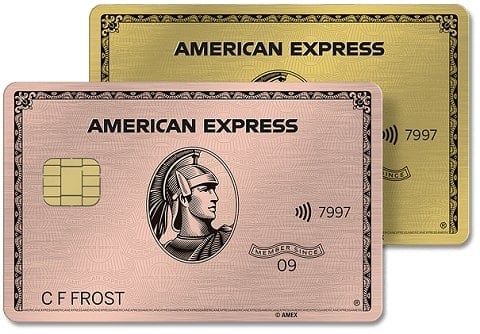

Delta Gold vs. AmEx Gold: AmEx Gold Boasts More Glitter

It’s hard to top the American Express Gold Card’s flexibility and high rewards rate for dining and groceries.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

They’re both gold and they’re both American Express cards, but these two contenders head in different directions when it comes to their benefits. Like other airline credit cards, the Delta SkyMiles® Gold American Express Card has more to offer for frequent Delta fliers.

The American Express® Gold Card, on the other hand, is a better fit for anyone looking for more flexibility, since it earns AmEx Membership Rewards. Plus, you’ll earn a higher rewards rate at grocery stores and restaurants, two popular categories that you’ll definitely spend money in (you have to eat, after all).

Both cards charge somewhat steep annual fees, which can chip away at the value you’d get. But unless you’re Delta-loyal, the American Express® Gold Card comes out ahead.

on American Express' website

on American Express' website

$325.

$0 intro for the first year, then $150.

You may be eligible for as high as 100,000 Membership Rewards® Points after you spend $6,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you’re approved and find out your exact welcome offer amount – all with no credit score impact. If you’re approved and choose to accept the Card, your score may be impacted.

Earn 70,000 Bonus Miles after you spend $3,000 in purchases with your new Card, and an additional 20,000 bonus miles after you make an additional $2,000 in purchases on the Card, both within your first 6 months. Ends 04/01/2026. Terms Apply.

4 points per $1 at restaurants worldwide (plus takeout and delivery in the U.S.) on up to $50,000 in purchases per year.

4 points per $1 at U.S. supermarkets on up to $25,000 in purchases per year.

3 points per $1 on flights booked directly with airlines or on amextravel.com.

1 point per $1 on all other eligible purchases.

Terms apply.

2 miles per $1 on restaurants (plus takeout and delivery in the U.S.)

2 miles per $1 at U.S. supermarkets.

2 miles per $1 on Delta purchases.

1 mile per $1 on other purchases.

Terms apply.

None.

None.

The $325 annual fee on the American Express® Gold Card is enough to give anyone pause but if food is a major portion of your budget and you use the card’s other perks, you can offset that cost. The card’s generous welcome bonus helps, too.

Why the American Express® Gold Card is better for most people

Generous rewards

In addition to the welcome offer, here’s what you’ll earn on an ongoing basis:

4 points per $1 at restaurants worldwide (plus takeout and delivery in the U.S.) on up to $50,000 in purchases per year.

4 points per $1 at U.S. supermarkets on up to $25,000 in purchases per year.

3 points per $1 on flights booked directly with airlines or on amextravel.com.

1 point per $1 on all other eligible purchases.

Terms apply.

Valuable redemptions, even on Delta

The American Express® Gold Card earns rewards in the form of AmEx Membership Rewards points. Redeem them for travel, a statement credit, buying gifts cards or using points at checkout with participating merchants. That flexibility alone sets the American Express® Gold Card apart. But even if you're planning on using all your rewards on Delta purchases, the American Express® Gold Card could still be a better option than the Delta SkyMiles® Gold American Express Card.

You'll usually get the most value out of your points by redeeming them towards travel purchases, specifically transferring them to one of AmEx's transfer partners, which includes Delta. Every point you transfer will be worth one Delta mile. So the American Express® Gold Card could earn you 4 Delta miles on grocery store purchases and restaurants, compared to the Delta SkyMiles® Gold American Express Card's 2 miles. It's important to note that you will have to pay a $.0006 fee for each point you transfer to a U.S.-based airline (up to $99).

Statement credits

The American Express® Gold Card offers several statement credits with specific merchants:

Up to $120 per year (up to $10 per month) at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, and Five Guys (enrollment required).

Up to $120 per year (up to $10 per month) in Uber Cash, which you can use for Uber Eats orders or Uber rides in the U.S. Your AmEx card must be selected as the payment method for your Uber or Uber Eats transaction to redeem the Amex Uber Cash benefit.

Up to $100 per year ($50 semi-annually) in annual statement credits after enrolling and using your card on eligible purchases at U.S. restaurants on the Resy app or Resy.com.

Up to $7 per month ($84 annually) in statement credits after enrolling and using your card at Dunkin' Donuts locations in the U.S.

Terms apply.

Who might prefer the Delta SkyMiles® Gold American Express Card?

The Delta SkyMiles® Gold American Express Card charges an annual fee — $0 intro for the first year, then $150 — which is also on the pricey side for a card in its class. (Competing cards from other airlines tend to charge just under $100 per year.) But the card does offer some compelling perks for Delta fliers, such as a generous checked-bag benefit, various discounts and credits, not to mention a solid welcome bonus. Terms apply.

For the annual cost, however, the card lacks other benefits you see with other general travel cards at this price point, including airport lounge access and statement credits toward TSA PreCheck or Global Entry.

Travel perks

If you're more interested in getting perks while flying with Delta than earning rewards for your spending, then the Delta SkyMiles® Gold American Express Card is a better choice. It offers:

A free checked bag for up to nine passengers on the same reservation. This normally would cost $35 per passenger each way for the first checked bag. A family of four flying round trip will save $280, more than offsetting the annual fee.

A $200 Delta flight credit after you spend $10,000 in a calendar year.

An up to $100 credit when you book prepaid hotels or vacation rentals through Delta’s travel portal, Delta Stays.

15% off when booking award travel on delta.com or the Fly Delta app.

20% off in-flight food and beverage purchases.

Terms apply.

Which card should you get?

If you fly Delta multiple times per year and check bags, you’ll get value out of the Delta SkyMiles® Gold American Express Card. But the American Express® Gold Card is the winner in terms of the value of your earned rewards points. Plus you get much more flexibility when you redeem those points, making it a better fit for anyone who isn’t loyal to one specific airline.

Capital One Venture Rewards Credit Card

Travel

For a limited time, the Capital One Venture Rewards Credit Card is offering new cardholders an especially rich bonus: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel!

Find the right credit card for you.

Whether you want to pay less interest or earn more rewards, the right card's out there. Just answer a few questions and we'll narrow the search for you.