H&R Block Review 2026: Pricing, Features, Ease of Use

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

H&R Block's e-filing tax products are intuitive and easy to use, and the free version offers filers a robust selection of forms, making it our top pick for best free tax software. Although it’s not the most expensive of the tax programs we reviewed, H&R Block's online tax software isn’t the cheapest either.

So what else makes H&R Block stand apart from the crowd? Access to tax pros.

If you’re a filer who needs some help along the way, you’ll find plenty of options at H&R Block. With the exception of the free tier, all of the company’s online DIY packages include unlimited help at no additional cost. This grants you access to unlimited chat or video sessions with a trained tax pro throughout your filing process.

And if you find yourself wanting face-to-face help, H&R Block is also a top choice: You can make an appointment at one of the company’s 9,000 brick-and-mortar locations throughout the U.S.

How much does tax prep cost with H&R Block?

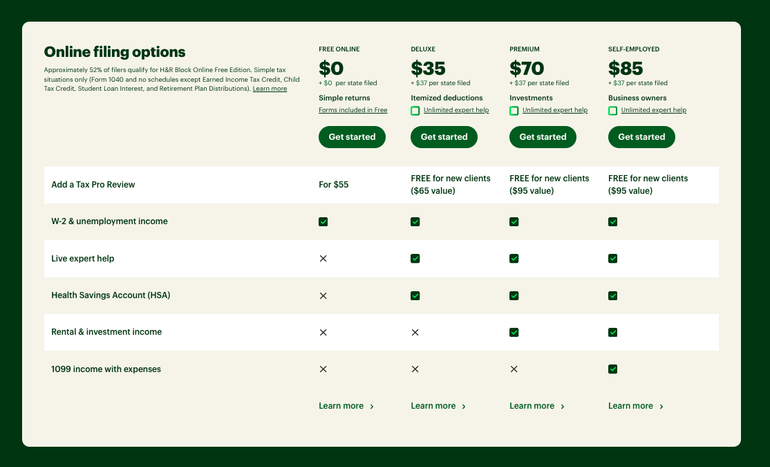

Free version

Like the free tax software from most of its competitors, H&R Block Free lets filers with relatively simple tax situations file both state and federal returns at no cost. This means if you just need to turn in your Form 1040 or take basic credits, like the earned income tax credit or child tax credit, this package might be a good fit for you. It can also handle unemployment income and deductions for tax on tips and overtime pay.

H&R Block’s free package also lets you file Schedule 1-A and limited Schedules 1, 2 and 3 of Form 1040, which is a big bonus, because many taxpayers need to file those forms to report things such as deductible student loan interest, certain retirement contributions, alimony and the lifetime learning credit. The caveat here is that you may need to upgrade if the specific form you need to finish your schedule isn’t included. The provider says that roughly 52% of filers are eligible for the free version.

| |

FREE | $0 + $0 per state filed. Allows you to file a 1040 plus earned income credit, child tax credit, student loan interest, Schedule 1-A, and limited Schedules 1, 2 and 3, which makes it usable by a lot more people than most other free software packages. |

