The Complete Guide to Emirates Skywards

Here's what you need to know about Emirates’ loyalty program, including how to use your miles on ultra-luxury cabins

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

Have you seen those photos of ridiculously blinged-out airline seats? You know the ones: They often include flashy big-screen TVs, pop-up minibars, digital windows and seats so big you could melt right into them.

These luxurious cabins belong to Emirates, an international airline based in the United Arab Emirates. While the airline will happily sell you a ticket to fly in these seats, we’ve got another way.

In this guide to the airline’s loyalty program, Emirates Skywards, we'll show you how to gain elite status, earn miles and redeem them for those super-fancy seats — without even traveling to the Middle East.

About Emirates

Emirates isn't all gold-hued seats and private cabins. It has all the regular cabins you'd expect from an airline, including economy class seating. Yet even Emirates economy class sets the bar high in terms of quality. Emirates was the first airline to introduce individual television screens in economy class (that was way back in 1992), and it continues to lead the industry in innovation.

Starting in November 2025, Emirates began rolling out Starlink Wi-Fi across its entire 232-aircraft fleet, offering passengers free, ultra-fast internet connectivity — regardless of which cabin they're flying in.

What the airline is really known for, however, is its ultra-exclusive first class products, which offer perks such as onboard showers, standing bars for business and first class travelers, and state-of-the-art, faux digital windows (in case you get a middle suite). The first class bathroom on the Emirates A380 aircraft even has heated floors.

By signing up, you will receive newsletters and promotional content and agree to our Terms of Use and acknowledge the data practices in our Privacy Policy. You may unsubscribe at any time.

Fare types

Emirates operates four different cabins of service: economy, premium economy, business class and first class. Though, you won’t find each class of service on every flight since planes are configured differently. That's especially true of Emirates premium economy, which was only just announced in 2021 on a small set of routes, but has been rapidly expanding.

» Learn more: The best perks of Emirates Airlines first class

Main U.S. routes on Emirates

Emirates operates flights between its Dubai hub and the following U.S. cities:

- Boston.

- Chicago-O’Hare.

- Dallas.

- Houston-Intercontinental.

- Los Angeles.

- Miami.

- Newark.

- New York-John F. Kennedy.

- Orlando.

- San Francisco.

- Seattle.

- Washington-Dulles.

The airline also flies between Newark and Athens, Greece, and between New York-John F. Kennedy and Milan. Historically these so-called “fifth freedom” routes have been an easy way to fly the airline for a relatively low number of miles compared with flying all the way to Dubai.

Emirates Skywards frequent flyer sign-up

To sign up for the Skywards program, go to this page and complete the form. You’ll be given the option to receive promotional emails, which can be helpful to keep up with fare sales, new routes and the like.

How much Emirates miles are worth

NerdWallet values Emirates miles at 1 cent per point, as of our most recent analysis. In January 2023 the program increased its award pricing across the board for premium cabins, so you’ll want to make sure these miles still represent a good value to you.

To help you understand how much your Emirates Skywards miles are worth, we compared cash prices and reward redemptions for economy round-trip routes across several destinations and dates. We divided the cost of the cash ticket by the cost of the reward ticket to determine a “cent per mile” value for each flight, then averaged this value across several flights and dates.

Free Wi-Fi on Emirates

Emirates is in the process of equipping its entire fleet with Starlink Wi-Fi,which is completely free, regardless of cabin class or Skywards membership status.

Rollout timeline:

- First commercial flight: November 23, 2025 (Boeing 777-300ER).

- Boeing 777 fleet: November 2025 onwards.

- Airbus A380 fleet: Starting February 2026.

- Full fleet completion: Mid-2027.

How to access: Simple one-click connection with no payment required and no need for Skywards membership. The service works on both seatback screens and your personal devices.

Fleet coverage: Emirates is installing two antennae on each Boeing 777 and three antennae on each Airbus A380 (an industry first) to ensure optimal connectivity across all cabin classes. Live TV over Starlink will also be available, initially on personal devices and then on seatback screens from late December 2025.

