Disney’s New Credit Card Is the Only Disney Card I’d Recommend

The new Disney Inspire Visa Card has a $149 annual fee, but its perks are well worth it for frequent Disney travelers.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

For years, I've had to tell Disney fans something they didn't want to hear: "Don't get the Disney credit cards."

As a huge Disney fan, I’ve been disappointed by the brand's previous lineup of credit cards. But that changed with the launch of the Disney Inspire Visa Card on Feb. 3, 2026. Though the $149 card has a higher annual fee than its counterparts, it’s the first Disney card where the math actually works for frequent Disney travelers.

What the other Disney cards got wrong

Before the Disney Inspire launched, Disney had two co-branded credit cards:

- The $0-annual-fee Disney® Visa® Card.

- The $49-annual-fee Disney® Premier Visa® Card.

Both come with low earnings rates.

The $0-annual-fee Disney® Visa® Card offers just 1% back on all card purchases in the Disney Rewards Dollars, with no bonus rewards on Disney purchases or other categories. Many great cash-back cards, by comparison, earn 2% or more on purchases. Disney Rewards Dollars can be redeemed for certain purchases on Disney, including theme park tickets, resort stays, cruise line purchases, purchases at DisneyStore.com and tickets for Disney movies at AMC Theatres. One Disney Rewards Dollar is worth $1.

The Disney® Premier Visa® Card earns slightly better rewards:

- 5% in Disney Rewards Dollars on card purchases made directly at DisneyPlus.com, Hulu.com or ESPNPlus.com.

- 2% in Disney Rewards Dollars on card purchases at gas stations, grocery stores, restaurants and most Disney U.S. locations.

- 1% on everything else.

Still, that’s not good enough to justify its $49 annual fee. It also didn’t offer any meaningful perks beyond what the $0-annual-fee option offered.

By signing up, you will receive newsletters and promotional content and agree to our Terms of Use and acknowledge the data practices in our Privacy Policy. You may unsubscribe at any time.

What the Disney Inspire Visa gets right

The Disney Inspire offers something its sibling cards don’t: Multiple annual credits that are easy for Disney fans to earn and redeem. You’ll get:

- 200 Disney Rewards Dollars after spending $2,000 on U.S. Disney Resort stays and Disney Cruise Line bookings each anniversary year.

- $100 statement credit after spending $200 on U.S. Disney theme park tickets each anniversary year, including annual passes.

- Up to $120 annual credit on Disney+, Hulu and ESPN+ purchases, broken out as $10 monthly statement credits on purchases of $10 or more. Opt-in required.

The welcome offer adds $600 in value, with $300 Disney Gift Card eGift for new cardmembers upon approval and a $300 statement credit after spending $1,000 on purchases in the first three months from account opening.

The card also offers decent rewards on everyday spending, earning Disney Rewards Dollars at these rates:

- 10% at DisneyPlus.com, Hulu.com, and Plus.ESPN.com.

- 3% at most other U.S. Disney locations (including on annual passes or Magic Key passes) and gas stations.

- 2% at grocery stores and restaurants.

- 1% on all other card purchases.

You’ll need to vacation at Walt Disney World, Disneyland or a Disney cruise at least once per year to make up for the annual fee.

The 200 Disney Rewards Dollars bonus alone ($200 value) more than covers the $149 annual fee if you hit the $2,000 spending threshold on U.S. Disney resort stays or Disney cruises.

Even if you don’t meet that benefit, you might still come out ahead if you can maximize the other credits, such as the $120 annual streaming credit or $100 U.S. Disney theme park ticket statement credit.

