A Beginner’s Guide to Traveling on Points and Miles

Ready to get started with points and miles? Here's what you need to know.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

Welcome to the world of travel rewards! Whether you're dreaming of business class flights to Tokyo, free beach vacations or simply want to visit family without breaking the bank, this guide will show you how to make it happen with miles and points.

You don't need to be a frequent flyer or travel expert to benefit. Even occasional travelers can score free flights and hotel stays by following a few simple strategies.

» Learn more: The best travel credit cards might surprise you

On this page

- 1. Set up your travel goals

- 2. Understand the different types of points and miles

- What are the best airline and hotel rewards programs?

- 3. Get your finances ready

- 4. Earn points fast with welcome bonuses

- 5. Maximize your everyday spending

- 6. Redeem points like a pro

- 7. Use transferable points strategically

- Advice from the pros for getting started with points and miles

By signing up, you will receive newsletters and promotional content and agree to our Terms of Use and acknowledge the data practices in our Privacy Policy. You may unsubscribe at any time.

1. Set up your travel goals

Before diving into credit cards and loyalty programs, take a moment to think about what you actually want.

Common travel goals:

- Premium experiences: Fly business or first class internationally and stay at luxury hotels.

- Family visits: Use miles for economy flights to see loved ones regularly.

- Budget travel: Maximize free night certificates, lounge access and complimentary breakfast to travel more affordably.

- Dream destinations: Visit specific places like Japan, Europe or the Caribbean.

Once you know where you want to go, you can focus your strategy. For example, if your family lives in Atlanta (a Delta Air Lines hub), prioritize earning Delta SkyMiles. If you're dreaming of Japan, find out which airlines offer the best routes from your home airport and then target earning credit card points that can be transferred or redeemed for travel with that airline.

With an understanding of your goals (and where you'll travel), you can better focus your strategy in the next steps.

» Learn more: Are travel credit cards worth it?

2. Understand the different types of points and miles

Think of points and miles like different currencies. Just as 100,000 Japanese yen isn't worth the same as 100,000 U.S. dollars, 100,000 points in one program can be worth vastly different amounts than 100,000 points in another.

» Learn more: What are travel points worth and why do they matter?

Airline miles

Airline miles are specific to each airline. Common ways to earn them include:

- Flying with that airline (or their partners).

- Using the airline's co-branded credit card.

- Shopping through airline portals.

For example, you might earn United MileagePlus miles through flying with United Airlines. Or, you might use one of United's co-branded credit cards, such as the United℠ Explorer Card, which earns United miles every time the card is swiped. Some purchases earn more miles than others. For instance, the United℠ Explorer Card earns 2 United miles per $1 on restaurants and hotels, and 1 United mile per dollar on everything else. Then, you can redeem miles for award tickets on that airline (and its partners).

Popular domestic airline frequent flyer programs

- Atmos Rewards: Alaska Airlines and Hawaiian Airlines' joint loyalty program is great for West Coast travel and award tickets on Cathay Pacific to Asia.

- American Airlines AAdvantage: Useful for low award rates to Europe in the fall and winter.

- Delta SkyMiles: Good for last-minute bookings; no “close-in fees” for tickets booked less than 21 days before travel.

- Southwest Airlines Rapid Rewards: Generally good award availability.

- United MileagePlus: Usually has the highest award availability due to Star Alliance membership.

Popular international airline frequent flyer programs

- Air Canada Aeroplan: No 21-day close-in booking fees.

- Air France/KLM FlyingBlue: Offers discounted monthly Promo Rewards.

- British Airways Club: Distance-based award chart makes it great for short-haul award flights.

- Virgin Atlantic Flying Club: Excellent premium economy experience for low number of points (despite high taxes).

Hotel points

Hotel points work similarly to airline miles. You typically earn them through:

- Staying at hotels in that chain.

- Using the hotel's co-branded credit card.

Some of these cards offer bonus points in certain categories. For example, the World of Hyatt Credit Card earns 2 points per dollar spent at fitness clubs or on gym memberships.

