Scan to download the app

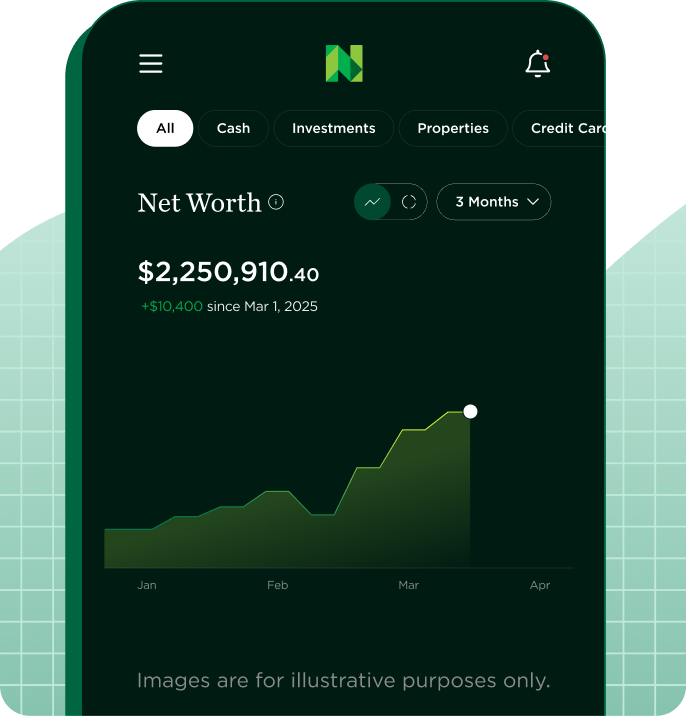

Discover what’s waiting for you in the NerdWallet app.

