How Much Does a Home Warranty Cost?

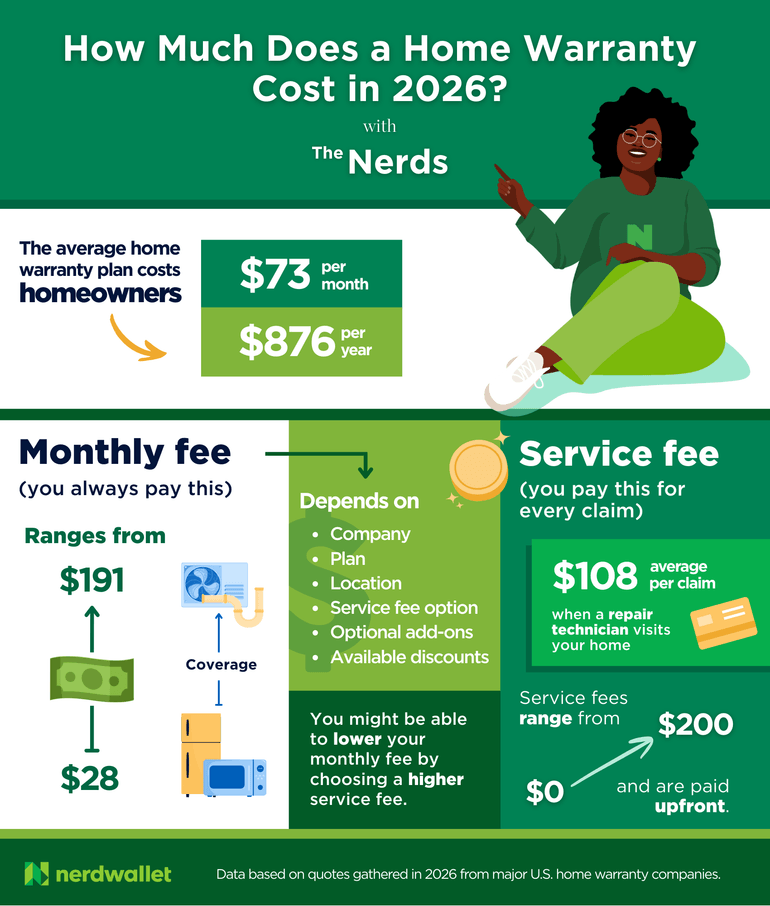

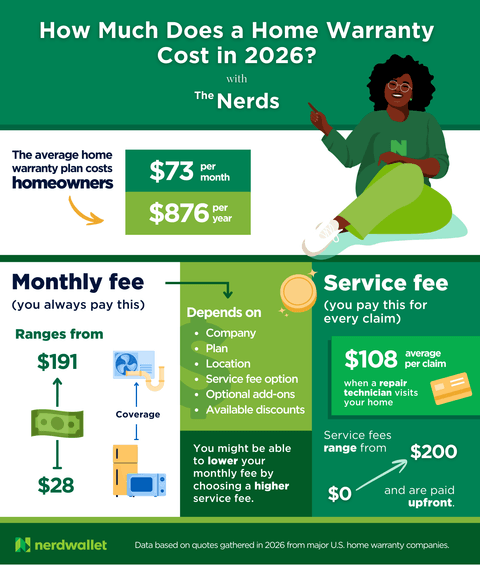

You’ll pay $73 per month on average. You might pay more for a better plan, but discounts and holiday sales could save you money.

Some or all of the mortgage lenders featured on our site are advertising partners of NerdWallet, but this does not influence our evaluations, lender star ratings or the order in which lenders are listed on the page. Our opinions are our own. Here is a list of our partners.

A home warranty costs $73 a month on average in 2026, but the price of a plan can range from as low as $28 to as high as $191 per month, according to NerdWallet’s analysis. Service fees can add to the cost, averaging $108.45 per service call.

How much you’ll actually pay for home warranty coverage depends on several factors, including your location, the company you go with and the plan you choose. Here’s a breakdown of what fees to expect when using a home warranty and how much you might have to pay.

TL;DR? Check out an infographic of this article

Home warranty costs

A homeowner warranty plan usually comes with a monthly fee and several potential fees.

Monthly fees. You’ll pay a monthly or annual fee regardless of how often you do (or don’t) use your plan. This cost is the easiest to budget for because you’ll pay the same fee throughout the term of your service agreement.