And many offer big bonus points on spending at that actual hotel brand. For example, the Marriott Bonvoy Boundless® Credit Card earns up to 17 total points per dollar spent at over 7,000 participating Marriott hotels.

Hotel points are sometimes redeemable for things like gift cards (and can sometimes be transferred to airlines), but they're generally most valuable when used to book rooms.

Popular hotel rewards programs

Transferable credit card points

These are the most flexible rewards because you can transfer them to multiple airline and hotel partners. The major transferable point programs are:

These points tend to offer multiple redemption options, such as gift cards, cash back or by transferring to specific hotel or airline partners. And those transfers can sometimes make for the best redemption.

For example, a Chase Ultimate Rewards® point is worth just 1 cent when exchanged for cash. But they transfer 1:1 to World of Hyatt. Considering NerdWallet values Hyatt points at 1.8 cents each, that's a much better redemption (assuming you'd stay at a Hyatt).

What are the best airline and hotel rewards programs?

NerdWallet conducts an annual comprehensive, domestic industry-wide analysis of airlines and hotels to find the best rewards programs.

The Atmos Rewards program scored the top spot in our rankings of the best airline loyalty programs for 2026. Here's how all the big frequent flyer programs stack up:

On the hotel side, Hyatt retained its No. 1 position as the best hotel rewards program.

Of course, the best travel loyalty program for you depends on how much you spend on travel, how often you fly or stay at hotels and what credit cards you have. If you have more access to certain brands (i.e., live near a Southwest hub) or prefer to stay at a Marriott, for instance, take that into account before committing to earning rewards exclusively with a certain loyalty program. Here is our full analysis of travel rewards programs in 2026.

3. Get your finances ready

Before applying for travel credit cards, make sure you're in good financial shape.

Check your credit score: Most travel rewards cards require excellent credit scores (720 and up). If yours is lower, work on improving your credit first.

Pay bills in full each month: This is non-negotiable. Credit card interest rates are high, and paying interest completely erases any rewards you earn. Travel rewards should save you money, not put you in debt.

Use credit cards instead of cash or debit cards: The more you use your rewards credit card for everyday purchases, the more points you'll earn. Just stick to your normal spending (so don't buy things you don't need just to earn points).

» Learn more: How do travel credit cards work?

4. Earn points fast with welcome bonuses

Credit card welcome bonuses are typically the fastest way to accumulate a large number of points. These bonuses can range from 50,000 to 175,000+ points, often worth $500 to $2,000+ in travel.

How welcome bonuses work: You typically need to spend a certain amount within the first 3-6 months. For example, "Earn 75,000 points after spending $5,000 in the first 3 months."

🤓 Nerdy Tip

Time your credit card application with a big purchase (like holiday shopping or a home renovation) to make meeting the spending requirement easier. » Learn more: The best travel credit card bonus offers available now

Airline credit cards

- Alaska and Hawaiian Airlines: The Atmos™ Rewards Ascent Visa Signature® credit card earns 3 points for every $1 spent on eligible Alaska Airlines and Hawaiian Airlines purchases, 2 points for every $1 spent on eligible gas, EV charging station, cable, streaming services, and local transit, including ride share purchases, and 1 point for every $1 spent on all other purchases.

- United Airlines: The United Club℠ Card has a high annual fee: $695. Despite the high annual fee, the card offers 4 United miles per $1 on United purchases, 2 United miles per $1 on restaurants and travel, a United Club membership, a $120 statement credit toward Global Entry, and much more.

» Learn more: NerdWallet’s best airline credit cards

Hotel credit cards

- Marriott Bonvoy: Here’s the current offer on the Marriott Bonvoy Boundless® Credit Card: Earn 5 Free Night Awards (each night valued up to 50,000 points) after spending $3,000 on eligible purchases within 3 months of account opening with the Marriott Bonvoy Boundless® Credit Card. Certain hotels have resort fees. The card also comes with an annual free night certificate worth up to 35,000 points and a ton of other perks. The annual fee is $95.

