The Guide to Free Spirit by Spirit Airlines

Spirit is a low-cost U.S. airline, and its Free Spirit loyalty program allows flyers to earn and redeem points.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

Spirit Airlines, known for ultra-low base fares and a la carte fees for just about everything, serves about 70 destinations in the U.S., Central America, South America and the Caribbean.

The name of the airline’s frequent flyer program is Free Spirit. Customers earn points based on how much money they spend with the airline. Every dollar spent on Spirit (along with purchases made on the Free Spirit® Travel More World Elite Mastercard®) helps customers earn elite status as well as points for redemptions, such as flights.

Since Spirit is a low-cost carrier, flights start as low as 2,500 points.

Here’s what you need to know about earning and redeeming points, elite status, the Spirit Saver$ club and the Free Spirit loyalty program.

What is Spirit Airlines Free Spirit?

Spirit Airlines’ frequent flyer program is called Free Spirit. The program is free to join, and you can find the Spirit Airlines frequent flyer sign-up here.

When you join, you'll get a Free Spirit frequent flyer number. Make sure its added to your account so that you can earn points with every flight.

🤓 Nerdy Tip

Add the Free Spirit phone number to your phone book in case questions arise: 1-855-728-3555. How do Spirit points work?

Spirit has two types of points:

- Free Spirit points, which are earned on paid flights. Free Spirit points can be redeemed for award flights.

- Status Qualifying Points (SQPs), which allow you to earn and keep your elite status.

Free Spirit points

When you fly with Spirit Airlines, you'll earn Free Spirit points based on the cost of your flight and your elite status level. General members without elite status earn 6 points per $1 spent on airfare and 12 points per $1 spent on À La Smarte add-ons, like bags and seats.

The higher your level of status, the more points you will earn.

Spirit also offers other ways to earn Free Spirit points, including using the Free Spirit® Travel Mastercard® or the Free Spirit® Travel More World Elite Mastercard® for your everyday spending or making purchases with Spirit’s partners.

After you’ve earned enough Free Spirit points, you can redeem them for free flights on Spirit Airlines.

Status Qualifying Points (SQPs)

These points go towards earning and keeping your elite status. SQPs can be earned in two ways:

- When you book travel with Spirit, you will earn 1 SQP for each $1 spent on flights, bags, seats and other extras.

- If you hold the Free Spirit® Travel More World Elite Mastercard®, you will also earn 1 SQP for every $10 spent on everyday purchases.

» Learn more: How Spirit Airlines fees work

By signing up, you will receive newsletters and promotional content and agree to our Terms of Use and acknowledge the data practices in our Privacy Policy. You may unsubscribe at any time.

Do Spirit points expire?

Spirit points expire if you don't have any points activity in your Free Spirit account for 12 months in most circumstances.

Though, if you hold the Free Spirit® Travel More World Elite Mastercard® or the Frontier Airlines World Mastercard®, your points don't expire.

As long as you earn or redeem points with Spirit or with the airline’s partners within a 12-month period, your points won't expire.

Spirit Airlines elite status

The Free Spirit elite status program has three status levels: Free Spirit, Free Spirit Silver and Free Spirit Gold.

Simply joining the program gives you Free Spirit status. Silver and Gold statuses must be earned, and members get perks like earning more points per flight, no redemption fees and points pooling.

Here's a snapshot of the earning bonuses and how to obtain these status tiers.

| Benefit | Free Spirit member | Silver | Gold |

|---|---|---|---|

| Points earned on fares | 6x. | 8x. | 10x. |

| Points earned on À La Smarte options | 12x. | 16x. | 20x. |

| How to earn this level of status | Join the Free Spirit program. | Earn 2,000 SQPs by spending $2,000 on flights or $20,000 on the Free Spirit® Travel More World Elite Mastercard® (or a combination of the two). | Earn 5,000 SQPs by spending $5,000 on flights or $50,000 on the Free Spirit® Travel More World Elite Mastercard® (or a combination of the two). |

Perks of Silver status include expedited boarding and security, an exit row seat assignment within 180 minutes of departure, seat selection at check-in and waived overweight bag fees.

