The Guide to Turkish Airlines Miles&Smiles

You can start taking advantage of Turkish Airlines Miles&Smiles program by transferring points from Citi.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

Turkish Airlines is a member of the Star Alliance and a powerhouse airline that connects more countries around the globe than any other airline. Frequent flyers often praise Turkish Airlines for its excellent onboard cuisine and the Istanbul lounge.

The Turkish Airlines Miles&Smiles program allows frequent travelers to earn and redeem miles with the airline and its partners. But recent changes to its award charts have gutted most of its former sweet spots.

Still, the program can offer decent value on certain redemptions, and of course, elite status cardholders can earn Star Alliance Gold status once they hit a certain threshold. This allows them to enjoy extra benefits whenever they fly any Star Alliance airline.

Here’s how you can benefit from the Miles&Smiles program from Turkish Airlines.

Get the 'Cheat Codes' to Cheaper Travel

Unlocking the secret to saving a ton on travel is easier than you think. 📤 Our free newsletter shows you how in 5 min. or less.

About Turkish Airlines

Turkish Airlines rivals leading global carriers with its extensive route network and premium services. It serves more than a dozen destinations in the United States, including all Star Alliance hubs, as well as other key gateway cities.

These include:

- Atlanta.

- Boston.

- Chicago-O’Hare.

- Dallas-Fort Worth.

- Denver.

- Detroit.

- Houston-Intercontinental.

- Los Angeles.

- Miami.

- Newark.

- New York-John F. Kennedy.

- San Francisco.

- Seattle.

- Washington-Dulles.

Flights to Turkey from the U.S. take between 10 and 14 hours, depending on the city pairs. Once you are in Turkey, Turkish can connect you to airports that can be hard-to-reach on other airlines, including cities in Azerbaijan, Iraq, Russia and Somalia. In fact, it flies to more countries than any other airline in the world.

The onboard experience is just as impressive as the airline’s network.

- Flying economy class on Turkish Airlines includes delicious food from Turkish’s DO & CO flight kitchens, entertainment at every seat and in-seat power on long-haul flights. Alcoholic beverages are available on international flights only. On longer flights, passengers receive an amenity kit with in-flight accessories to make the journey more comfortable.

- Business class on Turkish Airlines turns up the onboard experience to include flat-bed seats on longer flights and cuisine prepared by onboard “flying chefs” who can customize meals for passengers’ individual tastes. The Turkish-inspired menus are a favorite of travelers.

How to earn Turkish Airlines Miles&Smiles miles

Earning miles in Turkish Airlines’ loyalty program, Miles&Smiles, is easy, and the more you earn, the more places you can redeem them for future travel. These are some of the top ways to earn miles:

- Fly Turkish Airlines and credit your flights to Miles&Smiles.

- Fly a Star Alliance airline like United Airlines or Lufthansa as well as partner airlines like Azul or IndiGo and credit your flights to Miles&Smiles.

- Transfer credit card points to Miles&Smiles. The program partners with Bilt Rewards, Capital One Miles and Citi ThankYou points. Generally speaking, they transfer a 1:1 transfer ratio when transferring at least 1,000 points (though some Citi cards have lower transfer rates).

- Transfer points from hotel loyalty programs (we recommend Marriott Bonvoy for the 3:1 transfer ratio).

- Reserve a rental car and give your Miles&Smiles number.

- Book a hotel stay via booking.com and Jolly and earn 2 Miles&Smiles miles for every euro spent.

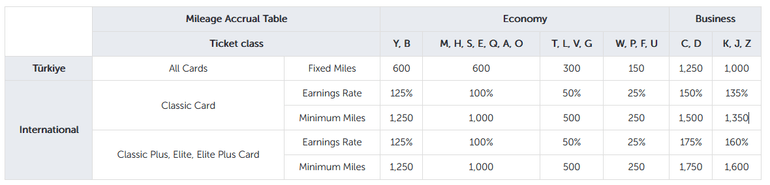

Earn by flying on Turkish Airlines

The Miles&Smiles Turkish Airlines earning chart shows just how many miles you can accrue, depending on your destination and fare type. Domestic flights in Turkey earn based on a fixed amount, while international flying is based on distance, fare type and elite status. Cheaper fare types earn fewer miles than more premium fare types.

