Marriott Bonvoy Guide: How to Earn, Redeem and Maximize Points

Here's what you need to know about elite status, earning points and redeeming points within the Bonvoy program.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

Marriott Bonvoy isn't just big — it's massive. With 30+ brands, thousands of properties and a loyalty program that spans from budget-friendly Fairfield Inn to ultra-luxury Ritz-Carlton, navigating Bonvoy can feel overwhelming. But here's what most travelers miss: despite its size, Bonvoy follows predictable patterns that smart travelers can exploit for maximum value.

Whether you're looking to earn free nights through credit card spending, achieve elite status for premium perks, or simply understand which redemptions deliver the best bang for your buck, this complete guide breaks down everything you need to know about maximizing the Marriott Bonvoy loyalty program.

» Learn more: Things to know before joining Marriott Bonvoy

By signing up, you will receive newsletters and promotional content and agree to our Terms of Use and acknowledge the data practices in our Privacy Policy. You may unsubscribe at any time.

What is Marriott Bonvoy?

Marriott Bonvoy is the world's largest hotel loyalty program, born from the 2019 merger of Marriott Rewards, SPG, and Ritz-Carlton Rewards. It's free to join and offers a straightforward value proposition: earn points through stays and spending, redeem for free nights and experiences.

Core benefits of Marriott Bonvoy for all members (yes, even those in the free-to-join tier) include:

- 10 base points per dollar spent (varies by brand).

- Exclusive member rates (up to 15% off).

- Free Wi-Fi at all properties.

- Mobile check-in and digital key.

- No foreign transaction fees on co-branded credit cards.

But while membership is free, the real value comes through strategic earning and smart redemption — not casual participation.

Marriott Bonvoy point values: what your points are actually worth

Based on our most recent analysis, NerdWallet values Marriott Bonvoy points at 0.8 cent apiece.

Bonvoy points (previously known as Marriott Rewards points) have dropped in value since we started tracking them in 2019. And while there's no way to tell whether they will go up or down in the future, don't count on them maintaining their value over time.

» Learn more: What are points and miles worth this year?

How to earn Marriott Bonvoy points: 8 proven methods

These eight strategies make for some of the most common ways to boost your balance, but read our complete guide to earning Marriott points for more.

1. Stay at Marriott hotels

You’ll typically earn 10 base Bonvoy rewards points per dollar spent at Marriott properties. So if you spend $100, you’ll earn 1,000 points. However, some budget brands (such as Residence Inn and Towneplace Suites) offer lower base earning rates.

Bonvoy elite status holders earn additional points on top of this base rate:

- Silver members earn 10% more.

- Gold members earn 25% more.

- Platinum members earn 50% more.

- Titanium and Ambassador members earn 75% more.

2. Use a Marriott credit card

The Marriott credit card portfolio includes a half-dozen consumer and business cards issued by Chase and American Express.

Personal credit cards that earn Marriott Bonvoy points

Annual fee

$0.

$95.

$250.

$650.

Rewards

• 3 Marriott Bonvoy® points per $1 at participating Marriott Bonvoy hotels.

• 2 points per $1 on grocery stores, rideshare, select food delivery, select streaming and internet, cable and phone services.

• 1 point per $1 on all other eligible purchases.

• 6 Marriott Bonvoy® points per $1 at participating Marriott Bonvoy hotels.

• 3 points per $1 on up to $6,000 a year in combined purchases on grocery stores, gas stations and dining.

• 2 points per $1 on all other eligible purchases.

• 6 Marriott Bonvoy® points per $1 at participating Marriott Bonvoy hotels.

• 4 points per $1 on up to $15,000 a year in combined purchases at grocery stores and on dining.

• 2 points per $1 on all other eligible purchases.

• 6 Marriott Bonvoy® points per $1 at participating Marriott Bonvoy hotels.

• 3 points per $1 at restaurants worldwide and on flights booked directly with airlines.

• 2 points per $1 on all other eligible purchases.

Terms apply.

Other benefits

• 5 Elite Night Credits annually.

