No Credit Score Doesn’t Mean a Zero Credit Score

If you have no credit history, you have no credit score — but not a zero credit score.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

The most frustrating thing about credit might be the chicken-and-egg problem of establishing it: Nobody wants to give you credit when you don’t have a track record of using credit.

But if you’ve never had credit and don’t have a credit score, that doesn’t mean you have a zero credit score. You have the absence of a score: You’re “credit invisible.”

Why you don’t have a credit score

No one has a credit score of zero, no matter how badly they have mishandled credit in the past.

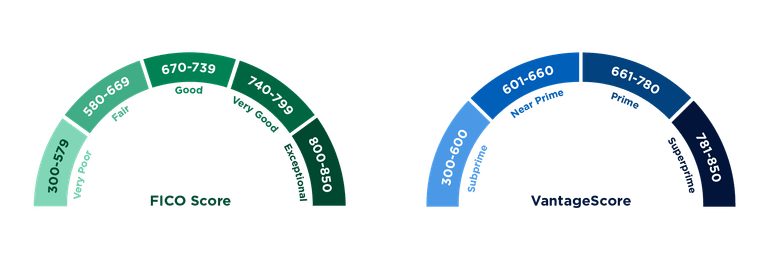

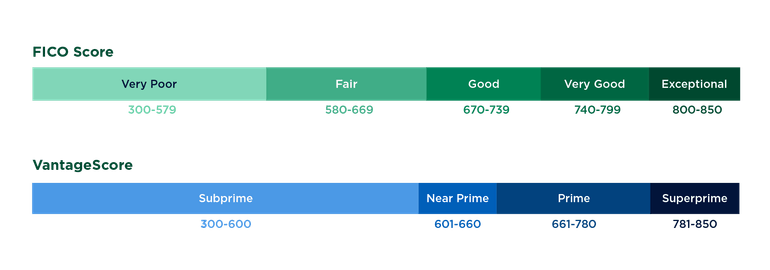

The most widely used credit scores, FICO and VantageScore, are on a range from 300 to 850.

Tommy Lee, a senior director at FICO, said scores of 300 are "extremely rare."

Reasons you might not have a score are:

- You’ve never been listed on a credit account.

- You haven’t used credit in at least six months.

- You have only recently applied for credit or been added to an account.

What’s the starting point for your score?

Just as being new to credit doesn’t mean you start at zero, it also doesn’t mean you begin in the basement at 300. After all, if you’ve never had credit, you’ve never made score-devastating mistakes.

When you have no credit history, the credit bureaus just don’t know enough about you to guess whether you’ll pay back borrowed money. And that’s all a credit score is — an estimate of the likelihood you’ll pay back the next credit you’re granted, based on the data in your credit reports.

Once you begin using credit, scores can be calculated. You likely won't start with a good credit score but you won’t be at the bottom of the scale, either.

How to get credit in the first place

To introduce yourself to the credit bureaus and develop a credit history, you should apply for credit. Two products designed specifically for helping build credit are:

- Secured credit cards. These credit cards, as their name suggests, are secured with cash. The deposit is typically the credit limit.

- Credit-builder loans. These are loans that are released to you only after you have made the payments. They can be a good way to build a payment history and to accumulate a small emergency fund at the end of a loan term.

Before you apply, request a free credit report from each of the three credit reporting agencies by using AnnualCreditReport.com. If you’ve never had credit but do have a file, that’s a red flag: Maybe someone else’s information has been mixed up with yours or someone is using your identity to get credit. Dispute credit report errors to get them cleaned up.

Once you’re approved for your first lines of credit, follow these basic rules:

- Pay bills on time, every time. Payment history influences your scores the most.

- Use only a small portion of your credit limit. Keep your balances at less than 30% of your limit, and the lower the better.

- Aim for a mix of account types — for example, installment loans with regular payments, such as an auto loan, and revolving debt, such as credit cards.

Follow these steps and you’ll fatten up your credit reports in short order. You’ll also have built a credit score that gets you lower interest rates and access to better credit products — an unsecured credit card or one that offers rewards, for example.

Don’t focus too much on the numbers

You know what credit experts say about credit scores? Don’t get too hung up on the numbers. Your credit score gets recalculated on demand, whether it’s requested 10 minutes or 10 months after the last time somebody asked, and it accounts for the most recent additions to your credit reports.

Rod Griffin, senior director of public education at Experian, one of the three major credit bureaus, says that you should focus instead on your “general risk” category. Each lender can set its own parameters, but generally, the range for credit scores looks like this:

Stress less. Track more.

See the full picture: savings, debt, investments and more. Smarter money moves start in our app.

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Related articles