Emirates Skywards elite status tiers

Emirates has four elite tiers: Blue, Silver, Gold and Platinum. Here’s what’s required to earn each status at a glance, along with some notable perks:

| Tier | How to qualify | Notable benefits |

|---|---|---|

| Blue | Immediately upon signup for Emirates Skywards. | Ability to buy upgrades with miles, paid lounge access and waitlist priority on fully-booked flights. |

| Silver | Must earn 25,000 tier miles or take 25 flights. | All of the above, plus complimentary seat selection, excess bag allowances, priority check-in and complimentary lounge access in Dubai. Earn 30% bonus miles when flying Emirates. |

| Gold | Must earn 50,000 tier miles or take 50 flights. | All of the above, plus priority phone service, complimentary lounge access worldwide and guaranteed seats even on full flights. Earn 50% bonus miles when flying Emirates. |

| Platinum | Must earn 150,000 tier miles and take one qualifying flight in first or business class. | All of the above, plus last-seat award availability, the ability to gift a Gold membership and no expiration on miles. Earn 100% bonus miles when flying Emirates. |

Let’s dive deeper into each tier’s benefits (note: The Wi-Fi benefits listed below apply to aircraft that have not yet been equipped with free Starlink for all passengers, which is rolling out between now and mid-2027).

Emirates Blue status benefits

- Special member-only offers and travel packages by tier.

- Ability to nominate a personal “travel coordinator” for your account.

- Priority waitlist for fully-booked flights.

- Buy upgrades using your miles at the airport.

- Paid Business Class lounge access in Dubai and other select airports.

- Free Wi-Fi when traveling in first class.

Emirates Silver status benefits

- Special member-only offers and travel packages by tier.

- Ability to nominate a personal “travel coordinator” for your account.

- Priority waitlist for fully-booked flights.

- Buy upgrades using your miles at the airport.

- Complimentary access to any Emirates Business Class lounge in Dubai.

- Additional lounge access for a fee.

- Free Wi-Fi when traveling in business or first class.

- Complimentary seat selection when flying economy (regular seats only).

- Extra baggage allowance up to 26 pounds (12 kilograms).

- A 30% bonus on earned miles when flying Emirates.

- Priority check-in and boarding.

Emirates Gold status benefits

- Special member-only offers and travel packages by tier.

- Ability to nominate a personal “travel coordinator” for your account.

- Priority waitlist for fully-booked flights.

- Buy upgrades using your miles at the airport.

- Complimentary lounge access for yourself and one adult guest at any Emirates Business Class lounge in Dubai and at lounges throughout the Emirates network.

- Additional lounge access for a fee.

- Free Wi-Fi when traveling in business or first class.

- Access to preferred seats in economy.

- Extra baggage allowance up to 35 pounds (16 kilograms).

- A 50% bonus on earned miles when flying Emirates.

- Priority check-in and boarding.

- Gold-level priority service when calling the call center.

- Priority baggage tagging upon arrival, where available.

Emirates Platinum status benefits

- Special member-only offers and travel packages by tier.

- Ability to nominate a personal “travel coordinator” for your account.

- Priority waitlist for fully-booked flights.

- Buy upgrades using your miles at the airport.

- Complimentary lounge access for yourself, one adult guest and two guests under 17 at any Emirates Business Class lounge in Dubai and at lounges throughout the Emirates network.

- Additional guest lounge access for a fee.

- Free Wi-Fi when traveling in any cabin.

- Access to preferred seats in economy, including Extra Legroom seats.

- Extra baggage allowance up to 44 pounds (20 kilograms).

- A 100% bonus on earned miles when flying Emirates.

- Priority check-in and boarding.

- Platinum-level priority service when calling the call center.

- Priority first-class baggage tagging, when available.

- Access to Last Seat Classic Flex Plus reward tickets.

- Ability to gift Gold status to one other person.

- No expiration of Skywards miles.

How to earn Emirates miles

There are multiple ways to earn Emirates Skyward miles, from flying on Emirates and its partner airlines to using a transferable currency or holding an Emirates co-branded credit card. Here are all the ways you can increase your balance of Skyward miles.

Earning when you fly Emirates

Unlike most U.S. airlines, Emirates calculates earned miles based on distance flown and fare class, rather than the ticket cost. On top of that, as noted above, Silver members earn 30% bonus miles per flight, Gold members earn 75% and Platinum members earn 100%.

As a Blue member, here’s what you’d earn on a one-way flight between Miami and Dubai, for example:

- Economy (saver level): 3,600 miles.

- Business (saver level): 15,000 miles.

- First: 30,000 miles.

Earning when you fly other airlines

Emirates lists more than a dozen airline partners through which you can earn miles through flying, including Air Canada (but no U.S. airlines at this time). You’ll earn up to 2 Skywards miles per mile flown on these partner airlines, as long as you choose to credit your flights to Emirates.

Earning Emirates miles with a credit card

Emirates launched two credit cards for U.S. travelers a few years ago, both issued through Barclays. The bonuses on these cards alone are enough to get you well on your way to an award flight.