When you reach Gold status, you get all the above and exit row seat assignment or seat selection at booking, a free carry-on and checked bag, and free drinks and snacks.

» Learn more: The guide to Free Spirit elite status on Spirit Airlines

How to earn Spirit points

There are a few key ways to earn Spirit points.

Spending on flights and À La Smarte purchases

You earn Free Spirit points based on the amount of money spent on Spirit flights, À La Smarte options (flight related purchases) and your status within the Free Spirit program.

So, if you buy a flight for $100 and add on $40 of bag charges (an À La Smarte option), here is how your earn rate will look for the $140 purchase, broken down by status level.

| Earn rate | Free Spirit | Silver | Gold |

|---|---|---|---|

| Flight | 6. | 8. | 10. |

| A La Smarte | 12. | 16. | 20. |

| Total Free Spirit points earned | |||

| Flight | 600. | 800. | 1,000. |

| A La Smarte | 480. | 640. | 800. |

| Total points earned | 1,080. | 1,440. | 1,800. |

| Total SQPs earned | 140. | 140. | 140. |

The higher your status, the more points you will earn for your purchases. If you also have a Spirit airlines credit card and use it to make these purchases, you will also earn additional points for that.

Spending on a co-branded credit card

You also earn Free Spirit points when you use your Spirit co-branded credit cards for everyday purchases.

For example, the Free Spirit® Travel More World Elite Mastercard® earns the following points based on expense type:

- 3 points per $1 spent on eligible Spirit purchases.

- 2 points per $1 spent on eligible dining and grocery store purchases.

- 1 point per $1 spent on all other purchases.

- 1 SQP for every $10 spent on everyday purchases.

The card is currently offering a sign-up bonus: Earn 60,000 Bonus Points + a $100 Companion Flight Voucher after making at least $1,000 in purchases within the first 90 days of account opening.

Spending with partners

Spirit has partnerships with a variety of merchants that allow Free Spirit members to earn points as well. These retailers and service providers include hotels, rental cars, wine and lifestyle partners. Spirit's online shopping mall includes dozens of retailers, some offering up to 15 points per dollar spent.

Members can earn points by participating in surveys through the Points for Thoughts program.

With the Free Spirit Dining program, you can earn points when you dine at thousands of outlets and pay with a credit card linked to your account.

Spirit Cruises offer thousands of points for booking cruises.

» Learn more: Earn bonus points with airline promotions

Buying additional Free Spirit points

You can buy Free Spirit points for a whopping 2.5 cents apiece, with bonus points available during promotional periods. However, this is generally a terrible idea since it's poor value for your money.

» Learn more: 4 times it makes sense to buy miles

Spirit Airlines credit cards

You can earn Free Spirit points when using the airline’s credit cards. Spirit offers the following two credit cards for the U.S. market, which are issued by Bank of America.

Free Spirit® Travel Mastercard®

The Free Spirit® Travel Mastercard® has an annual fee of $0.

The card earns 2 points per $1 on Spirit purchases and 1 point per $1 on everything else.

There are no foreign transaction fees, which is impressive for a no-fee card.

Free Spirit® Travel More World Elite Mastercard®

Free Spirit® Travel More World Elite Mastercard® The card earns 3 points per $1 on Spirit purchases, 2 points per $1 on dining and groceries, and 1 point per $1 on everything else, for an annual fee $0 intro for the first year, then $79.

Only the Free Spirit® Travel More World Elite Mastercard® allows you to earn SQPs for everyday spend at a rate of $10 = 1 SQP. If you’re after elite status with Spirit, getting this card makes a lot of sense.

Using the flight example above, if you used the Free Spirit® Travel More World Elite Mastercard® for that $140 purchase, you would earn 14 SQPs. Although this isn’t the fastest way to earn status, if you’re using the card for everyday purchases, the SQPs will add up pretty quickly.