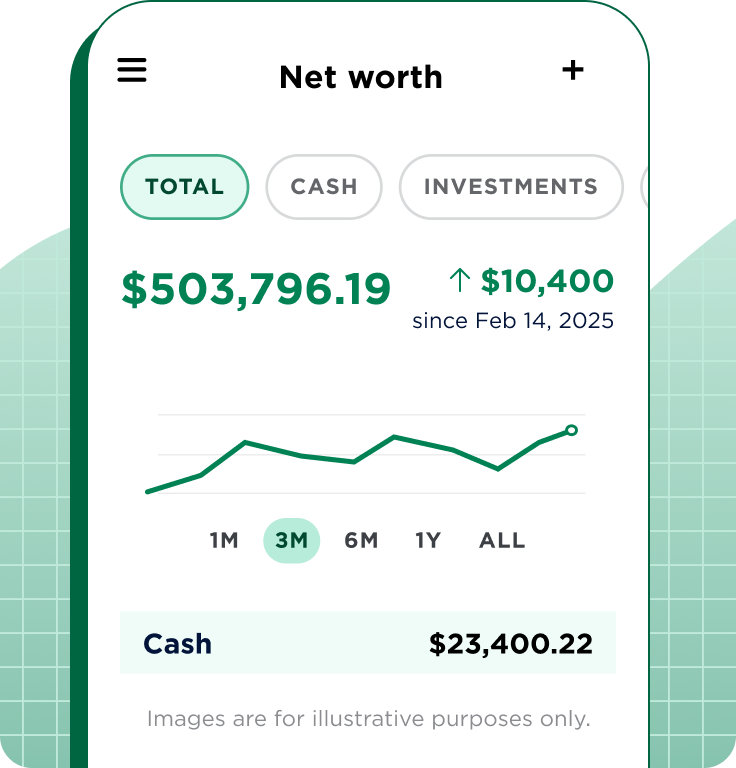

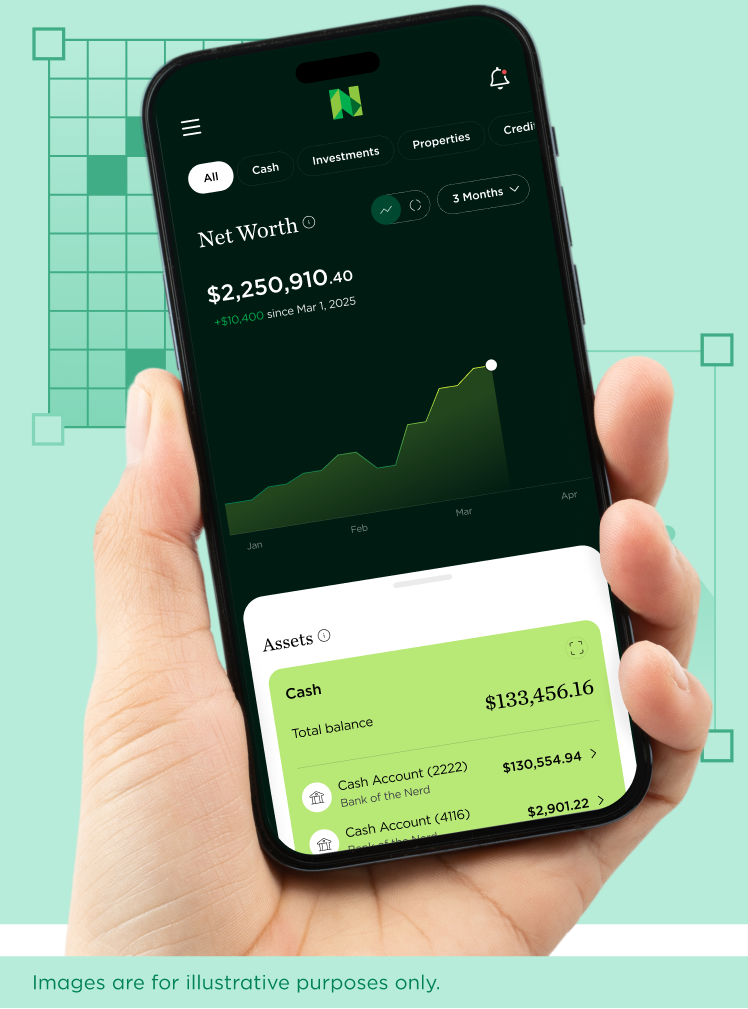

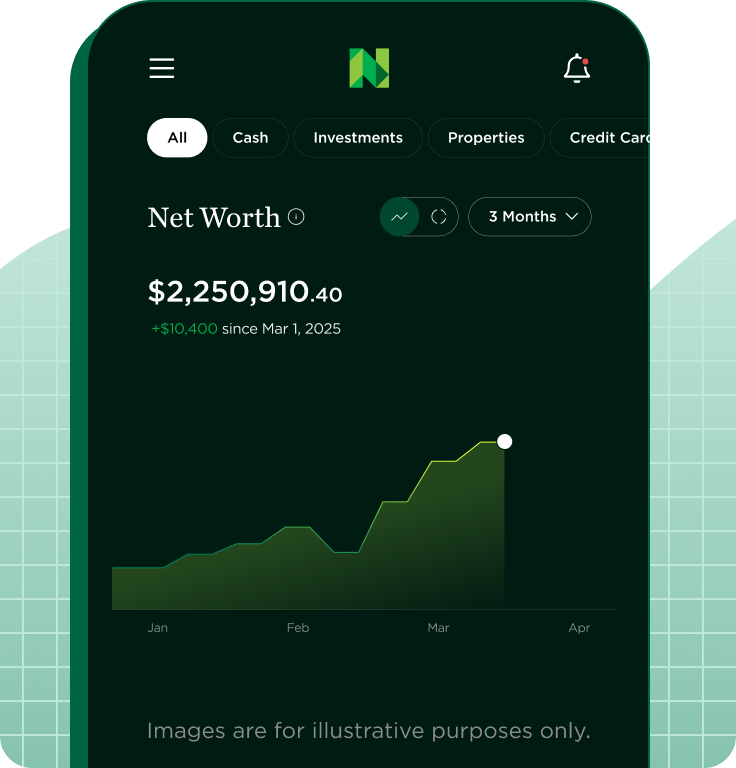

Net worth tracker

We’ll help you track your net worth so you have a clearer view of your finances.