Paid packages

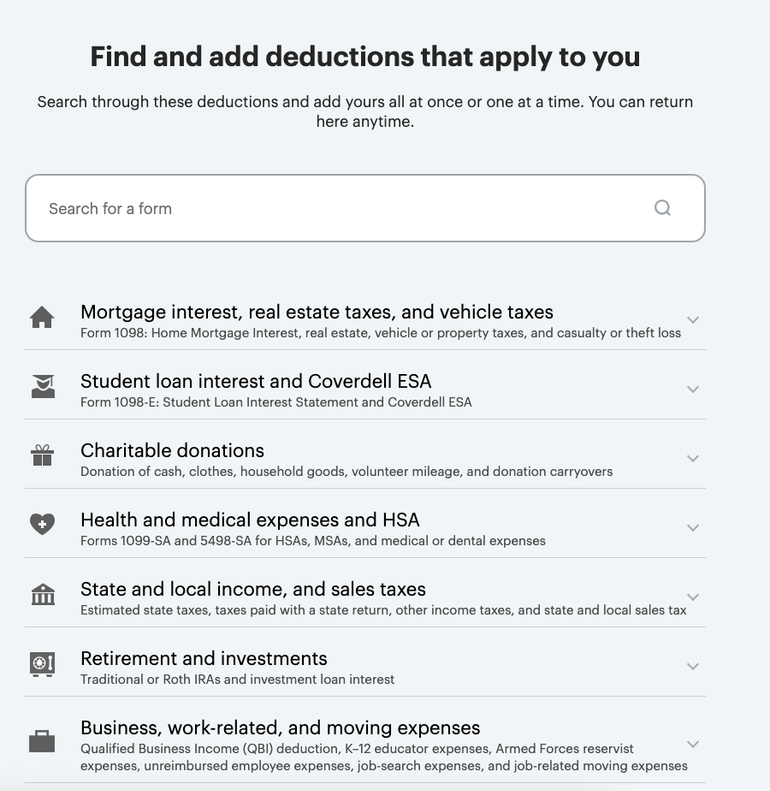

While H&R Block's free version has expanded capabilities, if you plan to itemize deductions, were a landlord, freelanced, sold crypto, contributed to an HSA, ran a small business or had any other complex situations going on, you’ll probably need to upgrade to one of H&R Block’s paid packages.

One bonus for H&R Block is that the paid packages — Deluxe, Premium and Self-Employed — include expert help. In previous years, getting access to human tax help meant that H&R Block users had to upgrade to the company’s higher-priced “Online Assist” packages. Now, assistance comes standard.

If you want a final review, however, you’ll have to upgrade to Tax Pro Review.

| |

PAID PACKAGES | Deluxe $35 + $37 per state. Itemize and claim several tax deductions and credits. Works well for business income but no expenses. Premium $70 + $37 per state. For investors or rental property owners (Schedules D and E, and K-1s). Self-Employed $85 + $37 per state. For small-business owners, freelancers and independent contractors. All paid packages include unlimited tax pro help and AI Tax Assist. Promotion: NerdWallet users receive 20% off federal filing costs. |

One note about prices: Providers frequently change them. Prices are accurate as of Feb. 3 and are based on the information provided on H&R Block's website. Discounted services and packages may be available toward the beginning of the tax filing season, but these markdowns tend to be replaced with surge pricing closer to the tax filing deadline and afterward. You can verify the latest price by clicking through to H&R Block’s site

H&R Block also offers desktop software, where your return doesn't reside in the cloud, but it’s not part of our review.

How we nerd out testing DIY tax software 🤓

Our reviewers — who are writers and editors on NerdWallet’s content team — do hands-on testing of every online DIY tax program featured in our analysis. By using these programs ourselves, we can provide detailed insights into the user experience.

We evaluate each tax software based on specific features and the actual experience of filing taxes using those features. This includes but is not limited to analyzing navigation, ease of accessing help, available import options and the quality of contextual guidance provided to users.

To ensure fairness and eliminate bias, our team collaborates to compare user experiences across products. Scoring is based on clearly defined criteria, which are weighted equally in the overall score. This approach ensures a balanced and reliable assessment of each tax software product.

Transparency: What’s clear — and what’s not

As a prospective customer, few things are more frustrating than having to dig for basic information about pricing and product features. Being able to understand what you need — and how much it will cost — should be table stakes. This year, we evaluated each provider on specific aspects of transparency, including how easy it was to compare product offerings before signing up, how easy it was to downgrade or upgrade packages once using the software, and how intrusive upselling was throughout the filing experience.

Product comparison

H&R Block offers a range of tax products, including DIY, full-service and in-person preparation. When it comes to how easy it is for customers to compare DIY offerings, H&R Block does a solid job of presenting information in a clear, helpful way.

The DIY comparison module — which outlines the differences between the Deluxe, Premium and Self-Employed packages — is accessible within one click of the homepage, though the homepage language guiding you to the comparison module could be clearer. Some customers may be unintentionally funneled into a different section of the website or into a personal recommendation filter, which isn’t ideal. Still, compared with TurboTax, H&R Block makes it relatively easy to compare which tax situations each product covers and pricing. Users can also navigate to each package’s landing page to learn more with relative ease.

Upselling

Upselling can be annoying — and when it becomes too frequent, it can be disruptive.

In our testing, H&R Block’s upselling felt somewhat intrusive, though not nearly as frequent as that of some other providers. Customers encounter full-page ads for optional add-on services such as audit defense, Tax Pro Review and Spruce debit cards. As with TurboTax, we found that skipping these ads often required extra steps, as the upsell option was typically highlighted. In one instance, an editor accidentally added a service she didn’t intend to purchase because of the design — an experience we found concerning.

