FICO Score 9: What You Need to Know

The FICO 9 credit scoring model includes rent payments, downplays medical debt and excludes paid collections.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

FICO Score 9 is the second-latest version of the well-known credit scoring model. It was released for lender use in 2014 and is taking its place alongside its predecessor, the widely used FICO 8.

All credit scores come from data in your credit reports, weighed according to proprietary formulas that calculate a score, typically on a 300-850 scale. Your credit score is designed to reflect the risk in lending you money, and the FICO Score 9 is a better predictor of that risk, says Tommy Lee, a senior director at FICO.

The two biggest providers of credit scores are FICO and VantageScore.

How the FICO Score 9 is different

- Medical debt. Health care-related debt has less of an impact on the score than other types of debt. About 15 million Americans have medical debt on their credit reports, according to the Consumer Financial Protection Bureau. FICO's latest scoring model gives that debt less weight than, say, credit card debt.

- Paid collections. Collections accounts that have been paid in full are disregarded in score calculations. (This is also true for FICO's newest versions — FICO 10 and FICO 10T.)

- Rent payments. If rent payments are reported, they are part of the score calculations. Before now, rent payments were added to credit reports but weren't used to calculate a FICO credit score (they were, however, used for VantageScore 3.0).

Stress less. Track more.

See the full picture: savings, debt, investments and more. Smarter money moves start in our app.

When will lenders use it?

The scoring company reported in 2023 that FICO 8 and FICO 9 are the most widely used models by all three of the major credit bureaus.

Where can I get FICO Score 9?

FICO Score 9 has been available to consumers since 2016. You can purchase it from FICO or possibly get it free from your credit card issuer, a lender or credit counselor through FICO’s Open Access program, which allows lenders and credit counselors to share scores used in lending decisions.

What it takes to get a good FICO score

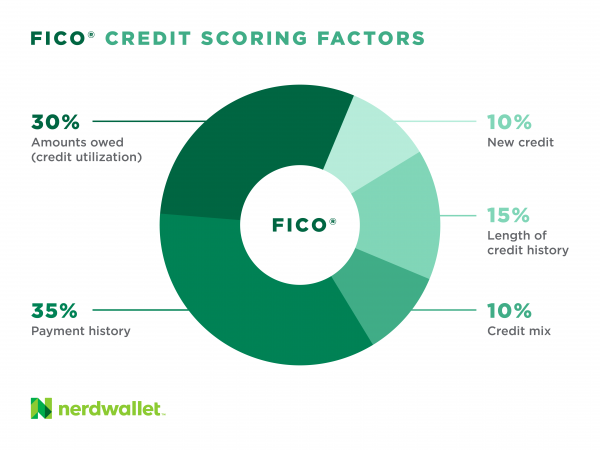

When you apply for credit, you don’t get to choose what credit score is used. But the way to get a good score is the same no matter which scoring model is used:

- Pay bills on time, every time. Late payments hurt your score, and the later they are, the worse the damage.

- Use credit lightly. Lower credit utilization can make a big difference in your score.

- Check your credit reports. You can dispute errors or negative information that’s too old to be reported and have it removed.

Other credit score factors, including how recently you’ve applied for credit, the mix of your credit accounts and how long you’ve had credit also affect your score. But if you consistently pay your bills on time and keep balances low, you’re likely to have a good score no matter what model is used.

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Related articles