Service fees. Most home warranty companies require customers to pay a service fee, sometimes called a trade fee, every time a technician responds to a claim. Customers usually have to pay service fees even if the technician doesn’t repair the item during that initial visit or the home warranty company denies the claim. Budgeting for service fees can be tricky, but you can aim to pay three service fees a year.

Optional coverage fees. If you want coverage that isn't part of a plan, such as for a pool, some companies will let you add coverage for an additional monthly fee. This amount is usually added to your monthly fee.

Types of home warranty costs

Monthly fees

The average monthly fee for a home warranty plan is $73 which comes out to $876 a year.

But that number could be a lot higher if you choose a plan that covers more items than other plans and has high coverage limits. The price could also be lower if you go with a company that offers less coverage and doesn’t pay as much for repairs.

To give you an idea of how widely monthly fees can differ, our Home Services editorial team researched quotes from 19 companies in different states to represent different costs of living. We also used addresses in different ZIP codes in each state to see if pricing changed. The table below summarizes the range of quotes that we got from each company.

What does all that data mean? Mostly that you don’t know how much you’ll pay for a home warranty until you get quotes from the companies you’re thinking of using. But if you want a simpler comparison of prices, here’s a distilled set of numbers to consider.

Service fees

Our editorial team’s research shows that service fees were around $108 on average.

Most companies charge customers a service fee to assign a repair company to a claim, but some home warranty companies have started offering plans with no service fee. You’ll usually pay more in monthly fees for this kind of plan though.

For some companies, the service fee is the same for all customers; others allow you to select the service fee amount when you buy the plan. Generally, the higher the service fee, the lower the monthly fee.

A reputable home warranty provider will tell you what your service fee will be before you purchase a plan, and most of them state the fee in your service agreement.

» MORE: Are home warranties worth it?

Advertisement

Factors affecting home warranty cost

Several factors go into the final price of your home warranty fee, including your location, the plan you choose, your service fee and more.

Location. Some plans charge different prices in different areas. This can vary by state, city and even ZIP code. For example, Elevate Home Warranty charges different rates for the same coverage in different ZIP codes within the same city. We compare the prices for Elevate’s cheapest and most expensive plans for different ZIP codes in the table below to show how much pricing can change from one location to another.

Example of rates by ZIP code for Elevate Home Warranty

Among the ten ZIP codes we researched for Elevate Home Warranty, there was a $42 difference between the cheapest and most expensive quotes for the Standard plan and a $75 difference between the cheapest and most expensive quotes for the Epic plan.

Plan coverage. Which items your plan covers will also affect your monthly fee. Generally, the more items it covers and the better the coverage, the more expensive the plan.

Company. Some companies offer cheaper plans all around, while others are known for more expensive fees.

Add-on coverage. Adding coverage outside of a plan’s items will increase your fee as well. Optional coverage is often available for things such as pools and spas, water softeners, additional refrigerators, septic systems, well pumps and roof leak repairs. How much each additional item increases your fee depends on the company.

Service fee. If you have the option to choose your service fee, your choice will affect your monthly fee. Usually plans with higher service fees cost less per month and vice versa.

Square footage. Most home warranty plans typically cover primary structures that are 5,000 square feet or fewer. If a plan allows you to cover a house that is larger than its standard size, you might pay more for the additional coverage.

» MORE: What does a home warranty cover?

NerdWallet's Editorial Team Picks for Best Overall Home Warranties

See which home warranties our writers and editors think are the best options for homeowners.

How to get a home warranty quote

Many home warranty companies will give you quotes online, but a lot of them want your contact information first. You might need to provide:

- Your name.

- The address you want covered.

- The square footage of the home if it’s more than 5,000 square feet.

- Which plan you prefer, though some companies provide quotes for all of their plans at once.

- Any additional coverage you want, such as for a pool.

Once you provide this information, the home warranty company’s website usually shows you the monthly or annual price of your plan. If the company lets you choose your service fee, you can probably switch between the options to see how different service fees affect the price.

If you want to go ahead with a contract, you can usually sign up and pay through the company’s website

✏️ A Nerdy Note

Entering your contact info might come with marketing calls. If you have to give a company your phone number to get an online quote, expect to get marketing calls from the company’s sales representatives. If you’re just looking for quotes to compare and don’t want to get a lot of calls from companies, consider using an alternate phone number through a service like Google Voice.