Upgrading and downgrading

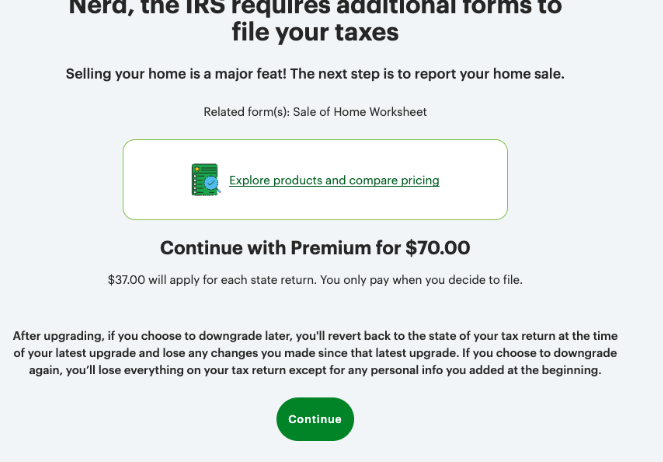

In 2025, the FTC required H&R Block to update its downgrade process, ruling that the company’s prior approach harmed consumers. Previously, customers were forced to contact customer service to downgrade, after which their information was wiped, requiring them to restart their return.

Since the ruling, H&R Block has significantly improved the process, making it much easier to switch package types with the click of a button in the side rail of its online DIY products. If you need to downgrade your package after upgrading, only partial information will carry over into the new return. While this represents a meaningful improvement, we found there is still room for refinement. Certain aspects of the return that aren’t tied to premium features — such as additional dependents added when using a pricier tier — could reasonably be carried over to a lower-tier package.

On the other side of the coin, H&R Block does a good job of explaining why an upgrade would be needed with clarity and transparency. Should you attempt to add a form, income or information not covered by your package, the software will flag that an upgrade is required and allow you to compare product options. It also discloses pricing before moving forward in your return.

What it’s like to use

How it works

H&R Block's online filing software follows the popular model of a friendly chat with a tax pro. If you're a new user, you'll be asked to select a series of prompts that applied to your tax situation in the last year, such as if you have kids, own a home, had a health savings account, or donated to charity.

Based on the information provided, H&R Block will match you with one of its many available packages. You can either agree with its suggestion or choose a different product. If you're a returning user, your information is auto-populated from last year, which makes modifying or adding new details easier.

As with most other providers, your actual tax return — the form that gets submitted to the IRS — is filled out piecemeal and behind the scenes. The program runs you through a series of questions to determine eligibility for certain tax breaks or assess reporting requirements.

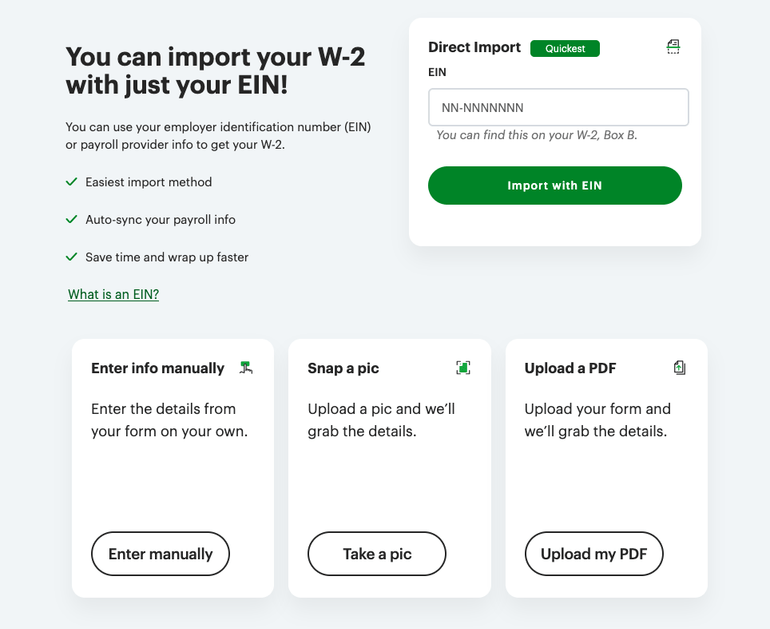

Questions are posed simply, with helpful contextual information and links made available as needed. The program also allows you to automatically import or upload photos of select tax forms, such as your W-2 and some 1099s, to save you time when adding your income and wages.