Earn with Turkish Airlines partners

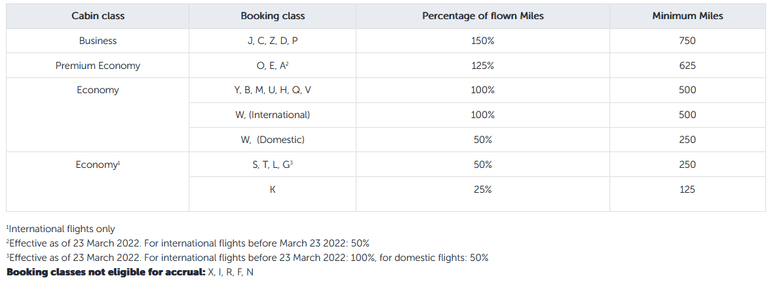

Turkish has two dozen Star Alliance partners, but it also has several other airline partners that allow you to earn miles in its loyalty program.

Each airline has different rules for how many miles you can earn based on the fare class of your ticket and the flight distance. If you book a premium cabin ticket, you'd earn more miles than booking one of the cheapest economy class fares.

This is what you would earn when flying Air Canada but crediting tickets to Turkish Miles&Smiles.

Be sure to pay attention to the restrictions at the bottom of each airline page. For example, Air Canada awards miles only on certain fares in economy class and only when flying an international itinerary.

Earn miles using a credit card

While Turkish Airlines has its own co-branded credit card, it is missing the big perks that other premium cards can provide. Still, many travelers may be interested in applying for it. If not, you can still earn Turkish miles from many other credit cards with transferable points programs.

There are many credit cards that allow transfers to Turkish Miles&Smiles. They include cards that earn in the following programs:

- American Express Membership Rewards.

- Capital One Rewards.

- Citi ThankYou points.

- Numerous other international banks, including Arab Bank and HSBC.

The best U.S.-based programs let you transfer your points to Miles&Smiles at a 1:1 ratio. And you can earn a lot of points with these programs on certain spending categories that you can then transfer to Turkish.

Convert hotel loyalty points to Turkish Airlines miles

While you can transfer points from hotel loyalty programs to airline frequent flyer miles, we don’t usually recommend it. That is because the value you get is greatly reduced when moving points from hotels to airlines. Still, it can be a great way to top up your Turkish account if you are short of just a few miles for a great flight redemption.

Marriott Bonvoy

Marriott allows transfers from its program into Miles&Smiles in 1,000-mile increments. This means you can get close to an award by flying Turkish or its partners and then just add the additional miles needed for your next redemption. The real sweet spot, however, is transferring 60,000 Bonvoy points because you would receive a bonus of 5,000 Turkish Miles&Smiles miles.

You can also choose to earn Turkish miles instead of Marriott Bonvoy points when staying at Marriott Bonvoy hotels. Depending on the Marriott brand, you would earn 1 or 2 miles per $1 spent.

You could also choose to earn Bonvoy points for your stay and then transfer to Miles&Smiles using a ratio of 3 points for 1 Miles&Smiles mile. We recommend this method only if you have top Marriott Bonvoy elite status (or have signed up for one of Marriott’s seasonal promotions) and would earn more points by doing this. It may require a little math, though.

🤓 Nerdy Tip

It’s usually better to earn Bonvoy points and transfer them instead of choosing Turkish miles. For example, you would get 3,000 miles on a $1,500 stay (2 miles per dollar spent) at a Sheraton.But, if you spent $1,500 at a Sheraton and opted to earn Bonvoy points, you’d get at least 10 points per dollar, for a total of 15,000 Bonvoy points (and a lot more if you have elite status or are using a Marriott Bonvoy credit card). Transferring just 15,000 Bonvoy points to Miles&Smiles using the 3:1 ratio would yield 5,000 Turkish Airlines miles, much more than the 3,000 for opting to earn Turkish miles. Accor Live Limitless

You can convert 4,000 Accor points to 2,000 Turkish miles.

Hilton Honors

Hilton Honors points, earned via hotel stays, credit card use and credit card transfers, convert into Miles&Smiles miles at a 10:1 ratio in increments of 10,000 points.

» Learn more: The guide to Hilton transfer partners

IHG One Rewards

You need to choose Turkish Miles&Smiles as your program if you want to earn miles with stays at IHG One Rewards properties. Most IHG brands award 2 miles for every eligible $1 spent. At Staybridge Suites and Candlewood Suites, the earnings drop to 1 mile per $1 instead.

Choice Privileges

The Choice Privileges points program has a 5:1 transfer ratio, but you must transfer at least 5,000 points in one go. You can probably get better value out of these points through other redemptions.

Other ways to earn Turkish Airlines miles

There are other ways to pad your Turkish loyalty balance.

Additional hotel partners

Other hotel programs that offer Turkish miles based on how much you spend include Wyndham Rewards and Serena Hotels.

Car rentals

If you’re renting a car, there are numerous familiar rental brands that award miles for doing business with them.

They include:

- Alamo.

- Avis.

- Budget.

- Enterprise Rent-a-Car.

- Europcar.

- Hertz.