• Automatic Silver Elite Status.

• Free Night Award (valued up to 35,000 points) every year after account anniversary.

• 15 Elite Night Credits annually, qualifying you for Silver Elite status, plus path to Gold Status when you spend $35,000 on purchases each calendar year.

• 1 Elite Night Credit toward Elite Status for every $5,000 you spend.

• Free Night Award (valued up to 50,000 points) after spending $15,000 in a calendar year.

• Gold status, plus 15 Elite Night credits each year toward Platinum Elite status.

• 1,000 points per paid eligible stay booked directly with Marriott Bonvoy at participating properties. Terms apply.

• Free Night Award (valued up to 85,000 points) every year after your account renewal month.

• Platinum status and 25 Elite Night credits per year.

• Fee credit for either Global Entry or TSA Precheck.

• Priority Pass Select lounge membership (enrollment required).

• Up to $300 in statement credits per calendar year (up to $25 per month) for eligible purchases at restaurants worldwide.

• Terms apply.

New cardholder offer

Earn 2 Free Night Awards (each night valued up to 50,000 points) after spending $1,000 on eligible purchases within 3 months of account opening with the Marriott Bonvoy Bold® Credit Card. Certain hotels have resort fees.

Earn 5 Free Night Awards (each night valued up to 50,000 points) after spending $3,000 on eligible purchases within 3 months of account opening with the Marriott Bonvoy Boundless® Credit Card. Certain hotels have resort fees.

Earn 85,000 Bonus Points after you spend $4,000 in purchases in your first 3 months from your account opening.

Earn 100,000 Marriott Bonvoy® bonus points after you use your new Card to make $6,000 in purchases within the first 6 months of Card Membership. Terms Apply.

Learn more

* Rewards earned by using one of these cards at participating Marriott Bonvoy hotels come on top of the points you earn for being a member of the Bonvoy loyalty program. Taken together, paying with a Bonvoy card at a Bonvoy location can earn 14-17 points per dollar spent.

** There are two Marriott Bonvoy cards with substantially the same benefits but they come from different issuers. The Marriott Bonvoy Bountiful™ Card, described above, is from Chase. Its near-twin is the Marriott Bonvoy Bevy® American Express® Card, which you can read about here.

To view rates and fees of the Marriott Bonvoy Brilliant® American Express® Card, see this page.

Business credit cards that earn Marriott Bonvoy points

Marriott offers a single small-business card, the Marriott Bonvoy Business® American Express® Card, which currently features this welcome offer: Earn 3 Free Night Awards after you use your new Card to make $6,000 in eligible purchases within the first 6 months of Card Membership. Each Free Night Award has a redemption level up to 50,000 Marriott Bonvoy® points, for a total potential value of up to 150,000 points, at hotels participating in Marriott Bonvoy®. Terms apply.

The Marriott Bonvoy Business® American Express® Card also offers:

- 6x points at participating Marriott Bonvoy hotels.

- 4x points at restaurants worldwide, at U.S. gas stations, on wireless telephone services purchased directly from U.S. service providers and on U.S. purchases for shipping.

- 2x points on all other eligible purchases.

- 1 Free Night Award every year after your Card account anniversary.

- Complimentary Marriott Bonvoy Gold Elite status.

It carries an annual fee of $125. Terms apply.

» Learn more: Which Marriott Bonvoy credit card should I choose?

🤓 Nerdy Tip

If you have multiple personal Marriott credit cards, the elite night credits don't stack on top of each other. However, if you have a Marriott business credit card, those nights stack on top of personal cards. For example, if you have the Boundless card and the Business card, you’ll receive 30 elite night credits every year. 3. Earn points for dining out

Marriott has a program called Eat Around Town that rewards you for eating at restaurants in their extensive collection — that's whether or not you're actually traveling.

When you dine and pay at an eligible restaurant using your linked debit or credit card, you earn bonus Marriott Bonvoy points for every dollar you spend. Even better is that these points are in addition to any rewards earned from your cards (and no, you don't even have to have a Marriott credit card). You can link any debit or credit card to earn Bonvoy points through Eat Around Town.