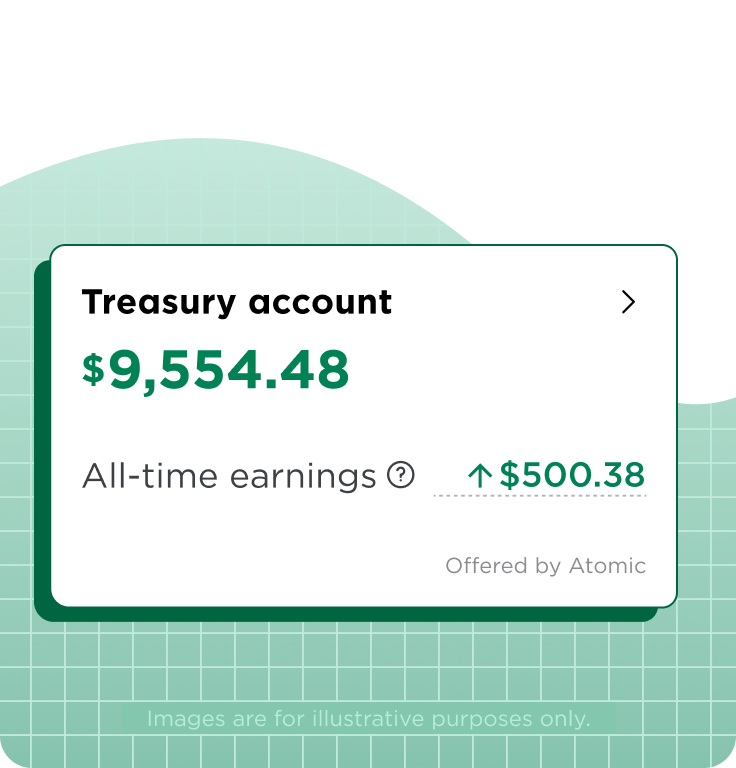

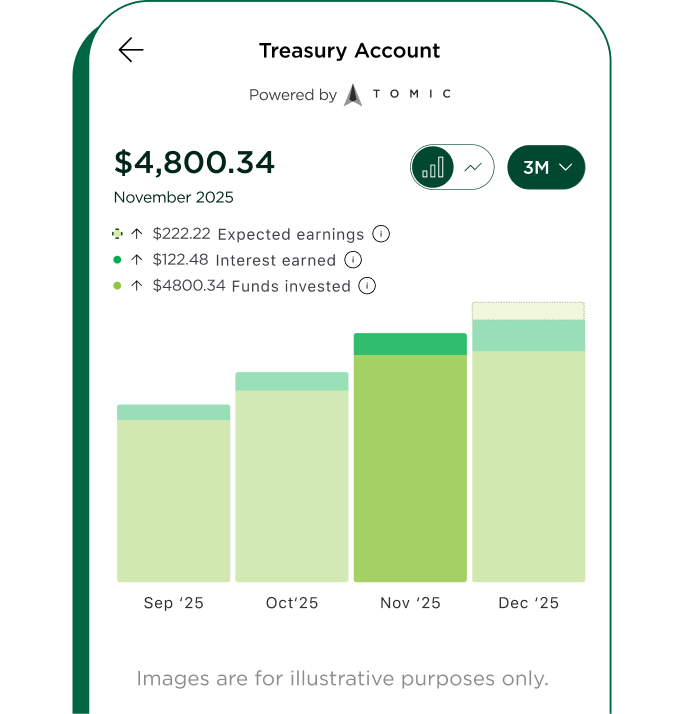

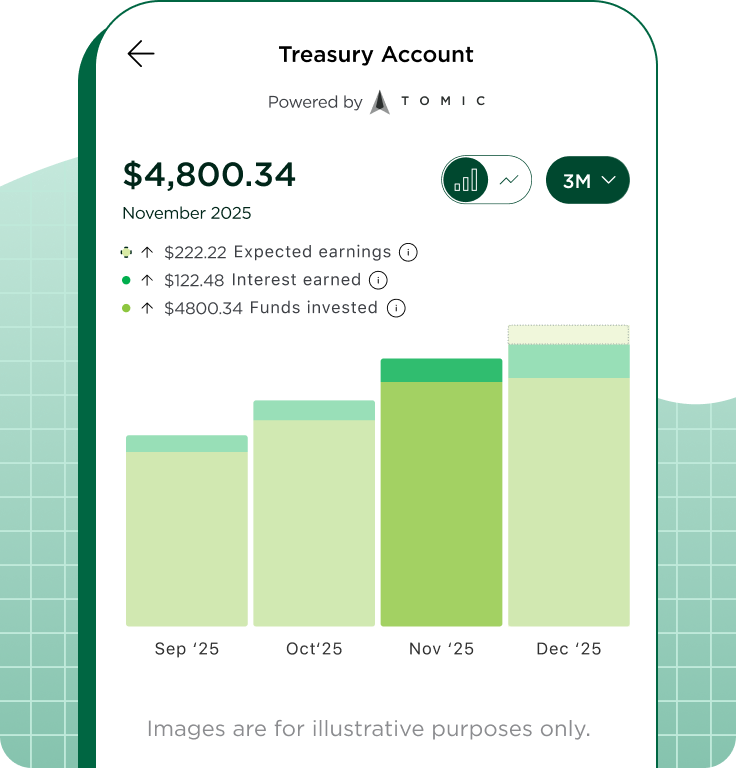

Treasury account

Earn % APY* by investing in U.S. Treasury Bills with a Treasury account offered by Atomic Invest. Pay zero state and local taxes on earned interest.**

