What Is Diversification? How It Works, Benefits

Diversification is the act of spreading investment dollars across a range of assets to reduce investment risk.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet, Inc. does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

Diversification is the simplest way to boost your investment returns while reducing risk. By choosing not to put all of your eggs in one basket, you protect your portfolio from market volatility.

Diversification may look different for each investor, however. How much risk you're willing to weather and how long you plan to invest are just two factors that affect your strategy.

Luckily, there are plenty of tools available that make it easy to diversify your investment accounts.

Diversification definition

Diversification is a common investment strategy that entails buying different types of investments to reduce the risk of market volatility. It's part of what’s called asset allocation, meaning how much of a portfolio is invested in various asset classes.

Three of the most common asset classes are stocks, bonds and cash (or cash equivalents). To achieve diversification, investors will blend dissimilar assets together (like stocks and bonds) so that their portfolio does not have too much exposure to one individual asset class or market sector.

Investors have many investment options, each with its own advantages and disadvantages. Some of the most common ways to diversify your portfolio include diversification by asset class, within asset classes and beyond asset class.

» Want easy and automated diversification? Learn about investing through robo-advisors.

Diversification example

Say you invested all of your money only in Apple stock (AAPL). Apple is a technology company, so this would mean that your asset allocation would be 100% equity (or stock) all in the technology sector of the market. This is a risky approach because if Apple stock prices were to slump due to unforeseen circumstances, your whole investment portfolio would suffer the consequences. You might diversify within the technology sector by investing in other tech stocks, but if the whole technology sector is negatively impacted, your portfolio would still take a big hit.

To appropriately diversify a portfolio, you’ll need to include stocks from many different sectors. Even still, you may also want to include bonds or other fixed-income securities to protect against a dip in the stock market as a whole.

The benefits of diversification

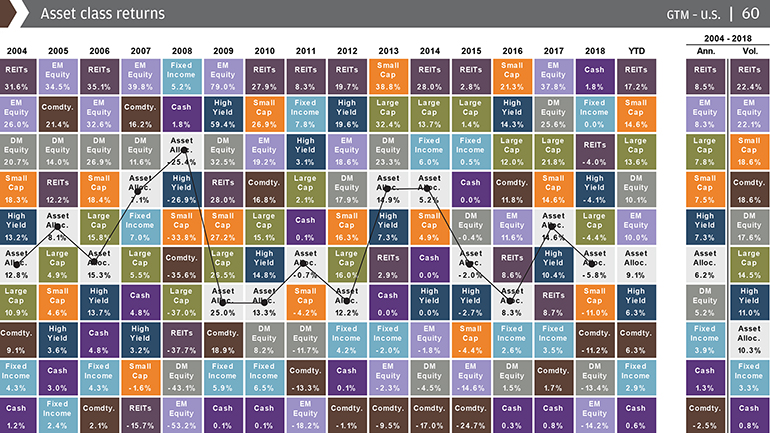

Portfolio diversification reduces overall risk while increasing the potential for overall return. That’s because some assets will perform well while others do poorly. But next year their positions could be reversed, with those that once lagged behind becoming the new winners.

Over short-term periods that return can vary widely. However, a well-diversified portfolio tends to earn the market’s average long-term historic return. Owning a variety of assets minimizes the chances of any one asset hurting your portfolio. The trade-off is that you never fully capture the startling gains of a shooting star. The net effect of diversification is slow and steady performance and smoother returns, never moving up or down too quickly. That reduced volatility puts many investors at ease.

Diversification by asset class

The three main general asset classes in an investment portfolio are stocks, bonds and cash.

Stocks (or equities) allow investors to own a piece of a company. Stocks offer the highest long-term gains but are volatile, especially in a cooling economy.

Bonds (or fixed income) pay interest to investors who lend money to a company or government. Bonds are income generators with modest returns but are usually weaker during an expanding economy. Generally, bonds have an inverse relationship with stocks.

Cash (or cash equivalents) is the money in your savings account, pocket or hidden under your pillow. In terms of risk and return, cash is low on both counts. Cash can buffer volatility or unexpected expenses and acts as “dry gunpowder” to invest during opportune times.

cious metals), and alternative investments, such as cryptocurrency. These asset classes usually have a lower correlation to the stock market and can, as such, be effective in aiding diversification.

» Want to see a list of potential investments? Here are the best investments for any age or income.

Diversification within assets

Investors can break these categories down further by factors such as industry, company size, creditworthiness, geography, investing strategy, bond issuer and style.

Diversification within stocks

Industry or sector

The economic cycle affects each business and respective stock differently. As a result, intermingling companies operating in all kinds of industries is another way to reduce market risk. Some sectors are considered cyclical, where a company’s fortune moves in sync with the economic cycle.

