How to Cancel a Southwest Airlines Flight

You can cancel your Southwest flight online, and you'll get a refund or travel funds depending on the fare type.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

Southwest Airlines is making big changes, like charging for bags, rebranding its fares and adding assigned seating. Its once-simple cancellation and refund policy is changing, too. Here’s the latest about how to cancel a Southwest flight.

By signing up, you will receive newsletters and promotional content and agree to our Terms of Use and acknowledge the data practices in our Privacy Policy. You may unsubscribe at any time.

How to cancel a Southwest flight

If flight plans change, you can cancel your Southwest flight either online, through the app or by calling customer service at 1-800-I-FLY-SWA (1-800-435-9792).

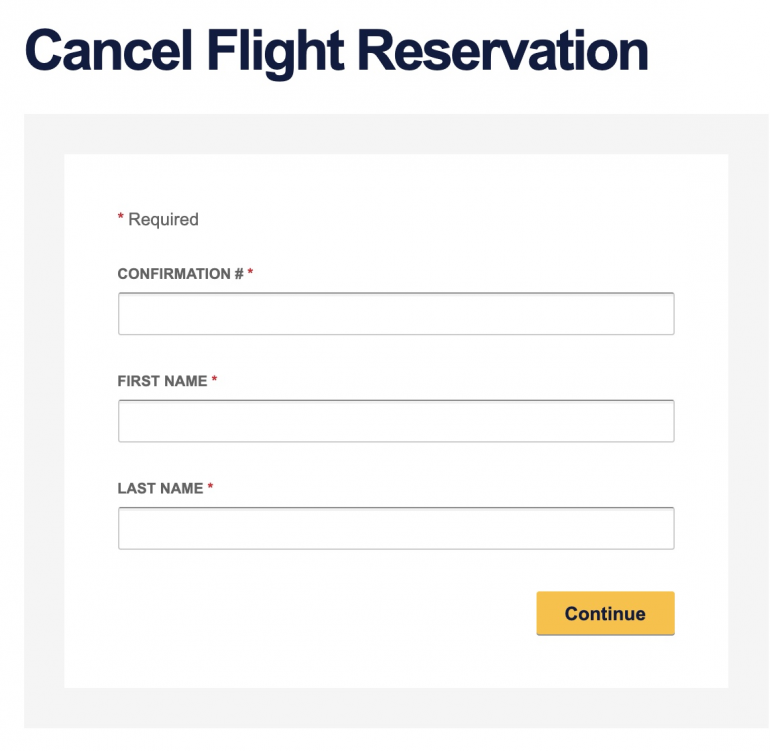

You can either go to the “Manage Reservations” section of the website or the app. From there, if you are logged into your Rapid Rewards frequent flyer account, you can choose a reservation or type in your name and confirmation number and then select the cancel option.

🤓 Nerdy Tip

If more than one person is on a reservation and you need to cancel the flight for only one person, you need to divide the reservation first before canceling. You can do this by going into “Manage Your Reservation” and then “Split a Booking.” This will trigger a new confirmation number for the person taken off the original reservation, so make sure to keep track of it. You can cancel a portion of the trip and keep the rest. If you do that, just keep in mind it might change some of the fees associated with the booking, like bag fees. Southwest began charging $35 to check one bag and $45 for the second bag beginning with travel booked, ticketed or changed on or after May 28, 2025.

While it’s often best to cancel as soon as you know you won’t need the ticket, you can cancel up to 10 minutes before the scheduled departure time. So if your flight is at 5 p.m., you have until 4:50 p.m. to cancel.

If you don’t cancel before that time limit, you will most likely lose the entire value of the ticket as a result of Southwest’s no-show policy. The exceptions are if the ticket was a Choice Extra or Choice Preferred fare.

All types of fares can be canceled without a fee.

» Learn more: Best airline credit cards

By signing up, you will receive newsletters and promotional content and agree to our Terms of Use and acknowledge the data practices in our Privacy Policy. You may unsubscribe at any time.

How to change or rebook your Southwest flight

If your Southwest flight no longer works for you, you may be able to change it.

