at a 3:1 ratio, where 3,000 Marriott Bonvoy points transfer to 1,000 Atmos points. Transfers from Marriott are limited to 240,000 Bonvoy points per day. Additionally, you'll earn a 5,000 Atmos point bonus for every 60,000 points you transfer. NerdWallet values Atmos rewards at 1.2 cents each, and Marriott Bonvoy points at 0.8 cent each, so at the 3:1 transfer ratio, you’d be exchanging 2.4 cents of Marriott Bonvoy points for 1.2 cents of Atmos points. That’s not a great deal unless you’re topping off your Atmos points balance for a specific redemption.

Other ways to earn Atmos points

The Atmos Rewards Shopping portal offers bonus rewards for making online purchases at more than 1,100 retailers. Log in through the portal, find a retailer, click through the link and make your purchase as normal to earn bonus Atmos points, in addition to rewards you’d earn for using a credit card.

You can also earn bonus rewards by dining at an Atmos Rewards Dining partner. Once you sign up for the dining program, link a credit card through your account and use that card to pay at a qualifying restaurant. The program will recognize the charge on your card and issue bonus Atmos Reward points.

Buying Atmos points

The Atmos Rewards program sells points, but often for a price of 2 cents apiece or more. That’s higher than the 1.2 cents per point NerdWallet puts on Atmos Rewards, making it generally a poor value. However, there are a few instances where it might make sense to purchase miles, such as topping off your account for an award.

How to use Atmos Rewards

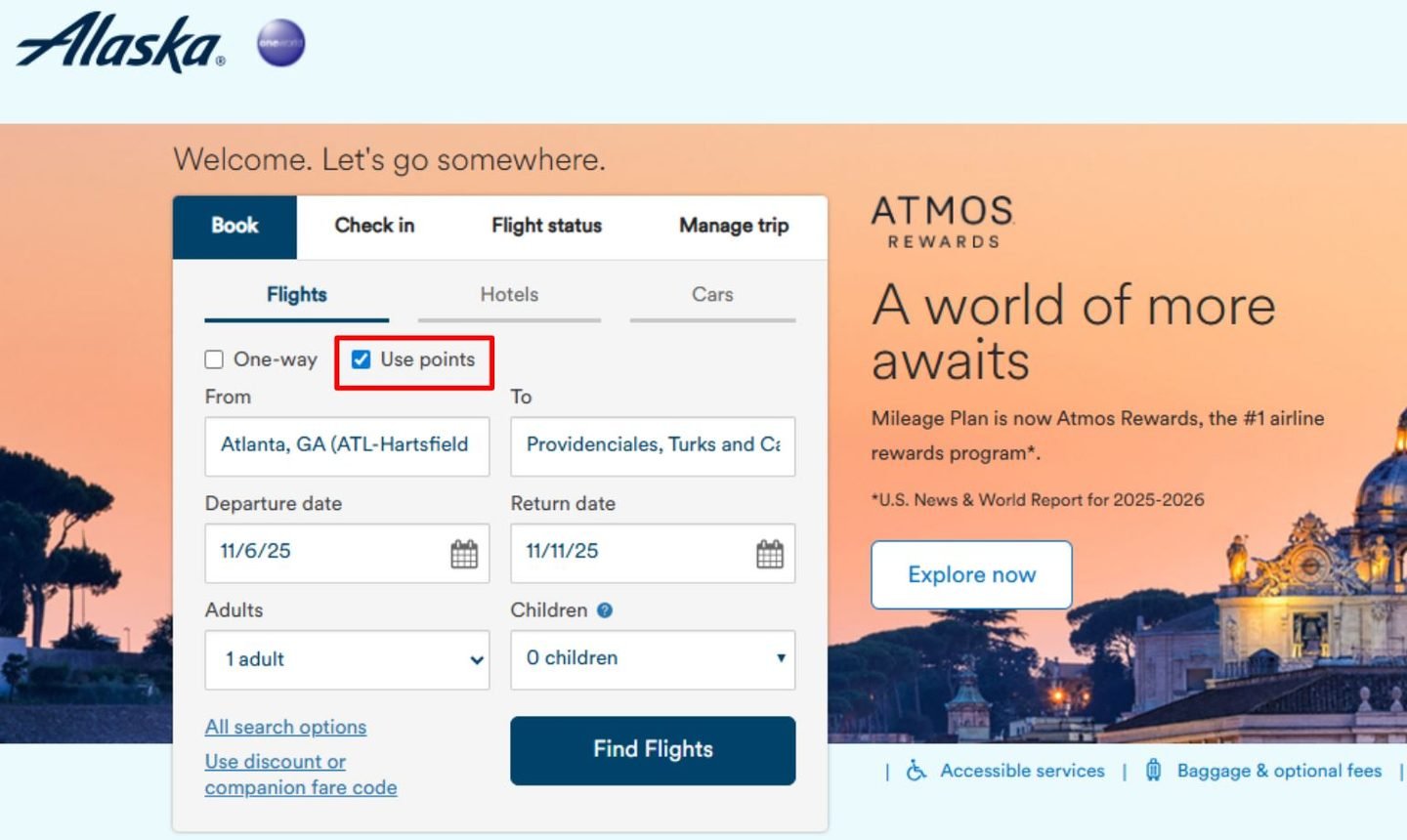

To use Atmos Rewards, log in to your online account through the airline website. Enter your travel details and select “Use points” to return the available reward flights.

Alaska and Hawaiian set award ticket fares according to class of service and the distance of your trip. You can’t book basic economy fares with points. Premium economy fares typically start at around 30% more points than a regular economy fare. For flights within the contiguous U.S. and Alaska, award tickets on Alaska or Hawaiian start at 5,000 points each way in economy and 15,000 each way for first class.