- Hilton Honors: The Hilton Honors American Express Business Card provides another excellent offer: Earn 175,000 Hilton Honors Bonus Points plus a Free Night Reward after you spend $8,000 in purchases on the Hilton Honors Business Card in the first six months of Card Membership. Offer ends 4/15/2026. Terms Apply. The annual fee is $195. With this card, you’ll earn 12 points per $1 on Hilton purchases. You'll also get 5 points per $1 on other eligible purchases for the first $100,000 in a calendar year (and 3 points per $1 thereafter). Terms apply. If Hilton hotels are your thing, this is a great card to have. To view rates and fees of The Hilton Honors American Express Business Card, see this page.

» Learn more: NerdWallet’s best hotel credit cards

Transferable point credit cards

- Chase Ultimate Rewards®: Here’s the current offer on the Chase Sapphire Preferred® Card: Earn 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening. On this card, you’ll earn 2 points per $1 on travel (5 points per $1 if you book travel through Chase' travel portal), 3 points per $1 dining at restaurants worldwide, select streaming services and online grocery purchases (excluding Target, Walmart and wholesale clubs) and 1 point per dollar on all other purchases. The card has a $95 annual fee.

- American Express Membership Rewards: The American Express Platinum Card® currently has the following welcome offer: You may be eligible for as high as 175,000 Membership Rewards® Points after spending $12,000 in eligible purchases on your new Card in your first 6 months of Membership. Welcome offers vary and you may not be eligible for an offer. Terms apply. With this card, you’ll earn 5 Membership Rewards® points per $1 spent on flights and prepaid hotels booked on AmExTravel.com (on up to $500,000 per calendar year). You'll also get a $200 annual airline credit for incidentals (enrollment required)*, up to $200 a year in Uber Cash when you use your card to pay for U.S. Uber Eats orders or rides (enrollment required) and many other benefits. Although the annual fee is $895, the card provides various annual credits that offset the fee. Terms apply (see rates and fees). This is an excellent premium travel card.

- Citi ThankYou: The Citi Strata Premier® Card has the following sign-up offer: Earn 60,000 bonus ThankYou® Points after spending $4,000 in the first 3 months of account opening, redeemable for $600 in gift cards or travel rewards at thankyou.com. The annual fee is $95. You will also earn 3 points per $1 at restaurants, supermarkets, gas stations, flights and hotels. The points can also be transferred to a number of airline and hotels programs, and there are no foreign transaction fees.

- Capital One Miles: The Capital One Venture Rewards Credit Card has the following welcome bonus: LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel. The annual fee is $95. You earn 2 miles per $1 on all purchases and there are no foreign transaction fees. You will also receive a statement credit toward Global Entry or TSA PreCheck.

» Learn more: How to choose a travel credit card

5. Maximize your everyday spending

Once you have your cards, use them strategically.

Use bonus categories to earn more points: Some credit cards offer bonus points for spending in certain categories. For example, the Chase Sapphire Preferred® Card earns bonus points on travel and dining at restaurants. So, if you hold this card along with another credit card, you’d probably use the Chase Sapphire Preferred® Card for all your travel and dining expenses.

Consider cards with rotating bonus categories: Though bonus categories can be annoying to keep track of, they can provide a great opportunity to earn big cash back.

For example, during the last quarter of 2025, Chase Freedom Flex® cardholders could have earned 5% cash back on up to $1,500 spent at Chase's travel portal, department stores, Old Navy and PayPal. Between holiday shopping or December donations to charity made through PayPal, it might be easy to earn 5% back on a full $1,500 in spending that quarter.

Maximize the Chase trifecta strategy: Speaking of the Chase Freedom Flex® (plus other Chase cards that earn Chase Ultimate Rewards® points such as the Chase Freedom Unlimited®), you can further maximize points through what's called the Chase trifecta.

If you hold a premium travel card like the Chase Sapphire Preferred® Card, you can pool your points on an account with 1:1 transfer partners or more valuable redemption options in Chase's travel portal.