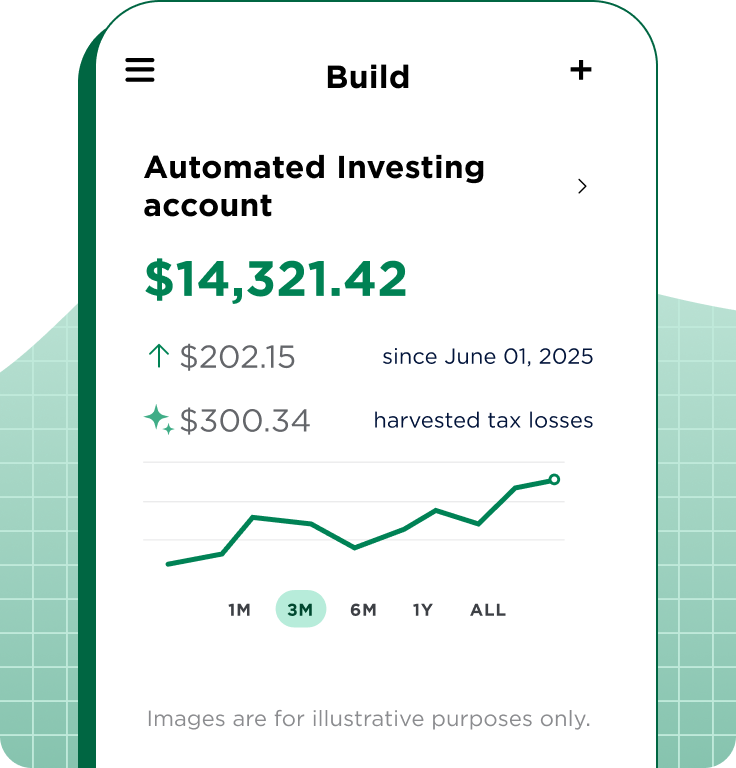

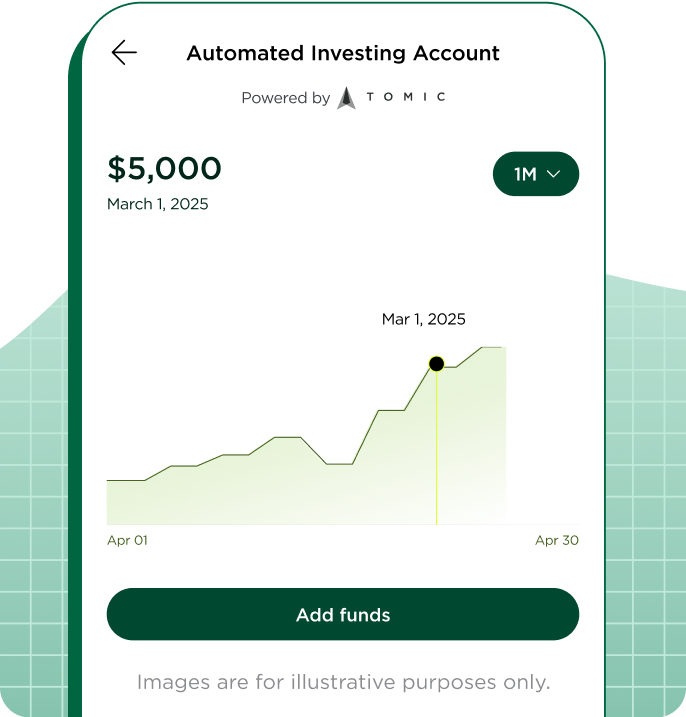

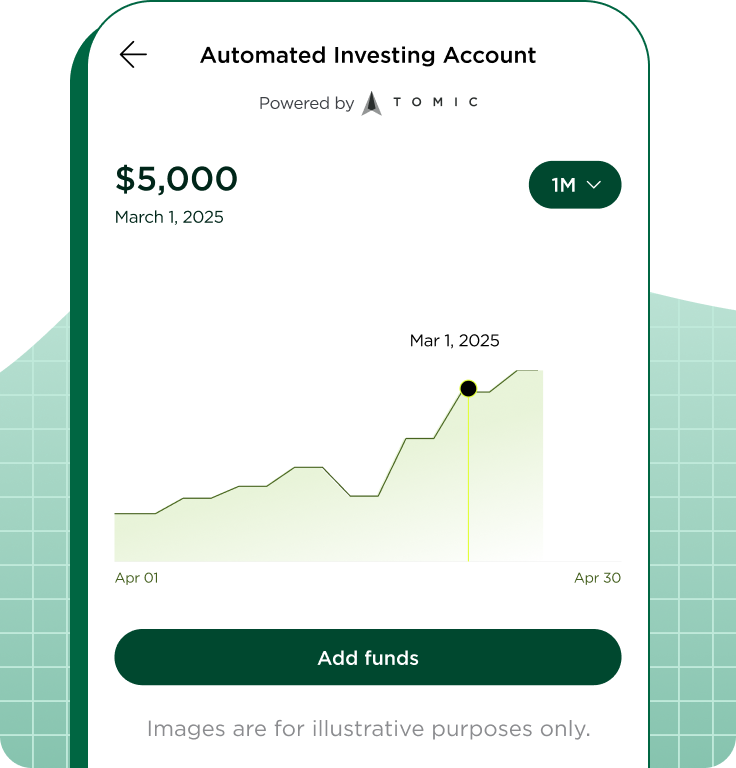

Automated investing

Put your wealth-building on autopilot with an Automated Investing account offered by Atomic Invest.

Exclusive content

Our money Nerds dig into finance topics and share insights that help you make smarter decisions.