How earnings vary across Spirit credit cards

Here’s how the earn rate will look like if you use either the Free Spirit® Travel Mastercard® or the Free Spirit® Travel More World Elite Mastercard® to pay for the flight:

| Free Spirit | Silver | Gold | |

|---|---|---|---|

| If purchased with Free Spirit® Travel Mastercard® | |||

| Total base points earned | 1,080. | 1,440. | 1,800. |

| Bonus Free Spirit points earned with credit card | 280. | 280. | 280. |

| Total Free Spirit points earned | 1,360. | 1,720. | 2,080. |

| Total base SQPs earned | 140. | 140. | 140. |

| Bonus SQPs earned with credit card | 0. | 0. | 0. |

| Total SQPs earned | 140. | 154. | 154. |

| If purchased with Free Spirit® Travel More World Elite Mastercard® | |||

| Total base points earned | 1,080. | 1,440. | 1,800. |

| Bonus Free Spirit points earned with credit card | 420. | 420. | 420. |

| Total Free Spirit points earned | 1,500. | 1,860. | 2,220. |

| Total base SQPs earned | 140. | 140. | 140. |

| Bonus SQPs earned with credit card | 14. | 14. | 14. |

| Total SQPs earned | 154. | 154. | 154. |

What is Spirit Saver$ Club?

If you fly often with Spirit Airlines, you might want to consider the Spirit Saver$ Club, which is a paid membership for customers to access discounts. This membership is separate from the Free Spirit frequent flyer program.

Members of the Spirit Saver$ Club get:

- Savings on seats, including Spirit’s Big Front Seats and exit rows.

- Discounted fares in cash and points.

- Up to 50% savings on bags.

- Promotional prices on À La Smarte purchases including Flight Flex, expedited security and boarding.

- Offers with select partners ranging from car rentals to wine merchants.

The membership costs $69.95 for 12 months, $99.90 ($5 savings) for 18 months and $129.90 ($10 savings) for 24 months.

🤓 Nerdy Tip

Students get 20% off when purchasing a 12-month Spirit Saver$ Club membership. If you use the perks offered by the Spirit Saver$ Club and often upgrade to the Big Front Seat, the discounts could be meaningful.

How to redeem Spirit points

There are several ways to redeem Spirit points, but some will give you better value than others.

For Spirit flights

You can redeem your Free Spirit points for award flights on Spirit's website. Spirit uses a dynamic pricing model to determine the cost of a flight in points. Flights start as low as 2,500 points. Customers can also book flights using a combination of points and cash, starting at only 1,000 points.

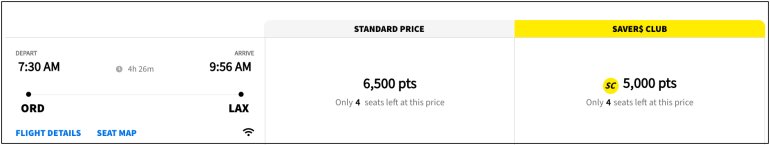

Here’s an example of the costs for a flight from Chicago-O'Hare to Los Angeles on March 1, 2023, in dollars and points:

Spirit shows two different prices: a standard price and the Saver$ Club price. If you’re not a Saver$ Club member, and you redeem 6,500 points for this flight redemption, you would extract a value of 1.4 cents per point.

If you join the Saver$ Club, you’d save $14 or 1,500 points for your ticket. Since the cost of a 12-month Spirit Saver$ Club membership is $69.95, if you often fly with Spirit, the membership could make sense.

Using Points + Cash

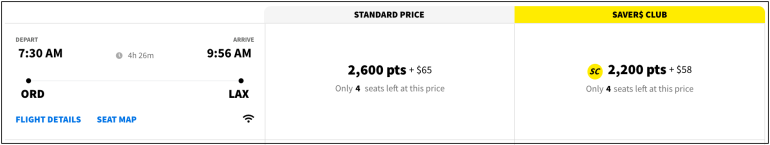

Spirit also offers customers the ability to use a combination of points and cash to purchase a flight. However, do the math to make sure it makes sense.

