HMBradley Launches Credit Card With Automatic Rewards Customization

The card works in tandem with HMBradley bank accounts, which adjust APY based on how much you save each quarter.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

» This story is out of date

The HMBradley credit card is being discontinued. Per the CEO, "HMBradley is beginning a wind-down of our consumer deposit and credit card programs over the next 30 days," starting Nov. 15, 2023. See NerdWallet's best credit cards for other options.

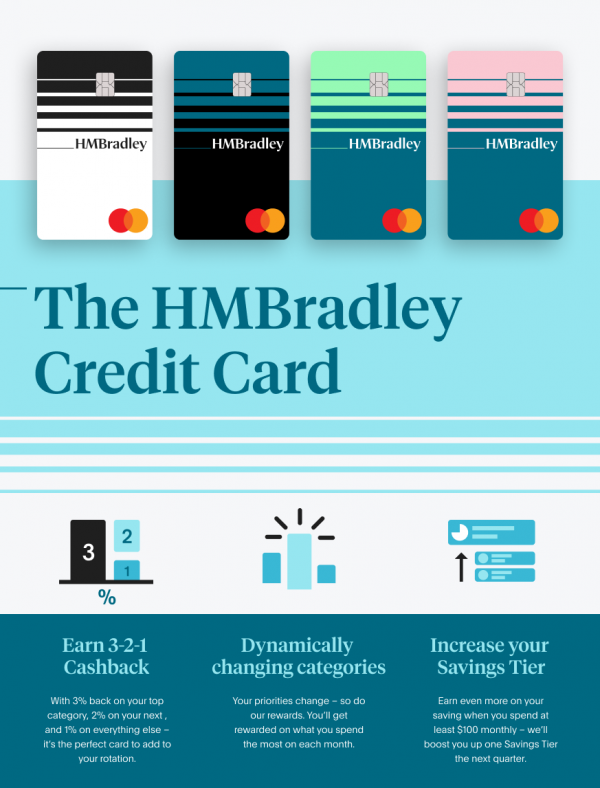

Online banking platform HMBradley is launching a credit card that automatically rewards you more where you spend the most, eliminating the need to select or activate new bonus rewards categories or cycle through multiple cards to maximize cash-back earnings.

However, the card serves a limited audience. You must have an HMBradley bank account to apply for the card, and it’s geared toward applicants with credit scores of 700 or higher. (The card uses VantageScore 4.0 for underwriting.) To qualify for an HMBradley bank account, you must be invited by an existing account holder.

How the HMBradley credit card works

Image courtesy of HMBradley

The HMBradley card, issued by Hatch Bank, earns unlimited cash back, and it adjusts monthly to earn rates based on your spending habits. It offers:

3% cash back in your highest spending category for the statement cycle. As of Dec. 15, 2021, to earn 3% cash back, you must spend $100 per month and get $2,500 direct deposited in your HMBradley bank account each month.

2% cash back in your second-highest spending category.

1% cash back on everything else.

In terms of what the card considers to be spending categories, HMBradley says it makes "every effort to include all relevant merchant codes in the appropriate category," and that currently, the only categories of merchant codes that wouldn't qualify include transfers, cash, fees and adjustments and investments.

You can redeem cash back by requesting a direct deposit into your HMBradley bank account, or another bank account of your choice.

Rewards customization is not unique among credit cards, but most of the ones that feature it require you to actively opt in or select your favored bonus categories from a list. The automation feature is available via a few business credit cards, but among consumer cards it's a new wrinkle.

Other key features of the HMBradley credit card

Annual fee: $5 per month (translating to $60 per year), waived for the first year.

Interest rate: 13.9%-22.9% APR.

Foreign transaction fee: None. As a Mastercard, the HMBradley credit card is accepted worldwide.

Late payments: The card waives the first late payment fee, and there is no penalty APR.

Geographic restrictions: None. U.S. residents in any state who are age 21 and over can apply.

Potential savings tier bump: Cardholders who spend at least $100 per month with their HMBradley card are eligible to move to a higher Savings Tier level with HMBradley. (More on that below.)

How HMBradley bank accounts work

Because the HMBradley credit card works in tandem with an HMBradley deposit account, it’s helpful to know how their accounts operate. The FDIC-insured accounts work as a combined checking and savings account, earning a higher yield while eliminating restrictions on the number of withdrawals you can make. The APY you earn on your deposits readjusts quarterly, depending on how much you save (“how much you save” means the percent of your deposits that remain in your account at the end of the quarter). You must direct-deposit money into your account each month and save at least 5% of your deposits to earn interest.

3% APY: Save 20% or more of your deposits.

2% APY: Save 15-20% of your deposits.

1% APY: Save 10-15% of your deposits.

0.5% APY: Save 5-10% of your deposits.

If you save less than 5% of your deposits over a quarter, you’ll earn 0% APY. Essentially, HMBradley deposit accounts incentivize you to save more.

How to get the HMBradley credit card

After you open an HMBradley deposit account, you may see an offer link on your account dashboard to get the credit card. (Through its "One Click Credit" process, the lender says that it receives consent from customers to pull soft credit inquiries every month in order to see if they qualify for credit offers.)

When you click on that offer link, you'll be pre-approved. You’ll see the terms you qualify for, including APR and credit limit. If you accept the offer, there’s a chance you’ll then be subject to a hard inquiry, but you’ll be notified if that’s the case.

Once you opt in to the card, there’s no additional waiting period. You can also add your card to your Apple Wallet, Samsung Pay or Google Wallet instantly upon approval.

Find the right credit card for you.

Whether you want to pay less interest or earn more rewards, the right card's out there. Just answer a few questions and we'll narrow the search for you.