4. Host meetings or events at Marriott

Whether you’re planning meetings for your company or a private event, like a wedding or birthday, you can earn Bonvoy points at Marriott properties. You’ll receive two Bonvoy points for every dollar you spend, plus you'll earn one elite night credit for every 20 room nights booked.

There is a cap on points though. Most Bonvoy members can earn up to 60,000 points per event on eligible room, food, beverages and audio/visual charges. Titanium and Ambassador members earn up to 105,000.

5. Refer friends to join Marriott Bonvoy

When you invite friends to join the Marriott Bonvoy loyalty program, you'll each earn 2,000 bonus points per stay for their first five stays (that's a potential of 10,000 points for each of you).

Marriott allows members to refer up to five friends to earn bonus points through this referral program each calendar year, making for a way to potentially rack up as many as 50,000 points annually through your network.

6. Earn through Marriott cruise, rental car and shopping partners

Cruises: You'll earn 3x Bonvoy points when you book a cruise through Marriott's cruise partner program, called Cruise with Points. Additionally, Chase Marriott Bonvoy card members receive an extra 2x points when they book through the Cruise with Points program.

Rental cars: Bonvoy members earn 500 points when they rent a car with Hertz or 250 points with Dollar or Thrifty. Elite status members earn an additional 200 bonus points with Hertz or 250 bonus points with Dollar or Thrifty.

Tours and activities: You can also book the things you do on your vacation through Marriott. These include things like food tours, theater tickets and river cruises. Compare the prices versus booking these things directly, as they can sometimes be more expensive on Marriott's site. But, booking does give you the chance to earn points.

7. Purchase Marriott points

Marriott Bonvoy points can also be purchased in increments of 1,000 for $12.50. This means that points cost 1.25 cents each. Now here's the rub. Considering we value Marriott points at 0.8 cent, this generally isn't a good deal, as you're paying more in cash than what they're usually worth.

It can make sense though if you can jump on a limited-time points sale, or you've found a specific redemption with outsized value.

» Learn more: 4 times it makes sense to buy points

8. Transfer credit card points

Marriott is a transfer partner for Chase Ultimate Rewards® and American Express Membership Rewards, which means these points can be turned into Marriott points. Generally, this isn't the best use of these otherwise valuable credit card points, but if you have a specific high-value Bonvoy redemption planned, it could be worth it. Terms apply.

» Learn more: The complete guide to earning Marriott Bonvoy points

🤓 Nerdy Tip

Marriott Bonvoy points expire if there is no qualifying activity in your Marriott account within 24 months. Qualifying activity includes making a purchase on a Marriott credit card, earning points by staying at a hotel, earning points through a Marriott Bonvoy partner, redeeming points or purchasing points. Marriott brands: where to stay based on your style

There are more than 30 different Marriott hotel brands, ranging from affordable to luxury. We’ve organized the brands by price point to help you familiarize yourself with the different properties.

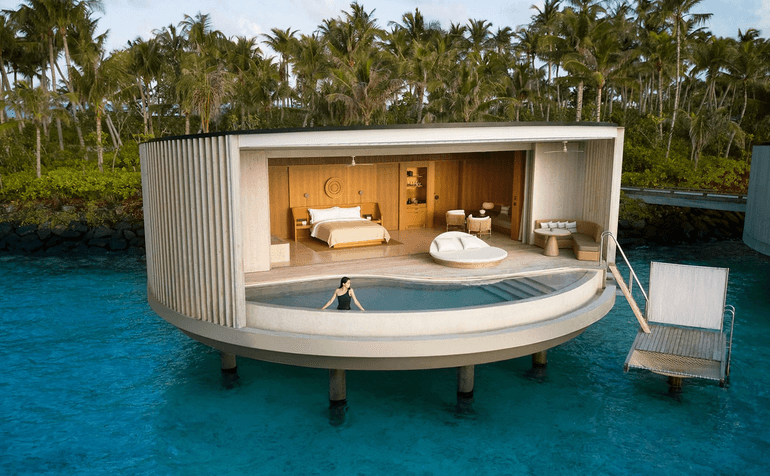

Luxury brands

The hotels in this category are expensive, well known and usually offer high-end experiences for guests. They include:

- The Ritz-Carlton.

