Is the Chase Sapphire Reserve Worth Its New Annual Fee?

New credits can help offset the $795 annual fee if you spend on luxury hotels, hip restaurants and event tickets.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

Since its release in 2016, the Chase Sapphire Reserve® has been a mainstay among the best travel rewards credit cards.

Almost nine years later, Chase has revamped the card, modifying existing benefits and adding a suite of new ones while raising the annual fee to $795. The new annual fee applies to cardholders who apply on or after June 23, 2025. Existing cardholders won’t see the new annual fee kick in until their next renewal on or after Oct. 26, 2025.

Even at that $795 cost, the Chase Sapphire Reserve® is worth considering if you can maximize its benefits. Here’s how to decide whether the card is a good fit for you.

Four benefits can justify the annual fee

The Chase Sapphire Reserve® now has the highest annual fee of any publicly available personal credit card, but it can still be justifiable depending on your travel and shopping tendencies. Here are four standout benefits that together make a compelling case for adding the card to your wallet.

1. The $300 annual travel credit

Chase touts this as “the most flexible travel credit available,” and for good reason. Unlike other travel credit cards, this credit does not require you to book travel through the issuer’s travel portal. Instead, the credit applies to a wide range of travel purchases, including flights, hotels, cruises, car rentals, bookings made with online travel agencies, and even public transportation like trains, buses, and ferries.

Chase’s annual $300 travel credit also posts automatically after qualifying transactions. The benefit is so effortless that I often find I’ve used it without realizing.

The only negative aspect is that points aren’t awarded for purchases offset by the credit.

2. The $500 annual hotel credit

Chase Sapphire Reserve® cardholders can now receive up to $500 of credit annually for stays of two nights or longer booked through Chase Travel℠ at over 1,100 properties in The Edit collection. These stays are eligible for daily breakfast for two, a $100 property credit, and room upgrades and late check-out (depending on availability).

The benefit is split into two semi-annual $250 credits: one for January to June and another for July to December. While cardholders can’t redeem all $500 on a single stay, those who already book luxury hotel rooms regularly should have no trouble using the full amount.

Two factors dampen my enthusiasm for this benefit. First, The Edit collection benefits are inferior to those offered by AmEx Fine Hotels and Resorts. The Edit only offers late checkout when available, whereas Fine Hotels and Resorts guarantees 4pm checkout. If you’re excited about luxury hotel perks, the American Express Platinum Card® may be a better fit. Terms apply.

Second, because the average nightly rate at most properties in The Edit collection exceeds $250, budget travelers may find using this benefit means spending more money, not less.

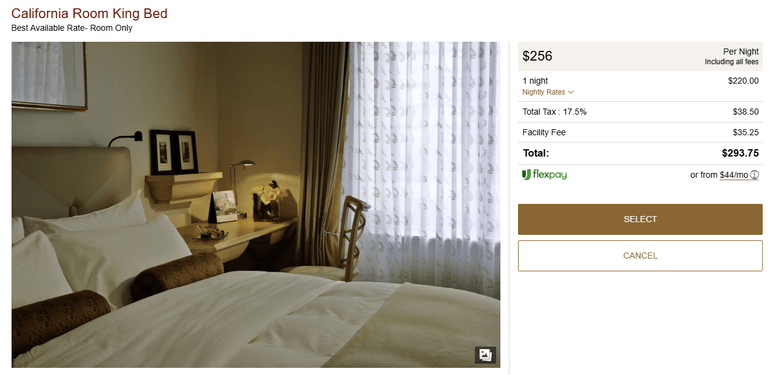

In my experience, Chase Travel℠ also doesn’t reliably offer competitive rates for hotel stays. For example, consider this one-night stay in November at the Taj Campton Place in San Francisco. Booking directly through the hotel, the rate for a California Room with a king bed is $293.75.

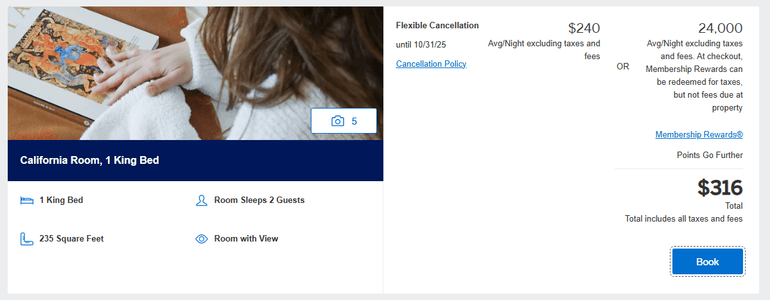

AmEx Travel lists a higher rate of $316, but I’d be inclined to pay it given that this reservation also includes breakfast for two, a $100 food and beverage credit and other Fine Hotels and Resorts benefits.

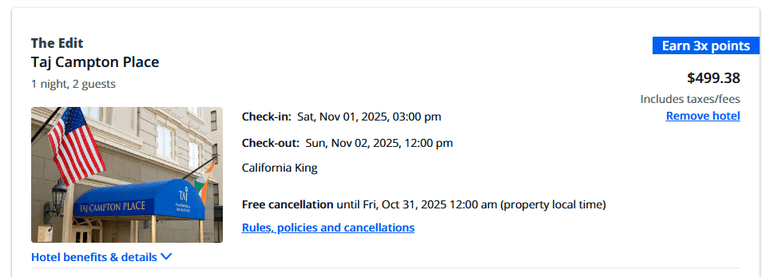

In contrast, Chase Travel℠ offers the same room for nearly $500, which effectively wipes out any value added by The Edit benefits. This is an extreme example, but such pricing disparities are unfortunately common in my experience.