Notably, we found the basic chat function included with the free product largely unhelpful. In our experience, it often got stuck in repetitive loops when it couldn’t answer a question and struggled with basic technical questions (such as where to upload 1099-INT information). Upgrading to a paid package unlocks AI Tax Assist, which offers more useful and accurate responses. However, it’s worth noting that more capable AI assistance comes standard with TurboTax’s free package.

What it looks like

H&R Block’s interface is visually simple, straightforward, and easy to use, and it explains concepts as you go. Beginners and seasoned filers alike will find the program very navigable and appreciate the intuitive roadmap.

Skipping around to specific sections can be a little trickier than it needs to be — the program won’t let you pick and choose which parts of the return to fill out first — but a banner across the top keeps track of where you are in the filing process. We also found that the Q&A portion was a little less comprehensive than TurboTax's, leaving customers to potentially work a little harder to find some forms.

All that said, H&R Block still shines when it comes to overall design. Embedded links provide more information about topics without having to wander around, the help menu is visible from all pages, and you can click to access the H&R Block searchable database and — for paid users — H&R Block AI assist and tax pro support.

A shopping cart button up top tells you which package you’re buying, whether you’ve also selected add-ons, and how much your total software bill is so far. It also keeps track of your total refund but doesn’t give you too much insight into how that total is determined until the end of your filing experience.

Notable features and tools

You can switch from another provider: H&R Block can import last year’s return from an H&R Block or TurboTax data file, or you can import a PDF of your tax return from any provider. For former TurboTax users, the switch is potentially even easier: You can port up to 150 fields from your prior-year return by simply entering your phone number.

Auto-import certain tax documents: You can import your W-2 from your employer (via PDF or direct import if your payroll provider is partnered with H&R Block), which lets you avoid time spent keying in numbers from little boxes. You also have the choice to upload a photo of it. You can also import many kinds of 1099s, and the Self-Employed version lets you import your 1099-K or 1099-MISC directly from Uber if you have a driver’s account.

Donation calculator: The Deluxe, Premium and Self-Employed packages also integrate DeductionPro, which helps calculate the deduction value of donated clothes, household items and other objects. Notably, TurboTax discontinued its version of this product — ItsDeductible — this year, so if donation assistance is important to you as an itemizer, H&R Block might offer more value here.

Crypto support: H&R's integration with CoinTracker eliminates one of the biggest pain points for crypto investors: manual entry. Premium and Self-Employed users can link their CoinTracker accounts to automatically import their crypto transactions.

Platform mobility: Because the software is online, you can log in from other devices if you choose to work on your return here and there. There’s also a mobile app available.

Ways to get human tax help

Three notable support offerings from H&R Block are Unlimited expert help, Tax Pro Review and H&R Block Full Service (virtual and in-person).

Unlimited expert help

People who pay for the Deluxe, Premium and Self-Employed products will automatically get access to unlimited chat or video screen-sharing sessions with a certified public accountant, an enrolled agent or a trained H&R employee at any point while preparing their returns. A downside of this service is that the tax pro will not review, sign or e-file your return for you. They are merely there to help with questions that come up along the way.

Tax Pro Review

This add-on service offers a one-on-one review of your completed return with a human tax pro who will go over your documents and check for accuracy and possible missed deductions or credits. If you want, the tax pro will also sign and e-file your return for you. The review usually happens within three days.

H&R Block says the add-on generally starts at $55, but the cost will vary depending on the package type (i.e., the more expensive the package, the pricier the add-on).

H&R Block Full Service

H&R Block also offers full-service virtual help, where a pro completes your entire return.

What also sets H&R Block’s human support features apart from other providers we review is its vast network of human tax preparers across the company’s 9,000 or so offices worldwide. Help at brick-and-mortar stores isn’t free, of course (in-office appointments start at $89), but it helps to know you can go there if you get confused or stuck.

Not all of H&R Block’s tax pros are CPAs or enrolled agents, but the company says pros undergo training, have completed the H&R Block Income Tax Course and have achieved certification level.