Book flights and hotel stays: Each time you book a flight or make a hotel reservation, make sure that you’ve registered for the airline or hotel chain’s loyalty program and input your loyalty number into the reservation. This is a straightforward way to earn travel rewards.

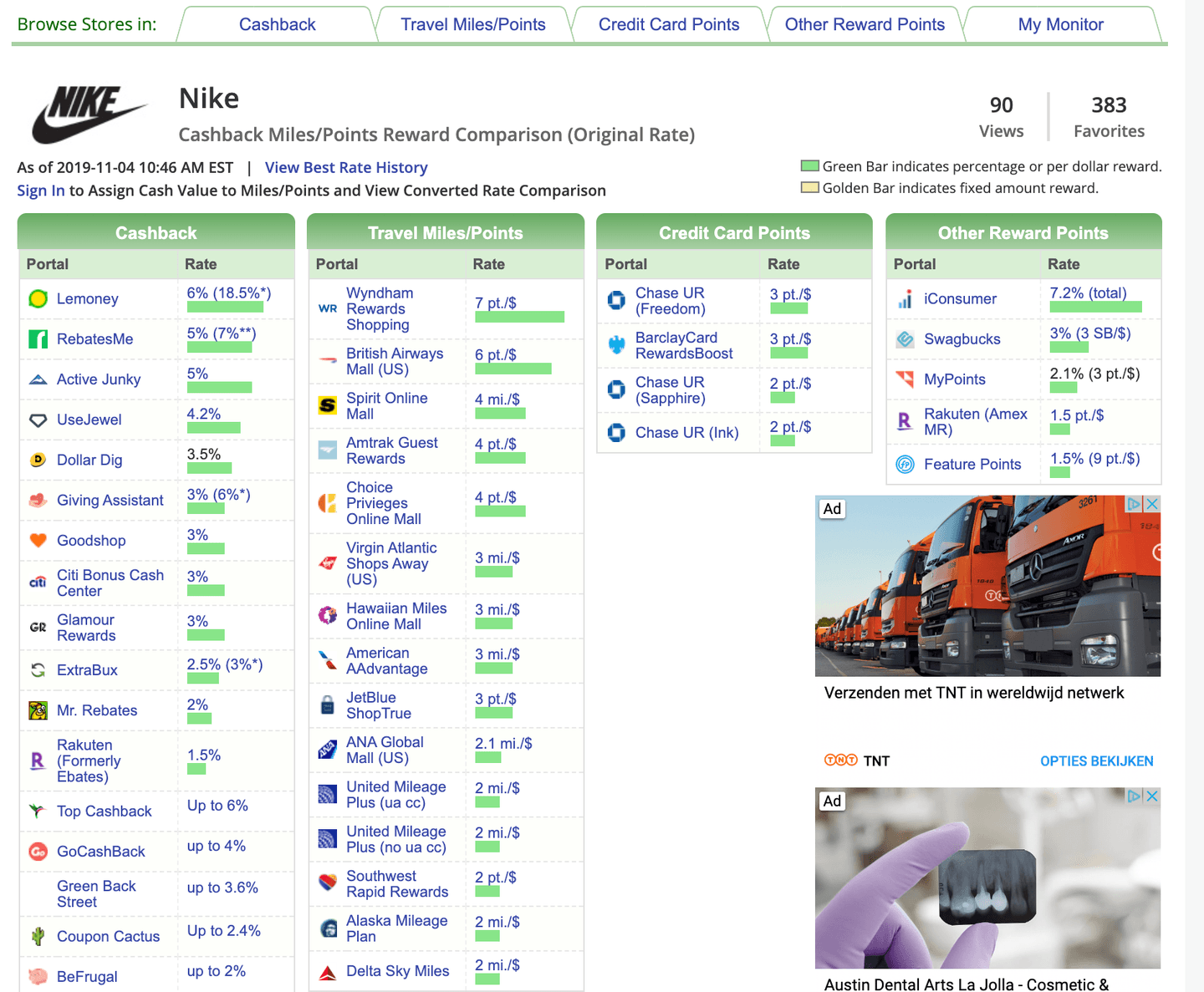

Shoponline via shopping portals: CashbackMonitor lists all shopping portals currently offering cash back, airline miles, hotel points or credit card points (transferable points).