Examples include consumer discretionary (clothing, electronics, cars, etc.), financial services, basic materials and real estate, where demand grows as the economy gets stronger. Some sectors are considered defensive, where the company’s business is less impacted by the economic cycle. Examples include consumer staples (groceries, tobacco, etc.), utilities, and health care — necessities that tend to be consumed at all times.

Size or market capitalization

Market cap is just a fancy way of saying "How big is this company?" Market cap is defined by the total value of a company's tradable stock (number of outstanding shares x price per share). Larger companies tend to be more stable and can weather economic downturns more easily, but they also tend to have less growth potential versus their smaller counterparts.

Style (growth vs. value)

Growth stocks are often expensive, but investors believe prices are justified due to high future growth potential. Value stocks are companies whose stocks are “on sale” or seem underpriced or undervalued.

» Learn more: How to buy stocks

Diversification within bonds

Credit quality

Bonds offer different levels of creditworthiness or safety, which corresponds with the bond’s level of return. For instance, Treasurys are considered practically risk-free since it’s unlikely the federal government will go bankrupt, which explains their relatively lower rate of return.

Maturity

Longer-term bonds receive higher returns because they are subject to more interest rate risk.

Type of issuer

Integrating bonds from various issuers can provide another level of diversification. Bond issuers include the U.S. government (such as Treasurys), municipalities, corporations and more.

» Learn more: How to buy bonds

Diversification within stocks and bonds

Geography

Countries have varied economic cycles so it makes sense to have exposure to both domestic and international markets. International or foreign markets are further classified as developed markets and emerging markets. Developed markets (European nations, Australia, Japan, Singapore, etc.) tend to have more stability, whereas emerging markets (Brazil, Russia, India, China, etc.) tend to be more volatile but have higher growth potential.

Active vs. passive

Many securities can be purchased through mutual funds, index funds or exchange-traded funds (ETFs). In active funds, a portfolio manager picks which stocks to include in the fund. This differs from passive index funds or ETFs, which mimic an underlying index and cost less. Passive funds often can outperform active funds during market upswings, but active funds can have better downside protection during market downturns.

Diversification beyond asset class

Diversification can extend beyond traditional asset classes found in typical investment accounts. Investment accounts have non-guaranteed returns since they are subject to market fluctuation. However, product types such as pensions, annuities and insurance can provide guaranteed income streams and returns. For reduced risk, investors often diversify their portfolio by spreading their investment dollars among these different product types as well.

Reducing risk through diversification

While diversification is an easy way to reduce risk in your portfolio, it can’t eliminate risk altogether. Investments still have two broad types of risk:

Market risk (systematic risk): These risks come with owning any asset — yes, even cash. The market may become less valuable for all assets for many reasons, such as a change in interest rates or war.

Asset-specific risks (unsystematic risk): These risks come from the investments or companies themselves. Such risks include the success of a company’s products, the management’s performance and the stock’s price.

You can radically reduce asset-specific risk by diversifying your investments. However, there’s just no way to get rid of market risk via diversification. It’s a fact of investing.

You won’t get the benefits of diversification by stuffing your portfolio full of companies in one industry or market — this can create higher risk. The companies within an industry have similar risks, so a portfolio needs a broad swath of industries. Remember, to reduce company-specific risk, portfolios have to vary by company industry, size and geography.

Other options include target-date funds, which manage asset allocation and diversification for you. You set your retirement year, and the fund manager does the rest, typically shifting assets from more volatile stocks to less volatile bonds as you approach retirement. These funds tend to be more expensive than basic ETFs because of the manager’s fees, but they can offer value for investors who really want to avoid managing a portfolio at all.

With these options, you can achieve the benefits of diversification relatively simply and affordably.

» Learn more: How to invest your IRA

How to diversify your portfolio

Creating a diversification strategy for your portfolio may sound difficult, especially if you don’t have the time, skill or desire to research individual stocks or investigate whether a company’s bonds are worth owning. Most securities can be purchased individually or in a collection, such as through a mutual fund, an index fund or an ETF.

For example, simple, low-cost, "set it and forget it" ETFs or mutual funds — especially index funds and target-date funds — can get a portfolio diversified quickly and safely while reducing risk. Robo-advisors are another option that can help with portfolio diversification.

Here's a diversified portfolio example that shows how diversification might look in your own portfolio.

A commonly used option for passive investors is an ETF or a mutual fund based on the S&P 500 index, a broadly diversified stock index of 500 large, industry-leading American companies. It’s diversified by industry and even though the companies are based in the U.S., a significant portion of their sales is generated overseas. Investing in the S&P 500 is an example of how you can gain benefits of immediate diversification with just one fund.

The downside: Such funds are concentrated in stocks. To gain wider diversification, you may want to add bonds to your portfolio. Plenty of diversified bond ETFs exist, and they could help balance out the volatility of a stock-heavy portfolio.

Virtually all large investment companies offer some index and bond funds, and they’re readily available for individual retirement accounts and 401(k) plans.