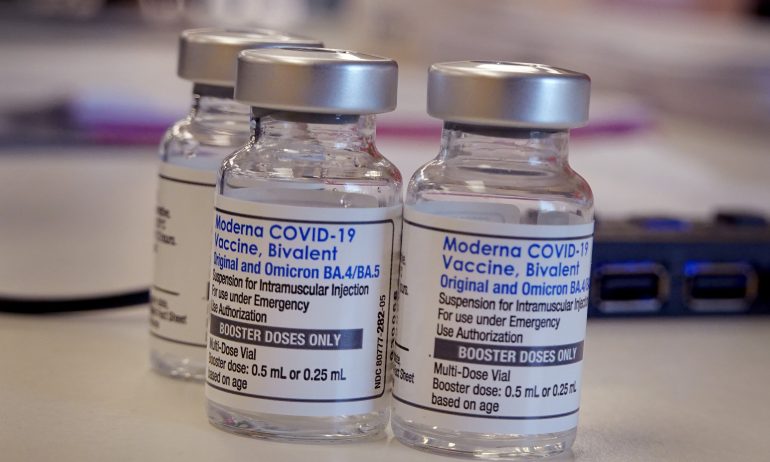

The Health Emergency Is Ending. Will COVID Costs Be Covered?

The health emergency expires May 11, with different impacts for those with private insurance, Medicare and Medicaid.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Why should you care that the COVID-19 public health emergency officially expires on May 11, 2023? Because, depending on your insurance, you may end up paying for tests, treatments and even vaccines.

“We’re going from a situation where we had universal access to COVID-19 vaccines, testing and treatment to one that looks more like the complexity of coverage and cost-sharing that characterizes the United States more generally,” says Sara R. Collins, senior scholar and vice president for health care coverage at The Commonwealth Fund, a health care advocacy foundation.

Every American could eventually see changes in their COVID-19 coverage, whether they have employer-provided or marketplace insurance, Medicare, Medicaid, or no insurance. And beginning this month, millions of Medicaid recipients are likely to lose all of that program’s health coverage, not just COVID-19 benefits.

Here’s a rundown on what to expect and how you can cope, depending on what kind of insurance you have.

Contents

If you have private insurance

If you have health insurance through an employer or your state or local marketplace, some changes in your COVID-19 coverage will depend on your plan.

Vaccines: Because COVID-19 shots are a recommended vaccination, your plan likely will cover the shots without a copay or other cost-sharing.

Tests: During the public health emergency, private insurers were required to provide at-home and lab tests for COVID-19 with no cost-sharing. That requirement ends May 11, but some plans may choose to continue the benefit.

If you anticipate the need for at-home tests — such as travel or visiting with people at high risk — consider stocking up on at-home tests while your insurance still pays for them.

Treatment: Paxlovid is the leading, life-saving antiviral pill for treating people in their first days of a COVID-19 infection — and has until now been provided free by the government. When current inventories of Paxlovid are exhausted after the public health emergency ends, however, Pfizer likely will hike the price from what the government has been paying, already a hefty $530 per course of treatment. Private insurers may ask you to pay a part of that high cost, as they do with many pharmaceuticals.

For people with Medicare

Medicare beneficiaries eventually may have to pay the full costs of at-home tests and a share of the cost of Paxlovid.

Vaccines: COVID-19 vaccinations will continue to be covered under Medicare Part B without cost sharing.

Testing: Medicare Part B beneficiaries will have to pay the full cost of at-home COVID-19 tests sold at drugstores. Part B will pay for lab-based tests when ordered by a provider, but there may be cost sharing to see the provider who writes the order.

Until the public health emergency ends May 11, Medicare beneficiaries are still entitled to obtain eight free tests over the counter every 30 days.

Another wrinkle: “People with Medicare Advantage won’t have guaranteed access to free at-home tests, but they may have coverage under their plan,” says Juliette Cubanski, deputy director of the Program on Medicare Policy at KFF, a health policy nonprofit.

Treatment: The good news is that the antiviral treatment Paxlovid will most likely continue to be free for some time after the public health emergency expires. “As long as there’s federal supply that the government purchased and distributed, that will be free for anybody,” says Cubanski.

The bad news is that free supply may only last for a few months; after that, Pfizer is likely to set a price higher than the current $530 per course of treatment.

Medicare beneficiaries will have coverage for Paxlovid only if they are enrolled in a Part D plan for prescription drugs. “The costs to Medicare enrollees will likely vary from one Part D plan to another because plans charge different amounts for different covered drugs,” says Cubanski. “Part D plans have tier systems for cost sharing, and each plan makes its own decision about which tier they assign a drug to.”

For Medicaid beneficiaries

Medicaid enrollees have considerable breathing room before their COVID-19 benefits become subject to change.

But there’s a major catch: Over the 12 months that began April 1, each state will reevaluate the eligibility of each of the more than 91 million Medicaid beneficiaries. As many as 14 million people are projected to lose all coverage, not just their COVID-19 benefits.

To help ensure that your eligibility renewal is processed properly, “it’s extremely important that your state’s Medicaid program has your up-to-date contact information,” says Kate McEvoy, executive director of the National Association of Medicaid Directors.

A prompt response to correspondence from Medicaid is essential. “We are concerned about people losing Medicaid coverage due to red tape, not because they’re actually ineligible for coverage,” says Allexa Gardner, a senior research associate at the Georgetown University McCourt School of Public Policy’s Center for Children and Families.

Maintaining coverage for children is another concern. “Children across all states have higher eligibility levels than adults do. Even if parents are no longer eligible for Medicaid, their children likely are eligible for CHIP or Medicaid,” says Gardner. But many parents may not be aware of this.

What can you do if your state Medicaid programs find you ineligible for continuing coverage? Contact a family member’s health plan or your state or federal insurance marketplace; depending on your income, you may be eligible for free or subsidized coverage.

Vaccines: Medicaid will cover all COVID-19 vaccinations without cost sharing through September 2024.

Testing: Every state’s Medicaid program is required to cover COVID-19 tests with no cost sharing through September 2024. After that, coverage will likely vary by state.

Treatments: COVID-19 treatments, including the oral antiviral Paxlovid, will be covered with no cost sharing through September 2024. After that, each state Medicaid program will determine coverage and cost.

For the uninsured

In 2021, more than 27 million Americans under the age of 65 had no health insurance, according to KFF. That number is likely to rise significantly as Medicaid reevaluates all beneficiaries’ eligibility.

Even if you’re young and healthy, going without health insurance is perilous. The public health emergency may be ending, but as of late March, an average of 2,370 people with COVID-19 were being admitted to U.S. hospitals each day, according to the Centers for Disease Control and Prevention. The average cost of a COVID-19 hospitalization in 2020 was $41,611, according to KFF.

So it’s critically important for everyone to try to find a way to afford health insurance, whether it’s through a private plan, Medicaid, or Medicare. Your life — financially and literally — could depend on it.

Image: Scott Olson / Getty Images News via Getty Images