Other Disney card benefits (available on all Disney Visa cards)

The Disney Inspire Visa Card also comes with a suite of perks that are available to anyone with any Disney Visa card, including the no-annual-fee version. These extras and discounts are genuinely useful — and in the past, they were one of the few good reasons you might apply for a Disney-branded card. On the Disney Inspire card, these perks make an already good card better. Benefits include:

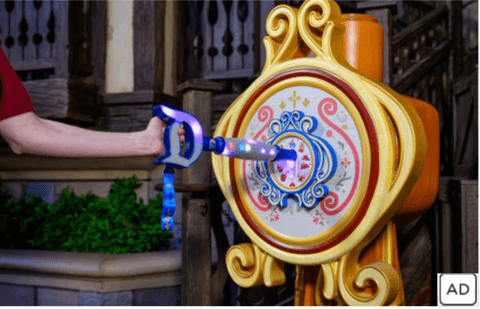

- Cardmember exclusive character meet-and-greets: Flash any Disney-branded credit card at select locations around Disney’s U.S. parks to gain access to special character meet-and-greets, meaning potentially shorter lines and access to characters that regular park visitors don't usually get to see.

- Dining and shopping discounts: Using your card gets you 10% off dining, merchandise and recreational experiences at select locations around the U.S. parks. Select guided tours can be booked for 15% off. And some locations offer even greater discounts. For example, the Wetzel’s Pretzels at the Disneyland Resort offers 20% off, and you can get 20% off purchases made through Joffreys.com, the same coffee company that supplies the coffee throughout the U.S. Disney parks.

- Goodies for booking certain trips: Disney regularly doles out extra swag when you use your card to pay for eligible Disney trips. Offers vary by park and time of year, but we’ve spotted deals including complimentary pins and cooler bags when booking a Disneyland Resort vacation package (which means a hotel plus park tickets).

See the complete list of Disneyland Resort and Walt Disney World Resort cardmember benefits.

💸 Save 5-10% or More on Real Disney Tickets

Same tickets, less money, no catch – guaranteed! Trusted NerdWallet partner.

Drawbacks of the Disney Inspire Visa Card

The primary drawback of the Disney Inspire Visa is that its most valuable benefits are credits on park visits or cruises.

Given those limitations, there are some people who should skip the Disney Inspire Visa Card:

- Less-frequent Disney visitors: If you like Disney but aren’t sure you go every year, this card won’t offer much value in the years you skip a Disney trip.

- People who book Disney Resort stays or Disney cruises through third parties. To earn 200 Disney Rewards Dollars after spending $2,000 on U.S. Disney Resort stays and Disney Cruise Line bookings on this card, you must book directly with Disney. That could pose a problem for people who prefer to book through other booking sites such as Expedia.

- People who book their lodging off-property: If you prefer to stay at non-Disney hotels or alternative lodging like a vacation rental, you’ll also miss out on the 200 Disney Rewards Dollars credit, which is a major part of the card’s value.

- Visitors to international Disney parks: Though the card has no foreign transaction fees, the benefits don’t extend to Disney’s international parks. If your Disney vacations include out-of-the-country destinations like Hong Kong Disneyland or Disneyland Paris, you’re better off with another travel credit card.

- People who travel to non-Disney destinations frequently: While this card is great for Disney, other cards offer better general travel benefits. The best premium credit cards, for example, offer more flexible rewards and more perks, such as lounge access and travel insurance.

» Learn more: The best Disney credit cards

Why this card changed my mind

With the launch of the Disney Inspire, I’m no longer telling people to avoid Disney-branded cards. In general, now, I’d say the Disney Inspire is a solid option for frequent Disney travelers.

Yes, you still have to go on a Disney cruise or stay at a U.S. Disney resort at least once a year to make the Disney Inspire card worth its annual fee. Even for frequent travelers, that’s a big commitment.

But if you’re regularly buying U.S. Disney park tickets, staying at Disney Resorts and booking Disney cruises, this card’s benefits will feel easy to earn and use. For some, that could easily justify its $149 annual fee.

Information related to the Disney® Visa® Card, the Disney® Premier Visa® Card and the Disney Inspire Visa has been collected by NerdWallet and has not been reviewed or provided by the issuer of these cards.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2026:

- Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

- No annual fee: Wells Fargo Autograph® Card

- Flat-rate travel rewards: Capital One Venture Rewards Credit Card

- Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

- Luxury perks: American Express Platinum Card®

- Business travelers: Ink Business Preferred® Credit Card

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

More like this

Related articles