Why Nearly Every Purchase Should Be on a Credit Card

Credit cards are convenient and secure, they help build credit, they make budgeting easier, and they earn rewards. And no, you don't have to go into debt, and you don't have to pay interest.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

Cash used to be king. People paid for everyday purchases with cash or with checks (which are functionally equivalent to cash), and they saved credit cards for big, infrequent purchases — If they had credit cards at all. Nowadays, credit cards are accepted almost everywhere, and some people never carry cash at all.

In general, NerdWallet recommends paying with a credit card whenever possible:

Credit cards are safer to carry than cash and offer stronger fraud protections than debit.

You can earn significant rewards without changing your spending habits.

It's easier to track your spending.

Responsible credit card use is one of the easiest and fastest ways to build credit.

Using credit cards does not mean going into debt. Spend money as you normally would, pay your balance in full every month, and you'll reap all the benefits of credit cards while never carrying debt or paying a penny in interest.

» MORE: NerdWallet's best credit cards

Credit cards are safer to carry and use

If you lose your wallet or get robbed, any cash you were carrying is almost certainly gone forever. If thieves go on a spending spree with your credit cards, however, you generally won't be held responsible for fraudulent purchases. It may take some time to sort out the resulting mess, but you won't lose any of your money.

Debit cards, too, pose a risk. When your credit card is used fraudulently, it's the card issuer that loses money. When your debit card is used fraudulently, the money comes out of your bank account. Assuming you report the fraud promptly, you should get your money back — eventually. It could be a while until things are sorted out. During that time, checks may bounce, automated payments may be refused due to insufficient funds, and you may have a hard time covering your bills.

Credit cards earn easy rewards

Credit card rewards exist to encourage you to use your credit card, and they're very persuasive indeed. With a simple flat-rate card that pays the same amount on every purchase, you can get back 1.5% or even 2% of every dollar you spend, either as cash or as points or miles to redeem for travel or other things. Spend $1,000 a month, and you could earn $180 to $240 a year without any special effort.

Other cards pay higher rewards in specific spending categories, such as groceries, gas or restaurants. Combine a handful of cards, and you can amplify your rewards considerably.

For example, say a family has four popular cash back credit cards — the Blue Cash Preferred® Card from American Express*, the Citi Double Cash® Card, the Discover it® Cash Back and the Chase Freedom Flex®. Using them strategically, that family could earn hundreds of dollars a year in cash back:

Spending | Rewards rate | Annual rewards | |

|---|---|---|---|

Groceries | $475 / month | 6% | $342 |

Restaurants | $300 / month | • 5% for three months • 3% for nine months | $126 |

Gas | $260 / month | • 5% for six months • 3% for six months | $124.80 |

Amazon.com | $100 / month | • 5% for six months • 2% for six months | $42 |

Streaming media | $60 / month | 6% | $43.20 |

Travel | $1,000 / year | 5% | $50 |

Everything else | $1,000 / month | 2% | $240 |

TOTAL | $968 |

A word of caution, however: Don't spend more than you normally would just to get additional rewards. A little cash back won't make up for that extra $100 at the grocery store or that extra $250 worth of clothes. And if you carry a balance from month to month, the interest you pay can more than eat up the value of your rewards, so pay in full whenever possible.

» MORE: Best rewards credit cards

Credit cards help you track spending

Keeping tabs on your budget can be a challenge no matter how you spend your money. But figuring out where cash went is especially difficult. Misplace a receipt, and there's often no other record of how much you spent and where you spent it. Checks? Forget to enter one in your check register, and you'll need to wait for the recipient to cash it before you can track it (and some people are notorious for holding on to checks for months).

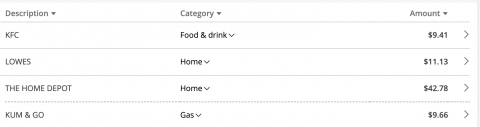

With credit cards, everything shows up on your account online in close to real time. Further, many issuers automatically categorize purchases according to the merchant:

Purchases on a Chase credit card identified by categories.

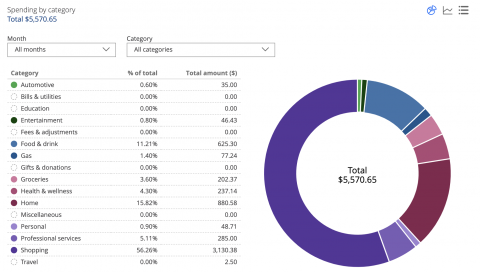

Most major issuers also let you generate reports to see how much you've spent in different categories in a given month, or for the year to date, or for a period you specify:

Spending report on a Chase credit card.

If you use a budgeting app like You Need a Budget, you can import data from your credit card and bank accounts. This makes it easy to fit each purchase into a budget category and see where you’re overspending and where you can stand to splurge a little.

» MORE: Best budgeting and saving tools

Credit cards help build credit

You don't need to have a credit card to have good credit, and you certainly don't have to carry a balance. But careful use of a credit card is the single best way to improve your credit scores, and good credit opens many doors. It makes it easier to find housing, whether a potential landlord is checking your credit before giving you the keys or you're applying for a mortgage to buy a home. Cell phone providers, insurance agents and utility companies also might use your credit history to determine your eligibility and even your rates. It can even boost your chances of landing a job, as many employers run credit checks on job applicants.

If you do have a credit card, making regular small purchases, keeping your balances low and paying your bills on time will improve your credit score over time.

When not to use a credit card

When you'll have to pay an extra fee: Merchants pay processing fees every time you use a credit card. Most of the time, those fees are rolled into the merchant's prices, like any other cost of doing business. But sometimes a merchant might pass the processing cost to you directly by tacking on an upfront surcharge or "convenience fee" for using your credit card. In those cases, you'll probably want to pay some other way, unless your credit card rewards are high enough that they'd cancel out the surcharge.

When you don't want the merchant to pay a fee: Similarly, you may want to avoid using credit cards with smaller merchants you especially want to support. They may appreciate it if you pay in cash or by check because then they don't have to pay the processing fees. Even debit cards are better than credit cards from merchants' standpoint as processing fees for debit cards tend to be lower than what they'd pay for a credit card transaction.

When you don't want to overspend: Some people have a hard time keeping their spending under control when they use a credit card. That five-figure credit card limit might make it hard to remember why you shouldn't buy that shiny object. If you're close to your credit limit or you're worried about racking up a high credit card balance, you may want to reach for your debit card or use cash.

There are a lot of great benefits for credit card users. Do your research to find the best credit card for you. Just make sure you're able to spend wisely, whatever method of payment you choose.

Capital One Venture Rewards Credit Card

Travel

For a limited time, the Capital One Venture Rewards Credit Card is offering new cardholders an especially rich bonus: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel!

Find the right credit card for you.

Whether you want to pay less interest or earn more rewards, the right card's out there. Just answer a few questions and we'll narrow the search for you.