Travel Insured International Review: Is it Worth The Cost?

Travel Insured International is a good option if you're looking for the ability to add coverages a la carte.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

at SquareMouth

Travel Insured International

Some TII plans offer primary medical coverage, which can be a significant advantage, especially in emergencies abroad.

at SquareMouth

Pros

- Annual or single-trip policies are available.

- Higher-level plan include optional add-ons for event tickets and for electronic equipment

- Rental car protection add-on for just $8 per day, even on lower-level plan.

Cons

- Many of the customizations are only available on the higher-tier plan.

- Coverage cost comes in above average in our latest analysis.

Travel Insured International offers two comprehensive plans for travelers, plus the opportunity to purchase an annual policy.

With the ability to add on a variety of coverages, Travel Insured International is a good option for those wanting more control over their plans. It’s a little more expensive than average but is easy to use and features transparent pricing, making it an appealing choice for those looking for simplicity when purchasing a travel insurance policy.

Why trust NerdWallet?

Our Nerdy editorial team aims to be a starting point in your travel insurance research. We default toward transparency and follow a comprehensive methodology for rating and reviewing travel insurance companies. Advertisers and advertising relationships do not influence our ratings. Learn more about our strict editorial guidelines.

What is Travel Insured International?

In business since 1994, Travel Insured International offers insurance policies to travelers. Travel Insured International is owned by Crum & Forster, which has an A (excellent) financial strength rating by AM Best, a company that specializes in ranking insurance businesses.

What does Travel Insured International cover?

Travel Insured International travel insurance coverage is comprehensive, which means you can expect a full suite of benefits when you purchase a plan. This includes Travel Insured International travel insurance medical coverage as well as other common coverages, such as trip delay insurance and luggage insurance.

- Trip cancellation and trip interruption: Reimburses prepaid, nonrefundable costs if your trip is canceled or interrupted for a covered reason.

- Travel Insured International health insurance coverage: Covers accidents and illnesses that occur during your trip.

- Emergency evacuation: Pays for the cost of an emergency evacuation to get medical care.

- Baggage insurance: Covers the cost to purchase new items or replace the ones that are lost in the event your luggage is delayed or lost.

Travel Insured International policies

| Trip cancellation | Trip interruption | Medical coverage | Luggage | |

|---|---|---|---|---|

| Worldwide Trip Protector Edge | Up to 100% of trip cost. | Up to 100% of trip cost. | Up to $10,000. | Up to $750 for loss, up to $200 for delay. |

| Worldwide Trip Protector | Up to 100% of trip cost. | Up to 150% of trip cost. | Up to $100,000. | Up to $1,000 for loss, up to $500 for delay. |

Add-on options

Travel Insured International offers lots of customization options for travelers, though the more expensive Worldwide Trip Protector policy has more choices.

Worldwide Trip Protector Edge

- Cancel for work reasons.

- Flight accident coverage.

- Emergency medical upgrade.

Worldwide Trip Protector

- Electronic equipment coverage.

- Event ticket registration fee protection.

- Flight accident coverage.

- Interruption For Any Reason (IFAR).

- Rental car insurance.

- Travel inconvenience coverage.

What’s not covered by a Travel Insured International plan

Travel Insured International’s policies are pretty comprehensive, especially when you factor in add-on options, but there are some exclusions that are nearly universal. These include:

- Dangerous activities (unless specifically included).

- Anything while you’re under the influence of drugs and alcohol.

- Known storms (those that already have a name).

- Acts of war.

- Intentional self-harm.

How Travel Insured International compares to its competitors

On a five-star scale, NerdWallet rated Travel Insured International four stars. This makes it one of the better options among the companies we surveyed and puts it on par with competitors TravelSafe, HTH Travel Insurance and Travelex.