- St. Regis.

- JW Marriott.

- The Ritz-Carlton Reserve.

- The Luxury Collection.

- W Hotels.

- Edition.

These premium brand hotels are sophisticated, but priced lower than the luxury brands. They include:

- Marriott Hotels.

- Sheraton.

- Marriott Vacation Clubs.

- Delta Hotels by Marriott.

- Le Méridien.

- Westin.

- Renaissance Hotels.

- Gaylord Hotels.

Select brands

These moderately priced properties feature useful amenities, comfortable spaces and locally inspired designs. They include:

- Courtyard.

- Four Points.

- Four Points Flex by Sheraton.

- SpringHill Suites.

- Protea Hotels.

- Fairfield by Marriott.

- City Express.

- AC Hotels.

- Aloft Hotels.

- Moxy Hotels.

Longer stay brands

The hotels in this category offer apartments or rooms that feature amenities that cater to longer trips (i.e., larger living spaces and kitchen). They include:

- Marriott Executive Apartments.

- Residence Inn.

- TownePlace Suites.

- Element Hotels.

- StudioRes.

- Apartments by Marriott Bonvoy.

Collections

The properties in this category are more unique, and generally fall in the boutique to luxury class. No two hotels in these collections are the same:

- Autograph Collection.

- Design Hotels.

- Tribute Portfolio.

- MGM Collection with Marriott Bonvoy.

» Learn more: Marriott brands — what to know

By signing up, you will receive newsletters and promotional content and agree to our Terms of Use and acknowledge the data practices in our Privacy Policy. You may unsubscribe at any time.

How to use Marriott Bonvoy points to maximize points value

Don't be tempted by the airline transfer offer. Using Marriott Bonvoy points on stays at actual Marriott hotels is almost always the best use of your points. Here are some tips to redeem your points for maximum value:

Let dynamic pricing work in your favor: Marriott changes award prices based on demand. If you travel on low-demand days, you'll stretch your points further.

Book at PointSavers properties: If you're flexible on travel date, browse the PointSavers tool on Marriott's website. There, you'll type in your desired destination and Marriott will display if any discounted rates are available for a discounted rate.

Flex your fifth night free benefit: When you redeem points for five consecutive nights at the same hotel, Marriott gives you the lowest Point-value night for free. This might be reason to save your points for five-night trips (as it's effectively a 20% discount).

» Learn more: Five ways to redeem your Marriott Bonvoy points

Transferring Bonvoy points to airline partners

Marriott Bonvoy points may also be transferred to around 40 airline partners, at a rate of 3 Marriott Bonvoy program points for 1 airline frequent flyer mile for most programs.

There's also a bonus for transferring in bulk: For every 60,000 points transferred to a frequent flyer program, Marriott Bonvoy will add a 5,000-mile bonus, applicable to most airlines (some exceptions include American, Delta and Avianca).

There's an extra bonus between United Airlines and Marriott: Instead of a 5,000-mile bonus, you will receive 10,000 bonus miles when you transfer Marriott points to United.

Still, given the general value of frequent flyer miles, transferring Bonvoys to airlines is generally not a good idea.

» Learn more: Marriott-United status match — how it works

Nerdy Perspective

How have you used Marriott Bonvoy points?

Bad Marriott Bonvoy redemption options

Here are a few other ways you can redeem Bonvoys, but we don't recommend it.

- Air + Car.

- Gift cards.

- TSA PreCheck.

- Merchandise.