How to save money on home warranties

Although home warranty companies set their own prices, there are a few things you can do to save money on your plan.

- Only get the coverage you need. Some companies have plans that are comprehensive and cover a mix of appliances and home systems, such as air conditioners. Others have appliance-only and system-only plans. Pay attention to what’s covered to avoid paying for coverage on items you don’t want coverage for.

- Get multiple quotes. Research companies and get quotes from several of them to compare your options. Don’t be afraid to be honest with a provider’s representative if you call for a quote — tell them you’re shopping around and want the best price. They might be able to get you a bit more of a discount than you expected.

- Ask for discounts. Some companies offer discounts for certain groups, such as older adults or veterans. When talking with a representative, ask what discounts are available and compare them to other companies' discounts.

- Wait for a sale. Many companies offer lower prices during certain times of the year and around holidays. If you know which company you want to go with, watch its prices and purchase a plan when it's offering a better deal.

What to know before buying a home warranty

Reading the coverage and exclusions information in your contract is one of the most impactful things you can do to avoid costly misunderstandings in the future. You have a right to read your contract before purchasing a plan, and it’s important to understand that home warranties:

- Always have exclusions to coverage, no matter what their sales pitches say. Read your contract carefully before purchasing a plan — especially anything listed as an exclusion or limit of liability. For example, a company might cover air conditioning systems but exclude certain parts or components, such as coils. Other companies cover plumbing repairs but won’t pay to clear all plumbing stoppages or repair certain types of leaks.

- Are not a type of insurance. Even though some companies call their service fees deductibles, home warranties do not work the same way as insurance policies. They differ in what they cover and how they pay for repairs or replacements. A home warranty is not a supplement for homeowners insurance.

- Limit how much they pay. If the cost of a repair or replacement goes beyond a limit stated in your contract, you’ll have to pay the difference. For example, if the bill for a repair is $2,000 and the limit is $1,500, you’re required to cover $500. This is in addition to your monthly premium and service fee.

- Can deny your claim for several reasons. Examples include if you had work performed on a covered item without approval or you modified the system or appliance.

- May not pay enough to cover the full cost of replacing a covered item. Home warranties often depreciate the value of items as they age, so you’ll likely have to pay at least some money to replace an item, even if it’s covered by the contract.

FAQs

How much is a home warranty on average?

A home warranty averages $73 a month in 2026, but prices can range from $28 to $191, depending on several factors.

What fees do I have to pay with a home warranty?

Home warranties usually charge a monthly or annual fee, similar to a subscription fee. Many also charge a service fee every time they send a contractor to your home. You might also have to pay any repair costs that the home warranty doesn’t cover.

Can I pay monthly or yearly for a home warranty?

Most home warranties let you choose between paying monthly or annually.

What does a home warranty’s monthly fee include?

The monthly fee only keeps your home warranty active so the company will respond to any claims you file. You have to pay a separate service fee when the company sends a contractor to your home.

What is a home warranty service fee?

Most companies require customers to pay a service fee when a repair technician comes to their house to look at a covered item. How much a customer pays depends on their contract but can range from no service fee to $200 per visit.

Find your next steps

Learn more about home warranties

The Nerds explain home warranties | What does a home warranty cover? | Are home warranties worth it? | Home warranty vs. home insurance

Compare home warranty companies

NerdWallet's picks for best home warranties | Best home warranties for appliances | Best home warranties for HVAC systems | Best home warranties for rental properties

Look for a new home warranty company

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

More like this

Related articles

AD

50% OFF Select Plans — Limited Time Only

Call American Home Shield

REDEEM NOW

on American Home Shield's website

AD

50% OFF Select Plans — Limited Time Only

- Comprehensive Coverage from Just $29.99/Month;

- Trusted by Over 2 Million Members for 50+ Years;

- No Records or Home Inspections Required.

Call American Home Shield

REDEEM NOW

on American Home Shield's website

AD

Protect Your Home for as little as $1 / Day

Call Select Home Warranty

REDEEM NOW

on Select Home Warranty's website

AD

Protect Your Home for as little as $1 / Day

- Great Home Warranty Protection with $150 off + 2 Months Free + Free Roof Coverage;

- Join the Select Benefits Program and Save up to 75% on Common Everyday purchases.

Call Select Home Warranty

REDEEM NOW

on Select Home Warranty's website