Credit Score Ranges: What They Mean and How They Work

Your credit score says a lot about your financial health — but what does that three-digit number really mean? This guide breaks down credit score ranges from poor to excellent, explains how lenders use them and shares easy ways to give your score a boost.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

A credit score is a three-digit number, usually between 300 and 850, that shows how likely you are to pay back money you borrow. Credit scores fall into ranges — excellent, good, fair or poor — and lenders use these ranges when deciding if you can get things like a credit card, mortgage or even a cell phone plan.

A higher credit score can help you qualify for more financial options and lower interest rates. Since your score can make a big difference, it's important to know what it is and where it falls on the scale.

What are the credit score ranges?

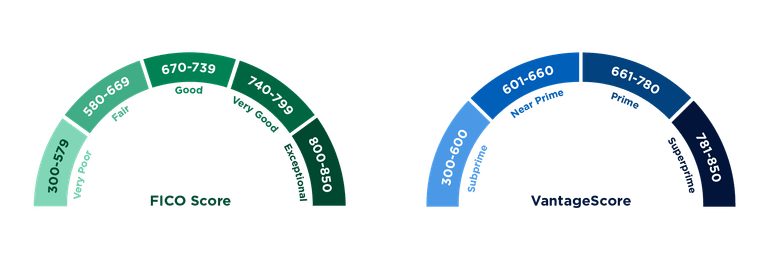

There are two companies that dominate credit scoring, FICO and VantageScore. Both use a credit score range of 300 to 850, but they have different ranges and call those ranges by different names. These are the general guidelines:

Because of these differences, here are some general guidelines for credit ranges:

- Excellent credit: Any score in the high 700s or above.

- Good credit: Any score from the mid-600s to mid-700s.

- Fair credit: Any score in the mid-500s to low 600s.

- Poor credit: Any score between 300 to high 500s.

Stress less. Track more.

See the full picture: savings, debt, investments and more. Smarter money moves start in our app.

Why are my FICO and VantageScore credit scores different?

Different models, different math

FICO and VantageScore both use a 300-850 scale and consider the same core factors — such as payment history, credit utilization and account age — but they weight those factors differently.

For example, payment history makes up 40% of VantageScores but only 35% of FICO scores. This creates some variation between the two models.

FICO 8 and VantageScore 3.0 are commonly used credit score models, but there are additional models available. Lenders might be using older or newer scoring models to calculate your scores.

Credit report data can vary

Scores can also vary depending on which credit bureau supplied the credit report data used to generate it — or even when the data was reported. In addition, not every creditor sends account activity to all three bureaus, so your credit report from each one is unique.

Why credit score ranges matter

Credit score ranges give lenders a quick way to assess an applicant’s credit risk and determine what kinds of financial products and interest rates to offer.

For example, someone with excellent credit might qualify for a lower interest rate on a car loan than someone with a fair score. The difference can translate into thousands of dollars saved over the life of the loan and smaller monthly payments.

Someone with good or excellent credit might also get access to premium credit cards with more generous rewards, such as high cashback rates, travel perks (airport lounge access, travel insurance, TSA PreCheck reimbursement), sign up bonuses and lower introductory interest rates.

On the other hand, someone with fair or poor credit may face higher interest rates, smaller credit limits or might get denied.

What factors affect your credit scores?

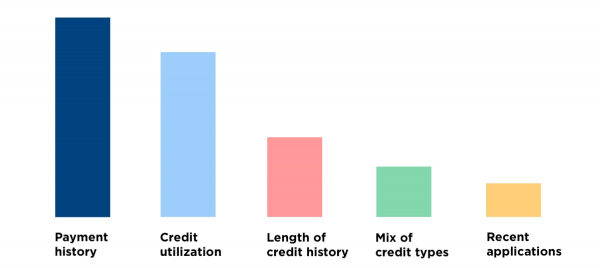

Your credit score is shaped by five key factors — but not all of them carry equal weight. Understanding how each one works can help you focus your efforts where they'll make the biggest difference.

Payment history

This is your record of paying your bills each month and it's the most important factor in your credit score. Missing a payment is detrimental to your score and can signal to lenders that you might be unreliable. A payment that's 30 days or more past the due date stays on your credit reports for seven years.

Tips for avoiding a late payment:

- Set up automatic payments for at least the minimum amount due.

- Use calendar reminders or app alerts to manage due dates.

- Group bill payments together to create a consistent monthly routine.

Credit utilization

This measures how much of your credit you are using at a given time. It's calculated by dividing your total credit balances by your total credit limits. It's recommended that you use less than 30% of your credit limits — but 10% or lower is better. Lenders get nervous if they feel like you rely too heavily on credit.

Tips for lowering your credit utilization:

- Make smaller payments throughout the month rather than waiting for the due date.

- Request a credit limit increase (but keep your spending level).

- Keep older cards open, even if you don’t use them, because it helps expand your available credit.

Length of credit history

The longer you've had credit, the more data lenders have to assess your financial habits. This factor looks at the average age of your accounts and your oldest account.

Tips for bulking up your credit history:

- Become an authorized user on a trusted person’s credit card, like a parent or partner. Ideally, you’ll get access to their credit history without the stress of being on the hook for the payments — although you should work out specific details with the primary accountholder.

- Consider enrolling in a rent reporting service or using Experian Boost, where you can get credit for paying rent, utilities and even streaming service bills on time.

Credit mix

This factor is all about the kinds of accounts on your credit report. Lenders like to see that you can use a variety of credit responsibly – whether that’s installment loans like an auto or student loan or revolving credit like a credit card.

Tips for mixing up your credit:

- Credit mix is moderately important to your overall score. That means it’s not worth rushing out the door to open a new account, but as you continue to build your credit profile, keep the diversity of accounts in mind.

New credit/recent applications

Every credit application results in a hard inquiry, which causes a small (but temporary) dip in your score. Many applications in a short period of time, however, can do more significant damage. The only exception is when you’re shopping for a rate on a mortgage or car loan. In this case, multiple hard inquiries made between 14 to 45 days are grouped together and counted as one.

Tip for applying for credit:

- Space out your credit applications every six months, if possible.

What isn't included in your credit scores

There are some things that are not included in credit score calculations, and these mostly have to do with demographic characteristics.

Your race or ethnicity, sex, marital status, age or where you live aren’t part of your credit score calculation. Your employment history — which can include things such as your salary, title or employer — is also not considered.

Stress less. Track more.

See the full picture: savings, debt, investments and more. Smarter money moves start in our app.

How can I check and monitor my credit?

You can check your own credit — it's free and doesn't hurt your score — and know what the lender is likely to see.

You can get a free credit score from a personal finance website such as NerdWallet, which offers a VantageScore 3.0 using data from your TransUnion credit report. Many personal banking apps also offer free credit scores, so you can make a habit of checking in when you log in to pay bills.

Remember that scores fluctuate. As long as you keep it in a healthy range, those variations won’t have an effect on your financial well-being. Bigger jumps might be cause for concern, indicating a missed payment or possible identity theft.

NerdWallet recommends placing a free credit freeze with each credit bureau — Equifax, Experian and TransUnion — for the best protection. A credit freeze allows you to use existing credit cards, but prevents criminals from applying for new credit using your personal data because access is blocked when a potential lender tries to approve a new application.

» MORE: How to improve your credit

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Related articles