» Learn more: How to get the most value from Marriott Bonvoy points

🤓 Nerdy Tip

If you have the Marriott Bonvoy Bold® Credit Card, you can use Chase's Pay Yourself Back feature to cover qualifying travel purchases made directly with an airline and at participating Marriott hotels (up to $750 in redemptions per year). You will likely be able to find better redemption rates by booking a hotel directly with points. But if you have a stash of points and nothing to do with them, this is a decent redemption option. Marriott Bonvoy elite status

The Marriott Bonvoy program consists of five elite status levels: Silver, Gold, Platinum, Titanium and Ambassador. We have a deeper dive into Marriott Bonvoy elite status, but below is a quick look at how that status levels compare:

| Silver Elite | Gold Elite | Platinum Elite | Titanium Elite | Ambassador Elite |

|---|---|---|---|---|

| Points earning bonus | ||||

| 10%. | 25%. | 50%. | 75%. | 75%. |

| Late checkout | ||||

| When available (time unspecified). | 2 p.m. (when available). | 4 p.m. (guaranteed). | 4 p.m. (guaranteed). | 4 p.m. (guaranteed). |

| Room upgrades | ||||

| None. | When available, no suites. | When available, including suites. | When available, including suites. | When available, including suites. |

| Check-in gift | ||||

| None. | Points. | Points, breakfast, or welcome amenity. | Points, breakfast, or welcome amenity. | Points, breakfast, or welcome amenity. |

| Lounge access | ||||

| None. | None. | Yes. | Yes. | Yes. |

| Annual choice benefit | ||||

| None. | None. | At 50 stays. | At 50 stays and 75 stays. | At 50 stays and 75 stays. |

| Ambassador service + Your24 | ||||

| None. | None. | None. | None. | Yes. |

Lifetime elite status

When you hold status for long enough, you'll get it permanently. Here's what you need to do to earn it:

- Silver. Five years of Silver elite status and 250 lifetime nights.

- Gold. Seven years of Gold elite status and 400 lifetime nights.

- Platinum. Ten years of Platinum elite status and 600 lifetime nights.

While you can easily achieve the number of elite status years by having the related Marriott credit card, earning lifetime status still requires a large number of elite night credits.

» Learn more: How to get Marriott Lifetime status

Elite night credits

When you book a stay using an eligible cash or points rate, you’ll receive one elite night credit for each night you stay. Marriott Bonvoy members earn elite night credits on cash rates, points reservations and when you book points and cash stays.

Some exceptions including Protea (requires two qualifying nights for one elite night credit) and Marriott Executive Apartments (requires three qualifying nights to earn one elite night credit).

Marriott occasionally offers promotions to earn additional elite night credits. Find and register for those promotions on Marriott's website.

When you have a Marriott credit card, you also receive elite night credits each year. The number of elite night credits varies based on the type of Marriott credit card you have — and they stack with the credits you earn from your eligible stays.

Marriott Annual Choice Benefit

Upon earning 50 elite nights with Marriott, you’ll receive an Annual Choice Benefit, which allows you to choose between several perks. You get another batch of benefits upon hitting crossing 75 elite nights.

50 night elite Annual Choice Benefit options

- Five Nightly Upgrade Awards to use for upgrades to premium rooms and suites.

- Save $1,000 on a purchase of a bed from any Marriott brand.

- Gift Silver elite status to a family member or friend.

- Donate $100 to the United Nations International Children’s Emergency Fund (UNICEF), World Wildlife Fund (WWF) or the Arne M. Sorenson Hospitality Fund.

- Five Elite Night Credits to help you reach the next elite status level.

75 night elite Annual Choice Benefit options

In addition to the above choices, Titanium elites also get the following two perks to choose from.

- One Free Night Award worth 40,000 Marriott points.

- Gift Gold Elite Status to a family member or friend.

» Learn more: Titanium vs. Platinum elite status

How to maximize the Marriott Bonvoy points program

Marriott Bonvoy rewards those who understand its complexity and optimize their approach accordingly. The program's size creates both opportunities and pitfalls — success comes from focusing on high-value redemptions, strategic elite status pursuit and leveraging credit cards effectively.