Take this flight for instance. If you use a combo of points and cash, you would need to pay $65 and 2,600 points.

If paid fully in cash, you’d spend $89, so by choosing the Points + Cash option, you’d only be saving $24 and still paying 2,600 points. For this redemption, you’d extract a value of 0.9 cent per point ($89 - $65 / 2,600). You’d get a much better value by if you used your points for the entire redemption.

Keep in mind point redemptions cover only the cost of airfare. Additional fees for luggage, seat selection and other amenities apply. Also, taxes and government fees must be paid at the time you book. Again, this is when the Saver$ Club can come in handy since it also offers discounts on purchases of bags, seats and more.

» Learn more: Which airlines have the best (and worst) fees?

For flights booked within 28 days of departure

Spirit charges extra fees for redeeming points for an award flight in a certain timeframe. If you book an award flight more than 28 days before you travel, there is no redemption fee. For those looking to travel within 28 days' or less, you will have to pay a $50 fee to redeem your points.

However, if you have the Free Spirit® Travel More World Elite Mastercard® or have elite status (Silver or Gold), the fees are waived.

Spirit Airlines partners

Spirit Airlines has a variety of rotating partners that allow customers to earn Free Spirit points. Partners have included hotels, car rental companies, wine merchants and lifestyle brands. Like many other airlines and hotels, Spirit also has a dining program.

Current partners include:

- Avis.

- Budget.

- Free Spirit Dining.

- Free Spirit Online Mall.

And others. Check the website's list of Spirit partners to see up-to-date offerings.

Spirit is not part of any airline alliance and doesn't have any partnerships with any other airlines. As such, any Free Spirit points earned can only be used on Spirit Airlines.

Frequently Asked Questions

How do I find my Free Spirit number?

To find your Free Spirit frequent flyer number, head over to www.spirit.com and click “Sign-In” at the top of the page. If you do not have your login details, choose the “reset password” option and enter the email address you used to register for an account. You will then receive instructions on how to access your account.

How do I check in online for Spirit Airlines?

When you’re on the Spirit website, go to the online check-in screen. You will need to input your last name and confirmation code to access your flight. Alternatively, you can log in and access your flight details along with the check-in information from your account. Online check-in begins 24 hours ahead of departure and closes one hour before your flight. It is free to check in online.

How do I get my Spirit boarding pass on my phone?

When you’re checking in online, select the “email boarding pass” option and input your email address. Access the email from Spirit on your mobile device to ensure that the information is accurate and the barcode is displayed. The emailed boarding pass is what you will need to show at the airport to both Spirit and Transportation Security Administration agents.

How do I reach Spirit customer service?

Spirit’s customer service can be reached by calling 1-855-728-3555. You can also send a WhatsApp message to that number by texting “Hello” or send an SMS to 48763. If you’d rather contact customer service online, you can do so at customersupport.spirit.com.

Free Spirit, recapped

Joining the Free Spirit frequent flyer program provides an easy way to earn Spirit points when you fly on the airline. If you’re a Spirit loyalist, the elite program is easy to earn and offers some decent perks.

Spirit’s points can't be used on any other airline, but award flights on Spirit can be reasonably priced in points because of the low-cost nature of the airline.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2026:

- Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

- No annual fee: Wells Fargo Autograph® Card

- Flat-rate travel rewards: Capital One Venture Rewards Credit Card

- Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

- Luxury perks: American Express Platinum Card®

- Business travelers: Ink Business Preferred® Credit Card

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Limited Time Only: Earn $1,000 Toward Travel!

Capital One Venture Rewards Credit Card

Travel

For a limited time, the

Capital One Venture Rewards Credit Card is offering new cardholders an especially rich bonus: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel!

More like this