Choice, Choice Preferred or Choice Extra tickets can be changed. Basic fares cannot. If you have a Basic fare ticket and need to change it, you can upgrade it to a different type of fare and then make the change.

There is no fee to make an itinerary change, but you will have to pay the fare difference if the new flight costs more than the original one. The reverse is also true. If the ticket costs less, you might get a flight credit. More about those later.

The process to change a flight is similar to the one for cancellations. Go to the “Manage Reservations” option on the website and either type in your name and confirmation number or select your reservation while logged into your Rapid Rewards account. Then select the “Change” option.

You can make a change up to 10 minutes before the scheduled departure time, and if there is more than one person on a reservation and the change is only for one person, you will need to divide the reservation before trying to make a change.

🤓 Nerdy Tip

If you have a lap child on your reservation and need to make a change, you will need to speak with a customer service representative rather than making the change online or in the app. Types of ‘refunds’ on Southwest Airlines

Aside from now charging for checked bags, the second biggest change Southwest has made is how it handles travel credits for things like cancellations and flight changes.

You can use a travel credit to book a future flight, but there's now a catch.

In the good ol’ days (like earlier in 2025) any funds in a flight credit with Southwest never expired, meaning you could use them whenever you wanted. But only the passenger named on the canceled ticket could use them.

Everything changed on May 28, 2025, when Southwest introduced two types of credits: flight credits and transferable flight credits.

Flight credit

This type of credit comes from canceling a Basic fare or if you downgrade a fare and cannot be transferred to anyone else. Basic fare flight credits for canceling a flight expire after six months from the date originally booked. If you booked a trip six months in advance and canceled one month out, for example, you'd only have one month to use that flight credit.

On or before May 27, 2025, all credits for canceling or changing a flight were called flight credits. If they were issued before that date, they do not expire. So the date they were issued is very important.

Transferable flight credit

Like the name implies, this type of credit can be transferred once to someone else and comes from Wanna Get Away Plus (Choice), Anytime (Choice Preferred) or Business Select (Choice Extra) fares.

Transferable flight credits began on May 28, 2025, and have a specific expiration date, which depends on the type of fare originally purchased and how you paid for it. Most expire in 12 months, but of course, there are exceptions. For example, if you bought a Business Select (Choice Extra) or Anytime (Choice Preferred) ticket with a Southwest gift card, the transferable flight credit will not expire.

The clock for the expiration date begins on the date the fare was purchased and ticketed, not the date you cancel it. So if you buy a Basic fare ticket several months before a trip and then cancel it, you won’t have much time to use those funds.

Your pre-May 28, 2025, flight credit without an expiration date could end up with an expiration date if you apply that flight credit to a new ticket and then cancel that reservation. It will turn into a transferable flight credit and have an expiration date. Make sure you use any credits with an expiration date before those without one.

You can look at all your available flight credits by logging into your Rapid Rewards account, selecting “My Account” on desktop or “My Travel Funds” on mobile or the app and then selecting “Payment.”

🤓 Nerdy Tip

Keep track of the confirmation numbers from the tickets you change or cancel that are associated with any type of flight credit. Even though credits are supposed to go into your accounts automatically, sometimes they don’t. You’ll need confirmation numbers to find them. Also, if you are not a member of the Rapid Rewards frequent flyer program, there would be no account for the credit to go into. When you book a new ticket and want to use a flight credit to pay for it, just add the original confirmation number associated with the flight credit during the payment process. You can use up to three methods of payment for each ticket, and a flight credit counts as one.

If you want to get your money back to your credit card, you’ll need to buy a Business Select (Choice Extra) or Anytime (Choice Preferred) ticket. If you cancel those, you can choose between either a method-of-payment refund or a transferable flight credit.

There is a caveat to that. If you use a flight credit to pay for a Business Select (Choice Extra) or Anytime (Choice Preferred) ticket, any refund will be in the form of a transferable flight credit.

If you used Rapid Rewards points to pay for your refundable ticket, you will get those points back if you cancel.

If you don’t want to mess with Southwest’s policies, another option is to file a travel insurance claim if you have a policy. Or, if you paid for your Southwest flight with a credit card that has travel insurance, you can file a claim with that card.