Let’s say, for example, you're shopping on Nike.com. Check CashbackMonitor for current shopping portal offers.

As seen above, many shopping portals offer cash back for Nike.com purchases. To earn the points, simply click on the portal you want to earn points with. For example, you could opt to earn 6 British Airways Avios per $1 spent, 2 United miles per $1, or 3 Chase Ultimate Rewards® points per $1 spent (at the time of this offer).

These portal points are in addition to what you’ll earn from spending on your credit card.

Dine at restaurants and earn points or miles (U.S. only): Dining rewards programs let you earn airline frequent flyer or hotel loyalty points just by dining at a participating restaurant. First, you sign up for an account with a dining program and add a credit card to your account.

When you dine at a participating restaurant and use the card on file, frequent flyer miles will automatically post to your dining account. Currently, Alaska Airlines, American Airlines, Delta, JetBlue Airways, Southwest, Spirit, United, Hilton and IHG offer dining programs.

Most dining programs are run by the Rewards Network, so you can earn loyalty points on only one program at a time. At this time, only U.S. restaurants participate in the dining programs.

6. Redeem points like a pro

There are good and bad ways to use miles and points. And then, there are some really good ways to redeem points. Here are NerdWallet's tricks for maximizing redemptions:

Redeem points or miles for airfare

Most travelers redeem frequent flyer miles for award seats on that same airline.

But some airlines are members of alliances, which means they have codeshare agreements that allow passengers to fly on one another’s flights and earn/redeem miles with each other.

For example, United Airlines and Lufthansa are members of Star Alliance. So, if you fly on Lufthansa, you can input your United Airlines MileagePlus number on the reservation and earn United miles.

Redemptions work the same way. You can use United miles on United.com to book a Lufthansa award ticket. Sometimes, this can make for a more valuable redemption.

The three main alliances are:

Star Alliance is the largest of the three, providing the most flexibility for earning and redeeming miles.

When applying for an airline credit card, consider not just how frequently you fly that airline, but also which partner airlines you want to fly and redeem points with.

» Learn more: Your guide to airline alliances

Redeem points for hotel stays

The six largest hotel brands with rewards programs are:

To use your points with each of these programs, search for hotel rooms through the website or app, usually selecting “use points” or a similar function on the search tool. For some programs, you must be logged into your reward account to search.

Unlike airlines, which offer spotty award availability, most hotels offer award availability whenever rooms are available. This makes it much easier to use these points, especially when booking at the last minute.

» Learn more: How to choose between hotel loyalty programs

Redeem points for rental cars

Unlike airlines and hotels, which follow similar rules across most brands and programs, rental car rewards are more like the Wild West. Each program has its own rules for earning and using points.

That said, the basic reward approach applies: You’ll earn points or credits by using a single rental car company, which you can then use to book future travel. The best tip is to stick with one program for enough consecutive rentals to make use of the rewards.

7. Use transferable points strategically

If you have a card that earns Chase Ultimate Rewards®, American Express Membership Rewards, Citi ThankYou or Capital One Miles, you can transfer points from those cards to member airlines or hotels.

The advantage of having credit card points is that you can keep your points in their most versatile form (with the issuer’s program) until you are ready to transfer them to an airline or hotel. Once transferred, the points cannot be refunded back.

Chase Ultimate Rewards® transfer partners

There are more than a dozen Chase transfer partners. The best Chase transfer partners include World of Hyatt, Virgin Atlantic Flying Club and JetBlue TrueBlue.

American Express Membership Rewards transfer partners

AmEx has even more transfer partners than Chase. The AmEx transfer ratios vary by program, but most are 1-to-1. Still, some can be as high as 1-to-2, which means that one AmEx point will become two hotel or airline points.

Citi ThankYou transfer partners

Citi’s transfer partners include more than a dozen airlines and five hotels, depending on the credit card you have.