- National Car Rental.

- Sixt.

Travel partners

Several other travel brands award miles for doing business with them.

They include:

- Booking.com.

- Halalbooking.

- RocketMiles.

- Turkish Airlines Holidays.

More ways to earn

Like other airlines, Turkish will sell miles directly at a ratio of 1,000 miles for $30. You can buy as many as 50,000 miles per calendar year. This only makes sense if you need to top up your account or your chosen flights cost more than the miles you are buying.

You can also earn miles by shopping with certain partners, although the list is not as robust as that of other loyalty programs that have their own online shopping portals.

» Learn more: How to choose a travel credit card

How to get top value from Turkish Airlines miles

Like many programs, there are sweet spots for redeeming miles as well as others that produce less value. But there have been some hacks that have cut away at the overall value from Miles&Smiles. Here are the ways to take advantage of what you have in your account.

Fly on Turkish Airlines

Use miles for economy or business class award tickets on Turkish Airlines by studying its new award charts, which include different redemption rates based on if you can score a “promotion” or a standard award ticket.

Recent changes have dampened the fun of the program by requiring more miles in many cases. One of the biggest changes is that now award tickets are priced on a per-segment basis. This can raise the cost of a multi-segment award significantly.

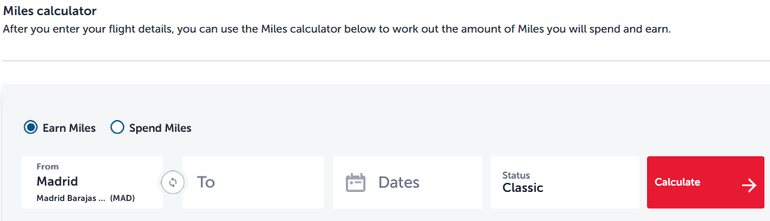

An online mileage calculator helps travelers determine how many miles they need for an award redemption. Recent changes have raised the lowest-tier “promotion” redemption for flights from North America to Turkey.

They now start at 40,000 points per segment in economy and 65,000 points in business class. While it costs more than before, it is still a solid deal since other U.S.-based programs can charge much more.

Fly on partner airlines

A separate award chart for Star Alliance and partner airlines is used for Miles&Smiles redemptions.

There are still some Miles&Smiles sweet spots with valuable redemptions, if you know where to look. One of our favorite Turkish Airlines sweet spots is for redemptions within the same country. This means you could fly a United flight to Hawaii for 10,000 miles per segment in economy or 15,000 miles per segment in the premium cabin.

For example, a round-trip economy flight from Los Angeles to Honolulu would cost 20,000 miles, which is a steal. Starting in Denver and connecting through Los Angeles? The cost, however, would double because of Turkish Airlines’ new per-segment award pricing.

You can also use miles to book award tickets for family and friends or for flight upgrades.

Redeeming for Turkish Airlines flights is a better deal because the mileage cost is lower than with partners, but we love the value that comes from redeeming rewards for flights within the same country (even if on a partner). This could include nonstop transcontinental flights within the U.S. (30,000 round-trip in business class on United is a great deal, if you can find availability).

» Learn more: The best airline credit cards right now

Other ways to spend your Miles&Smiles miles

You can also use your miles for other purchases, but the best value remains when redeeming miles for flights.

- Shop at Shop&Miles. Use your miles to buy from retailers like Godiva and Ikea. If you don’t plan on redeeming miles on flights, this is a great way to liquidate your account in exchange for a few gifts.

- Use miles for fuel. You can redeem miles for gift cards from gas partners like Shell.

Benefits of elite status in Miles&Smiles

If you fly Turkish Airlines and Star Alliance partners enough, you can earn elite status in the Miles&Smiles program. The level of perks you receive grows based on your elite status level.

You can also purchase status miles to boost your status. These are some benefits of each tier, with the status lasting for two years but based upon the previous 12 months to initially earn it.

Classic

This is the lowest level of membership tier and allows flyers to collect Miles&Smiles miles when they fly with Turkish Airlines and Star Alliance Program partners.

As a member, you can book award flights, redeem miles for upgrades and potentially earn miles from credit card transactions. On flights with Wi-Fi, Classic members are treated to unlimited messaging free of charge.

Classic Plus

Classic Plus level membership is earned by accumulating 25,000 status miles.

You get all of the Classic privileges plus:

- Access to business class check-in counters on domestic flights.

- Lounge access for domestic flights in Turkey.

- About 22 pounds (10 kilograms) of extra baggage allowance.

- 250 megabytes of in-flight Wi-Fi.

- Star Alliance Silver card privileges.

Elite

Elite level membership is the award for accumulating 40,000 status miles.