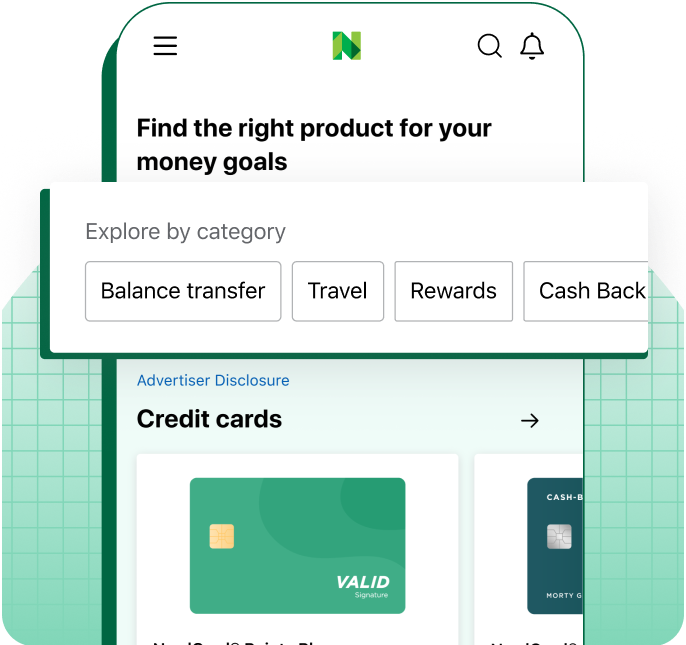

Financial product reviews

Explore our Nerds’ objective ratings and reviews and find the right credit card, bank account, or loan for you.

Scan to download the app

**Interest earned on Treasuries is subject to federal income tax.