You won’t get full value from the $500 credit if you’re overpaying or sacrificing superior benefits to use it, so be selective about when and where you book eligible stays.

3. The $300 annual dining credit

Another new benefit is a $300 annual dining credit at Sapphire Reserve Exclusive Tables, which is a curated list of OpenTable restaurants in a few dozen North American cities. The selection is modest in some locations — the list includes only six restaurants in Seattle and one in San Antonio — but cardholders who live in or regularly visit destinations with participating restaurants will have opportunities to redeem the credit.

Booking through OpenTable doesn’t affect the price you pay at the restaurant, so unlike the hotel credit above, you don’t run the risk of being overcharged for using this benefit.

Still, the limited selection means the dining credit shouldn’t be taken at face value, especially if you live outside of Sapphire Reserve’s selection of cities. This credit also comes as two separate credits — $150 in each half of the calendar year — so cardholders will have to dine out two separate times to get the maximum benefit.

4. $300 annual StubHub credit

This benefit offers Chase Sapphire Reserve® cardholders up to $300 of StubHub credit each year, split into two semi-annual credits of up to $150. StubHub sells tickets to a wide range of music, theater and sporting events, so redemption options are abundant.

When StubHub prices are competitive with other ticket sellers, this benefit is worth close to face value.

Additional benefits that are likely to add value

If you value the annual travel credit at $300 and assume you’ll use the other three credits for The Edit hotels, Sapphire Reserve Exclusive Tables and StubHub once per year, then those four benefits are worth $850. That’s enough to offset the Chase Sapphire Reserve® ’s $795 annual fee, but the case for holding the card is stronger if you can further maximize those credits or get value from these other Chase Sapphire Reserve® benefits.

Travel protections

The Chase Sapphire Reserve® offers a comprehensive set of travel protections that includes primary rental car insurance, trip cancellation and interruption insurance, compensation for lost or damaged bags, and more.

You can find similar benefits on other credit cards with lower annual fees, and it’s hard to pinpoint the value of benefits you hope to never use, but these protections have high upside for frequent travelers.

Lounge access

Chase Sapphire Reserve® cardholders (and up to two guests) get complimentary entry to the small but growing network of Chase Sapphire lounges, as well as Priority Pass lounges and select Air Canada Maple Leaf lounges.

The Chase Sapphire lounges are exquisite, but they serve only a handful of airports, so the value of access depends greatly on your travel patterns. Priority Pass lounges are less enticing but more widespread, so membership is handy if your travels routinely involve down time at the airport.

Complimentary Apple subscriptions

This new benefit provides up to $250 in annual value through complimentary subscriptions to Apple TV+ and Apple Music. If you already pay for these subscriptions, then this benefit provides easy savings. Otherwise, you may get some value out of being able to try them at no cost without relying on a standard free trial.

Lyft credits

Chase Sapphire Reserve® cardholders continue to receive Lyft credits worth up to $120 annually. Credits are issued in monthly $10 increments, and apply automatically to eligible in-app purchases after enrollment.

Expedited airport security enrollment credit

The Chase Sapphire Reserve® also continues to offer a credit of up to $120 every four years to cover the cost of Global Entry, TSA PreCheck, or Nexus enrollment. This perk may be useful even if you’re already enrolled in one of these expedited security programs, since the credit can be used to pay for someone else to apply.

Points earning rates

The Chase Sapphire Reserve® offers several travel-related rewards bonus categories:

- 8x points on all Chase Travel℠ purchases.

- 4x points on flights and hotels booked direct.

- 5x points on eligible Lyft rides.

When Chase Travel℠ offers competitive prices, the ability to earn 8 points per dollar provides an excellent return. Chase Ultimate Rewards® points can be worth 2.1 cents apiece or more in NerdWallet’s valuations if you transfer the points to a transfer partner for a high-value redemption. By that metric, the 8x category yields a return of 16.8% for eligible Chase Travel℠ purchases.

When booking airfare and hotels directly is cheaper, you can still earn a solid return of 8.4%.

Additional perks

These Chase Sapphire Reserve® benefits are less broadly useful than those above, but may add circumstantial value.

- Monthly DoorDash promotions worth up to $25.

- Complimentary annual DashPass membership.

- Up to $120 in statement credits annually toward Peloton memberships.

- Complimentary IHG One Rewards Platinum Elite Status.

- Complimentary access to Reserve Travel Designers offering end-to-end travel planning.

Who should get the Chase Sapphire Reserve®?

The value of the Chase Sapphire Reserve® card depends on how you use it, but it’s likely worth the annual fee if:

- You travel regularly, and not always frugally.

- You’re likely to use the hotel, dining and StubHub credits.

- Sapphire Reserve complements rather than competes with your other credit cards (the benefits aren’t redundant).

If none of those conditions are true, then another travel rewards card will better suit your needs. If only some of them are true or you’re not sure, try estimating the value you’ll personally get from each benefit based on your own travel and spending patterns. Comparing that estimated value to the annual fee will tell you whether Sapphire Reserve is a good fit.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2026:

- Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

- No annual fee: Wells Fargo Autograph® Card

- Flat-rate travel rewards: Capital One Venture Rewards Credit Card

- Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

- Luxury perks: American Express Platinum Card®

- Business travelers: Ink Business Preferred® Credit Card

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Limited Time Only: Earn $1,000 Toward Travel!

Capital One Venture Rewards Credit Card

Travel

For a limited time, the

Capital One Venture Rewards Credit Card is offering new cardholders an especially rich bonus: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel!

More like this

Related articles