The Emirates Skywards Premium World Elite Mastercard® charges a $499 annual fee and comes with the following:

- Bonus offer: Earn 50,000 bonus Skywards Miles after spending $3,000 on purchases in the first 90 days.

- Earnings rate: 3 miles per dollar spent with Emirates, 2 miles per dollar spent on qualifying travel purchases and 1 mile per dollar on all other purchases.

- Perks: Instant Gold status for a year, no foreign transaction fees, Priority Pass Select lounge access, fee waiver for Global Entry or TSA Precheck application and 10,000 anniversary miles.

Meanwhile, for a $99 annual fee, the Emirates Skywards Rewards World Elite Mastercard® includes:

- Bonus offer: Earn 40,000 bonus Skywards Miles after spending $3,000 on purchases in the first 90 days.

- Earnings rate: 3 miles per dollar spent with Emirates, 2 miles per dollar spent on qualifying travel purchases and 1 mile per dollar on all other purchases.

- Perks: Instant Silver status for a year and no foreign transaction fees.

» Learn more: Are the new Emirates Mastercards worth their fee?

Transferable currencies to Emirates

Even if you don’t fly Emirates often or use its credit cards, their miles are relatively easy to rack up via transfer from major reward programs. Miles can be transferred to Emirates from American Express Membership Rewards (5:4 ratio), Capital One Miles (4:3 ratio) and Citi ThankYou rewards (5:4 ratio). You can also transfer on a 3:1 basis from Marriott Bonvoy, and at varying other rates from hotel partners and car rentals. If you have Bilt Points, those transfer to Emirates at a 1:1 ratio.

Earning Emirates miles through partners

- Rental cars: Earn 1 mile per dollar spent when booking a rental car through Emirates’ website via their partner CarTrawler.

- Hotel stays: Earn up to 10,000 Skywards miles per night booking hotels through Emirates, and tack on 2,500 miles if you use a co-branded Emirates credit card to do so. There can be additional bonus offers available too. You can also earn miles staying at a variety of hotel chains.

- Shopping portals: Earn miles with every dollar spent at over 1,000 stores through the Emirates Skywards mall.

- Other partners: Emirates has a number of other partnerships with which you can earn miles, including cabs, a rideshare service and the Dubai Mall.

Pooling Emirates miles

Emirates allows you to create a family account of up to eight members, including yourself. You can credit 100% of reward miles earned by family members to this account.

Buying, gifting or transferring Emirates miles

Emirates lets you buy or gift miles, to the tune of $30 per 1,000 miles up to a maximum of 100,000 to 200,000 miles per year, based on your elite tier level. You can also transfer miles for $15 per 1,000 miles, up to 50,000 miles per year.

» Learn more: 5 sweet spots for Emirates miles

How to redeem Emirates miles

Emirates doesn’t publish an award chart for its own flights, but the airline makes it pretty easy to figure out how many miles a flight will cost. Use the airline’s mileage calculator to select your city pairs, then click “calculate.” On the results page, select the “spend” tab to see how many miles the itinerary costs.

Beware that Emirates will also levy surcharges on its own flights — sometimes hundreds of dollars.

When booking flights, you’ll have the option to pay with a combination of cash and miles. This can significantly knock down the cash price of a flight, so it’s worth checking out if you have a specific itinerary in mind and don’t have enough miles for a reward ticket.

Good Emirates redemption options

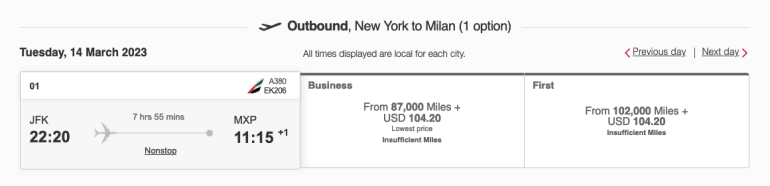

Award flights to Europe: The most competitive use of Emirates miles for most American travelers is on the airline’s flights between the U.S. and Europe. Here’s what you’ll pay to fly between New York-John F. Kennedy and Milan in one direction in the airline’s premium cabins:

Similar rates typically apply to the airline’s other U.S.-to-Europe route, between Newark and Athens.

These are solid rates compared with other rewards programs, especially considering you’re paying for an experience you won’t get on most other airlines flying between the U.S. and Europe. Flights on the A380 like the one above, for example, feature an on-board lounge for first class and business class passengers and private showers for those in first class.