| Company | Star rating | Basic plan cost | Premium plan cost | Generate a quote |

|---|---|---|---|---|

| Berkshire Hathaway Travel Protection | | $26. | $75. | |

| Tin Leg | | $36. | $188. | |

| WorldTrips Travel Insurance | | $47. | $66. | |

| World Nomads | | $63. | $115. | |

| Trawick International | | $100. | $194. | |

| AXA Assistance USA | | $114. | $159. | |

| AEGIS (GoReady) Travel Insurance | | $139. | $208. | |

| HTH Travel Insurance | | $146. | $233. | |

| Seven Corners | | $154. | $225. | |

| Travel Insured International | | $164. | $218. | |

| Allianz Global Assistance | | $166. | $291. | |

| USI Affinity Travel Insurance Services | | $169. | $297. | |

| AAA | | $183. | $222. | |

| IMG | | $183. | $252. | |

| Travel Guard | | $135. | $236. | |

| Arch RoamRight | | $202. | $225. | |

| These star ratings are based on a separate analysis of each travel insurance provider’s offerings. For more detailed scoring, see our recommendations for the best travel insurance companies, read each individual provider's NerdWallet review or view our methodology at the end of this article. Pricing is subject to change based on your specific trip details. You can verify the latest price by clicking through to Squaremouth (a NerdWallet partner). | ||||

How much is Travel Insured International travel insurance?

How much does Travel Insured International travel insurance cost? A sample trip for a 36-year-old traveler from Indiana to Canada for five days found that the cheapest Travel Insured International plan cost $164. If you were to spring for the premium plan, which increases your coverage limits, expect to pay $218.

Other providers charged anywhere from $10 to $202 for their basic plan for the same sample trip. Note that price isn't the only differentiating factor. Travel insurance cost and coverage are not identical across plans; each company offers various levels of scope, limits and exclusions.

How to buy a Travel Insured International policy

Purchasing a Travel Insured International policy can easily be done online. In fact, you don’t even need to create a quote to compare plans and their coverage levels. Travel Insured International’s plan page will give you all the important information you need to make an informed decision.

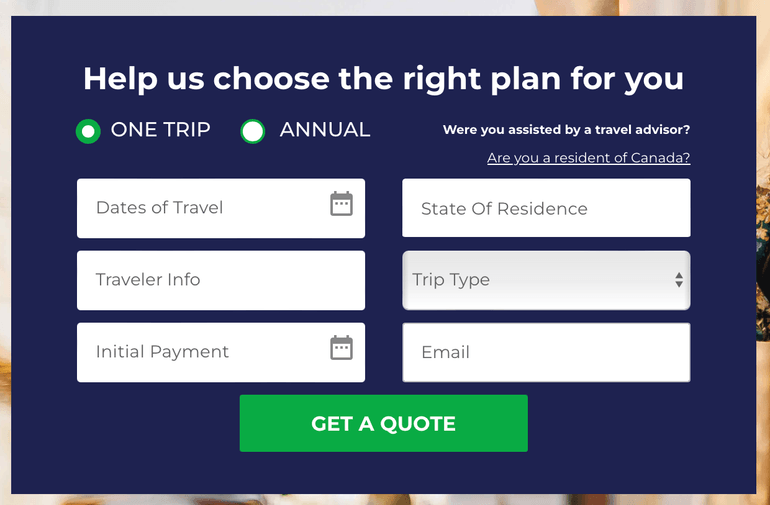

Once you’ve looked at the differences between plans, navigate to Travel Insured International’s homepage to generate a quote.

