2025-2026 Tax Brackets and Federal Income Tax Rates

Federal income tax rates range from 10% to 37%. Find out how they work and which brackets you're in.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

In 2026, there are seven tax brackets and rates: 10%, 12%, 22%, 24%, 32%, 35% and 37%. You may be taxed at just one rate or at several. How much you pay depends on factors such as your income and filing status.

Need to skip ahead?

How tax brackets and rates work

You’ve probably heard of terms like "tax bracket," "marginal tax rate" and "effective tax rate" — but what do they actually mean, and why do they matter? Below, we’ll break down how each concept works. Understanding the difference can help you better estimate what you’ll owe (and understand how to owe less in the future).

What is taxable income?

When it comes to determining your bill, the IRS uses your taxable income as the starting point for its calculations. Simply put, it's your gross income minus certain adjustments and deductions.

Gross income includes money you earn from all sources — that can mean your salary, freelance income, interest from a high-yield savings account and even capital gains you make from selling investments.

From there, you subtract any adjustments and deductions you're eligible for. These can include pretax contributions to a 401(k) or an IRA, as well as either the standard deduction or itemized deductions. The amount left over is your taxable income.

Determining taxable income

1. Start with your gross income (income from all sources before taxes).

2: Subtract tax adjustments (e.g., deductible 401(k) contributions, eligible IRA contributions, student loan interest).

3: Subtract your deductions (standard deduction or itemized deductions).

Result: Your taxable income.

What are income tax brackets?

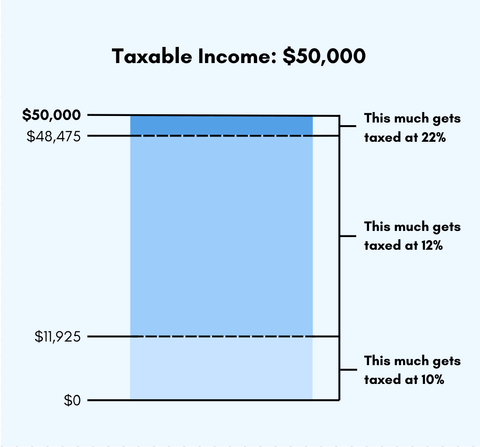

The federal government calculates your tax bill by first dividing your income into different taxable chunks called brackets. The income in each chunk is taxed at a different rate, ranging from 10% to 37%.

The beauty of tax brackets is that no matter which bracket(s) you’re in, you generally won’t pay a single tax rate on your entire income. The first portion of your income is always taxed at the lowest rate, and as your income increases, more of your money starts to spill over into higher-tiered tax brackets to be taxed at higher rates. This type of system is known as a progressive taxation.

For example, if you had $50,000 of taxable income in 2025 as a single filer, you'll pay a 10% tax on that first $11,925 and a 12% tax on the chunk of income between $11,926 and $48,475. Then, you'll pay a 22% tax on the rest because some of your $50,000 of taxable income falls into the 22% tax bracket.

What is a marginal tax rate?

You may sometimes hear someone say that they are "in the 22% tax bracket." That doesn't mean that they pay a 22% tax on their entire income but rather that 22% is the highest tax rate they pay on the last dollar of their taxable income. It typically equates to their highest tax bracket.

In the example above, this single filer's marginal tax rate is 22%. If their taxable income went up by $1, they would pay 22% on that extra dollar, too. Knowing your marginal tax rate can be helpful because it can help with tax planning, whether that's determining the impact of a bonus or the tax effects of locking in a capital gain.

What is an effective tax rate?

Your effective tax rate is the percentage of your taxable income that you actually pay in taxes — in other words, it's your average tax rate. Knowing your effective tax rate is helpful because it can give you a clearer picture of how much of your income goes toward federal income taxes overall.

To determine your effective tax rate, grab your tax return and then divide your total tax owed (line 24) on Form 1040 by your total taxable income (line 15).

In the example above, the single filer's total tax bill is roughly $5,914, or about 12% of their income. This makes their effective tax rate 12%.

Effective tax rate formula

Total tax owed ÷ total taxable income = effective tax rate.

How do tax brackets and rates work on the state level?

Now that you have a grasp on federal taxes, you might be wondering how your state handles taxing income. The answer? It depends.

Each state approaches it differently — for example, some have a progressive system similar to the federal government, where people pay different rates on different portions of their income; other states might use what's known as a flat tax, where everyone pays the same rate on the entirely of their income regardless of whether they made $500 or $500,000. There are also a small handful of states, such as Wyoming, that don't have a state income tax at all.