Book direct to take advantage of Best Rate Guarantee

Here's how you can use price comparisons to your favor: If you can find a lower rate within 24 hours of booking your initial reservation, Marriott will match the lower rate and give you an additional 25% discount on the room (20% for Design Hotels) or 5,000 Bonvoy points.

Use credit cards to earn elite status

Many Bonvoy members have trouble earning enough elite night credits each year to earn elite status based on how often they travel. One way around these requirements is the elite status that Marriott credit cards offer. Additionally, some Marriott cards allow cardholders to earn upgraded elite status based on annual spending.

- Marriott Bonvoy Bold® Credit Card. Silver status and 15 elite night credits.

- Marriott Bonvoy Boundless® Credit Card. Silver status and 15 elite night credits. Upgrade to Gold elite status after spending $35,000 within a calendar year. Additionally, earn one additional elite night credit for every $5,000 you spend each calendar year.

- Marriott Bonvoy Bountiful™ Card. Gold status and 15 elite night credits.

- Marriott Bonvoy Bevy® American Express® Card. Gold status and 15 elite night credits.

- Marriott Bonvoy Brilliant® American Express® Card. Platinum status and 25 elite night credits.

- Marriott Bonvoy Business® American Express® Card. Gold status and 15 elite night credits.

Terms apply.

Frequently Asked Questions

How do I use Marriott Bonvoy points?

Marriott Bonvoy points can be used to purchase gift cards or for online shopping, and they can be transferred to airline partner programs to book flights. But more often than not, the best way to use Marriott Bonvoy points is to book rooms at Marriott hotels. When purchasing a room from Marriott’s website, check the box stating “Use Points / Certificates” to search award rates and book your stay.

Is Marriott Bonvoy free?

Yes, it’s free to join the Marriott Bonvoy program, though you must provide your email address to join.

Is Marriott Bonvoy the same as Marriott Rewards?

Sort of, yes. Thanks to a huge hotel merger, the Marriott Rewards, SPG and Ritz-Carlton Rewards programs joined forces; in 2019, they combined to become the Marriott Bonvoy program.

Is Hilton part of Marriott?

No, Hilton is its own company, formally called Hilton Worldwide Holdings Inc. With a portfolio of 18 brands comprising more than 6,300 properties worldwide, Hilton hotels include Waldorf Astoria, Doubletree, Embassy Suites and Hilton Garden Inn. Marriott is a separate company, formally known as Marriott International. Among its approximately 30 brands are The Ritz-Carlton, St. Regis and SpringHill Suites.

How many hotels participate in the Marriott Bonvoy Program?

There are over 7,000 participating Marriott Bonvoy hotels.

Do Marriott Bonvoy points expire?

Yes, Marriott points expire after 24 months of inactivity. "Activity" includes both earning and spending points, so you can reset this expiration date either way.

To view rates and fees of the Marriott Bonvoy Business® American Express® Card, see this page.

To view rates and fees of the Marriott Bonvoy Bevy® American Express® Card, please visit this page.

To view rates and fees of the Marriott Bonvoy Brilliant® American Express® Card, see this page.

Information related to the Marriott Bonvoy Bountiful™ Card has been collected by NerdWallet and has not been reviewed or provided by the issuer of this card.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2026:

- Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

- No annual fee: Wells Fargo Autograph® Card

- Flat-rate travel rewards: Capital One Venture Rewards Credit Card

- Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

- Luxury perks: American Express Platinum Card®

- Business travelers: Ink Business Preferred® Credit Card

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

On this page

- What is Marriott Bonvoy?

- Marriott Bonvoy point values: what your points are actually worth

- How to earn Marriott Bonvoy points: 8 proven methods

- Marriott brands: where to stay based on your style

- How to use Marriott Bonvoy points to maximize points value

- Marriott Bonvoy elite status

- Marriott Annual Choice Benefit

- How to maximize the Marriott Bonvoy points program

Limited Time Only: Earn $1,000 Toward Travel!

Capital One Venture Rewards Credit Card

Travel

For a limited time, the

Capital One Venture Rewards Credit Card is offering new cardholders an especially rich bonus: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel!

More like this

Related articles