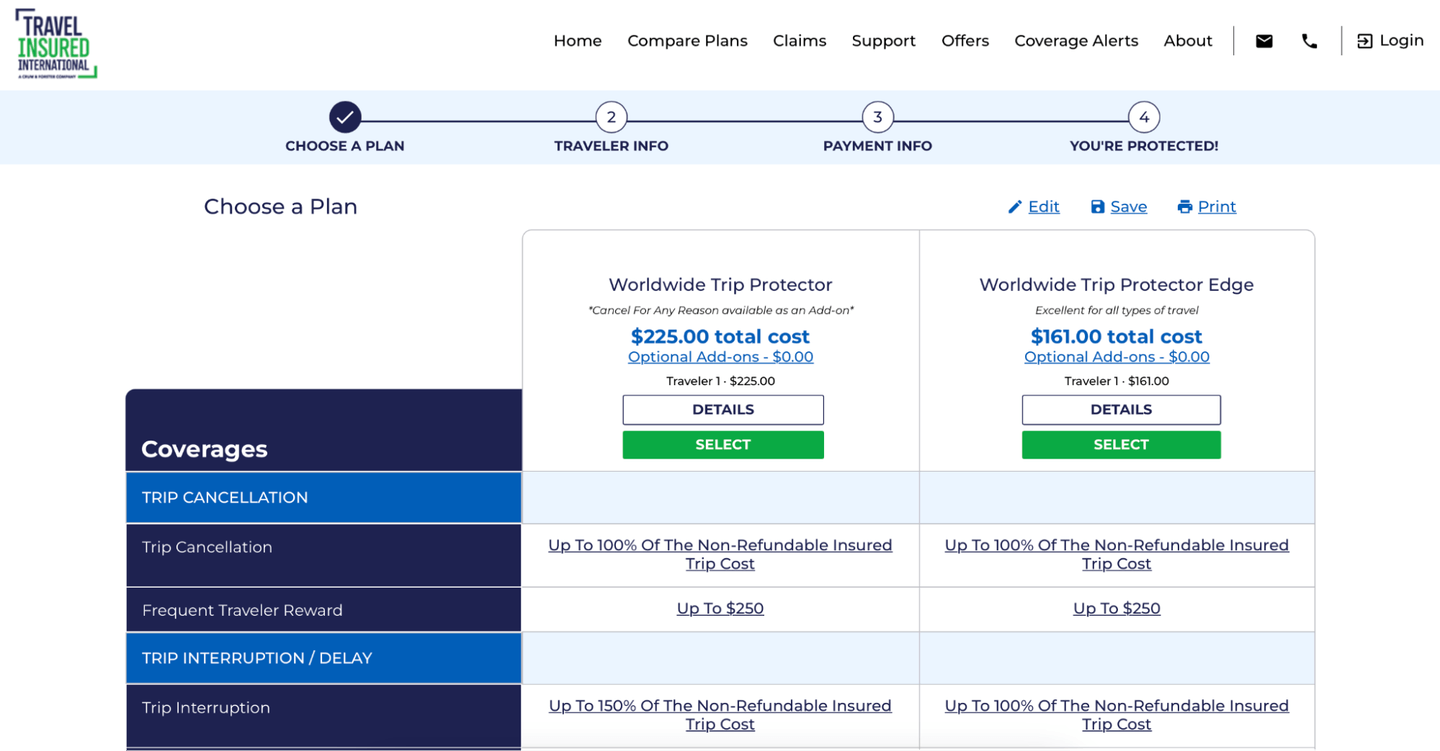

You’ll need to input your trip information, as well as your age and state of residence to get a quote. Travel Insured International will then show you the cost of each plan:

From there, you can select a plan and go through the checkout process. After you’ve paid, your coverage begins.

Consider comparison shopping

If you're not 100% sold on purchasing a plan from Travel Insured International, you can use a travel insurance aggregator to compare policies across multiple companies at once.

Which Travel Insured International travel insurance plan is best for me?

Selecting a Travel Insured International plan is easy since there are only two. You’ll simply need to decide whether you want higher coverage limits and the ability to add on more customizations or if you’d prefer the less expensive, but still comprehensive, plan.

Does Travel Insured International offer 24/7 travel assistance?

Yes, Travel Insured International offers 24/7 travel assistance. You can call:

- Within the U.S. and Canada: 800-494-9907.

- Abroad: 1-603-328-1707.

How to file a claim with Travel Insured International travel insurance

Filing a claim through Travel Insured International can be done online. To do so, you’ll want to navigate to Travel Insured International’s claim page. From here, you can submit your claim as well as view the status of any existing claims.

Is Travel Insured International travel insurance worth it?

Is Travel Insured International travel insurance good? It’s more expensive than many of its competitors, but a Travel Insured International policy does grant you the opportunity to customize your plan — and with benefits you don’t often see elsewhere. If this is valuable to you, a Travel Insured International plan could definitely be worth it for you.

Frequently Asked Questions

Does Travel Insured International cover flight cancellations?

If your flight is canceled by the airline, your Travel Insured International policy may cover you under the trip cancellation or trip interruption portion of your plan.

How long does a Travel Insured International refund take?

Travel Insured International doesn’t publish a schedule for how long a refund will take, but you can always view the status of your claims online via the claims portal.

