83(b) Election: Tax Benefits, Why and When to File

You could save on taxes through an 83(b) election by paying tax on company shares upon granting instead of vesting.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet, Inc. does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

If you are receiving stock options or other forms of equity compensation at work, the 83(b) election might help you minimize your tax outlay.

What is an 83(b) election?

An 83(b) election is a way to pay tax on the value of company stock options or restricted stock when they are granted rather than when they vest. The strategy makes more of the gains subject to capital gains tax instead of ordinary income tax, which can reduce the total tax on the shares over time.

» Not sure if an 83(b) election is right for you? Here’s how to find a good financial advisor

Our advisors can help you explore tax strategies and integrate equity into your investing plan.

on NerdWallet Wealth Partners' website. For informational purposes only. NerdWallet Wealth Partners does not provide tax or legal advice.

How the 83(b) election works

Making an 83(b) election means that you pay income tax earlier, often before your shares have had the opportunity to appreciate in value. If and when you sell shares for a profit down the road, the 83(b) election typically means the bulk of the profits are subject to capital gains tax rates instead of ordinary income taxes, which are usually higher.

For example, if you’re in the 24% tax bracket and part of your employer’s equity compensation package includes a grant of 10,000 shares of company stock that are worth $.01 per share at the time of grant, you could save money by making an 83(b) election. The example below shows what could happen if the share value rises to $5.00 per share at the time of vesting and $20.00 per share if you sold the shares more than one year after they vested.

83(b) election | No 83(b) election | |

|---|---|---|

Income tax paid when shares granted | $24 ($0.01 x 10,000 shares x 24% tax bracket) | $0 |

Income tax at vesting | $0 | $12,000 ($5 x 10,000 shares x 24% tax bracket) |

Capital gains tax when shares are sold | $39,980 ($19.99 x 10,000 shares x 20% capital gains tax rate). Note that you already paid tax on $0.01 of each $20 share when the shares were granted (tax applies to the remaining $19.99 here). | $30,000 ($15 x 10,000 shares x 20% capital gains tax rate). Note that you already paid tax on $5 of each $20 share when the shares vested (tax applies to the remaining $15 here). |

Total tax paid | $40,004 | $42,000 |

Holding shares for over a year prior to selling means you’d pay the more favorable long-term capital gains tax rates instead of the ordinary income tax rate on much of the gains. Filing an 83(b) also means you can start the holding period clock earlier, right after the grant date so capital gains can become eligible for the lower long-term capital gains tax rate.

Key terms:

The grant date is the date on which you receive a company restricted stock award or stock option award.

The vesting date is the date on which you can take actual ownership of the company shares or stock options, usually by satisfying a certain time period of employment.

The sale date is the date on which you sell the shares.

Ordinary income tax is the rate at which wages and most other income is taxed. It ranges from 10% to 37%.

Capital gains tax is a tax on profits from the sale of shares or other investments. Long-term capital gains tax is either 0%, 15% or 20%; short-term capital gains tax rates are the same as ordinary income tax rates.

Learn 5 common restricted stock mistakes investors make, and how to avoid them to help protect your wealth.

on NerdWallet Wealth Partners' website. For informational purposes only. NerdWallet Wealth Partners does not provide tax or legal advice.

Why to file an 83(b) election

The 83(b) election can come in handy if you expect to stay with your company for the long term (since you’ll need to wait until your shares vest in order to gain actual ownership of them), and if you expect the value of your company shares to grow over time.

Two situations are particularly common in 83(b) elections.

Stock option holders: If you’re able to exercise your stock options early (prior to vesting), you could elect to do so and file an 83(b) election within 30 days of exercise. This way, you can potentially minimize your future tax liability if the share price of your company happens to take off.

Startup founders: In some companies, particularly startups, compensation may include a significant amount of restricted stock (not to be confused with restricted stock units or RSUs). Restricted stock refers to company shares that are subject to certain stipulations, such as vesting and/or forfeiture (losing your shares if you leave the company). Key employees may be awarded a handsome quantity of restricted shares that could significantly increase in value from granting to vesting. Using the 83(b) election allows these employees the chance to save by shifting their tax treatment from ordinary income taxes to capital gains taxes.

Disadvantages of an 83(b) election

Must be done early. It is critical to remember to file your 83(b) election within 30 days of the restricted share grant or within 30 days of exercising your options early. Also, filing an 83(b) election is usually irreversible, so be sure you consult with a financial advisor if needed and settle on your tax strategy early.

Requires a tax payment. As the table above illustrates, an 83(b) election may require you to pay a portion of your tax bill sooner than if you didn’t make the election.

Could backfire if you leave the company. You could end up prepaying taxes on shares you never end up owning if you part ways with your company before they vest, or if the value of those shares decreases instead.

When and how to file an 83(b) election

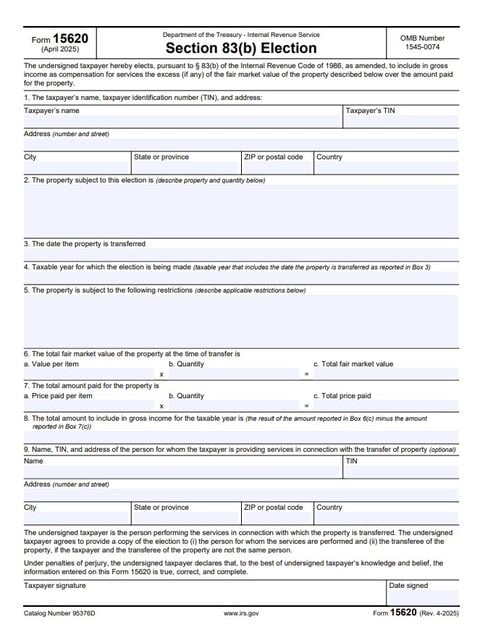

The process itself is fairly straightforward. Essentially, the employee completes and signs an IRS Section 83(b) form or letter that details certain key information:

Personal identifying information (name, address, Social Security number).

Description of the property awarded (number and type of shares of which company) along with the date received or purchased, any restrictions your shares are subject to and the fair market value of the shares on the date received or purchased.

The amount paid for the company shares.

The amount the employee will indicate as gross income on their income tax return.

The employee mails the election form or letter to their IRS Service Center and provides a copy to their employer.

Best practice is to send your election form through certified mail with a return receipt in case you need to prove that it was sent by a particular date.

IRS 83(b) election form

» Want a second opinion? See if a wealth advisor is useful for you