Crypto Hot Wallet vs. Cold Wallet: The Biggest Differences

Hot wallets connect to the internet for easier access, while cold wallets keep your crypto keys offline for security.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet, Inc. does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

Crypto wallets are essential to keep the keys to your digital cash safe. In order to choose the right wallet, you’ll have to understand the distinctions between a “hot” wallet and a “cold” wallet.

The biggest difference between hot wallets and cold wallets is that hot wallets can be connected to the internet through your computer or phone for convenient sending and receiving, whereas cold wallets are hardware storage devices that keep your data offline.

Both types protect your public and private keys — the cryptographically generated strings of letters and numbers that can authorize your crypto transactions. The right type of wallet for you depends on how much crypto you hold, your security preferences and how easily accessible you need your funds to be.

» Ready for a wallet? Here are our top picks

Deciding factors

| Hot wallet | Cold wallet | |

|---|---|---|

| Price | These are usually free, and some pay interest on stored crypto. | These require the purchase of an external device, around $50 to $250. |

| Better for | Hot wallets are convenient to access and use for trading. | Cold wallets are better suited for long-term storage. |

| Maximum number of cryptos | Hot wallets can store anywhere from one to tens of thousands of cryptocurrencies. | Cold wallets store anywhere from 1,000 to tens of thousands. |

| Cybersecurity | Average. Because they are connected to the internet, they could potentially be vulnerable to hacking. | Excellent. They can’t be accessed online, but they require security measures to keep them from getting damaged, lost or stolen. |

| Loss protection | Good. Most have recovery and backup options and can be accessed from multiple devices. | Average. Most have recovery and backup options for a lost password, but not for a lost device. |

| Ease of transfer to exchanges | Excellent. Hot wallets are easily accessible as the wallet is already internet-connected. | Average. Cold wallets require an extra step to connect online through USB, Wi-Fi or QR code. |

Best wallets for security: cold wallets

Since most cryptocurrencies are decentralized and don’t have extra security measures that a third party like a bank would provide, it’s especially important for wallets to have strong protections in place.

Cold wallets aren’t connected to the internet, so they’re less vulnerable to online hacks or theft than a hot wallet. This hardware only connects to your online account when it’s physically plugged in or using a unique QR code, so your private key never unintentionally comes into contact with an online server where it could potentially be accessed by someone else.

Most hot wallets have built-in security measures to keep your funds safe, like recovery seed phrases, but they can’t compare to the safety of fully offline cold storage.

Hot wallets can be accessed on more than one device, so in the event that your computer or phone is stolen, you can recover your funds through a seed phrase or other backup method. If you lose your cold wallet, you can still use a recovery phrase to access your keys, though you’ll need to purchase a new hardware device or plug the phrase into a compatible software wallet.

With both methods, if you lose track of your recovery seed phrase, you may lose access to your wallet permanently.

» See our picks for the top cold storage devices on our list of the best crypto wallets.

Advertisement

Fees $0per trade | Fees 2%-5.5% |

Account minimum $0 | Account minimum $1 |

Promotion Up to 4% match (up to $2M)when you open and fund an account with Webull | Promotion Noneno promotion available at this time |

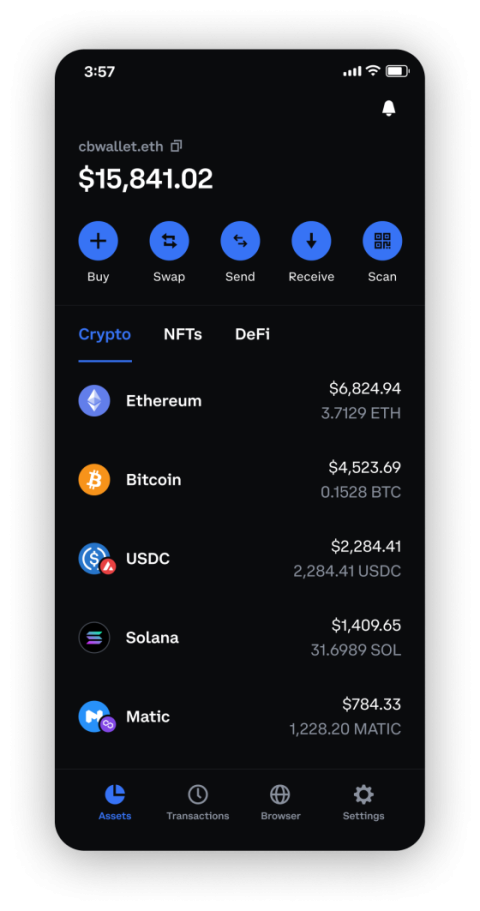

Best wallets for convenience: hot wallets

Because cold wallets live offline, they require the extra step of connecting to the Internet to access and move your funds. Hot wallets are already connected to the internet, so they’re much easier to use for regular transactions.

Bottom line

The biggest trade-off between hot and cold wallets is between security and convenience. Both methods can store plenty of different currencies, but the right method for you depends on whether you prioritize safety from potential online hacking or easy access to trading and staking.

For a better balance of security and convenience, you can use a combination of both wallet types, storing easy-access funds online to trade and earn interest while keeping the keys to larger investments offline for longer-term storage. Keeping a large amount of funds in a hot wallet can make your account a target for theft.

Other wallet options

Custodial wallets

Custodial wallets managed by online crypto platforms may be a good option for beginners or users looking for a more hands-off approach. These wallets allow users to store their funds directly on an exchange where they can be bought or traded. Some pay crypto interest or rewards on assets that are kept on their platforms.

These wallets are easier to access and recover, but because exchanges store such a large volume of crypto, they may be particularly attractive to hackers. And in some cases, crypto platforms have failed with customer assets in their custody, leaving individuals with limited options for recovering what they own. When the crypto industry last imploded in late 2022, several crypto platforms went out of business or froze customer assets. While managing your own wallet does come with certain risks, it also protects against losing access to your funds should such an event happen again.

Manual storage

Technically, you can store your wallet keys (basically these are long strings of letters and numbers) the old-fashioned way: on a piece of paper, kept in a safe or buried in the backyard. This method keeps your funds very safe from online hackers, but if your information gets lost or damaged, you’ll have no way to recover your assets.

Manual storage also makes it more difficult to move your coins online to trade or sell, unlike digital wallets — both hot and cold — which have built-in or integrated tools to help you interact with the blockchain.

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

More like this

Related articles