Once reaching Elite status, the perks of Classic and Classic Plus get rolled into the package, as well as:

- Lounge use on domestic and international flights for you and a guest (or spouse and children).

- Private telephone assistance.

- About 44 pounds (20 kilograms) of extra baggage allowance or one extra piece.

- Private entrances and passport control at Istanbul Airport, including when flying AJet.

- 400MB of Wi-Fi when in economy class and unlimited data when in business class.

- 50% discount on second paid business class ticket.

- Free seat selection.

- Star Alliance Gold card benefits.

Elite Plus

Elite Plus is the top-tier Miles&Smiles level, reached after accumulating 80,000 status miles, and comes with some of the most valuable benefits (on top of those offered at the lower tiers). Added perks at this level include:

- Two free cabin upgrades on Turkish Airlines flights.

- Guaranteed seat for certain classes.

- Elite gift card for up to three loved ones.

- About 55 pounds (25 kilograms) of extra baggage allowance or one extra piece.

What makes Turkish Airlines unique?

Turkish Airlines flies to more countries than any other airline via its Istanbul hub. This fact alone puts it in a league of its own. On top of that, Star Alliance membership, a low-fare carrier (AJet), world-class catering from DO&CO (including onboard chefs) and excellent lounges all round out the experience. Turkish has a few other extras that travelers can enjoy, even if not a member of Miles&Smiles.

Free layover hotel in Istanbul

Economy passengers with a 12-hour or more layover in Istanbul (or at least nine hours for business class passengers) benefit from a free hotel stay. The hotel quality is generally excellent with five-star accommodations for business class travelers (up to two days) and four-star hotels for economy travelers for one day.

These are not just airport hotels; they allow people to get out and enjoy Istanbul on an ultra-long layover in Turkey. That equates to a bonus mini-trip on your way to your final destination.

Eligible travelers have to go through immigration and head to the Turkish Airlines hotel desk, which is in the international arrivals section (where you pick up your luggage) at Istanbul Airport. Word of advice: Confirm 72 hours or more in advance if you are eligible for a hotel voucher at the check-in counter.

Not all fares or itineraries are, and the airline publishes a list of potential connecting pairs that offer this service online. If you exit the secure area of the terminal and do not have an onward boarding pass, you will not be able to reenter until your flight opens for check-in.

Among the rules worth noting is that you must be taking the next available connection to your destination. If you are flying from New York to Dubai via Istanbul and have two options (an earlier or later flight), you would not be eligible for a hotel if you take the later one.

In other words, the airline wants to provide the fastest connections possible for travelers. But, on some routes that are less frequently served, there may occasionally be a longer layover. That is why Turkish Airlines offers this benefit.

Also, keep in mind that the connecting flight must be Turkish-operated or a Turkish code-share and all part of the same reservation. The airline selects the hotel for travelers and provides transportation. However, in this author’s experience, a polite request for certain hotels that the airline normally uses is often honored, if available.

Free Istanbul tour

If you have an international flight connecting via Istanbul Airport and have more than six hours between flights, you can take advantage of Touristanbul. It is complimentary and offers tours to famous sites such as Dolmabahçe Palace, the Golden Horn, Taksim Square and Fener Greek Orthodox College.

This is a great way to kill time between flights but is not eligible on itineraries where you have a 24-hour or longer layover between flights.

You can check availability and see what tours are offered each day by entering your reservation details online. Sign up for tours at the hotel desk in the international arrivals section of the airport.

Student and disability discounts

Students with proper identification can earn up to a 20% discount on flights, and passengers with qualifying disabilities can receive savings of 20% on domestic flights and 25% on international flights. They simply need to upload proper documentation to their Miles&Smiles account. Companions on the same reservations also receive the same savings.

Why Turkish Airlines Miles&Smiles is worth exploring

Star Alliance flyers in the U.S. are most likely engaging with regional programs like United MileagePlus or Aeroplan, but if you travel overseas regularly, Turkish Airlines can be your gateway to top-tier benefits, in-flight services and extra perks. Even its economy class experience is superior to that of U.S. carriers, and the cuisine in all cabins wins awards.

Despite recent devaluations, Miles&Smiles remains a valuable program for frequent international travelers.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2026:

- Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

- No annual fee: Wells Fargo Autograph® Card

- Flat-rate travel rewards: Capital One Venture Rewards Credit Card

- Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

- Luxury perks: American Express Platinum Card®

- Business travelers: Ink Business Preferred® Credit Card

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Limited Time Only: Earn $1,000 Toward Travel!

Capital One Venture Rewards Credit Card

Travel

For a limited time, the

Capital One Venture Rewards Credit Card is offering new cardholders an especially rich bonus: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel!

More like this

Related articles