What Is a W-2 Form? Definition, How to Read It

Your W-2 form, or Wage and Tax Statement, helps you to fill out your annual tax return. Here's more on how to understand the form and what to do if it’s wrong.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

TABLE OF CONTENTS

What is a W-2?

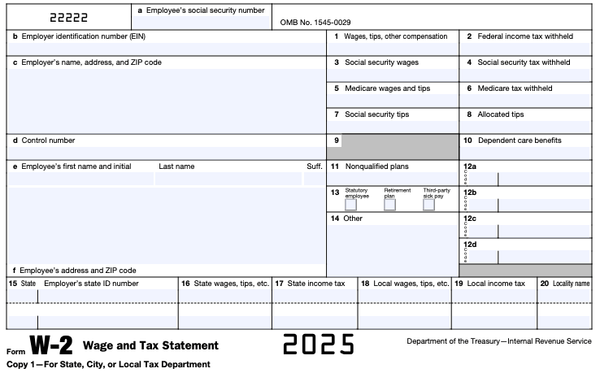

A W-2 is a tax form that summarizes an employee’s income from the prior year and how much tax was withheld. Employers send W-2s to employees and the IRS by the end of January.

You should receive a W-2 from every employer that paid you at least $600 during the year. Freelancers or independent contract workers who do not have taxes withheld by an employer get 1099s from their clients, not W-2s.

Understanding your W-2 form

You use the W-2 to help file your tax return. Form W-2 also shows more than just what you were paid. It details how much you contributed to your retirement plan during the year, how much your employer paid for your health insurance, or what you received in dependent care benefits. All of that data affects your tax picture.

Employers are legally required to send copies of your W-2 to the Social Security Administration and IRS (“Copy A”) and your state and local tax authorities (“Copy 1”). The IRS — and the state, if your state has income taxes — will compare the income you reported on your tax return to the information your employer sent to the government.

on Priority Tax Relief's website

on Alleviate Tax's website

How to get your W-2

Your W-2 form should be mailed to you by early February. If it doesn't show up, ask your employer for a copy and make sure it has the right address. Your employer may also tell you how to get your W-2 online from the HR department or payroll processor.

If you still haven't received your Form W-2 by the end of February, call the IRS. You’ll need to provide information about when you worked and an estimate of what you were paid.

Remember that your tax return is still due by the tax filing deadline, so if you don't have your W-2, you might need to file for tax extension or estimate your earnings and withholdings to get it done on time. The IRS might delay processing your return — read: refund — while it tries to verify your information.

If your W-2 finally shows up after you already filed your tax return, you might need to go back and amend your tax return with a Form 1040-X.

Nerdy Tip: If you're looking for a copy of an old W-2 that you attached to a prior tax return and you can't get a copy from the employer that originally issued it, you can request an IRS tax transcript online or use IRS Form 4506 to request a copy of your tax return.

» Ready to file? Check out NerdWallet's top picks for tax software

How to read your W-2

Here's a simple rundown of what each box on your W-2 means.

Box 1: Details how much you were paid in wages, tips, bonuses and other compensation. You'll use this information to fill out Line 1a of your Form 1040. If you are married or you have multiple jobs, the sum of all Box 1 wages should be included on Line 1a.

Box 2: Shows how much federal income tax was withheld from your pay by your employer. This amount will help you fill out Line 25a of your Form 1040. Note that the information you provided on your Form W-4 determines how much tax is withheld from your pay throughout the year.

Box 3: Shows how much of your pay in Box 1 was subject to Social Security tax. The maximum amount of income subject to Social Security tax is $176,100 for 2025 and $184,500 for 2026.

Box 4: Shows how much Social Security tax was withheld from your pay. Social Security tax is generally 6.2% of your income.

Box 5: Shows how much of your pay in Box 1 was subject to Medicare tax. Unlike Social Security, there is no limit to how much of your income is subject to Medicare tax.

Box 6: Shows how much Medicare tax was withheld from your pay. Medicare tax is generally 1.45% of your income, but some high-earners may be subject to an additional 0.9% Medicare tax.

Box 7: Shows how much of the tip income you reported to your employer (those tips are included in Box 1) was subject to Social Security tax.

Box 8: Shows the amount of other taxable tip income your employer allocated to you. This pay isn't included in Box 1, 3, 5 or 7.

Box 9: This box is generally left blank.

Box 10: Shows the amount of dependent care benefits your employer paid to you or incurred on your behalf. Any amount over $5,000 will also be included in Box 1.

Box 11: Generally, this box shows how much money was distributed to you during the year from your employer's deferred compensation plan. These plans can include pensions, IRAs and 401(k)s.

Box 12: Here, there are four areas in which the employer can provide more detail about some or all of the pay reported in Box 1. For example, if you've contributed to your company's 401(k) plan, the amount of your contributions might show up in Box 12 with the code letter "D." There are many codes, which you can see in the IRS' W-2 instructions.

Box 13: This box indicates whether your earnings are subject to Social Security and Medicare taxes but aren't subject to federal income tax withholding, whether you participated in certain types of retirement plans, or whether you got certain kinds of sick pay.

Boxes 16-19: Show how much of your pay is subject to state income tax, how much state income tax was withheld from your pay, how much income was subject to local taxes, and how much local tax was withheld from your pay

What to do if your W-2 is wrong

If your employer leaves out a decimal point, gets your name or a dollar amount wrong, or checks the wrong box, point out the mistake and ask for a corrected W-2. Waiting for a new W-2 will cost you time, but here’s something that could make you feel better: The IRS might fine your employer if the error involves a dollar amount or “a significant item” in your address.

on Priority Tax Relief's website

on Alleviate Tax's website