Capital One Miles transfer partners

Capital One has been on a tear adding new partners. It's also worked to improve redemption value for customers, making this program a rising star in the loyalty program space.

Advice from the pros for getting started with points and miles

Earn points if you’re an infrequent traveler

One of the biggest misconceptions about travel rewards is that they are only useful for frequent travelers. After all, weren’t the original rewards called “frequent flyer” programs for a reason?

Infrequent travelers can get just as much value from these rewards by focusing on a few priorities:

- Target big welcome bonuses. The welcome bonuses on credit cards, which are the points or miles you earn for signing up and hitting a minimum spending threshold, are not fixed. These cards will boost their bonuses periodically or add other valuable perks.

- Don’t chase travel-based promotions. Airlines and hotels will run deals to earn X number of points by taking Y number of flights or booking Z nights at a hotel. These are great for travel junkies, but not worth chasing or paying attention to if you aren’t.

- Set your spending categories and forget them. Different cards earn different numbers of points and miles based on where you use them, as described above. But you don’t want to have to do the math at every checkout. Give yourself easy reminders (including taping notes to your cards) so you know which one to use on gas, groceries, dining, etc.

Redeem points for good-enough value

Even here at NerdWallet, we're guilty of focusing on “maximizing” value. On the surface, that makes sense — isn’t that what we’re trying to do with all currency, from dollars to miles?

Yet it’s important to accept good-enough reward redemptions, especially when starting with this hobby. Your goal should be to offset or eliminate the cost of your travel goals, not to fly around the world in first class (unless that is your goal). In other words, the way to get the most objective value from your points might not align with your other priorities.

Keep it simple:

- Use the 80/20 rule to avoid perfectionism. Look for easy redemptions that check most of your boxes. Don’t labor four hours looking for the perfect redemption — it likely doesn’t exist.

- Make sure you’re getting the baseline value for a given travel currency by using a calculator. If a given flight or hotel stay gives you above-average value, that’s good enough.

- Have fun. If slogging through award calendars searching for availability is starting to feel like a chore, take a step back and find another, easier strategy.

Avoid common pitfalls

If travel rewards were easy, everybody would be doing it. The companies that run these programs want to entice you with big welcome bonuses and flashy promotions, but often make the work of actually redeeming points and miles confusing and complicated.

Here are some common pitfalls to avoid as a beginner:

- Don’t try to learn everything. What’s a fare class? What are United Airlines’ stopover rules? The travel rewards world is full of jargon, regulations and know-it-all experts. Don’t try to learn it all before you start, or you’ll never start. Stick to your goals and learn what you need to achieve them. Your knowledge will naturally expand.

- Don’t hoard your points. Saving money is a good thing, as its value can increase over time. Saving travel points, on the other hand, is generally a bad financial move, as they generally devalue over time. Don’t just earn points. Spend them!

- Don’t chase value. Booking a business-class flight to Norway in January might offer the best bang for your points, but … do you really want to visit Norway in January?

*More from American Express

American Express relies on airlines to submit the correct information on airline transactions to identify incidental fee purchases. If you do not see a credit for a qualifying incidental purchase on your eligible Card after 8 weeks, simply call the number on the back of your Card. Qualifying airlines are subject to change. See terms & conditions for more details

To view rates and fees of the American Express® Business Gold Card, see this page. To view rates and fees of The Business Platinum Card® from American Express, see this page. To view rates and fees of The Hilton Honors American Express Business Card, see this page. To view rates and fees of the American Express Platinum Card®, see this page.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2026:

- Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

- No annual fee: Wells Fargo Autograph® Card

- Flat-rate travel rewards: Capital One Venture Rewards Credit Card

- Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

- Luxury perks: American Express Platinum Card®

- Business travelers: Ink Business Preferred® Credit Card

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Limited Time Only: Earn $1,000 Toward Travel!

Capital One Venture Rewards Credit Card

Travel

For a limited time, the

Capital One Venture Rewards Credit Card is offering new cardholders an especially rich bonus: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel!

More like this

Related articles