Just make sure to factor in the added costs of any connecting flight you’d have to take.

» Learn more: How to book Emirates first class with points

🤓 Nerdy Tip

If you’re flying between Europe and Dubai and want to do so in the highest possible style, try to snag one of Emirates’ newer 777s with a first class cabin featuring just six seats that are enclosed from floor to ceiling. The two middle seats include digital windows that project images from cameras outside of the plane in real time. As of this writing, the planes generally fly between Dubai and the following European cities: Brussels, Frankfurt, Geneva, London-Stansted, Nice and Zurich. Partner redemptions: You can sometimes find good value in redeeming Skywards miles on partner airlines. Emirates isn’t a part of any of the major airline alliances, but you can see the airlines they partner with here, along with distance-based award charts for flying on each airline.

Award upgrades: Once you’ve booked a flight in cash, you can use your miles to upgrade to the next available class of service, assuming seats are available. Depending on how good a deal your cash ticket was, this can sometimes be a cheap way to upgrade your experience.

Free stopovers: Depending on the award fare booked, getting an extended stopover (more than 24 hours) in Dubai may be possible without using extra miles. These aren’t always bookable online so if it’s something you’re interested in, you’ll want to call in and ask.

» Learn more: The best airline credit cards right now

Bad Emirates redemption options

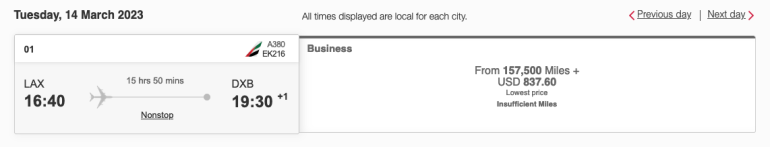

Award flights to Dubai and beyond: Unfortunately, pretty much any Emirates flight between the U.S. and the carrier’s hub in Dubai, and onward, will cost you. Flying one way from Los Angeles to the Emirati capital in business class, you’ll owe a whopping 157,500 miles plus over $800 in surcharges:

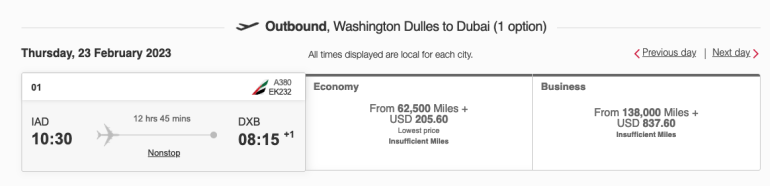

But note that flying economy knocks off most of the surcharges, as in this example between Washington-Dulles and Dubai:

Use the airline’s mileage calculator to plug in other examples of your choosing. Just remember to click “calculate,” then “spend” to see how much the itinerary costs.

Non-flight redemptions: You can use your Emirates miles to book hotels or special events directly, but these generally represent a poor value. If you have limited miles to burn, the Emirates store allows you to purchase airline merchandise with miles.

Other ways to redeem miles for Emirates flights

If Emirates miles are difficult to come by, you can book their flights through a variety of other airline programs, including Air Canada’s Aeroplan, Japan Airlines’ Mileage Bank and Qantas Frequent Flyer. Availability generally isn’t as good as when booking directly through Emirates. Be sure to watch out for potentially hefty surcharges.

» Learn more: Your guide to airline bonus point promotions

How to contact Emirates

Emirates’ U.S. phone number is 1-800-777-3999. In addition, you can access the airline via live chat, or contact them through Facebook or Twitter.

How long do Emirates Skywards points last?

Miles expire three years after they are earned or transferred, unless you have Platinum status, in which case they never expire. Additionally, Emirates lets you pay to extend any miles that are set to expire in the next three months. You can extend them for 12 months beyond their original expiration date.

Emirates Skywards, recapped

It can be surprisingly easy to rack up miles with the Emirates Skywards program, especially given their many transfer partners. Whether you’re looking to redeem those miles for an economy-class experience or one of their famous premium cabins, you have plenty of solid options to do so.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2026:

- Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

- No annual fee: Wells Fargo Autograph® Card

- Flat-rate travel rewards: Capital One Venture Rewards Credit Card

- Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

- Luxury perks: American Express Platinum Card®

- Business travelers: Ink Business Preferred® Credit Card

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Limited Time Only: Earn $1,000 Toward Travel!

Capital One Venture Rewards Credit Card

Travel

For a limited time, the

Capital One Venture Rewards Credit Card is offering new cardholders an especially rich bonus: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel!

More like this

Related articles