Partner award prices vary depending on the flight distance and geographic location of your destination. Alaska publishes three partner award charts: one for destinations in the Americas, one for Europe, the Middle East and Africa, and one for the Asia Pacific region. Many of those partners offer business or first class award space for a relative bargain compared to the cash cost. Even better, you can also book a free international stopover through a partner hub city when you redeem points.

For example, in April 2025 I used 60,000 Atmos points to fly in business class on partner Finnair from Chicago to Amsterdam with a free stopover in Helsinki (Finnair’s hub), a trip that would have otherwise cost just over $5,000. That trip resulted in a fantastic redemption value of 8.3 cents per point, far above NerdWallet’s value of 1.2 cents each for Atmos Rewards.

How much are Atmos points worth?

Based on our most recent analysis, NerdWallet values Atmos points at 1.2 cents each. Generally speaking, you’ll want to find award space at or above that value.

To determine the value of your own Atmos rewards for specific flights, divide the cash value of the ticket (less any applicable taxes and fees if you redeem miles) by the number of miles required for the flight. For example, if the ticket costs either $200, or 15,000 miles + $10 in taxes and fees, the math would be:

(($200 – $10) / 15,000) * 100 = 1.3 cents per mile.

Atmos Rewards elite status

Elite status in the Atmos Rewards program is earned with enough status points (previously known as elite-qualifying miles) within a calendar year. It's also possible to match your status from another airline (more on that below). For more detailed information, check out our Complete Guide to Atmos Rewards Benefits and Elite Status.

Elite status tiers

Elite status in the Atmos Rewards program is earned with enough status points within a calendar year. There are four tiers in the Atmos Rewards elite status program.

| Silver | Gold | Platinum | Titanium | |

|---|---|---|---|---|

| Earn this many status points | 20,000. | 40,000. | 80,000. | 135,000. |

🤓 Nerdy Tip

The loyalty tiers were rebranded August 2025, when Alaska and Hawaiian launched Atmos Rewards. If you're familiar with the old Mileage Plan tiers, you can think of Silver as MVP, Gold as MVP Gold, Platinum as MVP Gold 75K and Titanium as MVP Gold 100K. How to earn Atmos status points

Status points are different from award points, so the amount of status points you receive from credit card spending will be much lower than the number of award points. Atmos Rewards members can earn status points towards elite status by:

- Flying on Alaska, Hawaiian and its partners.

- Making purchases with an Atmos Rewards credit card (one elite status point per either two or three dollars spent).

You can earn bonus Atmos points by booking a more expensive fare class, and those bonus points count towards elite status qualification. Atmos Rewards members with elite status who are trying to requalify will also earn bonus points depending on their status level, however those bonus points will not count towards requalification.

Flights booked through Alaska or Hawaiian (including award tickets) will always earn status points equivalent to at least 100% of the distance flown, regardless of which airline you fly on. This includes Alaska and Hawaiian flights booked through Hawaiian. The one exception is if you purchase a Saver or basic fare, which will only earn 30%. You can get a bonus for more expensive fare classes and premium cabin fares.

However, partner flights booked on a partner website will earn at different rates: 25% of distance flown for discount economy, 50% for regular economy, 100% for premium economy, 125% for business class and 150% for first class. Those rates already factor in any premium bonuses.

While it may sound great to earn 150% for first class partner flights, contrast that to the 350% earnings you would get if you booked an international first class partner flight via Alaska. If your goal is to earn more miles, make sure to check the earning rates prices when booking through Alaska and partner sites to make sure you're getting the best return.

🤓 Nerdy Tip

Starting in 2026, Atmos Rewards will offer members the choice of how to earn elite status points. You’ll be able to choose between 1 point for each mile flown, 5 points per $1 spent on airfare and premium cabin upgrades, or a flat 500 points per segment flown. You’ll be able to change your selection once a year. Atmos status match

Atmos offers a status match challenge if you already have status with a select set of North American airlines. You will have 90 days to meet the requirements of the challenge; once you do so, your status will be extended further.

Oneworld elite status

Partner airlines within the Oneworld Alliance provide reciprocal status to Atmos Reward elites. Here’s how those benefits shake out when flying on Oneworld airlines:

- Atmos Silver elites receive Oneworld Ruby status. This offers some seat selection benefits when flying with Oneworld airlines.

- Atmos Gold elites receive Oneworld Sapphire status. This offers seat selection benefits, business class lounge access on international itineraries, priority boarding and baggage allowance when flying with Oneworld airlines.

- Atmos Platinum and Titanium elites receive Oneworld Emerald status. This offers seat selection benefits, first and business-class lounge access on international itineraries, priority boarding, expedited security and baggage allowance when flying with Oneworld airlines.

Alaska came in first place in NerdWallet’s recent analysis of the best airlines. Alaska notched above-average marks in several categories, including rewards rate.

Every year since 2020, Alaska has come in first in NerdWallet’s airline rewards program analysis.

Here’s a closer look at how Alaska competed across subcategories:

- First in rewards rates.

- Third in operations.

- Second in terms of total fees.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2026:

- Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

- No annual fee: Wells Fargo Autograph® Card

- Flat-rate travel rewards: Capital One Venture Rewards Credit Card

- Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

- Luxury perks: American Express Platinum Card®

- Business travelers: Ink Business Preferred® Credit Card

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Limited Time Only: Earn $1,000 Toward Travel!

Capital One Venture Rewards Credit Card

Travel

For a limited time, the

Capital One Venture Rewards Credit Card is offering new cardholders an especially rich bonus: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel!

More like this

Related articles