These two options work only if your policy covers the reason why you decided not to travel.

Top cards with travel insurance

Annual fee

$95.

$795.

$895.

$95.

Travel protections (not a comprehensive list)

• Trip delay: Up to $500 per ticket for delays more than 12 hours.

• Trip cancellation: Up to $10,000 per person and $20,000 per trip. Maximum benefit of $40,000 per 12-month period.

• Trip interruption: Up to $10,000 per person and $20,000 per trip. Maximum benefit of $40,000 per 12-month period.

• Baggage delay: Up to $100 per day for five days.

• Lost luggage: Up to $3,000 per passenger.

• Trip delay: Up to $500 per ticket for delays more than 6 hours.

• Trip cancellation: Up to $10,000 per person and $20,000 per trip. Maximum benefit of $40,000 per 12-month period.

• Trip interruption: Up to $10,000 per person and $20,000 per trip. Maximum benefit of $40,000 per 12-month period.

• Baggage delay: Up to $100 per day for five days.

• Lost luggage: Up to $3,000 per passenger.

• Trip delay: Up to $500 per trip for delays more than 6 hours.

• Trip cancellation: Up to $10,000 per trip. Maximum benefit of $20,000 per 12-month period.

• Trip interruption: Up to $10,000 per trip. Maximum benefit of $20,000 per 12-month period.

• Lost luggage: Up to $3,000 per passenger.

Terms apply.

• Trip delay: Up to $500 per ticket for delays more than 12 hours.

• Trip cancellation: Up to $10,000 per trip. Maximum benefit of $20,000 per 12-month period.

• Trip interruption: Up to $10,000 per trip. Maximum benefit of $20,000 per 12-month period.

• Baggage delay: Up to $100 per day for five days.

• Lost luggage: Up to $3,000 per passenger.

Learn more

To view rates and fees of the American Express Platinum Card®, see this page.

American Express travel insurance disclosures

Insurance Benefit: Trip Cancellation and Interruption Insurance

- The maximum benefit amount for Trip Cancellation and Interruption Insurance is $10,000 per Covered Trip and $20,000 per Eligible Card per 12 consecutive month period.

- Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply.

- Please visit americanexpress.com/benefitsguide for more details.

- Underwritten by New Hampshire Insurance Company, an AIG Company.

Insurance Benefit: Trip Delay Insurance

- Up to $500 per Covered Trip that is delayed for more than 6 hours; and 2 claims per Eligible Card per 12 consecutive month period.

- Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply.

- Please visit americanexpress.com/benefitsguide for more details.

- Underwritten by New Hampshire Insurance Company, an AIG Company.

Insurance Benefit: Baggage Insurance Plan

- Baggage Insurance Plan coverage can be in effect for Covered Persons for eligible lost, damaged, or stolen Baggage during their travel on a Common Carrier Vehicle (e.g., plane, train, ship, or bus) when the Entire Fare for a ticket for the trip (one-way or round-trip) is charged to an Eligible Card. Coverage can be provided for up to $2,000 for checked Baggage and up to a combined maximum of $3,000 for checked and carry-on Baggage, in excess of coverage provided by the Common Carrier. The coverage is also subject to a $3,000 aggregate limit per Covered Trip. For New York State residents, there is a $2,000 per bag/suitcase limit for each Covered Person with a $10,000 aggregate maximum for all Covered Persons per Covered Trip.

- Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply.

- Please visit americanexpress.com/benefitsguide for more details.

- Underwritten by AMEX Assurance Company.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2026:

- Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

- No annual fee: Wells Fargo Autograph® Card

- Flat-rate travel rewards: Capital One Venture Rewards Credit Card

- Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

- Luxury perks: American Express Platinum Card®

- Business travelers: Ink Business Preferred® Credit Card

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Limited Time Only: Earn $1,000 Toward Travel!

Capital One Venture Rewards Credit Card

Travel

For a limited time, the

Capital One Venture Rewards Credit Card is offering new cardholders an especially rich bonus: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel!

More like this

Related articles