Travel Insured International doesn’t publish a schedule for how long a refund will take, but you can always view the status of your claims online via the claims portal.

Is Travel Insured International travel insurance primary or secondary?

Travel Insured International’s insurance is primary.

Does Travel Insured International cover COVID-19?

Yes, Travel Insured International’s medical insurance plans include coverage for COVID-19.

Travel Insured International review recapped

If you’re heading on a major international vacation and you don’t have a premium travel credit card with sufficient limits, considering a Travel Insured International insurance policy could be a good bet.

The CFAR and IFAR options are solid benefits for those who want ultimate flexibility — especially since you can add coverages like these a la carte. If you’re looking for fewer benefits with lower limits, the Worldwide Trip Protector Edge is a good choice, while those wanting more customization options may want to consider the Worldwide Trip Protector plan.

Star rating methodology

Travel insurance rating and review methodology

Travel insurance

NerdWallet's ratings for travel insurance companies take into account the following details about each insurer:

- Scope of coverage.

- Customizability.

- Consumer experience and complaints.

- Cost.

The best travel insurers excel in all of these categories. They provide the information people need to make a purchase without any surprises along the way. They offer insurance at a fair price and allow customers to customize plans to meet their coverage preferences. They're also able to keep their customers happy throughout the relationship.

Data collection and review process

NerdWallet collects over a dozen data points for each insurer we analyze from their public-facing websites and third-party analyses. These data points are then compared against one another and against NerdWallet's standards for good travel insurance companies to determine a star rating.

Data is collected on a regular basis and reviewed by our editorial team for consistency and accuracy. Final star ratings are presented on a scale of one to five stars, where a one-star score represents "poor" and a five-star score represents "excellent."

The reviews team

The writers and editors behind NerdWallet's travel insurance reviews are insurance specialists who have had their work featured by or appear in The Associated Press, The Washington Post, The New York Times, the Chicago-Sun Times, U.S. News & World Report and the Society for Advancing Business Editing and Writing. Each writer and editor follows NerdWallet’s strict guidelines for editorial independence.

In addition to travel insurance, the team covers travel rewards programs, airlines and hotels.

Rating specifics

Our star ratings are weighted based on our editorial and professional opinions. We use the following weightings when rating travel insurers:

- Scope of coverage (25%).

- Customizability (25%).

- Consumer experience and complaints (25%).

- Cost (25%).

Scope of coverage ratings are based on assessments of a company’s standard protections, including:

- Travel medical insurance.

- Trip cancellation.

- Trip interruption.

- Trip delay.

- Baggage and personal belongings, lost luggage.

- Emergency medical assistance.

- Emergency medical evacuation.

- Emergency medical repatriation.

- Accidental death and dismemberment insurance.

- Rental car coverage.

Customizability ratings factor in whether coverage limits are fixed prices or a percentage of the trip cost (the percentage is generally better), whether a policy has customizations available, and the number of bonus features.

- 24-hour assistance.

- Pre-existing medical conditions coverage.

- Extreme sport coverage.

- CFAR add on availability.

- Travel health insurance.

- Interruption for Any Reason.

- Travel Inconvenience.

- Cancel for Work Reasons.

- Electronics coverage.

Consumer experience ratings are based on provider reviews on Squaremouth.com. If the company is not in the Squaremouth database, we default to Google reviews.

Affordability ratings are based on the percentage of total trip cost a plan costs a policyholder. Less than 4% is considered excellent, whereas over 9% is considered poor.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2026:

- Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

- No annual fee: Wells Fargo Autograph® Card

- Flat-rate travel rewards: Capital One Venture Rewards Credit Card

- Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

- Luxury perks: American Express Platinum Card®

- Business travelers: Ink Business Preferred® Credit Card

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Cards for Travel Insurance from our Partners

Chase Sapphire Reserve®

Rewards rate 1x-8x Points

Intro offer 125,000 Points

Chase Sapphire Preferred® Card

Rewards rate 1x-5x Points

Intro offer 75,000 Points

Southwest Rapid Rewards® Plus Credit Card

Rewards rate 1x-2x Points

Intro offer Companion Pass + 20,000 Points

More like this

Related articles