» Dive deeper: See state-by-state income tax rates and brackets

How often do tax brackets change?

After an annual performance review at your job, you might receive a cost-of-living raise. This helps to ensure that your salary (in other words, your purchasing power) is keeping up with the current cost of living.

Tax brackets work in a similar way. Each year, the IRS updates income thresholds through a process known as inflation adjustments. These small tweaks can help to prevent “bracket creep,” which can happen when rising wages push someone into a higher tax bracket even though their purchasing power hasn’t increased. Inflation adjustments can also reduce taxes for people whose pay hasn’t kept pace with inflation.

2025 tax brackets and rates

The table below shows the tax rates that correspond with different portions of your taxable income. The tax brackets are accurate for income earned in 2025, which is reported on tax returns filed in April of this year.

Tax rate | Single filer | Married filing jointly (or surviving spouse) | Head of household | Married filing separately |

|---|---|---|---|---|

10% | $0 to $11,925 | $0 to $23,850 | $0 to $17,000 | $0 to $11,925 |

12% | $11,926 to $48,475 | $23,851 to $96,950 | $17,001 to $64,850 | $11,926 to $48,475 |

22% | $48,476 to $103,350 | $96,951 to $206,700 | $64,851 to $103,350 | $48,476 to $103,350 |

24% | $103,351 to $197,300 | $206,701 to $394,600 | $103,351 to $197,300 | $103,351 to $197,300 |

32% | $197,301 to $250,525 | $394,601 to $501,050 | $197,301 to $250,500 | $197,301 to $250,525 |

35% | $250,526 to $626,350 | $501,051 to $751,600 | $250,501 to $626,350 | $250,526 to $375,800 |

37% | $626,351 or more | $751,601 or more | $626,351 or more | $375,801 or more |

Source: IRS | ||||

Estimate your 2025 tax rates

2026 tax brackets and rates

The tax brackets and rates below apply to taxable income earned in 2026 (taxes filed in 2027).

Tax rate | Single filer | Married filing jointly (or surviving spouse) | Head of household | Married filing separately |

|---|---|---|---|---|

10% | $0 to $12,400 | $0 to $24,800 | $0 to $17,700 | $0 to $12,400 |

12% | $12,401 to $50,400 | $24,801 to $100,800 | $17,701 to $67,450 | $12,401 to $50,400 |

22% | $50,401 to $105,700 | $100,801 to $211,400 | $67,451 to $105,700 | $50,401 to $105,700 |

24% | $105,701 to $201,775 | $211,401 to $403,550 | $105,701 to $201,750 | $105,701 to $201,775 |

32% | $201,776 to $256,225 | $403,551 to $512,450 | $201,751 to $256,200 | $201,776 to $256,225 |

35% | $256,226 to $640,600 | $512,451 to $768,700 | $256,201 to $640,600 | $256,226 to $384,350 |

37% | $640,601 or more | $768,701 or more | $640,601 or more | $384,351 or more |

Source: IRS | ||||

on Anthem Tax Services' website

on Alleviate Tax's website

How to lower your tax bill

Since taxes are paid as you earn money, ideally, you are withholding enough tax throughout the year via your W-4 or estimated tax payments to cover what you owe. An overpayment in tax throughout the year will result in a refund, while an underpayment may result in a bill.

Still, two common ways of reducing your tax bill are credits and deductions.

Tax credits can reduce your tax bill on a dollar-for-dollar basis; they don't affect what bracket you're in.

Tax deductions, on the other hand, reduce how much of your income is subject to taxes. Generally, deductions lower your taxable income by your highest federal tax rate. So, if you fall into the 22% tax bracket, a $1,000 deduction could save you $220.

In other words, take all the tax deductions you can claim. Deductions can reduce your taxable income and could kick you to a lower bracket, which means you pay a lower tax rate.

Tax planning can also help you strategize how to owe less next year. One of the easiest ways to lower your tax bill is contributing to a 401(k) if you have one. If you contribute up to the annual limit — $24,500 in 2026, plus extra catch-up contributions if you’re 50 or older — that amount is subtracted from your taxable income, reducing the taxes you owe now while helping you save for retirement.

Some employers also offer tax-advantaged programs like flexible spending accounts and dependent care accounts. These let you use pretax dollars to pay for qualifying expenses while further lowering your taxable income and potentially reducing your tax bill.

» Dive deeper: 7 tax strategies for 2026

Tax brackets and rates for past years

Need to file back taxes? Take a look at the tax brackets and rates for 2022-2024.

on Anthem Tax Services' website

on Alleviate Tax's website