Travel Rewards Can Take You Far — but Only If You Pay Attention

Although many Americans overestimate the value of credit card travel rewards, a penny per point is still valuable.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

More than one-third of Americans (35%) carry a credit card that gives them travel rewards for spending, but almost half (44%) overestimate the value of those rewards, thinking a point or mile is worth 5 cents or more, according to a recent NerdWallet study. Points and miles are actually worth around 1 cent each, on average. But they’re still highly valuable — if you use them effectively.

Reward redemption options aren’t created equal

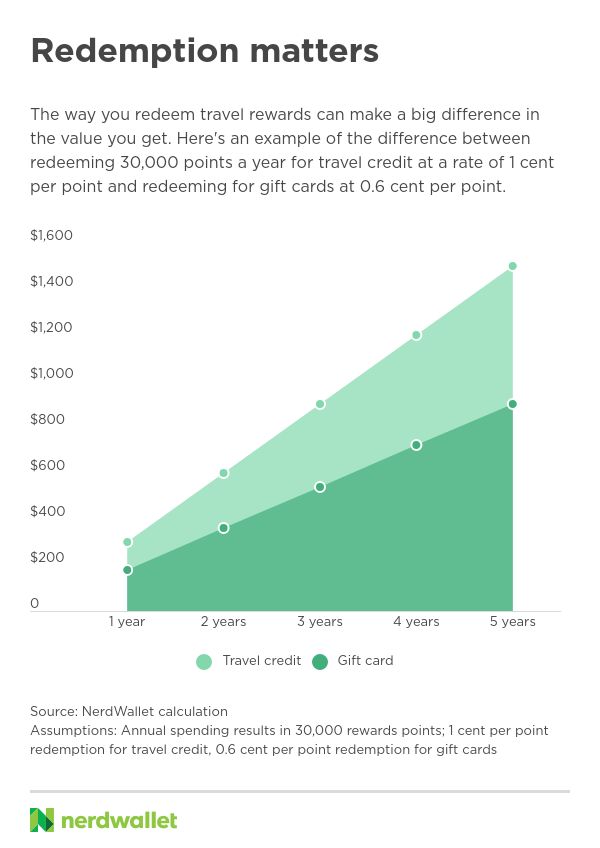

A point is a point is a point … or is it? While some travel credit cards have a single redemption option — such as credit against travel purchases — others offer multiple options, but they may not all provide the same value. For example, a travel card might let you redeem rewards for travel at 1 cent per point. That same card may also offer you a gift card redemption option at 0.6 cent per point.

A difference of four-tenths of a cent in value may not seem meaningful, but it adds up quickly when you’re redeeming thousands of points. Say your annual spending earns you 30,000 points per year. The difference between using the travel redemption option and the gift card redemption option in this scenario would be $120 per year, or $600 over the course of 5 years.

Think twice before saving up your rewards

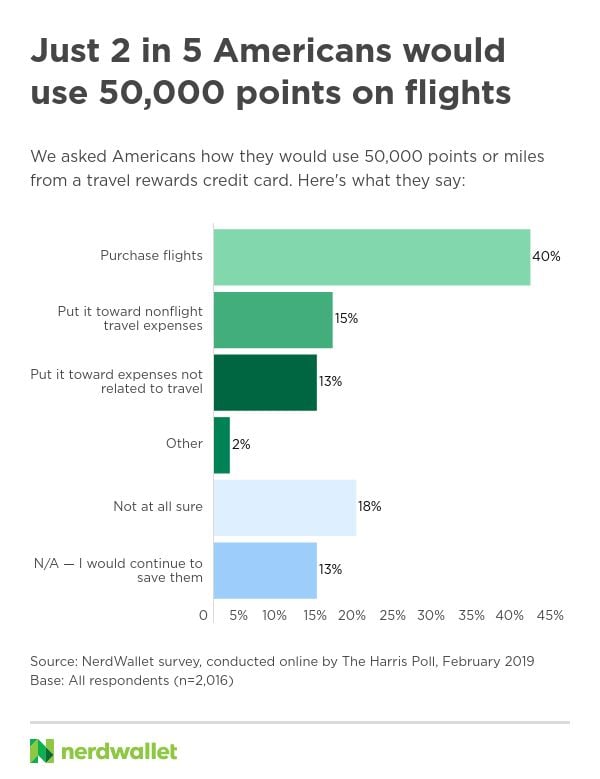

When asked what they would do if they accumulated 50,000 travel rewards points or miles, just over half of Americans (55%) said they’d use them for flights or nonflight travel expenses. However, about 1 in 8 (13%) say they’d continue to save them. That could be a big mistake.

The value of a travel point isn't static. Three major ways points can lose value are through devaluation, expiration and inflation.

Devaluation is common in the frequent flyer world. When a program increases the number of points you need to redeem for free travel, the value of each individual point goes down.

Expiration policies vary by issuer, but after a certain amount of time — or even if you don’t use your card for a while — some or all of your rewards could expire.

Inflation is inevitable, even if your points never expire and aren't devalued. As time goes on, today’s dollar becomes less valuable, dragging the value of a point down with it.

Don’t assume your rewards will hold their value. Save up enough to cover your next trip, then book it.

Other ways to go farther with your travel rewards card

Pick the right card for you. Getting good value out of a credit card starts with choosing the card that works best for you. This means evaluating the rewards, benefits and costs based on how much you spend and what you spend it on, the perks that you’ll actually use, and your tolerance for fees. The ideal card for you as a consumer isn’t necessarily the flashiest option. It’s the one that best suits your lifestyle.

Earn the sign-up bonus. Many rewards credit cards — particularly travel cards — have sizable sign-up bonuses, a pile of points you earn all at once for spending a certain amount in a specified period of time. If you choose a card with a sign-up bonus, know how much you’ll need to spend and when you’ll need to do it by. However, don’t spend more than you can afford just to earn a bonus. Before applying for a card, assess whether the spending requirement for the bonus is realistic.

Avoid interest. It may be tempting to spend more than you otherwise would to rack up rewards, but you can’t win that game. Credit card debt is one of the most expensive types of debt, and interest will quickly outweigh any rewards you earn on your spending. Limit your charges to what you can afford to pay off by the due date.

Earning and redeeming travel rewards doesn’t have to be complicated. But knowing what you have and what it’s worth will take you farther.

Find the right credit card for you.

Whether you want to pay less interest or earn more rewards, the right card's out there. Just answer a few questions and we'll narrow the search for you.