2025-2026 Tax Brackets and Federal Income Tax Rates

Federal income tax rates range from 10% to 37%. Find out how they work and which brackets you're in.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

The seven federal income tax rates are 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Tax brackets divide portions of your income into different windows based on filing status. These brackets determine which tax rates you end up paying. For example, a single filer with a taxable income of $60,000 will pay a combination of 10%, 12% and 22%.

2025 federal tax brackets

These brackets and rates apply to taxable income earned during 2025. The deadline for filing 2025 taxes will be April 15, 2026, or October 15, 2026, with an extension.

Tax rate | Single filer | Married filing jointly (or surviving spouse) | Head of household | Married filing separately |

|---|---|---|---|---|

10% | $0 to $11,925 | $0 to $23,850 | $0 to $17,000 | $0 to $11,925 |

12% | $11,926 to $48,475 | $23,851 to $96,950 | $17,001 to $64,850 | $11,926 to $48,475 |

22% | $48,476 to $103,350 | $96,951 to $206,700 | $64,851 to $103,350 | $48,476 to $103,350 |

24% | $103,351 to $197,300 | $206,701 to $394,600 | $103,351 to $197,300 | $103,351 to $197,300 |

32% | $197,301 to $250,525 | $394,601 to $501,050 | $197,301 to $250,500 | $197,301 to $250,525 |

35% | $250,526 to $626,350 | $501,051 to $751,600 | $250,501 to $626,350 | $250,526 to $375,800 |

37% | $626,351 or more | $751,601 or more | $626,351 or more | $375,801 or more |

Source: IRS | ||||

Expand each section to view the total taxes owed for each filing status.

2026 federal tax brackets

These brackets and rates apply to taxable income earned during 2026. The deadline for filing 2026 taxes will be April 2027.

Tax rate | Single filer | Married filing jointly (or surviving spouse) | Head of household | Married filing separately |

|---|---|---|---|---|

10% | $0 to $12,400 | $0 to $24,800 | $0 to $17,700 | $0 to $12,400 |

12% | $12,401 to $50,400 | $24,801 to $100,800 | $17,701 to $67,450 | $12,401 to $50,400 |

22% | $50,401 to $105,700 | $100,801 to $211,400 | $67,451 to $105,700 | $50,401 to $105,700 |

24% | $105,701 to $201,775 | $211,401 to $403,550 | $105,701 to $201,750 | $105,701 to $201,775 |

32% | $201,776 to $256,225 | $403,551 to $512,450 | $201,751 to $256,200 | $201,776 to $256,225 |

35% | $256,226 to $640,600 | $512,451 to $768,700 | $256,201 to $640,600 | $256,226 to $384,350 |

37% | $640,601 or more | $768,701 or more | $640,601 or more | $384,351 or more |

Source: IRS | ||||

Expand each section to view the total taxes owed for each filing status.

on Priority Tax Relief's website

on Alleviate Tax's website

How tax brackets and rates work

1. What is taxable income?

Your taxable income is your gross income after you account for certain tax deductions and other adjustments. These include contributions to a 401(k) or an IRA, as well as either the standard deduction or itemized deductions.

2. What are income tax brackets?

The U.S. has a progressive tax system. This means that people with higher incomes are subject to higher tax rates, and people with lower incomes are subject to lower tax rates.

The government decides how much tax you owe by dividing your taxable income into chunks called tax brackets. Each individual bracket gets taxed at a corresponding tax rate. Tax rates can range from 10% to 37%.

The beauty of tax brackets is that no matter which bracket(s) you’re in, you generally won’t pay that tax rate on your entire income. The highest tax rate you pay applies to only a portion of your income.

