1040 Form: What It Is, How to Fill One Out in 2026

Here's what you need to know about Form 1040: the mother of all tax forms.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

What is a 1040 form?

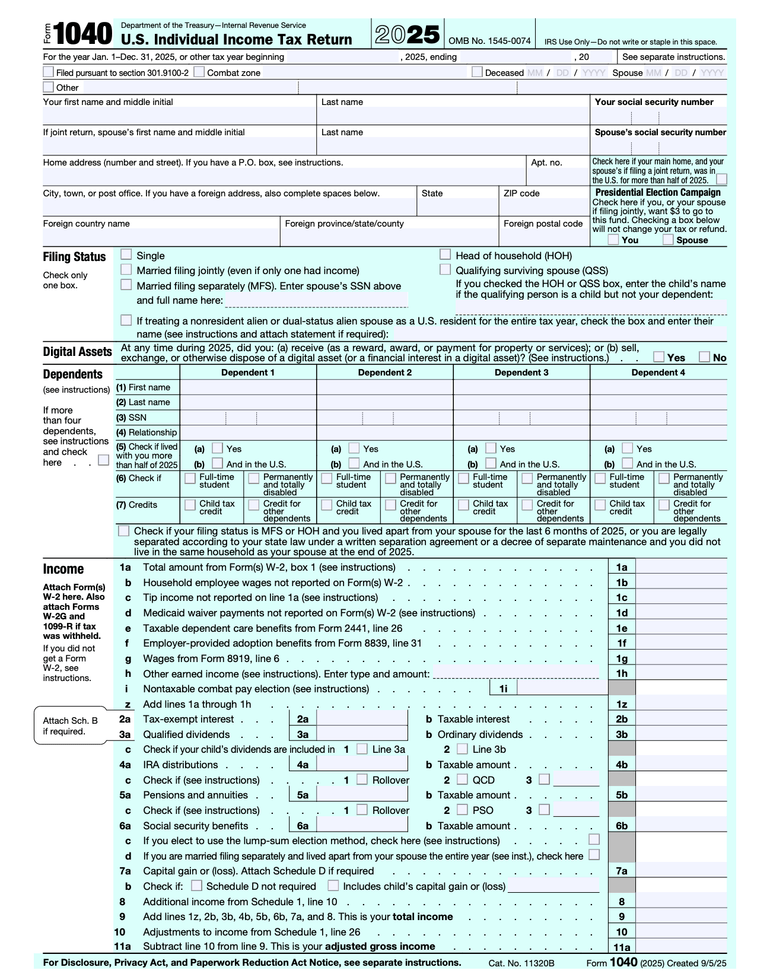

Form 1040, formally known as the “U.S. Individual Income Tax Return,” is the form people use to report income to the IRS, claim tax deductions and credits, and calculate their tax refund or bill for the year. The IRS releases a revised version of the form each year.

People who have a fairly simple tax filing situation may not need to file anything other than the standard Form 1040. But if you've got more things going on in your life, you may also need to get ahold of additional forms, called schedules, to submit alongside your Form 1040. Schedule A, for example, is a tax form familiar to those who itemize deductions on their tax return instead of taking the standard deduction.

» Need to back up? How income tax returns work

on Priority Tax Relief's website

on Alleviate Tax's website

Who needs to fill out a Form 1040?

Most U.S. citizens and permanent residents who work in the U.S. are required to file taxes.

However, you may not have to file a tax return if you're under a certain income threshold. The thresholds change annually based on:

Filing status.

Gross income.

Age.

Dependent status.

Self-employment status.

There are also other situations, such as owing taxes on an IRA or a health savings account, that may spell out a filing obligation.

And keep in mind that even if you don’t have to file taxes, you may want to think about turning in a Form 1040 anyway — skipping your return could mean losing out on a refund or other types of benefits.

» Not sure if you have to file a tax return? Our guide can help

How to fill out a 1040 form

If you're filing your return using tax software, you'll be asked to provide information that should then auto-populate Form 1040 (and any supporting schedules) behind the scenes. The software will then e-file it with the IRS, and you can print or download a copy for your records.

