Goodbudget Review: A Hands-On Digital Envelope System

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

There are many ways to approach building a budget. One traditional method, known as the envelope system, involves physically dividing your cash into separate envelopes for expenses like groceries and your cell phone bill.

Goodbudget is a virtual way to do this. This website and mobile app let you specify how you want to spend or save your funds. The basic free membership is an effective way for rookies to control and track their finances, but folks with expansive budgets might want to upgrade to the paid membership.

What is Goodbudget?

Goodbudget is a budgeting service that helps you log and allocate your finances. You can access it via your web browser or download the free app on iOS and Android devices from the App Store and Google Play store. You just need an email address and password to sign up. Your account syncs between the app and website, so you can easily manage your budget at home or on the go.

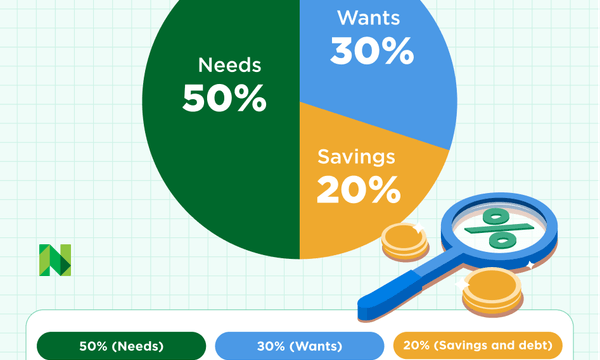

Goodbudget puts a modern twist on the old envelope tactic. The idea is to divvy up your money into digital “envelopes,” or categories based on wants and needs. For example, you set aside $100 in one envelope each month to use for eating out and $150 in another envelope for gas. You can choose from pre-labeled envelopes or create your own.

How does Goodbudget work?

To set up and use Goodbudget, follow the steps below:

- Create your envelopes. Most envelopes are for frequent expenses like rent, groceries and entertainment. Goodbudget also offers envelopes specific to annual expenses, such as holiday shopping or property taxes, and envelopes for goals, like saving for a new car.

- Input financial data. You will input your income, cash amounts, debts and balances from each of your financial accounts. (Or link accounts with the paid version.)

- Allocate funds. With all that information, you’ll decide how much money should be dedicated to each envelope.

- Record expenses. Every time you spend or receive money, log it in your Goodbudget account (or have it automatically sync with the paid version) and see how that affects your budget. For example, if you allot $200 per month to your groceries envelope and you spend $50 on food, you input the store name and amount spent in your groceries envelope. You would then have $150 left to spend on groceries for the month.

- Monitor your budget. Each envelope’s balance is represented by a colorful bar on your home screen that adjusts to reflect your activity. Green means you have money left in the envelope; red indicates you’ve gone over budget.

Like some other budget apps, Goodbudget syncs with your bank account and tracks transactions for you if you upgrade to the Premium version. You can link your Goodbudget account to as many supported checking, savings and credit card accounts as you want. However, investment accounts and debts are not automatically synced.

Additionally, transactions will only show after the funds have cleared your bank account. So that $50 grocery bill may not show up until a few days after your purchase.

If you prefer not to link your spending accounts, you always have the option to manually log your transactions or upload a history of transactions from your bank’s website to your Goodbudget account.

Free vs. paid plans

There are two Goodbudget plans: a free plan and a paid Premium plan that costs $10 per month or $80 per year. A previous plan, called Plus, is phasing out (more on that below).

Both versions let you do a lot, like edit your budget as needed and transfer money between envelopes. You can also schedule future transactions and set email notifications for them. So, for example, you could schedule your mortgage payments and have Goodbudget remind you of that transaction a couple of days before it happens.

- Accounts. The free version allows only one financial account, and the Premium version allows unlimited accounts. So those who want to monitor their spending from checking or savings accounts, as well as from a credit card, can do so only if they pay for the Plus plan.

- Devices. With the free version, you can access Goodbudget from up to two devices, while the Premium plan allows five devices.

- Envelopes. Users of the free version can use up to 10 regular envelopes and 10 envelopes specifically for goals and annual expenses. Premium subscribers have unlimited envelopes of both kinds.

- History. For free users, Goodbudget stores a year’s worth of transaction history. Premium subscribers get seven years tracked.

- Support. Free users get community support. Premium members get email support.

Goodbudget Plus

Goodbudget’s upgraded membership was previously known as the Plus plan. If you are currently a customer using the Plus plan, you can remain on that plan as long as you like without changes or interruptions in your account. The Plus and Premium plans share all the same features, except the Premium plan enables you to sync with your bank accounts.

» MORE: YNAB app review

The 'good' in Goodbudget

Users say Goodbudget is easy to use for the most part, according to reviews posted in the App Store and Google Play store. But some users point out that there's a learning curve, and we also had to poke around a bit to get familiar with the service. We recommend consulting the user guides and instructional videos on the Goodbudget website before you get started.

Goodbudget helps put your spending in perspective because it lets you break down your budget by expense and view personalized reports. Also, you can play around with your envelopes, adjusting allowances as you see fit.

The ability to access the same Goodbudget account from multiple devices is useful for partners who want to share their activity. (Note that there are also a few specialty budget apps for couples.)

The not-so-good

The free version isn’t a realistic option for everyone. Some users find it doesn’t include enough envelopes and dislike that it restricts them to one financial account. Of course, the paid plan lifts these restrictions, but paying for a budgeting service may seem counterproductive.

Also, entering purchases takes time and diligence; even if you import files from your bank account, you still have to categorize each transaction manually when using the free plan.

The verdict

Goodbudget seems to be an effective budgeting tool for many people — as of this writing, it has 4.6 stars out of 5 in the App Store (3.5 stars in the Google Play store) — but it’s also high-maintenance. The free version doesn’t automatically sync with your bank accounts or credit cards, which means you have to manually enter all of your transactions to stay up to date or upgrade to the Premium version. It’s a helpful tool for beginners looking for a hands-on approach to budgeting.

The free version of the app is limiting and might be too basic for most users. The Premium version will provide a more accurate, all-encompassing picture of your finances. But paying to use a budgeting tool may not be the best option for those trying to watch their spending.

Other tools to help you budget

- Try NerdWallet’s free app, which tracks your spending by budget category and helps you find ways to save.

- If it turns out that apps aren’t your thing, try our free budget template. Or explore other free budget spreadsheets.

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Related articles