What Is a Good Credit Score and How Do I Get One?

On a scale of 300-850, a "good" credit score falls somewhere in the mid-600s to mid-700s. Learn how to get a good score and what opportunities it unlocks.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

What is a good credit score?

A good credit score typically falls in the mid-600s to mid-700s on the commonly used 300-850 credit score range. Scores in the high 700s and above are generally considered excellent, while scores in the low 600s to mid-500s are considered fair. Scores between 300 to low 500s fall into the bad credit score range.

Lenders, such as credit card issuers and mortgage providers, may set their own standards on what "good credit" means as they decide whether to extend credit to you and at what interest rate

FICO vs. VantageScore

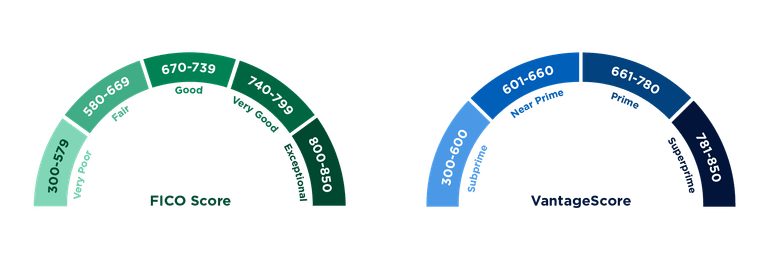

There are two major credit scoring companies, FICO and VantageScore. FICO, the most widely known credit scoring system, and its competitor VantageScore both use the same 300-850 credit score range. However, the two systems group good credit scores slightly differently.

A good FICO score is 670 to 739, according to the company's website. A good VantageScore is 661 to 780, which the company calls a "prime" credit tier.

Both companies use data about consumers from the three major credit reporting bureaus: TransUnion, Equifax and Experian.

There are other industry-specific credit scores that vary slightly, like the FICO Auto score, which can fall between 250 and 900.

How to get a good credit score

If you want to improve your credit score, you'll need to establish good credit habits and practice them consistently. Here's a list of financial habits that have the biggest impact on your score:

Pay bills on time

Payment history has the largest impact of all the factors that make up your score. A missed or late payment can do tremendous damage to a credit score and it can stay on your credit report for up to seven years. Luckily, the effect on your score will dwindle over time.

Keep credit utilization below 30%

Keeping your credit card balances well below your credit limits is a great financial habit. You should aim to use 30% or less of your available credit.

High utilization dings your score, but the damage will fade when you're able to reduce your balances and the lower utilization shows up on your credit reports. You also may be able to lower utilization by getting a higher credit limit or becoming an authorized user on a lightly used card with a large limit.

Leave credit cards open

Keeping older accounts open helps your average age of accounts, which has a small influence on your score. Closing an account cuts into your overall credit limit, driving up your credit utilization. However, there are some compelling reasons to close an account, including high fees or poor service.

Space out credit applications

Avoid making several credit applications in a short time frame. Credit checks for the purpose of credit decisions can cause a small, temporary dip in your score, and several in a short time can add up. That's why it's important to research credit cards before you apply.

Monitor your credit reports

Monitor your credit reports and dispute information you think is incorrect or too old to be included (most negative information falls off after seven years). Errors could lower your scores.

What a good credit score can get you

Having good credit matters because it determines whether you can borrow money and how much you'll pay in interest to do so.

A good credit score can also help you get approved for credit cards with higher credit limits, extra benefits and other incentives. In many states, people with higher credit-based insurance scores pay less for car insurance.

Here are some other things a good credit score can help you get:

An unsecured credit card with a decent interest rate, or even a balance-transfer card.

A desirable car loan or lease. If your credit score is around 700 or below, prepare for questions about negative items on your credit record when shopping for a car.

A mortgage with a favorable interest rate. You don’t need flawless credit to get a mortgage. In some cases, credit scores can be in the 500s. But credit scores estimate the risk that you won’t repay as agreed, so lenders do reward higher scores with lower interest rates.

An upper hand in the rental application process. Landlords or property managers use credit scores to screen tenants, although they generally aren't looking for immaculate scores. They're more interested in your credit record.

The ability to open new credit. This flexibility can help you cover expenses in a crisis or grant access to specialty rewards and travel cards. Being able to open a new line of credit when needed is a real benefit of having a good score.

What is the highest credit score?

The highest score you can have on the most widely used scales is 850.

It might feel like a fun challenge to try to hit that 850 number, but even if you do get there, the fluctuating nature of credit scores means you're unlikely to keep it month after month.

The reality is, you don't need a perfect credit score to get the best deals. A score in the high 700s or greater is generally considered excellent. And scoring 800 or above qualifies you for the best terms offered.