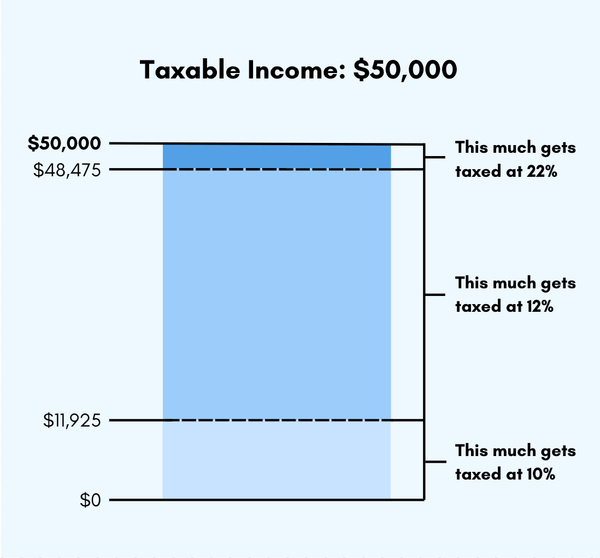

Federal tax brackets example

If you have $50,000 of taxable income in 2025 as a single filer, you'll pay 10% on that first $11,925 and 12% on the chunk of income between $11,926 and $48,475. Then, you'll pay 22% on the rest because some of your $50,000 of taxable income falls into the 22% tax bracket. The total bill is roughly $5,914 — about 12% of your taxable income — even though your highest bracket is 22%. That 12% is your effective tax rate.

3. How do tax brackets and rates work on the state level?

States may handle taxes differently from the federal government. Your state might have different brackets or a different system altogether. Colorado, for example, has a flat tax rate of 4.4% on taxable income, and some states, such as Wyoming, don't have a state income tax. (See state-by-state income tax rates and brackets.)

4. Are income tax brackets adjusted for inflation?

Federal income tax brackets — the window of income where a specific tax rate ends and begins — can be updated to reflect inflation. These tweaks, formally known as inflation adjustments, are a critical part of the tax code.

Bracket adjustments can help prevent people from ending up in a higher tax bracket as their cost of living rises. They can also lower taxes for those whose compensation has not kept up with inflation.

What is a marginal tax rate?

The marginal tax rate is the tax rate paid on the last dollar of taxable income. It typically equates to your highest tax bracket. For example, if you're a single filer in 2025 with $35,000 of taxable income, portions of your income would be taxed at 10% and 12%. If your taxable income went up by $1, you would pay 12% on that extra dollar, too.

What is an effective tax rate?

Your effective tax rate is the percentage of your taxable income that you pay in taxes. To determine your effective tax rate, divide your total tax owed (line 24) on Form 1040 by your total taxable income (line 15).

Nerdy Perspective

Thinking your income is taxed at a single rate is a pretty common misconception. You may have even heard someone say something like, 'I'm in the 32% tax bracket.' What they're probably referring to is their marginal tax rate: the highest tax rate they pay. The average tax rate you pay is called your effective tax rate, which gives you a better picture of how much tax you actually paid throughout the year. Using a tax calculator can be a good way to get a grasp on how these concepts play out.

How to reduce taxes owed

Since taxes are paid as you earn, ideally, you are withholding enough tax throughout the year via your W-4 or estimated tax payments to cover what you owe. An overpayment in tax throughout the year will result in a refund, while an underpayment may result in a bill.

Still, two common ways of reducing your tax bill are credits and deductions.

Tax credits can reduce your tax bill on a dollar-for-dollar basis; they don't affect what bracket you're in.

Tax deductions, on the other hand, reduce how much of your income is subject to taxes. Generally, deductions lower your taxable income by your highest federal tax rate. So, if you fall into the 22% tax bracket, a $1,000 deduction could save you $220.

In other words, take all the tax deductions you can claim. Deductions can reduce your taxable income and could kick you to a lower bracket, which means you pay a lower tax rate.

Tax brackets and rates for past years

Need to file back taxes? Take a look at the tax brackets and rates for 2022-2024.

on Priority Tax Relief's website

on Alleviate Tax's website

ON THIS PAGE

ON THIS PAGE