What the Nerds think

Sabrina Parys, editor/content strategist

"H&R Block is a name most of us recognize — and for good reason. One of the standout features of this company is its long tradition of offering in-office support. Unlike many other providers we review, H&R Block not only offers full-service tax preparation but also boasts a vast network of offices nationwide. Of course, booking an in-person appointment will add to your costs, but for many, the peace of mind that comes from sitting down with a real person to sort out a tricky tax situation can make it well worth the extra expense."

Customer support options

Here's a look at the various ways you can find answers and get guidance when filing your return with H&R Block. Notably, H&R Block’s customer support for its free package is limited to its online chatbot. This means you have to upgrade for phone or human chat support, which might be a sticking point for some.

Ways to get help

General guidance: Searchable knowledge base and website, including video tutorials, calculators, news, articles and guides.

Tech support: Customer service is limited to a chatbot with the free package. Free chat and phone tech support across Deluxe, Premium and Self-Employed packages; virtual assistance chat feature provides basic tax and tech support to help with simple questions. H&R Block also has an online support page.

AI Tax Assist: Another feature included for all paid packages is AI Tax Assist, a tool that uses data from the company’s Tax Institute to help answer user questions on a wide number of tax topics. Free users can upgrade to PLUS for access.

Help if you get audited

Getting audited is scary, so it’s important to know what kind of support you’re getting from your tax software. First, be sure you know the difference between "support" and "defense." With most providers, audit support (or "assistance") typically means guidance about what to expect and how to prepare — that’s it. Audit defense, on the other hand, gets you full representation before the IRS from a tax professional.

H&R Block offers free audit support, but you can also buy a product called Worry-Free Audit Support. This includes IRS notice correspondence management and help, audit preparation and in-person audit representation from an enrolled agent; it costs $20.

You can also add Tax Identity Shield for $20, which provides personal assistance if criminals use your personal information to file a fake tax return.

Ways to receive your refund

No matter how you file, you can choose between several ways to receive your refund:

Direct deposit to a bank account.

Loaded onto an Amazon gift card (2.5% bonus) for H&R Block desktop product purchases through Amazon only.

Spruce mobile banking.

You have the option of paying for the software out of your refund and getting a check or direct deposit for anything left over, but there’s a $42 charge to do so.

As of Sept. 30, 2025, the IRS no longer issues refunds as paper checks. The agency will instead use electronic methods to deliver refunds this filing season. While direct deposit is the most popular refund method, H&R Block’s alternative methods may be useful for taxpayers without access to a bank account.

How H&R Block stacks up

Promotion: NerdWallet users get 20% off federal and state filing costs. | |

Promotion: NerdWallet users receive 20% off federal filing costs. | |

Promotion: NerdWallet users can save up to an additional 10% on TurboTax. | |

Promotion: NerdWallet users receive 20% off federal filing costs on Classic, Premium, and Self-Employed packages with the code "Nerd20". |

These star ratings are based on a tax provider's free tier score. For more detailed scoring, see the full product details above. Providers frequently change pricing. You can verify the latest price by clicking through to each provider's site.

Is H&R Block right for you?

who use H&R Block’s paid options, human tax help — a feature that typically requires a paid upgrade with other providers — is available at no additional cost.

If you want to file your taxes online but would feel better knowing you can run to a human at a desk in a brick-and-mortar office, H&R Block stands alone with its massive physical presence.

» How does H&R Block stack up against the competition? TurboTax vs. H&R Block

Methodology

NerdWallet’s comprehensive review process evaluates and ranks the largest online tax software providers. Our aim is to provide an independent assessment of available software to help arm you with information to make sound, informed judgements on which ones will best meet your needs. We adhere to strict guidelines for editorial integrity.

We collect data directly from providers, do first-hand testing and observe provider demonstrations. Our process starts by sending detailed questions to providers. The questions are structured to equally elicit both favorable and unfavorable responses. They are not designed or prepared to produce any predetermined results. The provider’s answers, combined with our specialists’ hands-on research, make up our proprietary assessment process that scores each provider’s performance.

The final output produces star ratings from poor (1 star) to excellent (5 stars). Ratings are rounded to the nearest half-star. For more details about the categories considered when rating tax software and our process, read our full methodology.

DIVE EVEN DEEPER IN TAX SOFTWARE