Schedule K-1: What It Is and What to Do

Schedule K-1 is a tax form prepared by pass-through entities to report each owner's annual share of gains and losses.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet, Inc. does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

What is Schedule K-1?

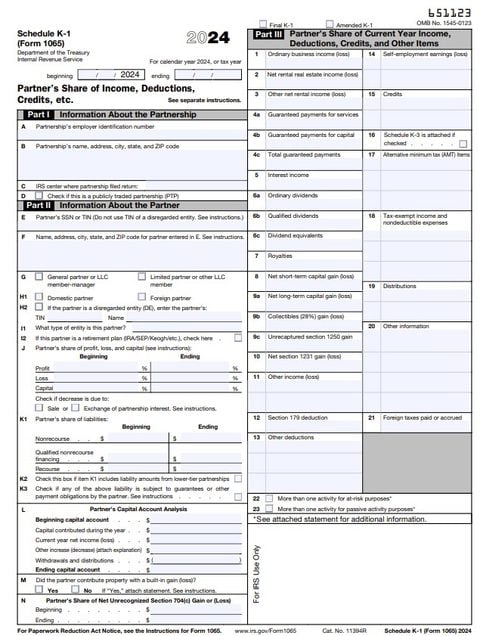

Schedule K-1 is a federal tax form that partnerships and certain other entities use to report the annual income, losses, credits, deductions and other distributions they made to partners, shareholders or beneficiaries.

The U.S. tax code allows certain types of businesses and trusts to pass their income-tax liability to the shareholders or partners who have a vested interest in the business. These “pass-through” entities can be partnerships, S corporations, trusts or estates.

How does a K-1 affect my taxes?

Receiving a Schedule K-1 typically means you received income from a partnership or other pass-through entity. You’ll likely need to report the income on your personal income tax return.

Who generates a K-1?

General partnerships

A partnership is usually not liable for the taxes on the income it generates. Instead, each partner is liable for those income taxes based on their ownership percentage in the business.

When a partnership files IRS Form 1065 with the IRS, outlining its financials, it must also prepare a Schedule K-1 for each partner to report their share of any profits, losses or distributions from the partnership. The partnership sends a K-1 to each partner (with a copy to the IRS). Upon receiving their K-1, the partner includes the information on their personal tax return for the year.

For example, if you and a partner own a business that is structured as a partnership and that generated $100,000 of taxable income last year, and you own 50% of the business, the partnership may send you (and the IRS) a K-1 reporting your share of the income ($50,000). You report that income, along with all your other income, on your personal tax return.

The amount of tax you owe on the income reported on a K-1 is often based on your other income, as well as your filing status, tax bracket, tax deductions and tax credits for the year.

S corporations

S corporations file IRS Form 1120-S each year, providing a detailed picture of income, gains, losses, deductions and credits. They also prepare and send a Schedule K-1 to each shareholder. The K-1 reflects the shareholder's percentage of the S corporation’s income or loss. The shareholder uses that information to file their personal tax return for the year.

Trusts and estates

Trusts and estates use IRS Form 1041 to report their income. While some trusts and estates pay income taxes directly, others pass the income through to their beneficiaries. In cases where the income is passed through, the fiduciary managing the trust prepares a Schedule K-1 for each beneficiary that receives income.

ETFs

Exchange-traded funds investing in commodity futures or currencies are often set up as limited partnerships. Investors in these ETFs may get a Schedule K-1 that reflects their share of the partnership income. To determine whether an ETF you own is a limited partnership, look in the fund prospectus or check with your financial advisor. Doing so might save you from having to amend your tax return later.

The more you earn, the more complex your taxes become. Learn the 10 traps to dodge.

on NerdWallet Wealth Partners' site. For informational purposes only. NerdWallet Wealth Partners does not provide tax or legal advice.

K-1s and the qualified business income deduction

Owners of businesses that qualify as pass-through entities may be able to take the qualified business income deduction (QBI), which lets them deduct up to 20% of their net business income. In other words, if you receive a Schedule K-1, you may qualify for the QBI tax deduction.

For example, if you receive a Schedule K-1 for $50,000 from a partnership, you may be able to deduct up to 20% of that income (or, $10,000).

However, only certain types of businesses and income qualify. Check with a financial advisor to see whether you qualify for the deduction.

K-1 basis

Schedule K-1 requires pass-through businesses to track each partner’s basis, or stake, in the company. Basis can increase or decrease each year depending on each partner’s profits, losses, additional contributions or withdrawals.

While your K-1 will report some details about your basis, it's important that you have a handle on those figures yourself. A financial advisor can help determine whether you need to report a gain or a loss on your taxes.

» MORE: How to invest $100,000

When should I receive my K-1?

The IRS requires pass-through entities to send Schedule K-1s to partners, shareholders or beneficiaries by March 15 each year. However, partnerships can request a six-month extension of that filing deadline, which is why K-1s have a reputation for being late. With the regular tax-filing deadline just a month later, there's a real chance for headaches.

If you’re expecting a K-1 and don't think you'll get it in time to meet the April tax deadline, consider getting a tax extension (though remember that an extension only gives you more time to file, not more time to pay).

If you file your taxes and receive a K-1 after you file, you may have to amend your tax return.

If you’re worried about Schedule K-1 or have additional questions, consult with a financial advisor to make sure you understand what to expect.

Schedule K-1.

» Need a pro? See our list of the best financial advisors

ON THIS PAGE

ON THIS PAGE