If you prefer to fill out your return yourself, you can download Form 1040 from the IRS website. The form can look complex, but it essentially does the following four things:

Asks who you are. The top of Form 1040 gathers basic information about who you are, what tax filing status you're going to use and how many tax dependents you have.

Calculates taxable income. Next, Form 1040 gets busy tallying all of your income for the year and all the deductions you'd like to claim. The objective is to calculate your taxable income, which is the amount of your income that's subject to income tax. You (or your tax preparer or tax software) consult the federal tax brackets to do that math.

Calculates your tax liability. Near the bottom of Form 1040, you'll write down how much income tax you're responsible for. At that point, you get to subtract any tax credits that you might qualify for, as well as any taxes you've already paid via withholding taxes on your paychecks during the year.

Determines whether you've already paid some or all of your tax bill. Form 1040 also helps you calculate whether those tax credits and withholding taxes cover the bill. If they don't, you may need to pay the rest when you file your Form 1040. If you've paid too much, you'll get a tax refund. (Form 1040 even has a spot for you to tell the IRS where to send your money.)

What do I need to fill out Form 1040?

You'll need a lot of information to do your taxes, but here are a few basic items that most people have to collect to get started:

Social Security numbers for you, your spouse and any dependents.

Statements of interest or 1099-DIV forms for dividends from banks or brokerages.

Proof of any tax credits or tax deductions.

A copy of your past tax return.

Your bank account number and routing number (for direct deposit of any refund).

» Getting ready to file? See our tax prep checklist

on Priority Tax Relief's website

on Alleviate Tax's website

Which Form 1040 schedules should I use?

Virtually everybody uses the regular Form 1040, but there are also three common schedules you may or may not have to tack onto it, depending on your tax situation and whether you want to claim certain deductions and credits. Some people may not have to file any of these schedules, while others may need to file more.

Schedule 1: Additional income and adjustments to income

File this if you had any of these:

Alimony income or payments.

Business income (you may also need to file a Schedule C).

Rental income (you may also need to file a Schedule E).

Farm income.

Unemployment income.

Educator expenses.

Deductible moving expenses.

Deductible health insurance expenses.

Schedule 2: Additional taxes

File this if you owe any of these:

Excess advance premium tax credit repayment.

Additional taxes on IRAs, retirement plans or other tax-favored accounts.

Household employment taxes.

Repayment of the first-time homebuyer credit.

Additional Medicare tax.

Schedule 3: Additional credits and payments

File this if you want to claim any of these:

Credit for child and dependent care expenses.

Retirement savings contributions credit (the saver’s credit).

Residential energy credit.

General business credit.

» Ready to crunch the numbers? Estimate your refund or bill with our tax calculator

Other types of 1040 tax forms

The standard Form 1040 is what most taxpayers need to fill out during tax time. However, there are a few other 1040 forms you may need to know about, including Form 1040-SR for seniors.

Form 1040-ES

Form 1040-ES can help freelancers or those who are self-employed calculate their estimated quarterly taxes. This form can also be used to estimate taxes on income that is not subject to withholding (e.g., dividends or interest). You'll likely also need to fill it out if you chose not to have taxes withheld on any unemployment or Social Security benefits you received.

Form 1040-NR

This form may need to be filled out by nonresident aliens who engaged in business or trade within the U.S., representatives of a trust and/or estate that is required to fill out a 1040-NR, or a representative of a deceased person who would have been obligated to fill out a 1040-NR.

Form 1040-SR

Form 1040-SR is a version of Form 1040 for people 65 and older. The basic differences between the 1040-SR and the regular 1040 tax form are cosmetic: The 1040-SR has a different color scheme, a larger font and an embedded standard deduction table (which may help more people over 65 claim their larger standard deduction).

Form 1040-V

If you end up owing the IRS on your return, you can choose to pay the balance by mail (rather than electronically), along with your return. But you'll need Form 1040-V, also called a "Payment Voucher," to do so. Most people choose to pay their tax bill online for convenience.

Form 1040-X

Form 1040-X is also commonly called an amended tax return. You'll need to fill out this form if you made a mistake, like forgetting to include an additional income, on your original return.