4 Reasons to Skip Marriott Bonvoy

Resort fees, hard-to-use free nights and limited points pooling are among the marks against this popular program.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

Joining a hotel loyalty program is a great way to increase your elite status tier with a specific chain as well as rack up enough rewards for a free stay. The program you ultimately pick is going to vary based on your travel patterns. Whether you go for Hilton Honors, IHG One Rewards, Marriott Bonvoy or Choice Privileges, we have to admit that there’s no perfect program.

If you’re considering joining Marriott’s loyalty program, examine its perks, such as a huge selection of properties all over the world and the ability to transfer Marriott Bonvoy® points to airlines, but also make note of the weaknesses of Marriott Bonvoy.

What are some weaknesses of Marriott Bonvoy?

1. Marriott charges resort fees for all members

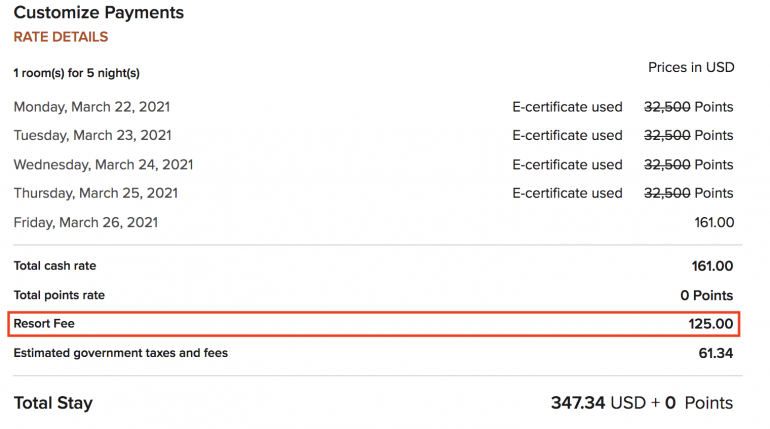

One of the bad Marriott Bonvoy policies is that the chain charges resort fees on both paid and award stays regardless of your elite status level. Marriott is failing at the basics by charging these fees in the first place, but passing them on to its elite members is one of the major complaints.

Even if you redeem points or free night certificates for a stay at a resort that charges these pesky fees, your stay isn’t going to be 100% free. Keep in mind that resort fees are charged nightly, which means that the longer your vacation is, the more cash you have to dole out at the end of your trip.

This Bonvoy policy isn’t on par with the industry standard, either. For example, World of Hyatt waives resort fees on all award stays for all program members (including non-elite members) and on paid stays for Globalist members. Hilton Honors also waives resort fees on award stays for all members.

By signing up, you will receive newsletters and promotional content and agree to our Terms of Use and acknowledge the data practices in our Privacy Policy. You may unsubscribe at any time.

2. Free night certificates are hard to use

Co-branded Marriott credit card holders receive a free night certificate at every membership renewal. You can redeem these certificates for free nights at Marriott hotels, but not just any hotel. Each type of certificate has a point cap. If your certificate is worth up to 35,000 Bonvoy points, it won't work on a hotel that costs 100,000 points. That can be quite limiting. And since Marriott Bonvoy members might encounter is peak pricing at the most desirable properties, this can be particularly limiting if you usually travel during busy seasons, like during Christmas.

Plus, free night certificates expire after a year once they are issued, which is the first limitation of using them.

» Learn more: Trouble using your Marriott free night certificates?

3. Points pooling is limited

Another complaint about the Marriott Bonvoy program is the fact that although points pooling is allowed, it has limits. Bonvoy members can transfer up to 100,000 Marriott points to another member and receive up to 500,000 Marriott points per calendar year.

The ability to transfer Marriott points allows program members to combine their rewards for a longer stay, which sounds great on paper. However, when you look at the award chart, you might notice that 100,000 Bonvoy points doesn’t get you far.

It’s enough to book one night at a Category 8 hotel during peak season, two nights at a Category 6 hotel during standard season or 20 nights at a Category 1 hotel during off-peak season. A Category 8 award night fluctuates from 70,000 to 100,000 points. During the standard season, it requires 85,000 points per night, so let’s use that as our target redemption rate.

If you and your travel companion want to both pitch half of the 340,000 points required to book four nights plus a fifth night free, you’re going to run into problems. Half of the redemption is 170,000 points, but one of you can transfer no more than 100,000 points to the other, which means one of the travelers has to front a lion’s share to book a stay at a high-category hotel.

When it comes to other chains, Hilton allows point pooling among 11 members, and each member can transfer up to 500,000 Hilton Honors points into one pool.

Hyatt lets World of Hyatt members combine points as well. There’s no limit to how many points you can transfer, but transfers can occur no more than once per 30-day period.

» Learn more: The best ways to rack up Marriott Bonvoy points

4. Bonvoy points valuation isn’t high

With Marriott Bonvoy points being worth 0.8 cent per point as per NerdWallet’s valuation, you’re going to need a lot of them to book a stay at a high-category property. Focusing on earning rewards with a co-branded Marriott credit card or by crediting your Marriott stays to the loyalty program is your best bet.

Keep in mind that Chase Ultimate Rewards® and American Express Membership Rewards transfer to Marriott Bonvoy at a rate of 1:1 as well. However, these flexible points have higher value partners, so it’s not in your best interest to convert them to Marriott and lower their worth.

If you’re looking to use flexible bank points for hotel stays, World of Hyatt offers a better option. The program’s award chart provides a higher valuation to Hyatt points at 1.8 cents each.

» Learn more: Which is best, Hyatt or Marriott?

The bottom line

The Marriott Bonvoy program isn’t a bad one for a frequent traveler. The hotel chain offers a large footprint of properties, making it easy to throw a rock and find a Marriott hotel in most corners of the world. However, some improvements to the program, such as higher limits on points pooling or waived resort fees for elite members, wouldn’t hurt.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2026:

- Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

- No annual fee: Wells Fargo Autograph® Card

- Flat-rate travel rewards: Capital One Venture Rewards Credit Card

- Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

- Luxury perks: American Express Platinum Card®

- Business travelers: Ink Business Preferred® Credit Card

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Limited Time Only: Earn $1,000 Toward Travel!

Capital One Venture Rewards Credit Card

Travel

For a limited time, the

Capital One Venture Rewards Credit Card is offering new cardholders an especially rich bonus: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel!

More like this

Related articles