Does a Credit Card Preapproval Offer Guarantee You’ll Get It?

A true preapproval means you'll almost certainly get the card if you apply. But be aware of the difference between preapproval and pre-qualification. And in some cases, preapproval can even be a red flag.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

Nerdy takeaways

- A "preapproved" credit card offer indicates a high likelihood of approval, should you choose to apply for the card.

- Being "pre-qualified" for a card is a good sign, but probably not as strong an indicator as preapproval — although some credit card issuers use the terms interchangeably.

- Just because you're pre-approved for a credit card doesn't mean it's necessarily a good deal.

If you get a notification from a credit card issuer that you've been "preapproved" for a credit card, your odds of getting that card if you apply are quite high.

That's because credit card preapproval offers often come from a financial institution you already do business with, or from an issuer affiliated with such an institution. They send these preapproval offers because they already know you, they consider you a valuable customer and want to do more business with you, and they already have the information they need to assess your creditworthiness.

However, this may not be the case if you've only been "pre-qualified" as opposed to preapproved.

'Preapproved' vs. 'pre-qualified' for a credit card

The terms "preapproved" and "pre-qualified" are similar, and some issuers even use them interchangeably. But there's an important distinction. In general:

- Pre-qualification means that the issuer has taken a look at your financial details and given you its best guess as to whether you’d be approved if you applied. It’s not a guarantee, but it’s a good sign.

- Preapproval, on the other hand, is more official. If you’ve truly been preapproved for a credit card, you're almost certain to get it if you apply.

To make things even more confusing, both can also be referred to as "prescreened" offers.

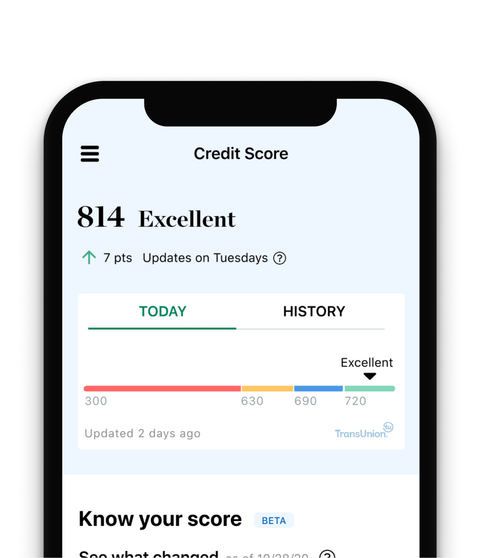

Find the best card for your credit

Check your score anytime, and NerdWallet will show you which credit cards make the most sense.

Preapproval with credit cards vs. other loans

With installment loans, such as mortgages and car loans, the difference between pre-qualification and preapproval is more clearly defined, and it's not uncommon for consumers to go through both as they get closer to a decision. As you start looking for a house, for example, pre-qualification gives you an idea of how much you'll be able to borrow. Getting preapproved allows you to make a firm offer to the seller when you find what you want.

With credit cards, on the other hand, you don’t typically need that kind of advance approval. So pre-qualification is much more common than true preapproval. In fact, receiving an unsolicited guarantee of approval from a credit card issuer can be a red flag. That’s because some issuers promise preapproval in the hopes of selling you on a card you don’t necessarily need or want. They may come from issuers that specialize in "instant-approval" cards for people with bad credit or no credit, which tend to carry extremely high fees.

Review any preapproved credit card offer you receive skeptically before applying to make sure it's the right choice for you.

🤓 Nerdy Tip

Struggling to get approved for a credit card that doesn't carry the high fees of "instant approval" cards? See our best credit cards for bad credit or our best starter credit cards for no credit. If you'd prefer not to get prescreened offers in the mail, you can opt out by going to optoutprescreen.com, which is run by the consumer credit reporting bureaus. You can sign up to opt out of prescreened offers for five years or permanently.

Major issuers generally offer pre-qualification

Many major credit card issuers and some smaller ones offer pre-qualification on their websites. The issuer typically asks for personal information, including your name and address and some or all of your Social Security number. It uses that information to run a "soft" check of your credit, which is one that doesn't affect your credit scores.

In some cases, you'll be able to see not only the card you pre-qualify for, but also the exact terms of the offer — such as the credit limit and interest rate — before you apply. These kinds of pre-qualfications are more specific and detailed and may even amount to a preapproval, but you still have to formally apply for the card.

If you decide to apply for the card based on that information, the issuer will go ahead and run the hard credit check. It will likely ding your score, but you'll have more assurance of approval.

🤓 Nerdy Tip

Issuers don't necessarily allow you to pre-qualify for all of their cards. In April 2021, for example, Capital One was offering pre-qualification for only a handful of its cards, and Citi wasn't offering it on any cards at that time. You can also make your own best guess about whether you’ll be approved for a card by considering your credit score. Some credit cards are available only to those with excellent credit, or good to excellent credit.

» MORE: What is a good credit score?

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Find the right credit card for you.

Whether you want to pay less interest or earn more rewards, the right card's out there. Just answer a few questions and we'll narrow the search for you.